he crypto market, daily candles matter to traders.

But whales, market makers, and institutional money focus their attention on one thing above all else:

👉 The Monthly Close.

This single close determines:

Whether the trend continues or stalls

Where liquidity will be drawn

Whether Bitcoin leads—or it becomes altcoins’ turn

In this article, we explore how whales interpret Bitcoin’s ($BTC ) monthly close, and why the following three theories hold the key to the next major move.

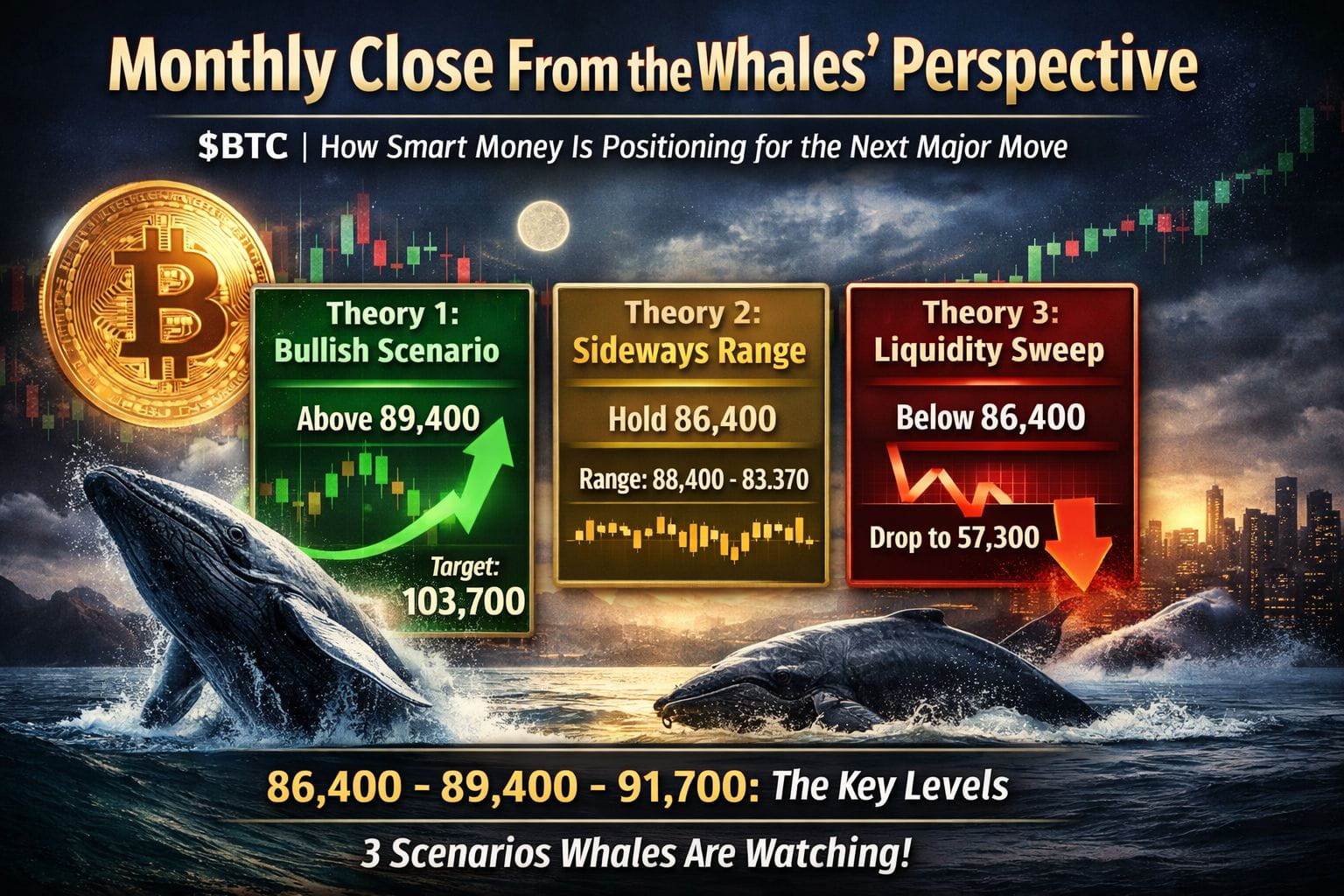

🔑 The Psychological Battlefield: 86,400 – 89,400 – 91,700

These zones are not ordinary support and resistance.

They are liquidity magnet levels—where large players make decisions.

🟢 Theory 1: Bullish Control — Whales Stay Long

Monthly Close > 89,400

If Bitcoin closes the month above 89,400, it is clearly a positive close.

What does this mean?

Whales are holding their positions

This is accumulation, not distribution

Preparation to move price into higher liquidity zones

📈 Next roadmap:

Holding above 91,700 = confirmation

Then 95,750

Final expansion target → 103,700

In this scenario:

Bitcoin dominance remains strong

Altcoins make selective moves

Market sentiment shifts into full risk-on mode

This is the phase where late bears are slowly liquidated.

🟡 Theory 2: Sideways Trap — Distribution in Silence

Monthly Close & Hold at 86,400

This is the most deceptive scenario.

On the surface, it looks like nothing is happening—

but in reality, smart money is actively working.

Potential move:

Bitcoin gradually declines → 74 → 69

Then enters a sideways range:

Upper: 88,400

Lower: 83,370

Key condition: 86,400 must hold

📉 Long-term implications:

BTC holdings slowly decrease toward the 58.55 area

Bitcoin enters consolidation

Altcoins receive a strong ~3-week relief rally

This phase:

Gives retail traders a false sense of safety

Allows smart money to rotate quietly

Causes $BTC -only watchers to miss major altcoin opportunities

This is a “nothing happens” market—where everything changes underneath.

🔴 Theory 3: The Market Maker’s Weapon — Full Liquidity Sweep

Clear Monthly Close BELOW 86,400

This is the most dangerous—but also the most logical whale strategy.

What it signals:

Reduction in holdings begins

Panic-driven, engineered sell-off

Elimination of short-term traders

📉 Breakdown structure:

Drop toward → 57.30

Swing confirmation levels:

69

66

62

Rebounds are expected from these levels.

⚠️ Ethereum confirmation:

ETH likely declines toward 2,270

BTC and $ETH experience a synchronized washout

⏱️ Timeframe:

~10 days

Objective:

Flush over-leveraged longs

Provide entry zones for strong hands

Build the next accumulation base

👉 Market maker mindset:

“If I were the market maker, I would choose Theory 3.”

Why?

Maximum pain

Maximum liquidity

Minimum resistance for the next cycle

🧠 Final Thought: Don’t Trade Candles — Read Intentions

These three theories are not predictions.

They are behavioral maps—a blueprint of how whales think.

📌 Remember:

Monthly close = narrative shift

86,400 = the line between control and chaos

Volatility = opportunity (for prepared money)

Bitcoin is not just a price—it is a liquidity engine.

Those who understand this survive.

Those who don’t become exit liquidity.

#BTC #ETH #cryptouniverseofficial #Write2Earn #TrendingTopic