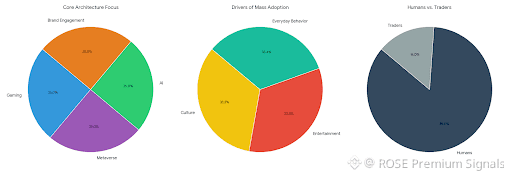

Vanar is being built for a reality that most blockchains still fail to understand: mass adoption does not arrive through financial speculation, it arrives through culture, entertainment, and everyday digital behavior. Instead of treating gaming, metaverse, AI, and brand engagement as side experiments, Vanar places them at the core of its architecture. This creates a fundamentally different type of Layer-1, one optimized not for traders, but for humans. The result is a network that does not try to pull users into crypto, but quietly embeds crypto into experiences users already want.

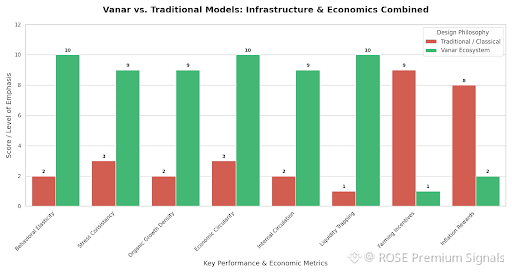

Traditional blockchains optimize for predictable transaction flows: swaps, transfers, staking, and arbitrage. Consumer behavior is the opposite of predictable. Players generate sudden transaction bursts, virtual worlds require constant micro-updates, and digital campaigns produce massive spikes in wallet creation within minutes. Most networks fracture under this type of load, forcing users to tolerate latency, congestion, and unpredictable fees. Vanar’s infrastructure is designed around behavioral elasticity, allowing it to absorb chaotic demand patterns while maintaining stability. This is not about chasing higher transaction-per-second metrics, but about engineering consistency under real-world stress.

The economic design of Vanar diverges sharply from classical GameFi models. Instead of using inflation-heavy reward systems to attract users, Vanar structures its ecosystem around internal economic circulation. In-game purchases, digital asset ownership, marketplace activity, and metaverse interactions continuously recycle value inside the network. This traps liquidity within the ecosystem, creating compounding transaction demand rather than temporary farming incentives. Over time, this builds organic economic density instead of artificial activity, aligning player motivation with long-term network health.

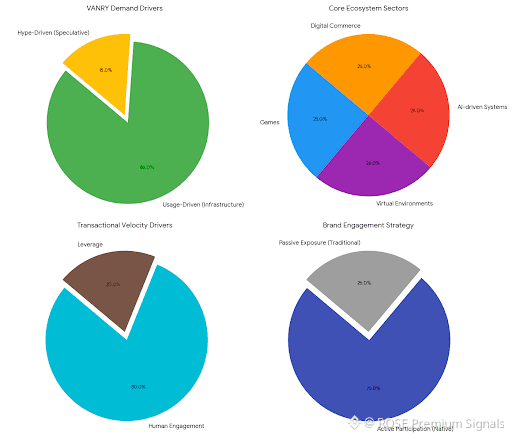

The VANRY token functions as economic infrastructure rather than speculative fuel. Its demand is generated by usage, not hype. Every interaction inside games, virtual environments, AI-driven systems, and digital commerce requires execution, settlement, and resource allocation, all of which depend on VANRY. This anchors token value in behavioral flow, creating a more stable demand structure than the cyclical capital rotations that dominate most crypto markets. When transactional velocity is driven by human engagement instead of leverage, price dynamics become fundamentally healthier.

One of Vanar’s most strategic moves lies in how it integrates brands into immersive environments. Rather than pushing promotional content into blockchain spaces, Vanar allows brands to operate inside virtual worlds where interaction becomes native. Engagement shifts from passive exposure to active participation. This transforms attention into measurable economic value, allowing brand interactions to generate on-chain behavioral data that can be optimized in real time. The blockchain becomes not just a settlement layer, but a behavioral analytics engine, capturing how users move, interact, and transact across digital ecosystems.

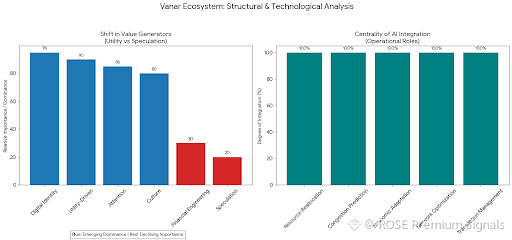

AI integration within Vanar is not cosmetic. It plays a central role in managing transaction flow, optimizing network load, and adapting economic parameters dynamically. By predicting congestion patterns and reallocating resources proactively, Vanar avoids the classic scalability bottlenecks that plague consumer-focused applications. At the economic level, AI-driven adjustments allow in-game asset pricing, transaction costs, and resource distribution to respond to live behavioral signals, creating adaptive digital economies that self-correct instead of collapsing under static models.

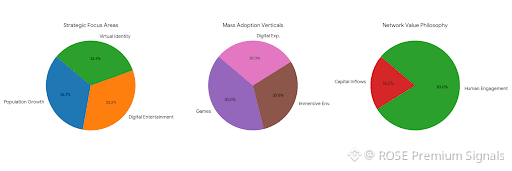

The deeper shift Vanar represents is structural, not technological. Crypto is transitioning away from speculation-first ecosystems toward utility-driven networks. Yield-driven capital loops are compressing, while attention, culture, and digital identity are becoming the dominant value generators. Vanar aligns directly with this transition, positioning itself as infrastructure for how people actually live online. As gaming, metaverse environments, and AI-driven social platforms expand, transactional demand will increasingly reflect user behavior rather than financial engineering.

This creates a different long-term trajectory. Networks that rely on capital inflows eventually face diminishing returns. Networks that capture human engagement compound value organically. Vanar’s architecture is designed to scale alongside population growth, digital entertainment expansion, and the monetization of virtual identity. As more daily activities migrate on-chain, the demand for stable, invisible, and consumer-grade blockchain infrastructure will accelerate.

Vanar is not attempting to reshape crypto culture. It is building underneath it, preparing for a world where blockchain becomes background infrastructure. If mass adoption arrives, it will not announce itself through speculation. It will quietly emerge inside games, immersive environments, and digital experiences people already love. Vanar is positioning itself to be the silent engine behind that transition, where technology disappears and utility becomes unavoidable.