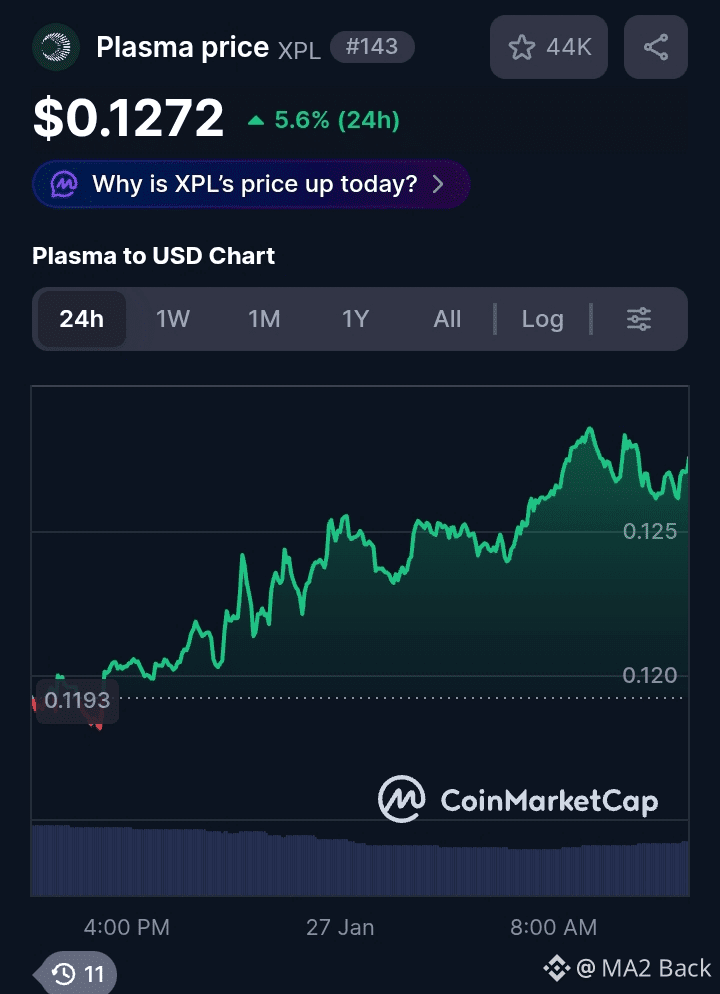

xpl$XPL is now trading near a very important demand zone after months of steady downside pressure

this area matters because it is where buyers previously stepped in with strong volume and defended price

looking at market structure the downtrend is still valid but momentum is clearly slowing

selling volume is decreasing and price is no longer making aggressive lower lows

this usually means sellers are getting exhausted

from a technical view the descending trendline has capped price many times

a clean break and hold above this trendline would shift short term structure from bearish to neutral bullish

this kind of move often attracts short term traders and spot buyers looking for a bounce

on chain data also shows interesting signals

outflows from exchanges are stabilizing and large wallets are no longer increasing sell pressure aggressively

this does not mean full reversal yet but it supports the idea of accumulation near demand

fundamentally plasma is still focused on stablecoin infrastructure and defi rails

price weakness recently is more about market rotation and liquidity drying up than project failure

if broader market sentiment improves xpl could react fast due to thin liquidity

risk management is still very important

a break below 0 114 would invalidate this demand zone and open more downside

confirmation is needed not prediction

overall this is a wait and watch zone

confirmation above trendline brings short term upside

failure means patience is required

dyor nfa

#XPL #Plasma #altcoinseason #Macro