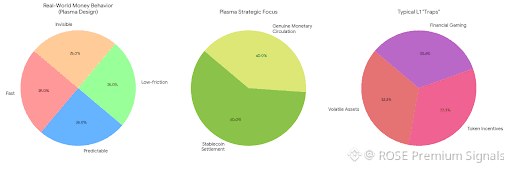

Plasma is not trying to be another smart contract platform competing for speculative capital. It is engineering a settlement layer for stablecoins that mirrors how money behaves in the real world: fast, predictable, low-friction, and invisible. This design choice immediately separates it from most Layer 1 blockchains, which remain trapped in architectures optimized for volatile assets, token incentives, and financial gaming rather than genuine monetary circulation.

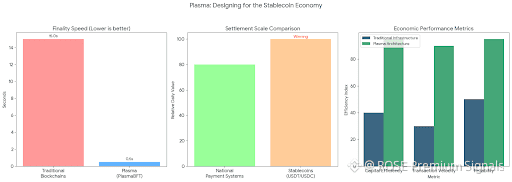

What Plasma understands — and most chains still don’t — is that stablecoins have already won the distribution battle. USDT and USDC now settle more daily value than many national payment systems. They are the rails of informal economies, emerging market commerce, remittances, payroll, gaming rewards, and increasingly, institutional treasury operations. Yet they still operate on infrastructure designed for trading, not settlement. Plasma flips this mismatch by designing the chain around stablecoins first, rather than treating them as secondary assets.

Sub-second finality through PlasmaBFT is not just about speed. It fundamentally alters economic behavior. When finality becomes near-instant, financial risk collapses. Merchants don’t price in confirmation delays. Arbitrage windows shrink. Capital efficiency rises. Payment flows start behaving like real-time cash settlement instead of probabilistic block confirmations. This creates a network environment where velocity matters more than speculation, and reliability becomes more valuable than yield.

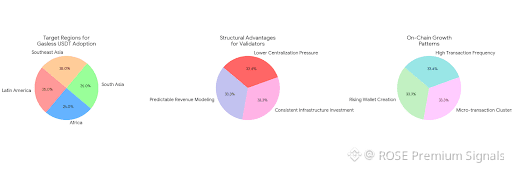

Gasless USDT transfers may appear like a UX upgrade, but economically, it dismantles one of crypto’s deepest barriers: native token dependency. In most regions where stablecoins are heavily used, acquiring gas tokens remains a friction point. Removing this friction instantly broadens addressable user bases across Latin America, Africa, South Asia, and Southeast Asia. The result is not incremental adoption, but step-function growth. On-chain data would reflect this through rising wallet creation, dense micro-transaction clusters, and extremely high transaction frequency per user — patterns rarely seen outside mobile money systems.

Stablecoin-first gas introduces another structural advantage: economic stability for validators. Traditional blockchains price fees in volatile native tokens, tying security budgets to speculative market cycles. Plasma anchors validator incentives in stablecoins, allowing predictable revenue modeling, consistent infrastructure investment, and lower centralization pressure. This is how real financial networks scale: not through speculative upside, but through stable operational margins.

Bitcoin-anchored security introduces an entirely different dimension: political neutrality. Instead of embedding trust solely inside governance frameworks or token-weighted voting, Plasma externalizes its security gravity toward Bitcoin’s settlement finality. This dramatically raises the cost of censorship, intervention, or political capture. For institutions and payment processors, this is a quiet breakthrough. It allows compliance and decentralization to coexist without compromising settlement guarantees.

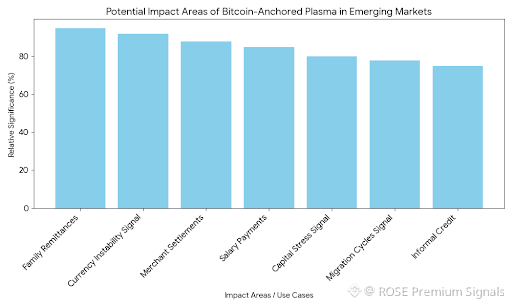

Where this becomes most powerful is in emerging market finance. Stablecoins already function as shadow currencies in inflationary economies. Plasma formalizes this reality into programmable financial infrastructure. Salary payments, merchant settlements, informal credit, family remittances — all can operate inside a frictionless, instant, and censorship-resistant environment. Over time, Plasma’s transaction data may become a real-time macroeconomic signal, reflecting capital stress, currency instability, and migration-driven remittance cycles long before governments release statistics.

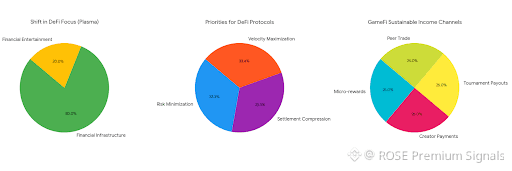

DeFi built on Plasma will not resemble today’s yield-driven casino mechanics. With volatility largely removed from the base layer, financial engineering replaces speculation. Lending markets tighten spreads. Liquidity pools prioritize flow optimization. Capital routing becomes about efficiency rather than reward extraction. The protocols that thrive will be those that minimize risk, compress settlement time, and maximize velocity. Plasma quietly reshapes DeFi into financial infrastructure rather than financial entertainment.

GameFi also changes dramatically in a stablecoin-native environment. When in-game economies settle directly in stablecoins with instant finality, virtual labor gains real economic meaning. Micro-rewards, creator payments, tournament payouts, and peer trade become genuine income channels rather than speculative token loops. This enables sustainable digital labor economies, not just inflation-driven engagement systems.

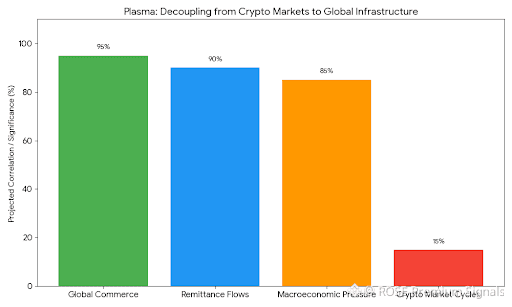

The long-term implication is clear: Plasma is not chasing crypto users. It is positioning itself as invisible financial plumbing. If successful, its usage metrics will decouple from crypto market cycles and instead correlate with global commerce, remittance flows, and macroeconomic pressure. That decoupling is the defining trait of true financial infrastructure.

Plasma doesn’t promise a new financial system. It quietly builds one where crypto stops feeling like crypto — and starts behaving like money.