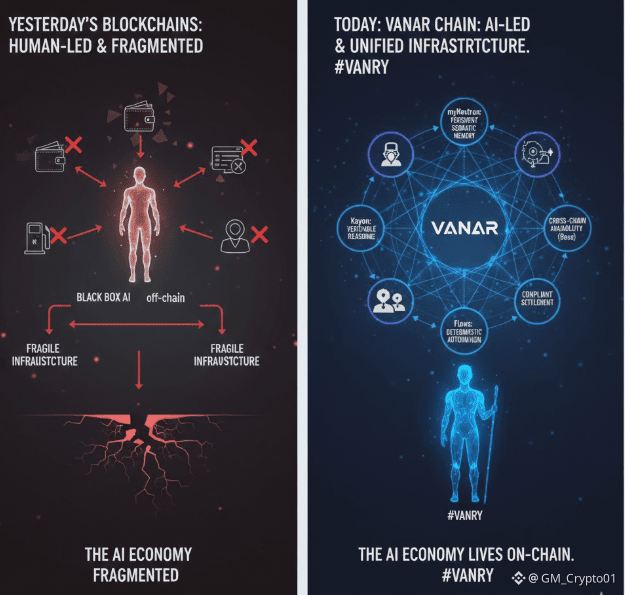

Most blockchains were born in an era where humans were the primary users. Wallets, dashboards, gas fees, governance forums everything assumed a person clicking, signing, and waiting. But the next phase of the internet is not being shaped by human latency. It is being shaped by autonomous systems that think, remember, act, and settle value without asking permission or pausing for UX.

This is where the real story of Vanar Chain begins.

Vanar is not positioning itself as another fast chain or a narrative heavy AI add on. It is quietly answering a more uncomfortable question what does infrastructure look like when the primary economic actors are intelligent agents rather than people When software does not just execute instructions but reasons adapts and compounds decisions over time

Most chains talk about AI as a feature layer. Vanar treats intelligence as a first class primitive.

AI added infrastructure retrofits models onto systems designed for throughput not cognition. That approach breaks down quickly. Agents need memory that persists across transactions. They need reasoning that can be audited and explained. They need automation that does not rely on brittle scripts. And most importantly they need native settlement rails that allow value to move as seamlessly as information.

This is why TPS has quietly become a distraction. Speed without intelligence is just noise. Vanar’s architecture is designed around the real requirements of AI systems semantic memory verifiable reasoning deterministic automation and compliant settlement. These are not marketing terms on a roadmap. They already exist as live infrastructure components.

myNeutron demonstrates something most chains still treat as theoretical persistent semantic memory at the infrastructure layer. For AI agents context is capital. Without memory intelligence resets every block. With memory agents can learn adapt and build continuity. This shifts blockchains from stateless execution environments into long lived cognitive systems.

Kayon pushes this further by embedding reasoning and explainability on chain. In an AI driven economy trust does not come from brand names it comes from verifiable logic. Enterprises regulators and users will not accept black box decisions that move capital. Kayon proves that reasoning itself can be native inspectable and provable at the protocol level.

Flows closes the loop by translating intelligence into safe automated action. This is where most AI narratives collapse because automation without guardrails creates systemic risk. Vanar’s approach treats action as something that must be constrained auditable and aligned with real economic rules not demo environments.

All of this would still be incomplete without value settlement. AI agents do not use wallets sign pop ups or manage keys like humans. They require global compliant payment rails that operate continuously. Payments are not an add on to AI first infrastructure they are the point where intelligence meets reality. Vanar’s alignment around real economic activity rather than sandbox demos is what turns intelligence into usable capital.

This is also why Vanar’s move toward cross chain availability starting with Base matters more than most realize. Intelligence does not respect chain boundaries. AI first infrastructure cannot remain isolated within a single ecosystem. By making its technology accessible across chains Vanar expands the surface area where intelligent systems can operate settle and scale. The result is not fragmentation but compounding usage and with it deeper utility for VANRY.

There is a broader implication here that many new Layer one launches are unwilling to confront. Web3 does not suffer from a lack of base infrastructure anymore. It suffers from a lack of proof that this infrastructure is ready for autonomous economies. Launching another chain without native intelligence is increasingly like building roads for horses in an age of autonomous vehicles.

Vanar is taking the opposite path. It is not chasing short lived narratives or speculative hype cycles. It is building readiness. Readiness for agents that transact reason collateralize assets and manage liquidity without liquidation events triggered by human panic. Readiness for enterprises that require compliance explainability and predictability. Readiness for an economy where data memory and capital converge.

In that context VANRY is not just a token. It is exposure to an intelligent stack where usage is driven by systems that operate continuously not sentiment that resets every market cycle. As AI becomes an economic actor rather than a tool infrastructure that was designed for it from day one will not just outperform it will become unavoidable.

Vanar Chain is not betting on a trend. It is building for the moment when intelligence stops being an application layer and becomes the foundation of the decentralized economy.