There's a fundamental problem with how money moves today, and it's not the one most people think about. Sure, international wire transfers take days, fees pile up like highway tolls, and your bank still closes at 5 PM like it's 1985. But the real issue runs deeper: our entire financial infrastructure is built on layers of intermediaries, each taking its cut, each adding friction, each creating a point where the system can break down or shut you out entirely.

Plasma isn't trying to fix banking. They're trying to make it obsolete.

The blockchain project has emerged with what might be the most ambitious infrastructure play in crypto: building a dedicated network optimized entirely for stablecoins, backed by a native token called XPL that's designed from first principles to align incentives across an ecosystem that doesn't quite exist yet. It's the kind of moonshot that either changes everything or becomes a cautionary tale, and right now, we're watching the opening act.

What makes Plasma particularly interesting isn't just the technology, though their Proof-of-Stake architecture promises the speed and efficiency needed to handle serious transaction volume. It's the economic design. The team has thought through token distribution and incentive mechanisms with the kind of rigor you'd expect from people who've studied why previous crypto networks flamed out spectacularly despite initial hype.

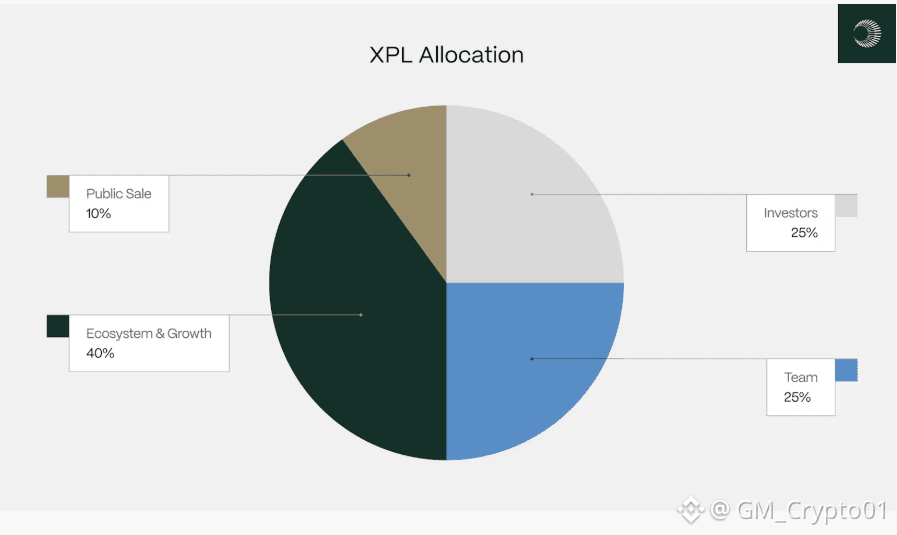

Consider the XPL distribution model. Out of ten billion tokens at mainnet beta launch, they've allocated forty percent, four billion tokens specifically for ecosystem growth and strategic partnerships. This isn't just venture capital speak for "we'll figure it out later." Eight hundred million of those tokens unlock immediately at launch to bootstrap DeFi partnerships, provide exchange liquidity, and seed early adoption campaigns. The remaining 3.2 billion unlock gradually over three years, creating sustained incentive alignment rather than a one-time sugar rush.

This matters because network effects in blockchain don't happen by accident. You need simultaneous adoption from multiple stakeholder groups—developers building applications, institutions providing liquidity, validators securing the network, and users actually transacting. Most crypto projects optimize for one group and hope the others follow. Plasma is trying to orchestrate all of them at once, using XPL as the coordination mechanism.

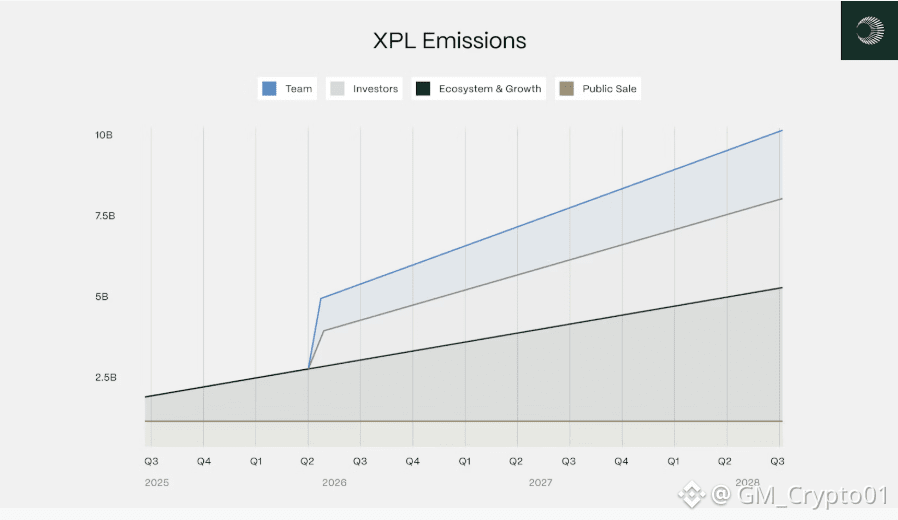

The validator economics reveal this thinking most clearly. Plasma starts with five percent annual inflation to reward validators—the entities that stake XPL to confirm transactions and maintain network consensus. This gradually decreases by half a percentage point yearly until settling at three percent long-term. Critically, inflation doesn't even begin until external validators and stake delegation go live, preventing early insider enrichment. Team and investor tokens that remain locked can't earn staking rewards, forcing skin-in-the-game participation rather than passive extraction.

But here's where it gets clever: Plasma implements an EIP-1559 burn mechanism, permanently destroying the base fees paid for network transactions. As adoption scales and transaction volume increases, this deflationary pressure counterbalances the inflationary validator rewards. The result is an economic flywheel where network usage directly moderates token supply, theoretically creating sustainable equilibrium rather than the death-spiral tokenomics that have plagued earlier projects.

The human element here deserves attention too. Plasma allocated twenty-five percent of XPL, 2.5 billion tokens to team members, but with a brutal vesting schedule: one-third locked behind a one-year cliff from mainnet launch, the remainder unlocking monthly over the subsequent two years. This isn't unusual in crypto, but combined with the no-rewards-for-locked-tokens rule, it creates genuine long-term alignment. The people building this can't cash out and disappear. They're committed to a multi-year journey whether they like it or not.

The public sale structure tells another story about regulatory realities and market access. Ten percent of supply went to public participants through a deposit campaign, but the unlock schedules split along geographic lines. Non-US purchasers got full access at mainnet beta launch. US purchasers face a twelve-month lockup extending to July 2026. This isn't arbitrary—it reflects the complex regulatory environment American crypto projects navigate, where playing by the rules means accepting constraints that seem almost quaint compared to offshore competitors.

Plasma's investor roster reads like a who's-who of crypto and tech elite: Founders Fund, Framework, Bitfinex among others. That twenty five percent investor allocationmatching the team share ollows the same three year vesting schedule, creating alignment across the cap table. These aren't financial tourists looking for quick flips. They're backing infrastructure that won't see serious returns unless the vision actually manifests over years, not quarters.

The technical architecture supports stablecoins specifically because that's where real-world adoption lives. People don't want to transact in assets that swing twenty percent in a day. They want dollar-equivalent value that moves instantly, costs nothing, and works globally. By optimizing the entire network for this use case rather than trying to be all things to all people, Plasma sidesteps the scaling challenges that turn general-purpose blockchains into expensive, slow consensus machines.

The collateralization infrastructure adds another dimension. Users can deposit liquid assets, both crypto tokens and tokenized real world assets to mint USDf, an overcollateralized synthetic dollar. This creates liquidity without forced selling, letting participants maintain exposure to their holdings while still accessing stable purchasing power. It's DeFi's answer to home equity lines of credit, except the collateral can be anything from Bitcoin to tokenized treasury bonds, and the whole system operates transparently on-chain.

What Plasma is really building is a new money layer for the internet, with XPL functioning as the economic bedrock. Just as central banks hold reserves to backstop national currencies, XPL stakes secure the Plasma network and align participant incentives. The difference is radical transparency—every transaction, every token movement, every governance decision happens on a public ledger where anyone can verify the rules are being followed.

The challenge ahead isn't technical—blockchain can handle payment rails. It's adoption. Financial institutions move slowly, regulators move slower, and changing how money works globally requires convincing entities with enormous sunk costs in current systems to embrace something fundamentally different. Plasma's strategy involves meeting traditional finance where it lives, building bridges rather than burning them, using token incentives to accelerate what would otherwise take decades of relationship-building and integration work.

Whether this succeeds depends on execution across multiple fronts simultaneously. The technology needs to work flawlessly at scale. The economic mechanisms need to prove sustainable through market cycles. Regulatory frameworks need to evolve in ways that permit rather than prohibit innovation. And enough users, validators, institutions, and developers need to show up and build something real.

Plasma is betting that if you design the incentives correctly, align them across stakeholder groups, and build genuinely useful infrastructure, the network effects eventually become self-sustaining. It's an audacious vision, funded by serious capital, built by people who've burned their bridges to legacy finance careers. In three years, we'll know if they rebuilt the financial system or just created another abandoned experiment in the blockchain graveyard.