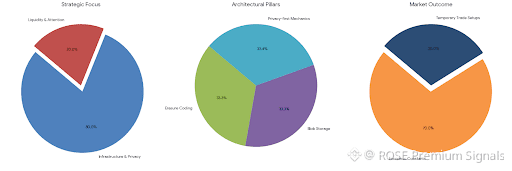

#walrus does not behave like a typical crypto project, and that is precisely why it matters. Built on Sui, Walrus approaches decentralized storage and privacy not as side features but as the foundation of its economic design. Where most protocols chase liquidity and attention, Walrus is engineering structural gravity. By embedding erasure coding, blob storage, and privacy-first data mechanics directly into its architecture, Walrus is turning storage into a financial primitive. This shifts the market from speculative narratives toward something far more durable: infrastructure that accrues value because real systems depend on it, not because traders rotate into it. The distinction is subtle but decisive. Projects that generate dependency become economic constants; projects that generate hype become temporary trade setups.

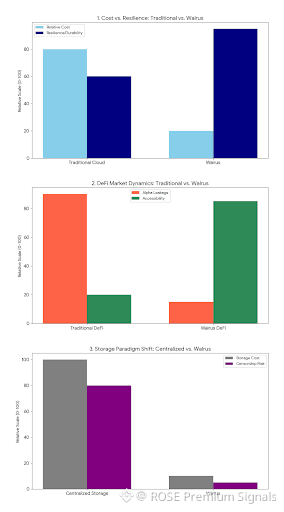

What makes Walrus structurally interesting is how it redefines cost. Traditional cloud pricing is linear, centralized, and politically fragile. Walrus flips this by dispersing data fragments across a decentralized network using erasure coding, allowing files to survive node failures without duplication overhead. The result is an economic curve where resilience becomes cheaper, not more expensive. This inversion has deep implications. It changes how DAOs budget, how games architect their economies, and how DeFi protocols price risk. When storage cost collapses and censorship risk approaches zero, capital behaves differently. Protocols can afford to persist more state, retain deeper historical data, and build models that were previously too expensive to maintain. On-chain analytics stops being a luxury and becomes a baseline expectation.

Most investors underestimate how powerful private storage becomes once it integrates natively with DeFi. Walrus quietly dissolves the artificial boundary between transactional privacy and data privacy. This is not just about hiding transfers; it is about controlling informational asymmetry. In high-frequency DeFi strategies, the value edge often comes from data lead time, not capital size. Walrus enables protocols to store sensitive execution logic, oracle inputs, and strategy parameters in decentralized form without exposing them to mempool surveillance or centralized failure points. This introduces a new class of private financial engineering, where sophisticated strategies no longer leak alpha through transparent state updates. The economic impact here is nonlinear: smaller players gain access to tools previously reserved for centralized funds, flattening the competitive curve inside DeFi.

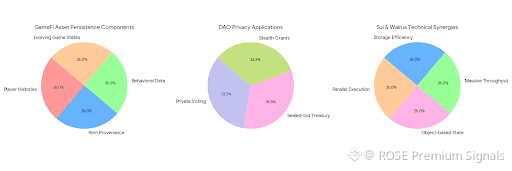

On Sui, Walrus benefits from parallel execution and object-based state, allowing massive throughput without congesting storage operations. This synergy matters because most storage solutions collapse under transactional load, forcing protocols to compromise either performance or decentralization. Walrus does neither. It treats storage as composable infrastructure, letting dApps embed data-heavy operations directly into their logic flows. In GameFi, this unlocks real asset persistence. Player histories, item provenance, behavioral data, and evolving game states can all live permanently on-chain without bloating costs. This creates economic memory inside games, where long-term player behavior becomes a tradable signal and asset lineage becomes provable. Entire secondary markets can emerge around data-rich NFTs, not as speculative images, but as evolving records of participation.

Privacy in Walrus is not ideological; it is mechanical. Most privacy chains fail because they isolate themselves from liquidity, while most public chains fail because they sacrifice confidentiality. Walrus instead inserts privacy at the data layer, letting applications decide what to reveal and when. This modular privacy reshapes governance dynamics. DAOs can conduct private voting rounds, sealed-bid treasury deployments, and stealth grant programs without leaking intent to competitors. Market manipulation becomes harder, insider advantages narrow, and governance capture becomes more visible. Over time, this forces token markets to price fundamentals more accurately, as information games lose dominance.

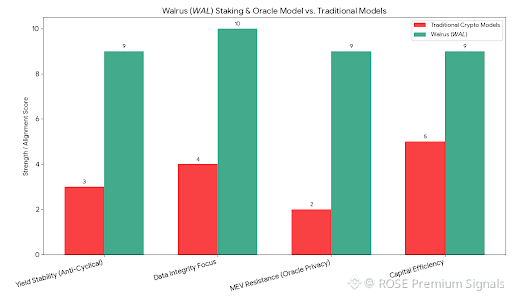

The staking model of WAL is quietly elegant. Instead of paying validators to secure empty blocks, Walrus aligns incentives around storage reliability and uptime. Nodes earn by preserving data integrity, not by inflating transactional throughput. This produces a fundamentally different yield profile. Rewards become correlated with network utility, not speculative demand. In bearish markets, when transaction volumes collapse, Walrus can continue generating yield through data demand. This anti-cyclical income stream is rare in crypto and will increasingly attract long-horizon capital, particularly from funds that prioritize infrastructure over short-term price momentum.

Walrus also reshapes oracle design. Instead of broadcasting sensitive inputs openly, data feeds can be committed privately and revealed only when economically optimal. This mitigates oracle front-running, reduces liquidation cascades, and stabilizes lending markets. When liquidation thresholds are no longer visible in real time, predatory MEV strategies lose effectiveness. This increases capital efficiency, allowing protocols to operate at tighter margins without raising systemic risk. Over time, this compresses yield spreads but increases volume, benefiting infrastructure tokens like WAL that monetize scale rather than volatility.

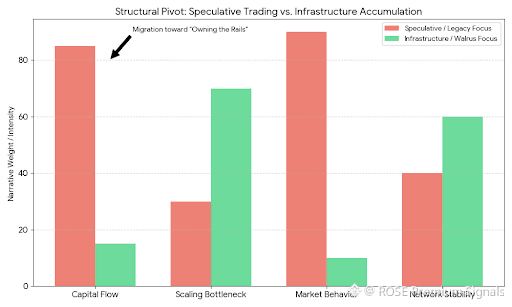

The on-chain metrics already hint at this structural pivot. Storage utilization curves, node retention rates, and WAL staking lockups show behavior more consistent with infrastructure accumulation than speculative trading. Wallet clustering analysis suggests growing institutional exposure, particularly from funds allocating into decentralized compute and storage narratives rather than traditional DeFi rotations. Capital is migrating from yield chasing toward owning the rails themselves. Walrus sits squarely inside this flow.

Where this becomes existential for the broader market is in Layer-2 scaling. Most L2s are bandwidth constrained not by execution, but by data availability. Walrus offers a decentralized alternative to centralized data availability layers, enabling rollups to offload massive state data without sacrificing censorship resistance. This positions Walrus as a backbone layer for the next generation of modular blockchains. If Ethereum’s future is execution abstraction, Walrus could become its memory substrate. That is not a small narrative shift; it is a tectonic one.

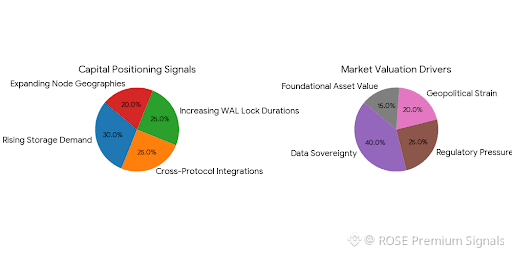

The real risk for Walrus is not competition, but invisibility. Infrastructure projects rarely trend. They accumulate silently, and by the time markets notice, most of the asymmetric upside is already absorbed. Yet the signals are forming: rising storage demand, cross-protocol integrations, increasing WAL lock durations, and expanding node geographies. These are not retail behaviors. They are capital positioning behaviors.

Over the next cycle, markets will increasingly price data sovereignty as a premium asset class. As regulatory pressure intensifies and centralized platforms fracture under geopolitical strain, decentralized private storage will stop being optional. Walrus stands at that inflection point. Not as a speculative play, but as a foundational asset that captures value from everything built on top of it. The protocols that define cycles are not the loudest ones. They are the ones that quietly become unavoidable. Walrus is engineering exactly that kind of inevitability.