When people hear the word finality, they imagine an ending.

A trade is done. A block is sealed. Nothing can change.

That idea feels safe, especially in markets where certainty is rare. But in real financial systems, finality is only the beginning of responsibility, not the end of work. A ledger can be closed while the system around it is still evolving.

This is where Dusk stands out.

At a glance, Dusk is described as a privacy-focused Layer 1 built for financial use cases that need confidentiality and compliance. That sounds technical, but the real value shows up in everyday problems:

Traders want private positions

Institutions want private counterparties

Settlements should stay confidential

But proof must still exist when auditors, banks, or regulators ask

Dusk is not trying to escape regulation. It is trying to function inside reality.

Final Blocks, Ongoing Work

Dusk’s mainnet journey made this philosophy clear. The network followed a staged rollout, gradually onboarding stakes and deposits before switching into full operational mode. The first immutable block marked an important milestone.

But that moment wasn’t the ending.

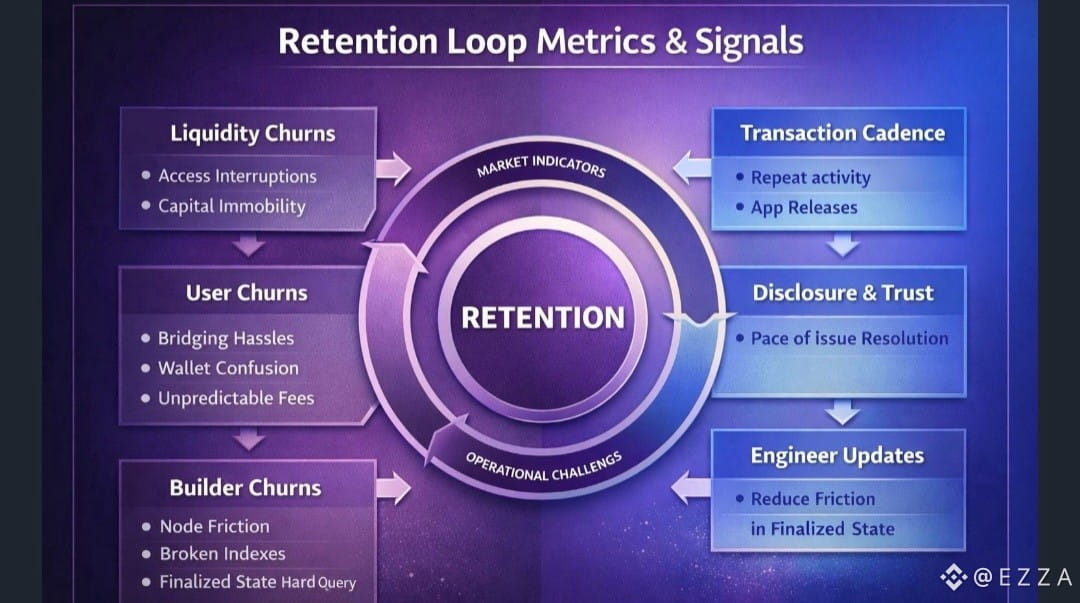

In real ecosystems, mainnet is where the hardest problem begins: retention.

Users leave when wallets are confusing or bridges feel unreliable.

Builders leave when nodes are painful to operate or finalized data is hard to query.

Liquidity leaves when access breaks or capital can’t move smoothly.

A blockchain can have perfect finality and still lose its ecosystem if the surrounding experience fails.

A Real Example of “Finality Isn’t Finished”

In early 2026, Dusk publicly disclosed unusual activity related to a team-managed wallet used for bridge operations. The key point wasn’t the incident itself.

The important detail was this:

The core Dusk mainnet was not affected

Finality continued uninterrupted

Bridge services were paused temporarily to be hardened

This is the real-world meaning of the phrase finality does not equal completion.

The protocol stayed solid, while the user-facing infrastructure continued to be improved.

That distinction matters for anyone trading or investing seriously.

Market Numbers vs Network Habits

On the market side, DUSK trades around the mid-teen cents range, with daily volume in the tens of millions and a market cap hovering in the mid-eight figures depending on the source. Supply figures commonly show a one-billion max supply with roughly half circulating.

Those numbers tell you about liquidity and attention.

They do not tell you about habit.

The deeper question is simple but powerful:

Do users come back for a second transaction?

Do developers build a second app after the first integration?

Do operators keep running nodes once the excitement fades?

Retention is what separates a launch from an ecosystem.

Where Retention Is Quietly Built

Retention is rarely driven by hype. It is built through boring, unglamorous engineering.

In Dusk’s node and infrastructure updates, you can see a focus on how finalized data is accessed, indexed, and served under real conditions. Improvements like better pagination defaults and operational hardening don’t make headlines, but they reduce friction — and friction is what silently pushes users away.

For financial infrastructure, boring is good.

Why This Matters for Real Finance

Imagine managing capital in a private allocation or tokenized security. You don’t want your full position size and counterparties exposed to the market. That creates risk and information leakage.

But you still need to prove ownership, settlement, and compliance when required.

This narrow corridor — private by default, verifiable on demand — is exactly where Dusk is positioning itself. If it becomes reliable and predictable, users stay. If it becomes stressful, they leave, regardless of how “final” the blocks are.

How to Look at Dusk Without Chasing Narrative

Instead of treating DUSK as a story trade, treat it like infrastructure already carrying weight.

Watch how transparently operational issues are disclosed and resolved

Track whether developer updates keep reducing friction around finalized state

Compare liquidity and volume with actual ecosystem progress

Busy charts don’t always mean durable usage.

The real edge is not predicting the future.

It’s staying close to whether the system keeps improving after finality.

Because in the end, finality closes a block —

retention builds a market.