plasma is a purpose‑built Layer‑1 networks blockchains designed not to be all things to all people, but to solve specific, real‑world financial problems. Among these, Plasma stands out with a clear mission: to become the de facto settlement layer for stablecoins and a global payments backbone that combines Ethereum‑style programmability, fast finality, and frictionless stablecoin transfers especially USDT.

Unlike generic Layer‑1 platforms that focus on DeFi yield farms or NFT hype, Plasma is engineered to make stablecoin use cheap, fast, intuitive, and scalable — bridging the gap between traditional payments rails and modern Web3 settlement infrastructure.

Why Plasma Matters: Solving Real Problems in Stablecoin Settlement

Stablecoins like USDT and USDC have become central to digital value transfer, with trillions of dollars in daily volume and broad adoption in remittances, cross‑border commerce, and decentralized finance. Yet most blockchains — even high‑performance ones — were not purpose‑built for settling stablecoin transactions at scale. Traditional networks often face:

High gas fees for simple transfers

Slow settlement and finality times

The need to hold native tokens just to send stablecoins

Complicated user onboarding for non‑crypto users

Plasma addresses these pain points head‑on with features like gasless USDT transfers (for basic sends), stablecoin‑first gas abstraction, and trust‑minimized Bitcoin security anchoring — making stablecoins feel like digital cash rails with near‑zero friction.

Core Architecture and Design Principles

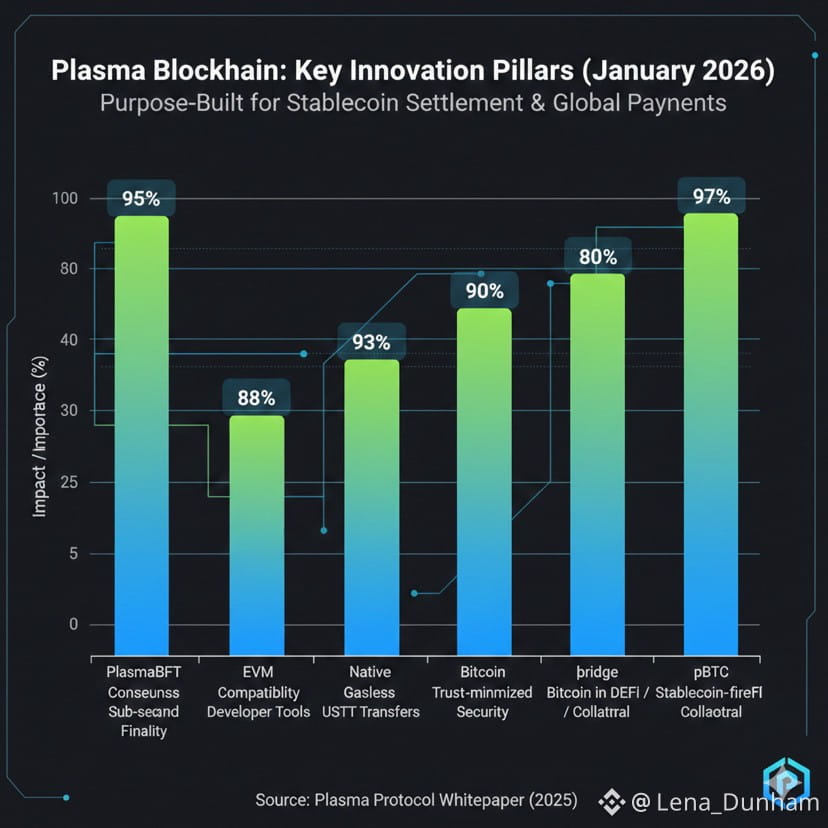

Plasma’s architecture combines proven blockchain components with innovations tailored for stablecoin settlement:

1. PlasmaBFT — Fast and Final Consensus

At the heart of Plasma is the PlasmaBFT consensus protocol — a robust Byzantine Fault Tolerant algorithm derived from Fast HotStuff. This design enables sub‑second finality, meaning transactions are effectively irreversible almost instantly. For settlement use cases — where certainty and speed are paramount — this is a game changer compared with probabilistic finality chains.

2. EVM Compatibility via Reth

Plasma is fully Ethereum‑compatible thanks to its use of Reth, a Rust‑based Ethereum execution engine. This allows developers to deploy Solidity smart contracts, use the same developer tools (Hardhat, Foundry, MetaMask, etc.), and bring existing DeFi and payments applications to Plasma with minimal changes.

This familiar developer experience positions Plasma as a payments chain that’s as open as Ethereum, rather than a closed or siloed system.

3. Native Paymaster System for Gas Abstraction

One of Plasma’s most user‑centric innovations is the protocol‑level paymaster system that sponsors gas for basic USDT transfers, allowing users to send stablecoins without needing to first acquire and manage native XPL tokens. This dramatically lowers the onboarding barrier for everyday users — a crucial factor for real‑world adoption.

Developers can also register custom gas tokens, enabling fees to be paid in stablecoins or other assets, which smooths the user experience and reduces friction even further.

4. Bitcoin Anchoring for Security

Plasma takes an innovative approach to security by periodically anchoring its ledger state to Bitcoin, via a trust‑minimized bridge. This means the blockchain can benefit from Bitcoin’s censorship resistance and immutability, creating a more neutral and secure settlement backbone without central custodial risk.

5. pBTC Bridge — Bitcoin in DeFi

The native Bitcoin bridge allows BTC to be moved into the Plasma ecosystem as pBTC, a token fully backed 1:1 by real Bitcoin and verified by decentralized verifiers. This makes BTC usable within Plasma’s EVM environment — for collateral, smart contracts, or cross‑chain finance — without relying on centralized intermediaries.

Gasless Transfers and User Experience

One of Plasma’s most talked‑about features is its support for gasless USDT transfers for basic payment flows. Thanks to the protocol’s paymaster system, users can send USDT without holding XPL or native gas tokens, removing a common point of friction that often scares off mainstream users.

This zero‑fee stablecoin transfer model makes Plasma ideal for:

Remittances and peer‑to‑peer payments

E‑commerce and merchant settlements

Micropayments and loyalty systems

All with the speed and efficiency that traditional banking rails struggle to match — especially across borders.

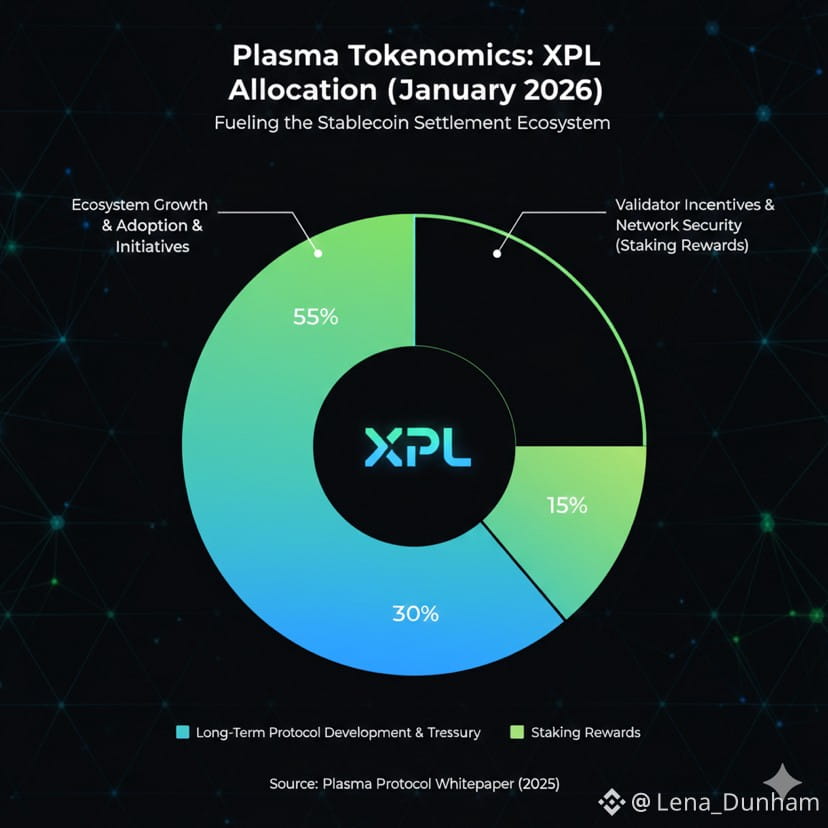

Tokenomics: XPL as the Economic Backbone

The native XPL token powers the entire Plasma ecosystem. Its functions include:

Network fees: XPL is used for transaction fees beyond basic gasless transfers.

Validator staking: XPL is used for securing the network via PlasmaBFT consensus.

Rewards: Validators earn XPL for supporting the chain and maintaining uptime.

Delegation: XPL holders can delegate tokens to validators to earn a share of consensus rewards without running infrastructure themselves.

Plasma’s economic model uses reward slashing rather than stake slashing, meaning misbehaving validators lose rewards but not their staked capital — balancing security with economic fairness.

The total supply of XPL is 10 billion tokens, with allocation geared toward ecosystem growth, validator incentives, and long‑term sustainability.

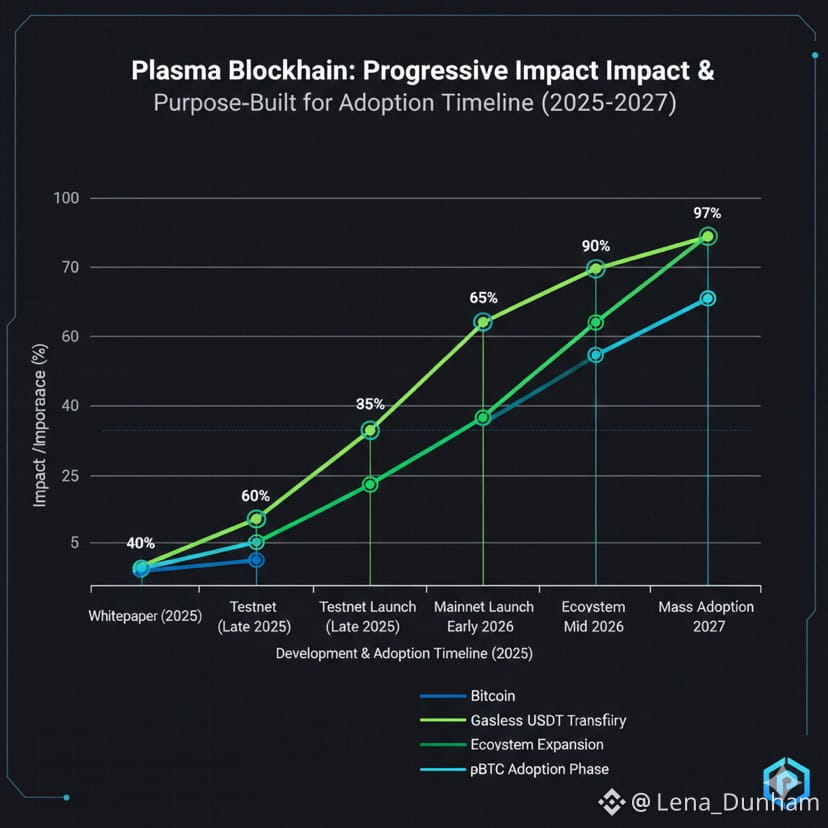

Mainnet Launch, Binance HODLer Airdrop & Market Impact

Plasma’s emergence into the market was highly visible thanks to its inclusion as a project in the Binance HODLer Airdrops program in September 2025. Eligible users who staked BNB via Binance Simple Earn and On‑Chain Yields products received XPL tokens before its official trading launch.

This strategic distribution helped bootstrap community engagement and liquidity. XPL launched with multiple trading pairs, including USDT, USDC, BNB, FDUSD, and TRY, expanding its accessibility on Binance’s global trading platform.

Beyond Binance, XPL quickly appeared on other major platforms and integrations, reflecting early ecosystem support for both users and developers.

Use Cases: Beyond Transfers

Plasma’s design enables a wide range of applications far beyond simple payments:

1. Cross‑Border Payments and Remittances

High fees and settlement times have long hindered global remittances. Plasma’s gasless stablecoin transfers and sub‑second finality offer a compelling alternative that is often faster and cheaper than traditional banking rails.

2. Commerce and Merchant Adoption

Online and physical merchants can accept stablecoins at near‑zero cost to the consumer, opening up global markets without the need for currency conversions or traditional card fees.

3. DeFi and Payments Infrastructure

Developers can deploy smart contracts for lending, staking, yield aggregation, and liquidity provisioning — all with deep stablecoin liquidity and integration with Plasma’s settlement layer.

4. Programmable Money and Payroll Systems

Fast, cheap stablecoin flows can enable programmable payrolls, automated subscriptions, and treasury settlement systems that are far more flexible and cost‑effective than legacy solutions.

5. Bitcoin and Cross‑Asset Finance

The pBTC bridge enables Bitcoin holders to participate in DeFi applications, stake BTC as collateral, or interact with smart contracts — all while maintaining trust‑minimized custody models.

Security, Consensus, and Network Decentralization

Security is baked into Plasma’s engineering:

PlasmaBFT consensus ensures rapid finality without sacrificing resilience to validator failures.

Bitcoin anchoring adds an extra layer of immutability and censorship resistance by periodically embedding state checkpoints into the Bitcoin chain.

Reward slashing discourages validator misbehavior while keeping economic risk manageable.

These design choices make Plasma attractive not only to DeFi builders but also to institutional players seeking blockchain infrastructure they can trust for real‑world settlement and compliance.

Plasma One and Stablecoin Utility Expansion

Beyond settlement rails, the Plasma ecosystem has introduced Plasma One — a stablecoin‑native neobank that aims to offer users permissionless access to saving, spending, and earning digital dollars. This includes features such as:

Earn programs on stablecoin deposits

Digital debit and credit integrations

Low‑cost peer‑to‑peer payments

This builds on Plasma’s settlement foundation to position stablecoins as usable digital cash for everyday finance.

Ecosystem Partnerships and Adoption Signals

Plasma’s growth narrative has been punctuated by partnerships and integrations that signal real momentum:

Integrations with major DeFi protocols and wallets continue expanding support for Plasma’s stablecoin rails.

Infrastructure tools and bridges enhance interoperability, making it easier for developers to build with familiar tools like Hardhat, Remix, and Foundry.

Community support and developer engagement are growing via testnets and incentivized campaigns.

These ecosystem elements are critical as Plasma transitions from its early launch phase into mature network adoption.

Challenges and Considerations

While Plasma has a clear mission and compelling design, it also faces real execution and adoption challenges:

Sustainability of gas sponsors: Long‑term viability of zero‑fee models depends on economic sustainability and network growth.

Decentralization trajectory: As with many new chains, early validator sets often start centralized and must evolve over time.

Competition: Other versions of payment‑focused chains or sidechains will vie for the same stablecoin use cases.

However, Plasma’s early market traction, strong technical foundation, and real use‑case focus position it well to address these issues over time.

Conclusion: A Stablecoin‑First Blockchain for Real Value

Plasma represents a significant evolution in blockchain design — a network built not for general purpose speculation or niche application, but for the fundamental economic function of money movement. By purpose‑building stablecoin settlement into the protocol, integrating Bitcoin‑anchored security, and enabling frictionless payments with EVM‑based tooling, Plasma seeks to become the backbone of real‑world stablecoin usage at scale.

Its gasless transfers, sub‑second finality, and flexible fee models reduce barriers for users and developers alike. Combined with tokenomics that secure the network and fuel growth, Plasma’s approach could reshape how stablecoins are used for remittances, commerce, treasury management, and everyday financial flows.

As adoption evolves in 2026 and beyond, Plasma’s success will depend not just on technology, but on ecosystem growth, integration with existing financial systems, and developer traction — an ambitious but compelling roadmap for the next generation of blockchain settlement infrastructure.