A city can print out bus tickets on a daily basis but when it shreds gate tickets the real question is not how many tickets there are on paper. What happens to the pile after some time is the question.

It is the appropriate frame of XPL.

This article will be of interest to three audiences: individuals with XPL and interested in supply drift, developers of products with interest in knowing what fee burning entails in product design and operators of nodes who would like to learn how the reward budget can remain healthy without perpetual dilution. I am going to keep on one track throughout: is it possible to burn base fee as the usage increases in Plasma offset inflation.

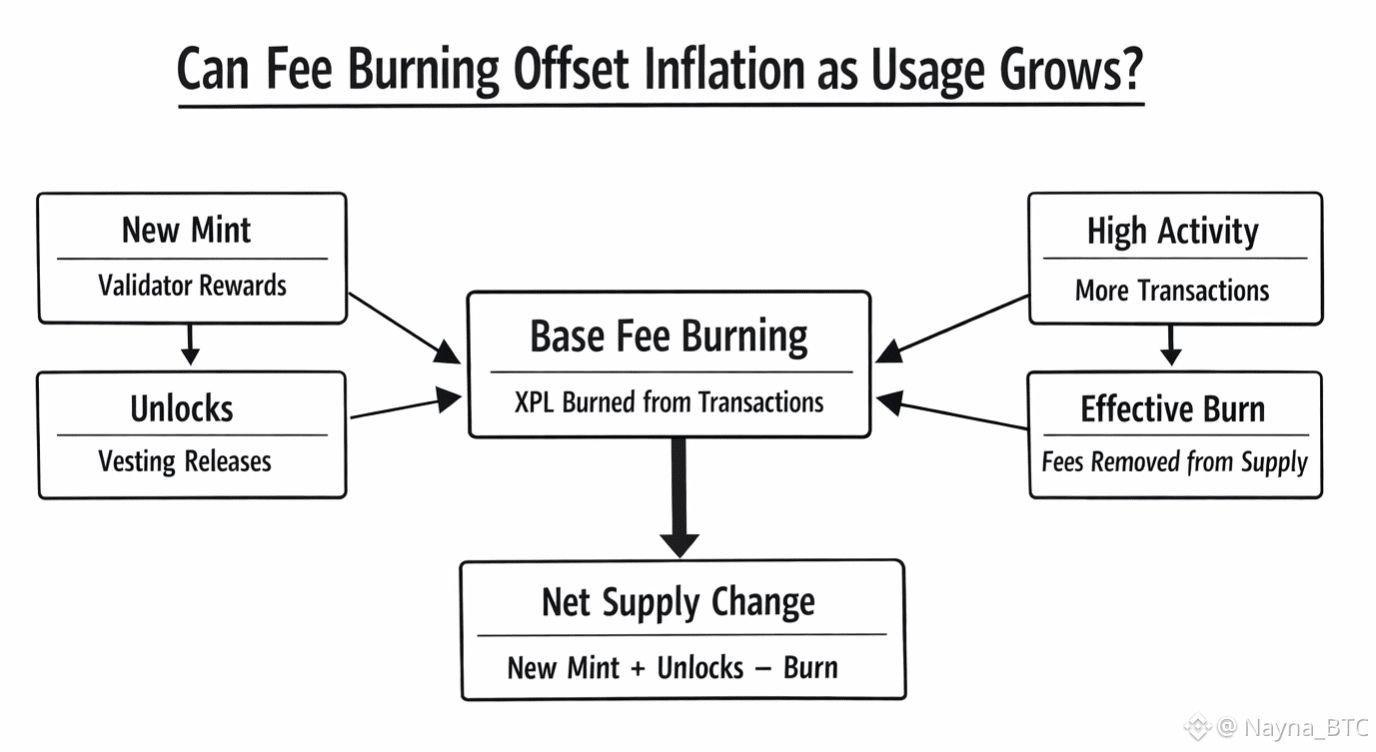

There are two modes of supply increasing and one decreasing.

There are two sources of supply pressure in XPL.

One is brand new mint, the traditional model of proof of stake. Plasma has defined a reward curve which begins with 5 percent per year and decreases by half-percent per year until it reaches 3 percent as a long-run base. Only in case of wider validator set coming alive and delegation of stake coming alive does inflation become active. This section is a live flow down to the point it is a plan.

The other source is unlocks. Unlocks in no way coin new tokens, but they cause a reversion in the portion of supply which is capable of circulating on the open market. Unlocks can have the same feel as inflation in that a holder is able to change what can be sold, lent, staked or even used in apps.

In the shrink side Plasma adopts an EIP-1559 style fee market where the base fee is burned. Supply is not concealed in the burning, it is destroyed. In case the activity is high, there are additional base fees paid, and additional XPL is burned.

Then the entire picture is easy to determine and difficult to guess beforehand.

New mint and unlock flow less burn flow is known as net supply change. Such is the formula of all the arguments on burning fees.

Fee burning is not a slogan. It is a design decision which has a very obvious purpose: tie the pressure of token supply to the demand of the network.

In an EIP-1559 style system, a user (or an app on behalf of the user) pays a fee which consists of two components. The chain sets the base fee which is burned. There is the addition of a tip to accelerate speed and is paid to the block producer. The point here is that the minimum fee is not given to anybody. It is removed.

Such a decision makes block space a sink of sorts. In case individuals wish to use the chain, they have to feed the sink. In case the chain is silent then the sink remains small.

Plasma is constructed on the basis of use of stablecoins hence the bet is not limited to high value transfers. It also on the high count usage: pay, send, settle, repeat. With such use at scale, then there is an opportunity that the burn can become more than a footnote.

The current market trackers of the XPL indicate that as of January 29, 2026, the XPL is trading at about 0.14, where an estimated 1.8 billion XPL are in circulation and the market cap is approximately 260 million. The volume has been in the high tens of millions of dollars and in some cases over one hundred million dollars per day.

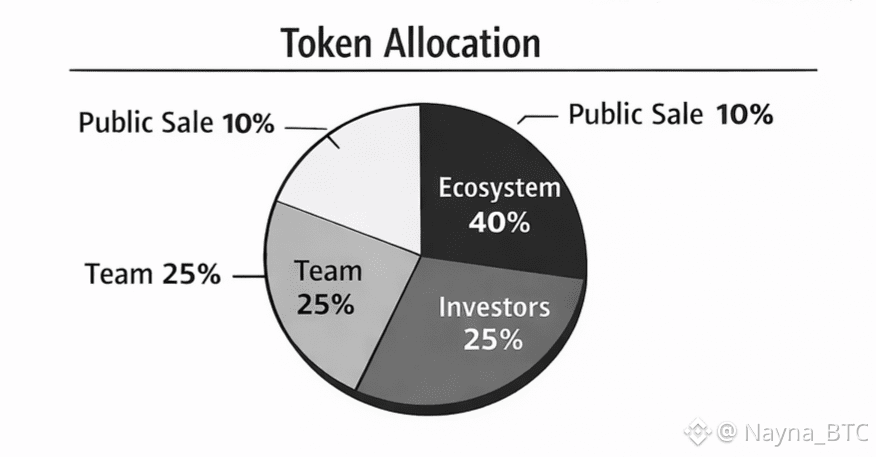

Plasma has outlined a preliminary supply of 10 billion XPL at mainnet beta launch with an aggregate comprising of a combination of public sale, ecosystem growth, team, and investor buckets alongside a reward system that may be augmented subsequently when broader validation is live.

And remember in this part but this: the difference between total supply and circulating supply is of more near term price pressure than any long-run max number. Long-run drift can be fought by burning, however, unlocks can change float.

The main issue: will burn be able to keep pace with inflation?

The following is the most spotless manner of thinking about it.

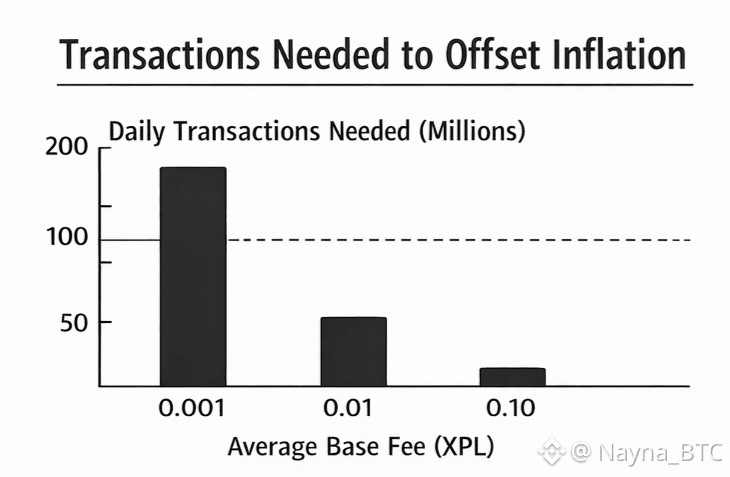

In the case of a live validator inflation the chain can mint up to 3% to 5% per year, depending on a schedule Plasma has provided. Using the present circulating supply of approximately 1.8 billion XPL as a crude base, then that would be approximately 54 million to 90 million XPL/year.

To completely counter that burning, yearly burns would have to land on the same band. That translates to 150, 000 to 250,000 XPL burned per day.

That is the important part now, how many transactions does that consume?

It relies on the mean base fee that is paid per transaction. I am not sure what the base fee will average in the long run on Plasma and anything purported by a firm would be theater. Yet we may well learn to do things by trying simple cases.

Suppose the mean base fee would be 0.10 XPL, the burning of 200,000 XPL per day would have consumed approximately 2 million transactions per day.

In case the average base fee was 0.01 XPL the same burn would require approximately 20 million transactions per day. Assuming the average base fee is 0.001 XPL, then it would require approximately 200 million transactions/day.

This is the reason why burning of fees is not magic. It is math. Inflation is beatable, but only in a condition (a) where activity is high enough, (b) base fees are not driven to near zero permanently or (c) where there are periods when the chain is so busy that base fees become high when demand surges.

This does not require enormous fees made by plasma. It requires a great deal of utilization, and a base fee which is actual, even though small.

The secret information: zero fee UX is not equal to zero burn.

Plasma discusses the world where the transmission of value can be zero-fee. It is a user objective, and it is significant to development.

However this is where people miss out on the fact that a chain can provide a zero fee feel and still pay a base fee on the level of protocols. The difference is who pays. The user can have their bill paid by a wallet, an app, or a merchant or a sponsor.

In case that is the model, burning does occur. The initial charge is paid, and it is still extracted out of supply. The burn sink continues to be filled although the cost line item may not be visible to the end user.

It is here, where I become opinionated though practically speaking. I prefer fee burn most when it entails the honest tradeoffs. Somebody must purchase block space. In case an app desires to conceal charges, it has to achieve that status by possessing a legitimate product and a successful business cycle. This is healthier than a system where the expenses are pushed into the bottomless token mint.

Burn is best applied in a lumpy demand.

It would be nice to live in a smooth world where blocks are never full, however, it can make burn weaker.

The base fee is increased in EIP-1559 when the demand exceeds target use by blocks. When the blocks are below target it falls. It is two geared in the burn rate.

At the low gear, burn is as a result of lots of small fees. Consider day-to-day payments, micro sends, call applications, and constant nourishment.

Burn jumps in the high gear with hot chain.

A busy chain burns not only because of the number of transactions, but also more because of the base fee applied to the transactions. High throughput and low delay objectives of plasma imply that it might not experience the spike of fees as frequently as a general chain that is constantly congested.

That is good for users. It is also an indication that the low gear counts more. The burn story is based on consistent, general utilization, and not on infrequent fee blazes.

That is not a weakness. It is simply an alternative shape of burns.

Break flow: the near term burning headwind will not replicate itself.

Burn will nevertheless not result in a decreased supply in the initial years of circulation despite unlocks.

Plasma has provided a direct roadmap: 10-billion XPL initial supply, 10 percent of which will be sold to the people, 40 percent will be used in the ecosystem and expansion, 25 percent among the staff and investors. The parts are unlocked on launch, followed by further unlocking. Ecosystem As an example, part of the ecosystem and growth bucket will unlock at launch, and the rest will unlock over a multi year period. Team and investor tokens are based on a one year schedule after which they will be unlocked monthly in the next two years. If the region has a specific date, normally a full unlock is opened to the purchaser on July 28, 2026.

This is important to you when you are concerned about burn offset since unlocks may be the primary source of the float growth prior to the beginner of the validator inflation. At that stage, burn need not outcompete minted inflation, however, it must outcompete market supply pressure due to unlocks, and that is a different game.

The good one is easy, anyway, unlocks are predetermined. Burning is tied to use. In case Plasma scales to heavy stablecoin traffic the burn curve may increase concurrently with the disappearance of the unlock curve.

What I would view in case I were scoring burn vs inflation: I believe you cannot make a judgment on this story based on token design only. You judge it from live data.

To begin with, observe the actual, and what is the practical rate of validator inflation. The released range is a guide, however, it is the live system that matters.

Second, watch base fees are burnt as a proportion of network fees. Clean EIP-1559 has the burn stream as the base fee, and the pay stream as tips to block producers. The entire thing is to have a burn share that remains significant.

Third, monitor the number of transactions and a combination of actions. A chain that is utilized by simple sends has another burn profile as compared to a chain utilized by heavy contract calls, at the same user count.

Fourth, monitor unlock time and changes in circulation supply. The burn may be robust and yet smothered up in case float increases rapidly over a brief period.

Fifth, observe scale-based fees of apps to users. The presence of sponsored fees is not merely a UX concentration, but an indication that apps value block space and have the ability to afford it.

Thus, is it possible to compensate inflation with fee burning as it becomes more used?

Yes, it can and not because of hope. It is the shape of the system.

Inflation path has been defined by plasma which is not open ended and base fee burning has attached the main counterweight to the usage. When the chain becomes heavily used, e.g., on a daily usage basis, then the burn sink may become large, regardless of the size of per transaction fees. The base fee gear may increase burn faster, in case the chain also caters to peak demand moments.

The truth of the matter is that it is not automatic that offset occurs. It is earned. It relies upon real usage, and even on a protocol-level fee market that remains real despite the user having a smooth, low cost experience.

I believe it was a thermostat and not a furnace. Inflation is a consistent source of heat which can be adjusted to a minimum of 5 percent all the way to 3 percent after it becomes active. The cooling system is burning, which is its responding system. Maximum burn on a daily basis is not the best. A system in which the pressure on supply is naturally increased by the increase in use without disrupting the experience that generates that increase in the first place is the best.

That is the bet XPL is making. When Plasma becomes a chain that people use to make their regular value flow, then the burn mechanic is not a design note any longer, it is now like a policy.