Introduction: The Need for a Next Generation Blockchain

As Web3 expands beyond speculative trading into real world financial use cases, traditional blockchains face two fundamental challenges:

Handling high transaction demand at scale

Providing true ownership and usability of digital assets without prohibitive cost

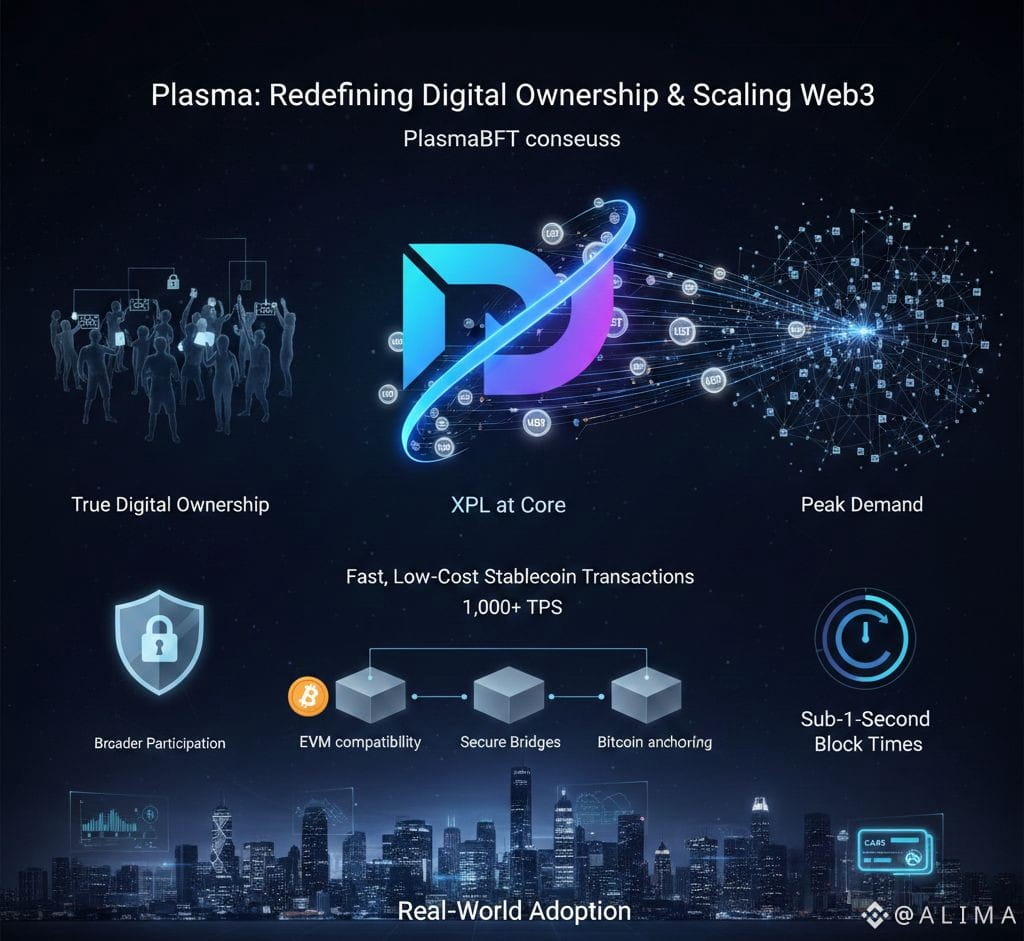

@Plasma is emerging as a next generation Layer 1 blockchain specifically engineered to solve these problems focusing on stablecoin payments, fast settlement and broad ownership of the network itself.

Plasma’s Core Purpose: Fast, Low Cost Stablecoin Transactions

Plasma is not just another general‑purpose blockchain it’s built for stablecoins like USD₮ as a foundational financial layer:

Purpose built for stablecoin transfers with an emphasis on utility rather than speculation.

Sub‑second block times and high throughput, surpassing 1,000 TPS at launch.

Zero‑fee stablecoin transfers for users, enabled by native paymaster contracts that sponsor gas for USD₮ movement.

EVM compatibility, allowing developers to deploy Ethereum based smart contracts with no code changes.

This design lowers barriers to everyday blockchain use from cross border payments to peer‑to‑peer commerce unlocking the potential for digital money that feels as usable as traditional money.

XPL: The Backbone of Plasma’s Financial Network

At the heart of this system is XPL, Plasma’s native utility and governance token. Its role spans across:

Security and consensus Validators stake XPL to secure the network.

Governance incentives. Helping align long term ecosystem development.

Supporting network sustainability through tokenomics designed to balance inflation with ecosystem growth.

The total supply is capped at 10 billion XPL, with structured allocations for public sales, ecosystem incentives, team and investors ensuring both decentralization and growth funding.

Plasma’s public participation strategy including broad token distributions regardless of deposit size was crafted to avoid concentration of ownership and foster a community owned network.

Scaling Under Peak Demand: Designed for an Always on World

One of Plasma’s biggest technical differentiators is its ability to maintain performance even under peak network demand something many traditional chains struggle with. Key elements include:

PlasmaBFT consensus A custom Byzantine Fault Tolerant protocol that finalizes transactions quickly and securely.

Deterministic finality and sub 1 second block times, allowing near instant settlement.

Customized gas token model, enabling fees to be paid in stablecoins or even BTC, reducing friction for users.

Bitcoin anchoring and secure bridges Periodic checkpoints on Bitcoin deepen the chain’s censorship resistance and security.

Together, these features let Plasma process transactions at high frequency without congestion or prohibitive costs, making it suitable for real time financial applications such as micropayments, streaming data commerce, and machine to machine value exchange.

Real World Adoption and Ecosystem Momentum

Since launching its mainnet beta in September 2025, Plasma has seen strong ecosystem growth:

Over $2 billion in stablecoin liquidity locked on mainnet at launch.

100+ DeFi integrations including borrowing, lending and trading from major protocols.

Integration with global exchanges like Binance for trading and yield programs tied to XPL.

Plasma One neobank expanding the blockchain’s utility into everyday finance with cards and cashback rewards.

These developments demonstrate real market demand for a blockchain optimized for digital money movement rather than just speculative traffic.

What This Means for Web3 and Digital Ownership

Plasma’s architecture signals a shift in how Web3 infrastructure can be built:

📌 True Digital Ownership

By focusing on stablecoins and accessibility, Plasma makes digital dollar holdings more functional and usable closer to real‑world money than typical crypto assets.

📌 Resource Allocation at Scale

The network’s high throughput and efficient consensus ensure that scarce compute and bandwidth are used effectively, even during peak demand.

📌 Broader Participation

Its inclusive token distribution strategy broadens ownership beyond whales and large investors a critical step toward democratizing financial infrastructure.

Conclusion:

Plasma is not just another blockchain project , it represents a specialized infrastructure for the next era of Web3, one where stablecoins are the primary vehicle for digital value and where scalability, usability and true ownership are built into the foundation. With XPL at its core, Plasma is positioning itself as a backbone for global, real world money movement in the decentralized age.