Today's hottest topic that has been trending should be that gold has risen to 5500, precious metals have gone completely crazy, what happened last night?

Last night, Powell announced that there would be no interest rate cut - holding steady, but this should be a fact that the market has already known. The FED watch tool shows that the probability of a rate cut in January was originally less than 30%.

But why did gold soar, while the US stock market showed little performance last night, with the Nasdaq up 0.17% and S&P down 0.01%, yet gold skyrocketed from 5200 all the way to a peak of 5600 points, increasing by 7% overnight? It should be noted that the current market value of gold has reached 39 trillion, and a 7% increase means the market value has risen by 2.5 trillion!

So in the future, don't say that something won't rise just because it is heavy; according to incomplete statistics, there are currently 300-600 million people holding gold assets (including physical gold, ETFs, funds, and financial derivatives)!

The main driver of this round of gold's surge is still the weakening of the dollar's credibility! The dollar is currently in a major devaluation cycle, with an interest rate of 3.75%, and it will likely decrease further! So we can see from the news that various countries are starting to stockpile gold as foreign exchange reserves, whereas previously it was the dollar!

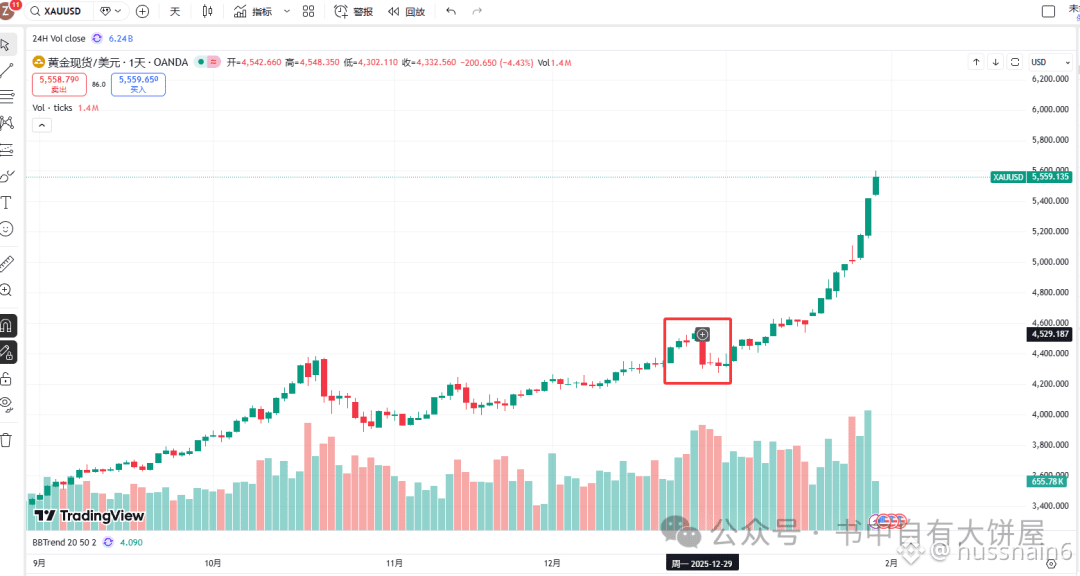

In the article on December 25, (‘Gold, Silver, and Copper’ all going crazy, this scene has only appeared twice in history), I did not judge when gold would peak, but there indeed was a round of decline on December 30 at that time. It was already a 'clamor' period; I didn't expect this wave to continue and become even crazier! But you must know that the crazier something rises, the more alert you should be!

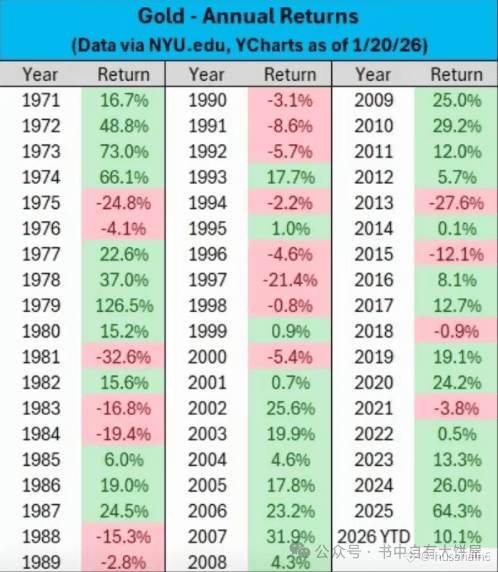

This round rose from 4,600 on January 19 to 5,600 on January 29, with a rise of over 20% in 10 days. It should be noted that the annual increase of gold in 25 years was 64%! In just 10 days, it has already risen the amount equivalent to 4 months of the 25-year increase!

If we start counting from the beginning of January, gold has already risen by 30%. You can take a look at the historical increase of gold; apart from the 64% in 25 years, the January increase has already surpassed the highest annual increase since 1979 (except for the 31% in 2007)!

And a 64% annual increase in 2025 is also quite exaggerated? 64% is already the most insane single-year increase since 1980! 1979 saw an increase of 126%, and 1979 was the craziest year for the previous two gold surges, with another occurrence in 2010 of 29%.

From a data perspective, gold's current rise has already entered a crazy phase! Everyone can feel the steep increase in data and the recent K-line!

If we exclude the declines of -3.8% in 2021 and -0.9% in 2018, which were relatively small, gold has already risen for 10 years!!

How much can gold rise? I can't predict it, but some institutions and 'experts' say gold could reach 10,000 in 26 years!

At least I don't believe it; rising to 10,000 means gold has to double, with a 26-year increase of over 100%. Based on the current gold volume of 39 trillion, reaching the level of that wave in 1979 seems quite difficult because if it doubles, the market value of gold would directly reach 80 trillion, close to 100 trillion!

I still maintain the viewpoint studied in the previous article (‘Gold, Silver, and Copper’ all going crazy, this scene has only appeared twice in history), the starting point of the stock market is the endpoint of gold! This wave of gold has indeed absorbed a lot of blood in the market; after all, it's the world's largest asset, and the momentum is so strong. It rose 7% in one day yesterday, equivalent to the market value of two Teslas or one Bitcoin!

Of course, it doesn't mean I don't have faith in gold; it's just that this wave of increases has been too fierce and too rapid. No asset rises without falling; a sharp rise will either lead to a deep correction or consolidate sideways! Historically, the largest annual decline of gold has only been 30%, with the maximum declines after the two surges in 1979 and 2010 being around 50%-60%! And as time goes by, the declines are getting smaller!

Compared to many stocks and cryptocurrencies, this kind of decline is actually considered low; gold remains the best anti-inflation asset! If you are a long-term player who can hold for more than 10 years, gold is still an OK choice! Of course, this doesn't mean you should buy now! Buying now may mean being stuck for a long time!

Speaking of the US stock market, it is currently not showing any signs of recession. The Nasdaq, SP500, and Dow Jones are all reaching new highs, although from October until now, there hasn't been much increase!

After all, the money in the market is limited. With precious metals rising like this, where is there spare money to enter other places?

So will the US stock market drop in the future? Unless something like the super financial crisis of 2008 or the internet bubble of 2000 occurs! That would also be a super historical 'black swan event'! Or if Trump goes crazy and starts a 'world war'! But the probability is extremely low!

If gold corrects in the future, then funds will inevitably find a place to flow into, so it is highly likely to still flow into the stock market!

Because according to institutional predictions, the global GDP growth rate will be 2.7%-3.3% in 2025 and 2026! This data can only be considered moderate, not aggressive, and not biased towards recession!

Speaking of Bitcoin, currently, although it has dropped to around 88,000, it is still fluctuating in the 80,000-94,000 range! If the US stock market continues to perform well, it will still drive Bitcoin! Currently, the correlation between the US stock market and Bitcoin is still as high as 90%!

I have previously mentioned that Bitcoin is digital gold, with a limited total supply that halves every four years! Although the consensus time is shorter compared to gold, it still performs well when looking at the overall extended cycle. If gold is like a house in the city center of a popular city, its price has been continuously rising and very crazily, then Bitcoin is like a house in the suburbs. Even if it drops, the city center's house will definitely be snatched up first. However, as people realize that the price is inflated, some will turn to the suburban houses!

Of course, this is just a metaphor. If Product A has better product strength, packaging, brand endorsement, etc., than Product B, and the price difference is 10 times, there will still be those who choose the cheaper Product B from the perspective of 'cost-effectiveness'. That's roughly the idea!

In fact, the 'surge' of gold is also beneficial for Bitcoin, at least it can be considered that Bitcoin still has more than 10 times the imagination space - 1 million dollars!