Picture a developer building a decentralized application that needs to verify legal documents on-chain. They face an immediate problem: blockchain storage costs make it prohibitively expensive to store actual files, so they resort to storing hashes that point to centralized services like AWS or IPFS. The documents aren’t really on-chain. They’re somewhere else, and if that somewhere else fails, the entire application breaks. This happened in April 2025 when AWS experienced a major outage. Major exchanges went offline. NFT platforms showed blank images. Applications that claimed to be decentralized revealed their centralized dependencies the hard way.

Vanar Chain saw this problem coming years before it manifested. Since 2020, when the project first emerged under the Virtua name, the team has been working toward a single ambitious goal: creating blockchain infrastructure where data doesn’t just get referenced but actually lives on-chain, compressed intelligently, and remains queryable by smart contracts. By the time that AWS outage hit in 2025, Vanar’s Neutron technology was already processing files at compression ratios reaching five hundred to one, storing complete documents directly on the blockchain where no cloud provider failure could touch them.

Gaming Led the Way to Something Bigger

The journey started in the entertainment sector for practical reasons. Jawad Ashraf and Gary Bracey, the founders, brought decades of experience from gaming, technology, and financial services. They understood that blockchain gaming faced a fundamental challenge: true ownership requires actual assets living on-chain, not just ownership records pointing elsewhere. When a player buys a sword in a game, they should own the sword itself as blockchain data, not a token that references an image hosted on someone’s server.

World of Dypians became a proving ground for what Vanar could handle. This massive multiplayer online role-playing game spans two thousand square kilometers of virtual landscape, features AI-driven NPCs, and supports over one hundred thousand NFT land parcels. In Q3 2025, it attracted one hundred thirty-five million wallet interactions, making it the blockchain gaming market leader by a substantial margin. These aren’t vanity metrics. Every wallet interaction represents a player engaging with on-chain assets: land ownership records, character attributes, weapon statistics, quest progress, and collectibles that exist as queryable data structures rather than external file references.

The game runs across multiple blockchains including Ethereum, BNB Chain, Conflux, Skale, and Vanar itself. This multi-chain approach required solving interoperability challenges that most projects avoid. How do you maintain consistent game state when assets move between networks with different architectures and consensus mechanisms? How do you ensure a player’s NFT land parcel retains its attributes when bridging from one chain to another? These technical hurdles forced Vanar to develop cross-chain capabilities that extended far beyond gaming.

Players engage with DeFi mechanics directly inside the game. They stake tokens, participate in yield farming, and trade NFTs in player-run marketplaces. The CAWS NFT collection provides gameplay bonuses and special abilities that actually affect mechanics rather than serving as cosmetic additions. Ownership of these NFTs grants access to exclusive events, enhanced interactions, and economic opportunities within the game’s sandbox economy. This integration demonstrated that blockchain gaming could support sophisticated economic systems if the underlying infrastructure handled data correctly.

The Cross-Chain Bridge That Changes Everything

In December 2025, Vanar integrated with NEAR Intents, fundamentally expanding what users could do with assets across different networks. NEAR Intents operates as an intent-based cross-chain protocol that processed over two billion dollars in volume during Q3 2025 and supports interaction with more than one hundred twenty-five assets spanning over twenty-five different blockchains. When Vanar connected to this infrastructure, it meant someone could swap native Bitcoin for assets on Vanar, move Ethereum-based tokens into Vanar applications, or bridge from networks like Zcash and Solana without multiple intermediate steps.

The integration works through chain abstraction. Users express what they want to accomplish rather than specifying how to execute each step. If someone wants to move assets from Starknet into a DeFi protocol on Vanar, they state that intent. Solver networks compete to fulfill it efficiently, finding optimal paths and handling the technical complexity behind the scenes. The user experiences a single action that completes in seconds, while underneath, the system coordinates across multiple chains, liquidity sources, and protocols.

This matters enormously for Vanar’s positioning in the broader ecosystem. Most blockchains exist as isolated networks where moving assets in or out requires bridging through intermediary tokens, accepting security risks from custodial bridges, and navigating fragmented user experiences. NEAR Intents processes over one million transactions per second and removes these barriers through protocol-level interoperability. For Vanar, it means applications built on the network can access liquidity and users from across the entire blockchain landscape rather than being limited to their own ecosystem.

The Base chain expansion reinforces this multi-chain strategy. Base, built by Coinbase as an Ethereum Layer 2, brings significant institutional presence and developer activity. Vanar’s expansion to Base enables AI agents operating on that network to utilize Vanar’s compression and intelligence capabilities while managing compliant payments and tokenized real-world assets. This creates a bridge between mainstream adoption channels through Coinbase’s infrastructure and Vanar’s specialized AI-native features.

Files That Think and Data That Acts

Neutron represents the technical breakthrough that makes everything else possible. Traditional blockchains handle sixty-five kilobytes or less per transaction. Anything larger requires storing the actual data off-chain and putting a hash pointer on the blockchain. Neutron transforms this limitation through a four-stage compression pipeline that shrinks files while preserving both content and meaning.

The first stage uses AI-driven reconfiguration. Neural networks analyze file structure, identify patterns, and reorganize data for optimal compression. This isn’t simple lossless compression like you’d get from zipping a file. It’s intelligent restructuring that understands what the data represents. A legal contract gets analyzed differently from an image file. The AI recognizes document types, extracts semantic meaning, and prepares the data for subsequent processing.

Quantum-aware encoding comes next, adding another compression layer while maintaining data integrity through encoding schemes resistant to quantum computing threats. This future-proofing matters for applications storing sensitive financial or legal documents that need to remain secure decades into the future. Chain-native indexing then structures the compressed data so smart contracts can query specific fields without reconstructing the entire file. A lending protocol can verify that a borrower’s identity document contains required information by querying the compressed data directly on-chain.

Deterministic recovery ensures perfect reconstruction when needed. The original file can be extracted from the compressed Seed with absolute precision. No information gets lost. No approximation occurs. A twenty-five megabyte 4K video compresses to roughly fifty kilobytes as a Neutron Seed. That Seed stores directly on the blockchain where it remains accessible regardless of external infrastructure failures. Smart contracts can analyze it. Applications can display it. Users truly own it as blockchain data rather than owning a reference to data stored elsewhere.

This architecture solved the problem exposed during the April 2025 AWS outage. While major exchanges and NFT platforms struggled with inaccessible data, applications built on Vanar’s Neutron layer continued operating normally. The data wasn’t dependent on AWS. It lived on-chain, compressed efficiently, and remained queryable throughout the disruption. This resilience matters increasingly as more critical applications migrate to blockchain infrastructure.

The Intelligence Layer That Understands Context

Kayon sits above Neutron as the reasoning engine that lets smart contracts think. Traditional smart contracts execute pre-programmed logic: if condition A occurs, perform action B. They cannot analyze unstructured data, cannot make contextual decisions based on document contents, and cannot adapt behavior based on information stored in files. Kayon changes this by enabling contracts to query compressed data and reason over it using structured AI-native logic.

Consider a tokenized real estate transaction. Traditional blockchain approaches store ownership records on-chain while keeping the actual property deed, inspection reports, and legal documents in external databases. Smart contracts reference these documents but cannot verify their contents. With Vanar’s architecture, all documents compress into Neutron Seeds stored on-chain. Kayon enables smart contracts to verify that inspection reports meet specific criteria, confirm that legal descriptions match ownership records, and enforce contract terms based on actual document contents rather than trusting external oracle feeds.

This enables compliant PayFi applications where regulations require verifiable documentation. A smart contract managing cross-border payments can verify identity documents, confirm compliance certifications, and enforce regulatory requirements by analyzing actual documentation stored on-chain. The documents exist as queryable data structures rather than opaque files that contracts can only reference. This transparency satisfies regulatory requirements while maintaining the automation and efficiency benefits of smart contracts.

The myNeutron tool demonstrates these capabilities for general users. Someone uploads documents, presentations, or data files to myNeutron. The system compresses them into Neutron Seeds that preserve semantic meaning and relationships within the data. These Seeds can live in cloud storage, Google Drive, or permanently on-chain based on user preferences. AI assistants can query these Seeds to answer questions, extract insights, and build context about the user’s knowledge base. The data remains portable across different AI platforms, eliminating vendor lock-in where users lose access to their context when switching between services.

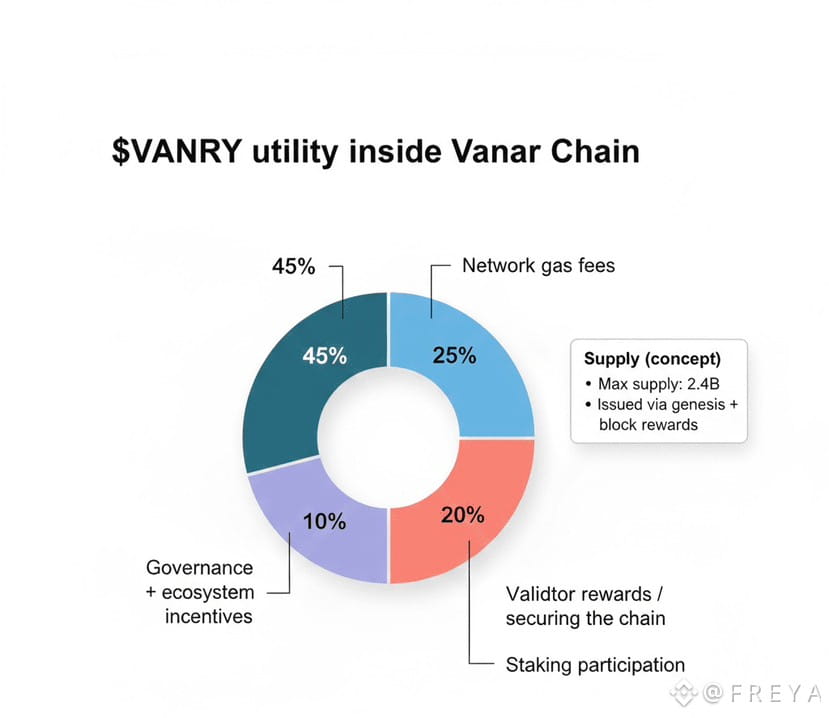

Pilot extends these concepts to wallet interactions. Instead of navigating complex blockchain interfaces, users communicate with their wallets through natural language. Commands like “send twenty USDT to Alice” or “swap half my ETH for BTC” trigger appropriate blockchain transactions. The AI interprets intent, constructs proper transactions, and handles technical details transparently. Each interaction creates, stores, or burns VANRY tokens as part of the execution process, building genuine utility into the token economics while simplifying user experience dramatically.

Consensus Built for Performance and Practicality

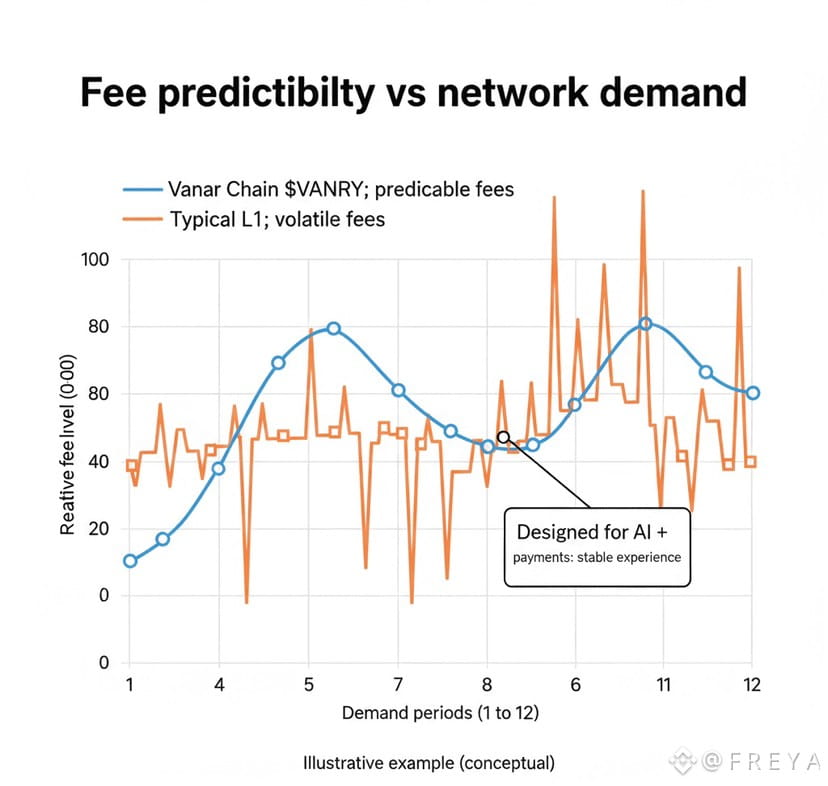

The underlying blockchain runs Proof of Authority enhanced with Proof of Reputation. This consensus mechanism prioritizes speed and predictability over the energy consumption that comes with Proof of Work or the capital requirements of standard Proof of Stake. Validators earn selection through demonstrated reputation and technical capability rather than purely staking capital. This approach reduces barriers to validator participation while maintaining network security through accountability mechanisms.

Block finality arrives in seconds with minimal communication overhead. The validator election process encourages transparent governance where community input shapes validator selection. Unlike networks that slash validator capital for misbehavior, Vanar penalizes through reward reduction rather than capital destruction. This reduces risk for institutional validators who cannot accept the possibility of catastrophic capital loss from operational mistakes or protocol edge cases. The reward slashing still maintains incentive alignment by reducing earnings for misbehaving validators without creating existential risk.

The Go Ethereum framework provides the execution layer, ensuring compatibility with the established Ethereum codebase while enabling customizations optimized for Vanar’s specific performance objectives. EVM alignment means developers familiar with Ethereum can deploy applications on Vanar without learning new languages or frameworks. The tooling, libraries, and development patterns transfer directly. This compatibility accelerates adoption by tapping into the largest blockchain developer community rather than requiring everything to be built from scratch.

As a Layer 1 blockchain rather than a Layer 2 scaling solution, Vanar maintains full control over network governance, security parameters, and customization. This matters for applications requiring minimal fees and high transaction speeds where Layer 2 solutions might introduce unwanted costs or dependencies on base layer settlement. The architecture supports real-time applications without relying on Ethereum’s base layer for every interaction while maintaining the ability to bridge assets when needed.

Partnerships That Validate and Extend Capability

NVIDIA’s involvement through the Inception program provides access to cutting-edge AI and graphics technologies including CUDA, Tensor cores, Omniverse, and GameWorks. This isn’t just branding. It positions Vanar as one of the few Layer 1 blockchains in the program with the only one offering these NVIDIA solutions across its entire partner ecosystem. The technology access accelerates development of AI-native features while the association signals credibility to enterprises evaluating blockchain infrastructure.

Google Cloud’s relationship through BCW Group brings validator operations powered by renewable energy resources. This addresses both performance and sustainability, allowing the network to scale while minimizing environmental impact. BCW Group’s track record processing over sixteen billion dollars in fiat-to-crypto transactions and operating validators on major networks like Polygon and BNB Chain adds operational expertise beyond just infrastructure provision.

The Emirates Digital Wallet partnership connects Vanar to fifteen major Middle Eastern banks and more than thirteen million customers. This mainstream financial integration demonstrates that the technology can meet requirements for speed, security, and regulatory compliance demanded by traditional financial institutions. These partnerships aren’t experimental pilots. They’re production integrations where real customers access Vanar’s capabilities through established banking relationships.

Development tool partnerships with ThirdWeb, Magic Square, and Paima Studios lower barriers for builders creating applications on the network. Security partnerships with HAPI, Immunefi, and ImmuneBytes protect projects and users through comprehensive security auditing and vulnerability bounty programs. The ecosystem approach recognizes that blockchain infrastructure succeeds or fails based on what gets built on top of it, not on technical capability existing in isolation.

Where Present Capability Points Toward Future Utility

The subscription model for advanced AI tools launching in Q1 2026 creates sustainable demand for VANRY tokens beyond speculation. Users will need tokens to access premium features in myNeutron, Kayon query capabilities, and other AI-native services. This builds utility-driven token economics where actual usage generates consistent demand rather than relying purely on market sentiment or future promises.

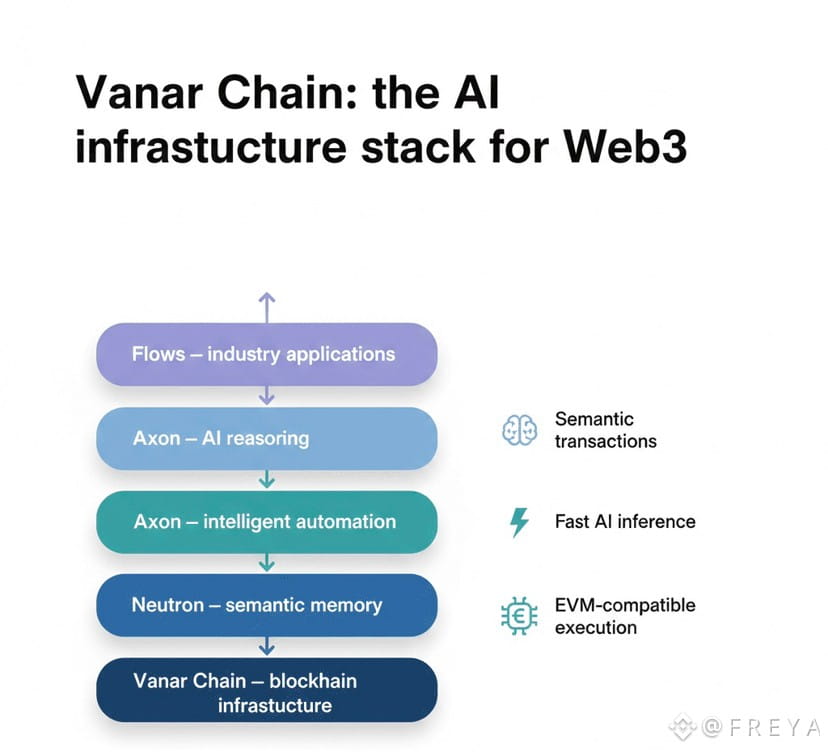

The Axon and Flows layers currently under development will enable intelligent automated workflows and application activation. Axon handles protocol-level automation where smart contracts execute complex sequences based on real-time conditions and data analysis. Flows orchestrates data movement across the ecosystem and activates applications based on triggers and intents. Together with the existing Vanar Chain, Neutron, and Kayon layers, they’ll form a complete five-layer architecture for AI-native blockchain applications.

Cross-chain integration continues expanding beyond NEAR Intents. The goal by 2026 involves completing protocols that enable seamless asset transfers between major blockchains without sacrificing security or requiring trusted intermediaries. This interoperability positions Vanar as infrastructure that enhances multiple ecosystems rather than competing in zero-sum battles for exclusive user attention. Applications can utilize Vanar’s intelligence and compression capabilities while maintaining connections to Ethereum DeFi, Solana gaming, or any other specialized network.

The agent economy represents the longer-term vision. As AI agents increasingly handle autonomous tasks, they need blockchain infrastructure that understands context, stores verifiable data, and enables complex decision-making based on real information rather than simple on-chain state. Vanar’s architecture specifically enables these use cases. An AI agent managing investment portfolios can verify fund documentation stored as Neutron Seeds, analyze terms using Kayon’s reasoning capabilities, and execute compliant transactions while maintaining complete audit trails of decision processes.

Enterprise adoption requires features still emerging. Confidential transactions remain on the roadmap to enable private business-to-business settlements and payroll processing where transaction details need to remain hidden from public view while maintaining verifiability for parties to the transaction. Zero-knowledge proofs and other privacy-preserving technologies will integrate with Vanar’s existing compression and intelligence layers to serve applications where privacy compliance matters as much as transparency.

The Fundamental Shift Toward Intelligent Infrastructure

Most blockchain development focuses on making transactions faster or cheaper. These improvements matter, but they represent incremental optimization of fundamentally similar architectures. Vanar pursues a different direction entirely: making blockchains intelligent by default. Data shouldn’t just exist on-chain as inert bytes. It should be queryable, analyzable, and executable by smart contracts that can reason over actual content rather than just processing pre-defined logic.

This shift becomes critical as blockchain applications move beyond simple value transfer into complex economic coordination, regulatory compliance, and autonomous agent operations. A lending protocol needs to verify more than just collateral balances. It needs to confirm that borrowers meet regulatory requirements, that collateral meets quality standards, and that documentation supports claimed values. Traditional blockchains force these verifications off-chain through oracle systems that reintroduce trusted intermediaries. Vanar’s architecture performs verification on-chain using actual documentation stored as compressed, queryable data.

The gaming ecosystem proved these concepts at scale. One hundred thirty-five million wallet interactions in a single quarter demonstrates that the technology handles real usage, not just theoretical capability. World of Dypians players own actual game assets stored on-chain, participate in economies driven by verifiable scarcity, and engage with AI-driven systems that adapt based on player behavior. This isn’t a demo or testnet. It’s production infrastructure supporting mainstream applications with substantial user bases.

Cross-chain connectivity through NEAR Intents positions Vanar as infrastructure that amplifies rather than isolates. Users and developers don’t need to choose Vanar exclusively and abandon other networks. They can utilize Vanar’s compression and intelligence features while maintaining connections to Ethereum DeFi, accessing liquidity on multiple chains, and serving users regardless of their preferred network. This interoperability approach recognizes that the future involves multiple specialized blockchains working together rather than a single winner-take-all network.

The partnerships with NVIDIA, Google Cloud, major financial institutions, and established gaming companies validate the approach with entities that evaluate technology rigorously before committing. These aren’t speculative crypto-native projects hoping for mainstream breakthrough. They’re mainstream institutions integrating blockchain infrastructure into actual business operations where reliability, compliance, and performance aren’t negotiable.

As we look ahead, the question isn’t whether Vanar’s technology works. Production applications already prove capability at scale. The question becomes how rapidly adoption expands beyond early adopters into mainstream use cases. Will enterprises building tokenized real-world assets choose infrastructure with native intelligence and compression? Will game developers creating the next generation of blockchain games select networks where assets live fully on-chain? Will AI agent developers building autonomous systems utilize blockchain that understands context rather than just processing transactions?

These outcomes depend on execution across technology roadmaps, ecosystem development attracting builders and users, and continued partnership expansion connecting Vanar to traditional systems. The foundation exists. The capability has been demonstrated. The path forward requires converting technological advantage into widespread adoption, which always takes longer and requires more effort than purely technical development. But for applications that need intelligence embedded at the infrastructure level, where data must remain permanently accessible and queryable, and where AI agents need to reason over verifiable information rather than trust external feeds, Vanar built precisely what they require. Whether that becomes industry standard or remains a specialized solution depends less on technology now and more on whether the market recognizes what becomes possible when blockchains learn to think.