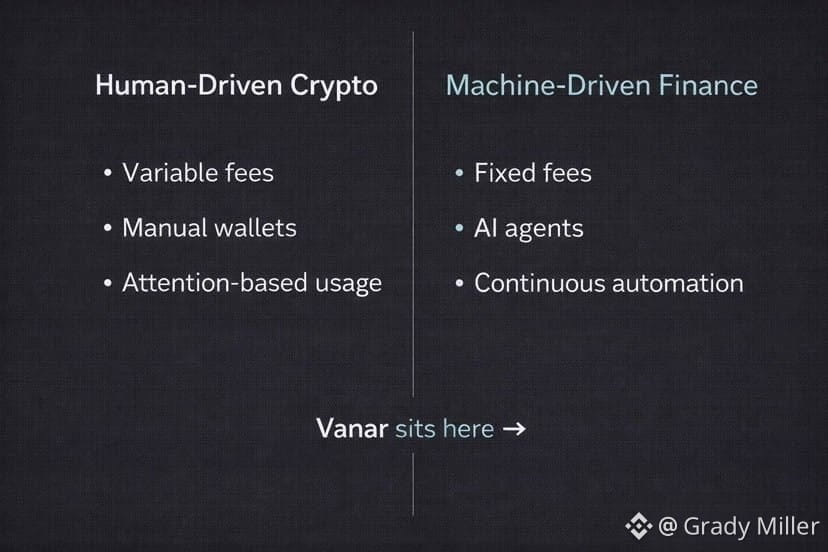

There is a moment in every technological cycle when progress stops being about people pressing buttons and starts becoming about systems talking to systems. Finance is slowly entering that moment. The next wave will not be driven by users manually approving transactions or constantly managing wallets. It will be driven by software. AI agents, automated treasuries, background compliance systems, payment routers, and financial programs that operate continuously without human attention.

Vanar Chain was built with this future in mind.

While much of the blockchain industry still designs networks as marketplaces competing for attention and speculation, Vanar approaches blockchain as infrastructure. I’m not talking about excitement or narratives. I’m talking about predictability, determinism, and reliability. These are not traits humans obsess over, but they are exactly what machines require.

When we step back and look at Vanar through this lens, its design choices start to make deep sense. This is not a chain trying to impress users. It is a chain trying to serve autonomous systems.

Rethinking Who the Blockchain Is For

Most blockchains today are optimized for human behavior. They assume people will watch gas prices, choose transaction speeds, and react emotionally to market conditions. That model worked in early crypto because humans were the primary operators.

But machines behave differently.

An AI agent does not feel urgency or excitement. It cannot guess whether a transaction will cost one cent or ten dollars. It cannot tolerate uncertainty in ordering or pricing. For automation to work at scale, systems must behave consistently every time.

Vanar begins by challenging a core assumption of crypto. Instead of designing for human bidding behavior, it designs for mechanical reliability.

We’re seeing a shift where the most important users of financial infrastructure are no longer people. They are programs.

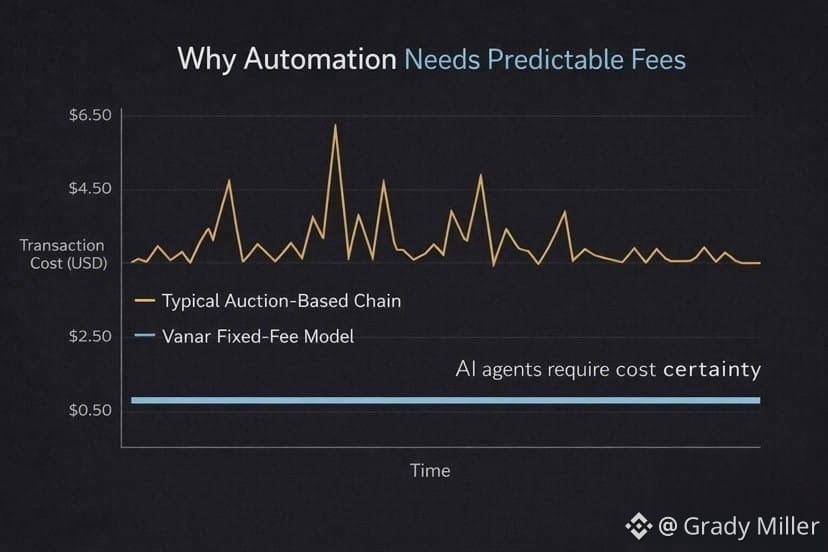

Why Fee Auctions Break Automation

Most existing blockchains operate like auctions. Transaction priority is decided by who pays more. Fees rise and fall based on congestion and speculation. This creates a dynamic environment that humans can navigate, but machines cannot.

An automated system cannot safely operate if it does not know whether a task will cost a fraction of a cent or several dollars. That uncertainty breaks business models.

Streaming payments becomes impossible. Automated invoice settlement becomes risky. Portfolio rebalancing loses precision. Every unpredictable fee turns into operational risk.

Vanar addresses this problem directly.

Instead of allowing fees to float wildly with market behavior, Vanar implements a fixed-fee structure. Transaction costs are anchored to stable fiat value rather than volatile token prices. When the value of the token changes, the protocol recalibrates internally using price feeds so users experience consistent costs.

The idea itself is simple, but the implication is powerful.

Predictable costs transform blockchain from a speculative environment into something closer to financial infrastructure.

If it becomes possible to know exactly what a transaction will cost tomorrow, next month, or next year, entire classes of automated systems become viable.

Stability Without Inviting Abuse

Low fees alone are not enough. When networks make transactions extremely cheap, they expose themselves to spam and denial-of-service attacks. Vanar does not ignore this reality.

Instead, it introduces a staged gas model.

Everyday transactions remain extremely inexpensive, allowing legitimate activity to flourish. Larger or resource-intensive operations automatically shift into higher fee tiers. This makes abusive behavior economically expensive while preserving affordability for normal use.

It is a quiet balance.

The network stays accessible without becoming fragile.

This approach reflects Vanar’s broader philosophy. Rather than pursuing ideological purity, it prioritizes systems that function reliably in the real world.

Transaction Ordering That Machines Can Trust

Another overlooked problem in blockchain automation is transaction ordering.

On many chains, transactions are prioritized by payment size. This allows front-running, bidding wars, and unpredictable delays. Humans may tolerate this chaos. Machines cannot.

Vanar uses a first-in, first-out ordering model.

Transactions are processed in the order they arrive, not by who pays the most. This eliminates manipulation and uncertainty.

For automated systems, this matters deeply. An AI agent must know that when it submits a transaction at a specific moment, it will execute in sequence without interference.

This design removes strategic behavior entirely.

There is no gaming. No bidding. No ambiguity.

Just execution.

This single decision shifts Vanar away from being a marketplace and toward being deterministic infrastructure.

Governance Built for Stability First

Vanar’s governance model follows the same pragmatic thinking.

The network begins with Proof of Authority to ensure stability and accountability during early growth. As the ecosystem matures, it transitions toward Proof of Reputation.

Validators are not selected purely by capital. They are evaluated based on behavior, uptime, reliability, and long-term performance.

This approach sacrifices early ideological decentralization in exchange for operational trust. For consumer speculation networks, that tradeoff might be controversial. For enterprise and automated systems, it is often necessary.

Institutions require identifiable operators, predictable governance, and accountable participants.

Vanar accepts this reality instead of pretending it does not exist.

Over time, as reputation data compounds, validator participation expands. Decentralization increases through demonstrated behavior rather than anonymous capital concentration.

This again reflects Vanar’s long-term mindset. Infrastructure matures slowly. Trust is earned, not declared.

Intelligence as Infrastructure, Not Decoration

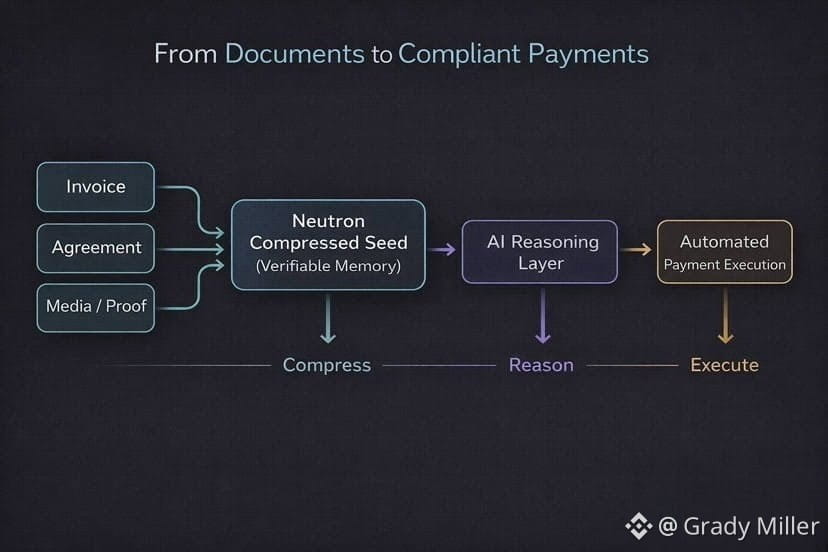

Many blockchains talk about AI. Vanar treats intelligence as infrastructure.

Instead of building AI features on top of applications, Vanar embeds intelligence into the base layer.

Through Neutron, data is not merely stored. It is compressed, structured, and represented in a meaningful on-chain format. Documents, media, invoices, contracts, and records become small, verifiable objects that retain semantic context.

This allows software to reason about data, not just reference it.

When combined with Kayon, Vanar’s reasoning layer, systems can analyze on-chain information, verify compliance, interpret documents, and take action without external oracles.

This matters because real finance is never just a payment.

Every transaction carries context. Invoices. Receipts. Identity verification. Regulatory obligations. Agreements. Conditions.

Most blockchains ignore this layer entirely.

Vanar argues that if context can be compressed and verified, AI agents can operate safely and autonomously.

That moves blockchain beyond token transfers into automated financial processes.

Why Autonomous Finance Changes Everything

As AI agents become more capable, they will begin negotiating, settling, and monitoring financial activity in real time.

Humans will not approve each transaction. Systems will.

But those systems require consistent rails.

They need predictable costs, deterministic ordering, and verifiable data. Without these foundations, automation becomes dangerous rather than efficient.

Vanar’s design choices begin to align clearly here.

It is not a consumer chain optimized for attention. It is backend infrastructure optimized for machines.

This perspective explains why Vanar prioritizes payment systems, stablecoin integration, and real-world financial rails.

Distribution matters more than ideology.

A technically perfect system with no merchants, no processors, and no institutional access remains isolated.

Vanar appears to be positioning itself as the blockchain layer that traditional systems can integrate with safely.

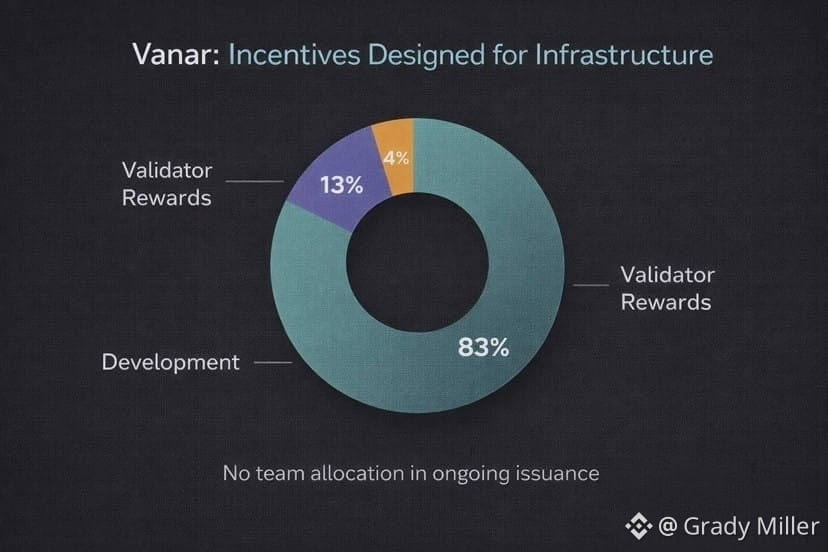

Tokenomics Designed for Longevity

Vanar’s token structure reinforces this infrastructure-first philosophy.

Issuance is directed primarily toward validators and ongoing development rather than insider extraction. There are no oversized team allocations designed for short-term profit.

Block rewards decrease over time, encouraging early participation while preserving sustainability.

The focus is clear.

Secure the network. Expand the ecosystem. Maintain long-term reliability.

Speculation is not the center of gravity. Utility is.

This does not make the token exciting in the short term. It makes it durable.

Risks and the Reality of Execution

No design is immune to execution risk.

Predictable systems must remain predictable under real-world load. Reputation-based validation must resist capture. Intelligent storage must remain useful beyond demonstrations.

These challenges are real.

Infrastructure projects fail not because ideas are flawed, but because complexity compounds over time.

Vanar’s path is slower. It does not generate overnight excitement. But infrastructure rarely does.

The systems that matter most are often invisible. They operate quietly beneath everything else.

The Direction the Industry Is Moving

As value begins moving automatically, blockchains will no longer compete on hype.

They will compete on reliability.

Agents will not care about branding. They will care about execution certainty.

Compliance will not be optional. Sustainability will not be negotiable.

In that environment, the most successful chains may be the least visible ones.

Vanar is making a clear bet on that future.

It is not building for headlines. It is building for systems that must function without attention.

If that future arrives, the winners will not be the loudest networks, but the ones that never break.

And that may be Vanar’s most important signal of all.

Not the excitement it generates today, but the quiet confidence of infrastructure preparing to be trusted tomorrow.