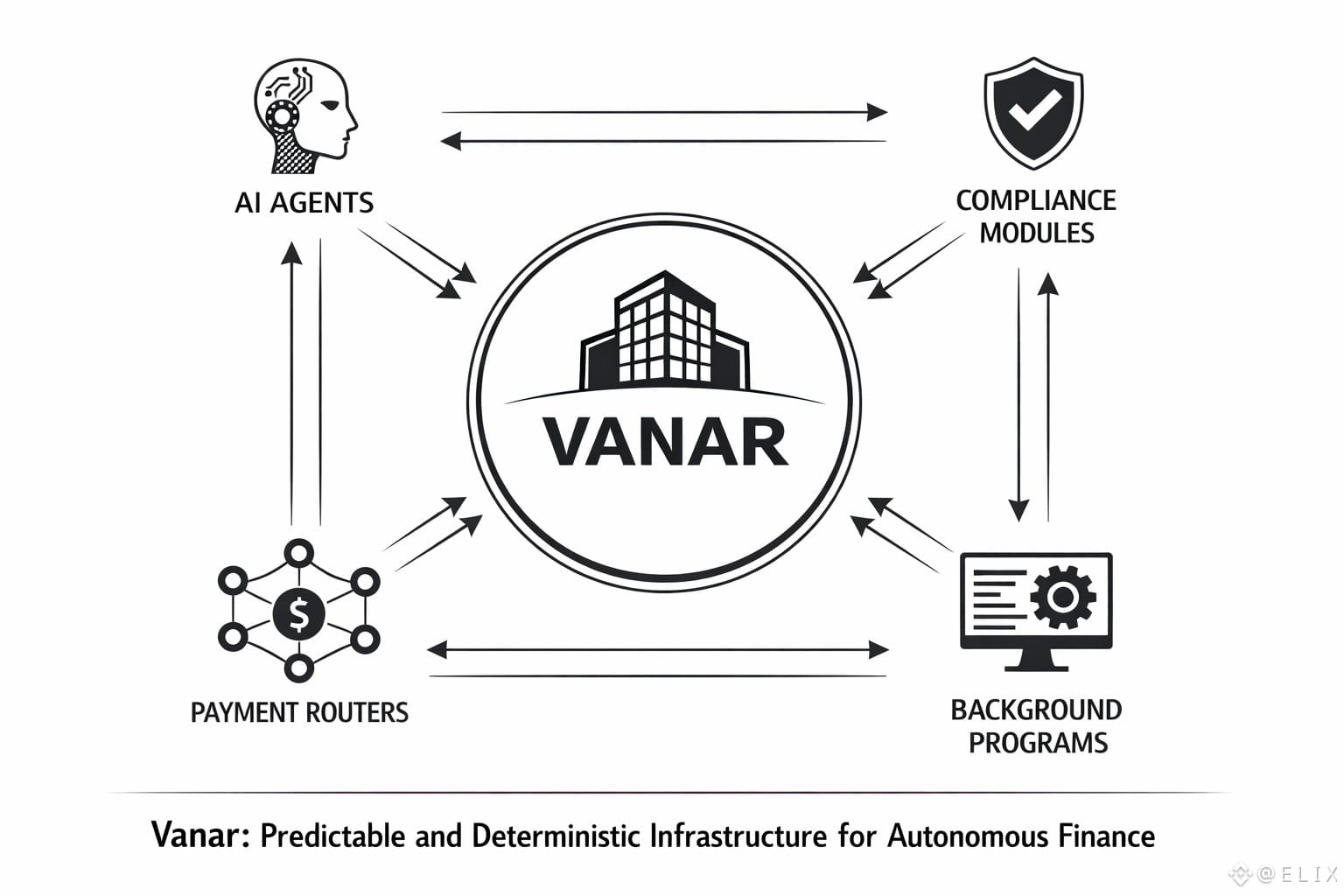

Vanar emerges as a blockchain designed not for human spectacle, but as machine-grade infrastructure. The next wave of adoption will not depend on users clicking buttons—it will be driven by AI agents, automated payment routers, compliance engines, and background programs capable of moving value seamlessly and continuously. In this environment, predictability is far more valuable than volatility, and this is where Vanar distinguishes itself.

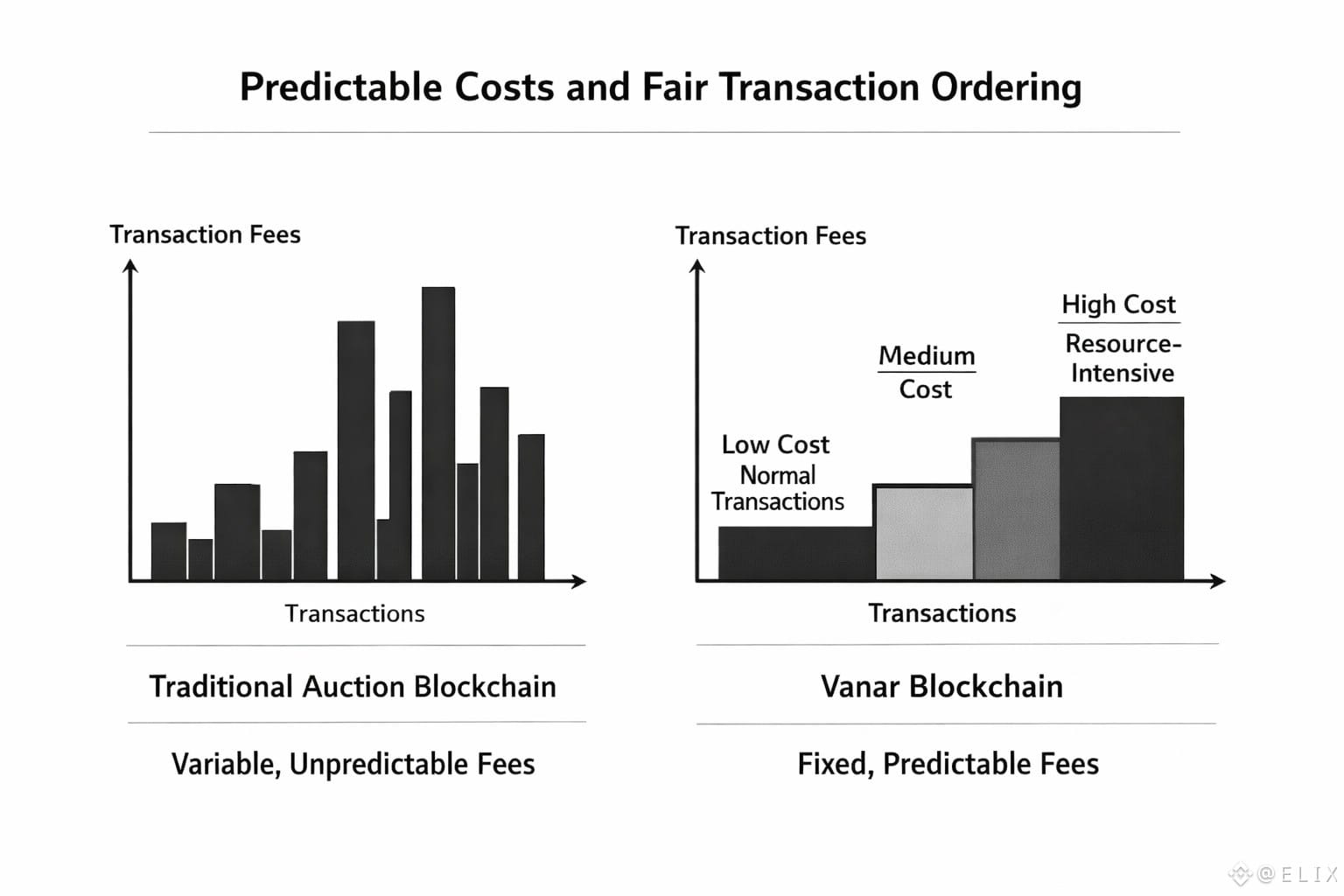

Most blockchains today operate like auctions: transaction costs fluctuate wildly, and order execution favors the highest bidder. While this model fuels speculation, it is ill-suited for automation. An AI agent cannot safely execute tasks if a transaction could cost fractions of a cent one moment and several dollars the next. Automation requires stability.

Vanar addresses this with a fixed-fee structure, tying transaction costs to stable fiat values rather than volatile tokens. This approach transforms blockchains from unpredictable marketplaces into reliable infrastructure for real-world business operations. At the protocol level, fees are recalibrated using multiple price feeds to ensure consistency, making cost projections precise and dependable—a necessity for businesses and automated systems alike.

Yet low fees alone are not enough. Minimal costs can invite spam and abuse. Vanar mitigates this with a staged gas system: routine transactions remain extremely affordable, while large or resource-intensive operations incur higher costs. This design balances accessibility and security, making normal usage inexpensive while discouraging network attacks.

Transaction ordering is another critical consideration for automation. Unlike traditional blockchains, Vanar processes transactions on a first-in, first-out basis rather than prioritizing the highest bidder. This eliminates ambiguity and prevents gaming of the system, ensuring that automated agents can execute tasks predictably and without delay.

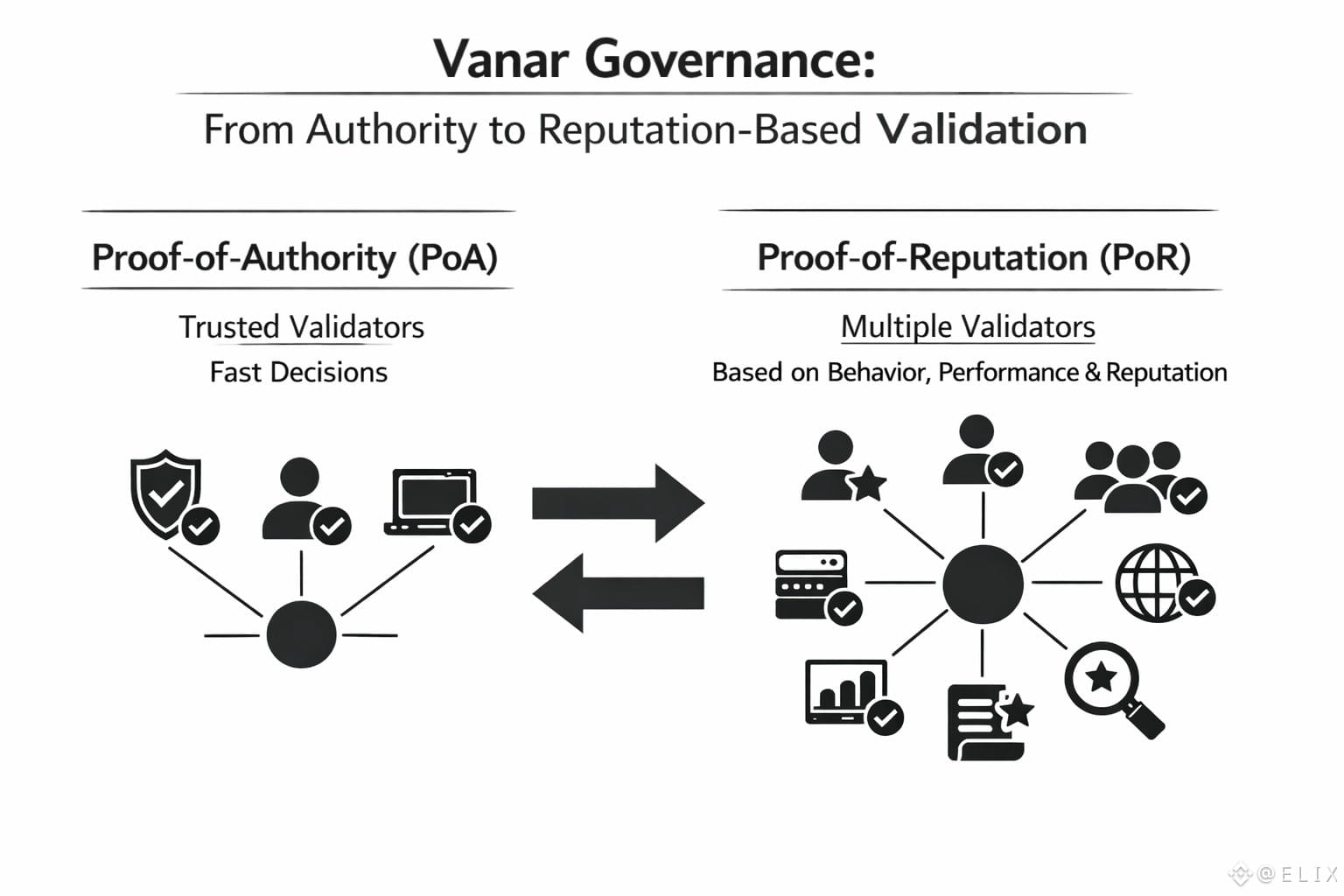

Security and governance are treated with the same rigor. Vanar begins with a Proof-of-Authority (PoA) model for rapid, accountable decision-making and gradually transitions to Proof-of-Reputation (PoR). New validators are admitted based on behavior, performance, and reputation, prioritizing stability and trust over early decentralization—a trade-off well-suited for institutional and enterprise use cases.

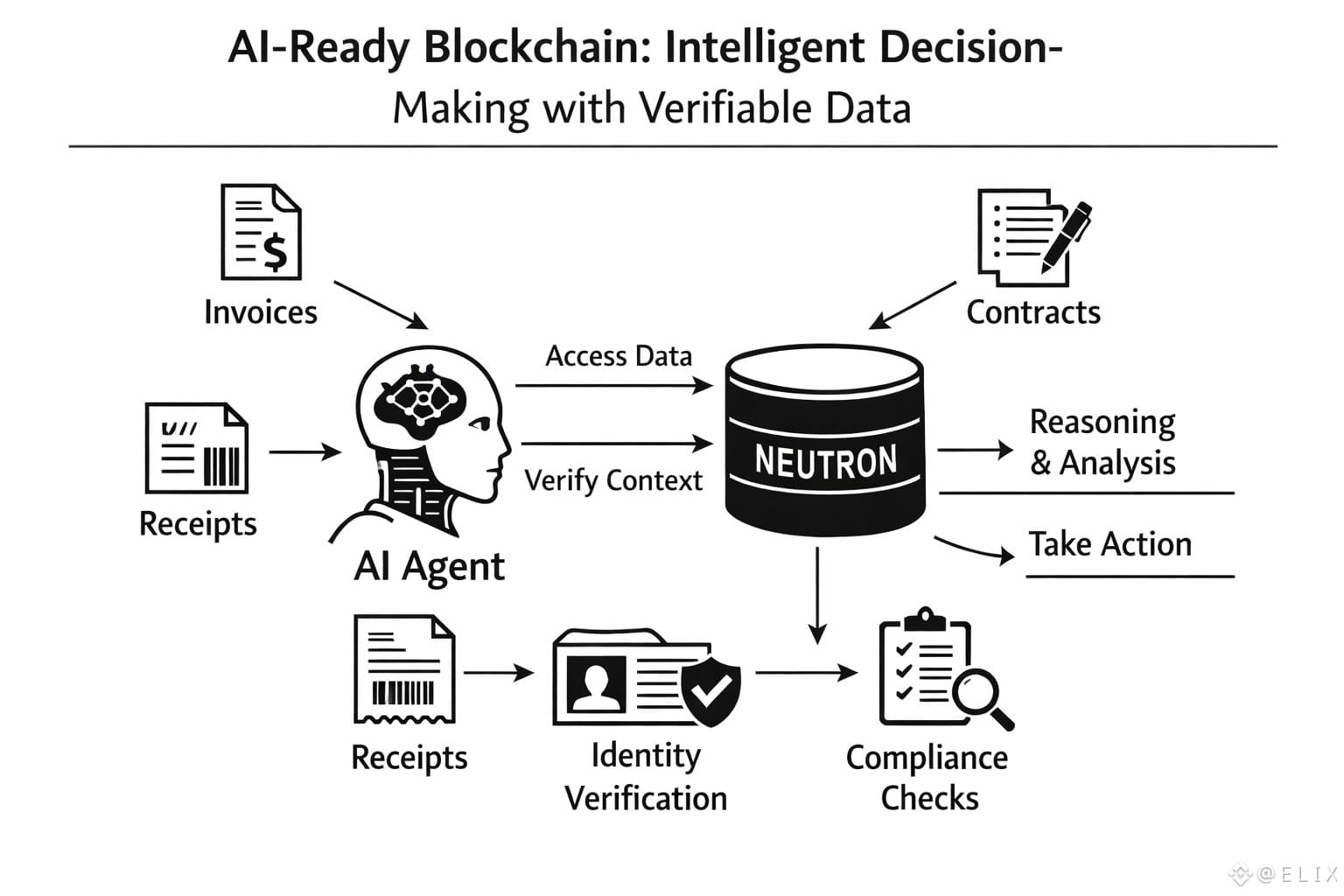

Vanar’s AI strategy is similarly pragmatic. Rather than embedding intelligence directly into applications, Vanar treats AI as a core infrastructure element. Through Neutron, on-chain data can be compressed, verified, and meaningfully represented, allowing AI agents to reason over it efficiently. In practice, this enables agents to safely access documents, media, and transactional context.

Payments are never isolated events—they involve context such as invoices, contracts, receipts, identity verification, and regulatory compliance. Many blockchains overlook this complexity, but Vanar captures it, empowering AI agents to act intelligently and autonomously. This shifts the paradigm from simple token transfers to automated, compliant financial processes.

As AI agents increasingly handle transactions, blockchains must provide consistent rails: predictable costs, reliable order execution, and verifiable data. Vanar’s design choices address these requirements, positioning it less as a consumer-facing chain and more as a backbone for autonomous financial systems.

Vanar also prioritizes real-world payment integration. Partnerships for stablecoin and conventional payment system adoption signal a long-term strategy: to become the blockchain layer that traditional financial institutions can safely and efficiently interface with. Technical perfection is insufficient without adoption; infrastructure thrives only when connected to users, merchants, and institutions.

Tokenomics reflect this infrastructure-first philosophy. New token issuance favors validators and developers over insiders, with no large team allocations. Block rewards decrease over time, encouraging early participation while preserving long-term sustainability. This demonstrates a commitment to network security and ecosystem growth rather than short-term speculation.

Vanar’s goal is reliability, not hype. It does not rely on overnight narratives or viral stories. Instead, it focuses on the quiet, persistent systems that underpin lasting infrastructure.

The greatest challenge lies in execution: predictable systems must remain predictable under real-world loads, reputation-based validation must resist manipulation, and intelligent data processing must prove practical beyond demos. If successful, Vanar could become one of the rare blockchains selected not for excitement, but for utility.

The future of value transfer will be automated, governed by AI agents, and constrained by compliance and sustainability requirements. @Vanarchain is betting on that future—and its approach may well define what a blockchain must be to endure.