Most blockchain conversations still revolve around the same tired comparison: L1 vs L1. Faster TPS, cheaper fees, louder narratives.

But that framing is already outdated.

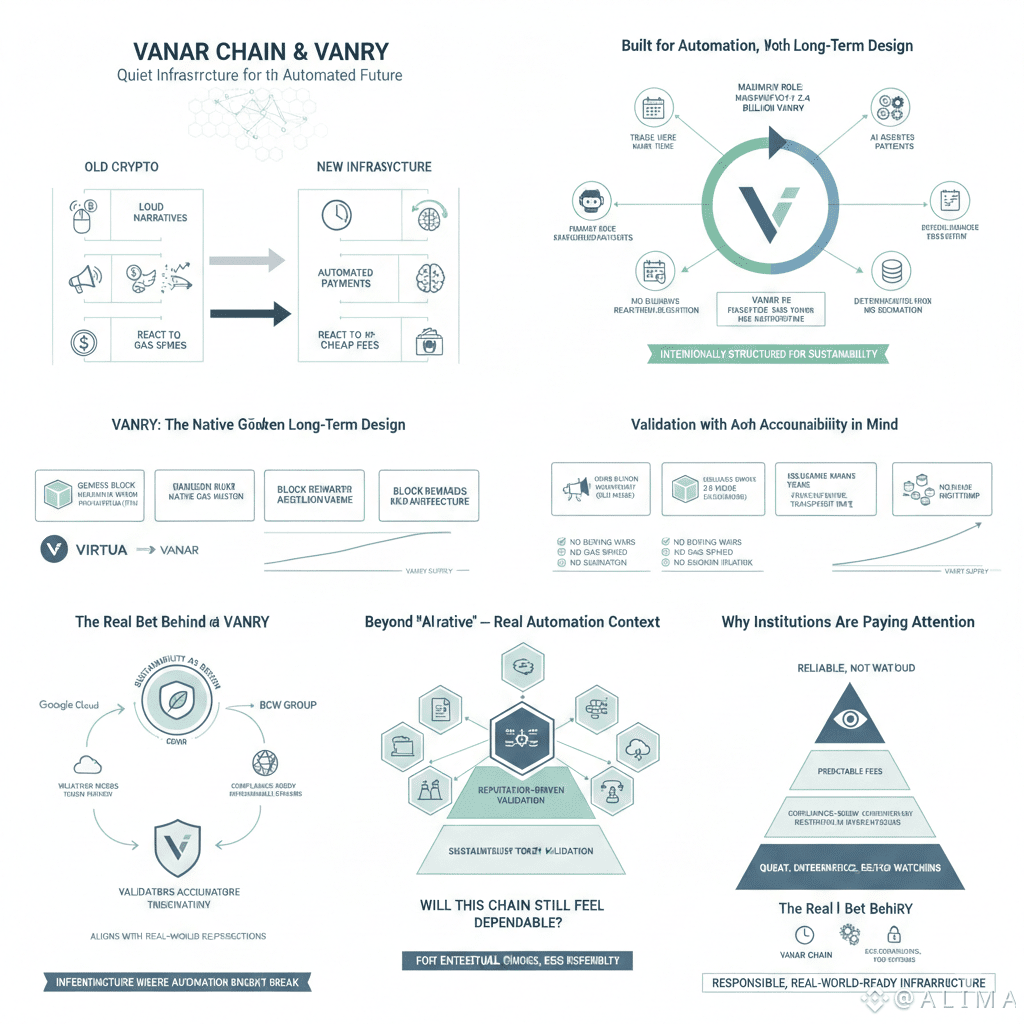

The next phase of crypto won’t be defined by humans clicking buttons. It will be defined by systems running quietly in the background AI agents, automated payments, subscriptions, settlement layers and machine to machine coordination.

And machines don’t care about hype.

They care about predictability.

That’s the lens through which Vanar Chain stands out.

Built for Automation, Not Button clicking

Most chains today still feel like they were designed for manual interaction:

Trade here

Mint there

Bridge when something breaks

React when gas spikes

That model doesn’t work for automation.

If you’re building:

AI driven agents

Scheduled payment flows

Subscription logic

Background settlement systems

You need one thing above all else: deterministic execution.

Vanar’s fixed fee architecture directly addresses this.

When transaction costs are stable:

Apps can plan ahead

Agents can schedule actions

Payment flows can run daily without surprises

No bidding wars.

No “gas just spiked.”

No broken automation.

This is a small design choice on paper but a massive one for real world systems.

VANRY: The Native Gas Token with Long 0term Design

At the core of the Vanar ecosystem is VANRY, the native gas token powering the network similar in function to ETH on Ethereum but with a very different issuance philosophy.

Key Characteristics of VANRY

Primary role: Native gas token for transactions and execution

Maximum supply: 2.4 billion VANRY

Clear issuance model with long term visibility

This isn’t experimental tokenomics. It’s intentionally structured for sustainability.

Token Minting: Transparent and Predictable

VANRY is minted through only two mechanisms, both designed for clarity and stability.

1. Genesis Block Allocation

At launch, an initial supply of VANRY tokens was minted in the genesis block to ensure:

Immediate network usability

Smooth transaction processing from day one

Operational readiness for the ecosystem

Vanar also represents the evolution of the Virtua (TVK) ecosystem.

TVK had a max supply of 1.2 billion tokens

Vanar minted 1.2 billion VANRY at genesis

A 1:1 swap ensured continuity for the Virtua community

This symmetry allowed existing holders to transition seamlessly into Vanar without dilution or disruption.

2. Block Rewards Over Time

Beyond genesis, all remaining VANRY tokens are issued exclusively through block rewards.

Issuance spans 20 years

New tokens are minted at a predefined, transparent rate

No sudden inflation events

No surprise supply shocks

This slow, measured release:

Incentivizes validators

Secures the network

Prevents abrupt supply fluctuations

The result is a more balanced and predictable economic environment.

Validation with Accountability in Mind

Another understated but important direction Vanar is taking lies in validation design.

Instead of leaning into full anonymity forever, Vanar is evolving toward a reputation-driven validator model.

That signals something important.

It says:

Validators should be accountable

Infrastructure should be trustworthy

The network should align with real world expectations

For enterprises and institutions, this matters. Trust isn’t built on mystery it’s built on responsibility.

Beyond “AI Narrative” Real Automation Context

Many chains slap “AI” onto their branding.

Vanar goes deeper.

The focus isn’t just on executing transactions it’s on context aware automation.

That means enabling systems where payments and actions are tied to:

Receipts

Rules

Identity checks

Compliance logic

Real world conditions

This is the unglamorous side of finance and also the part that actually scales.

Vanar is positioning itself as infrastructure where automation doesn’t break the moment things get complex.

Sustainability as Design, Not Marketing

Vanar also takes a deliberate stance on sustainability.

Through partnerships with:

Google Cloud

BCW Group

Validator nodes operate on renewable energy.

This isn’t a slogan. It’s an architectural choice.

For institutions, ESG alignment isn’t optional anymore and Vanar clearly understands that.

Why Institutions Are Paying Attention

When you step back, the pattern becomes clear.

Vanar is optimized for:

Predictable fees

Long term token stability

Accountable validation

Compliance ready infrastructure

Eco conscious operations

Automation at scale

This is why enterprises are watching closely.

Not because it’s loud but because it’s reliable.

The Real Bet Behind VANRY

The real question isn’t whether Vanar can attract short term attention.

The real question is:

When crypto stops being a hobby and starts being infrastructure will this chain still feel dependable?

That’s the bet Vanar is making.

Quiet. Deterministic. Built for systems that run in the background.

Vanar isn’t just calling itself an AI blockchain.

It’s raising the bar for responsible, real world ready infrastructure.