A follower recently asked me about how to approach DCA for his ENA position. I’m sharing this case for reference, focusing purely on strategy and risk management, without discussing conviction or price expectations.

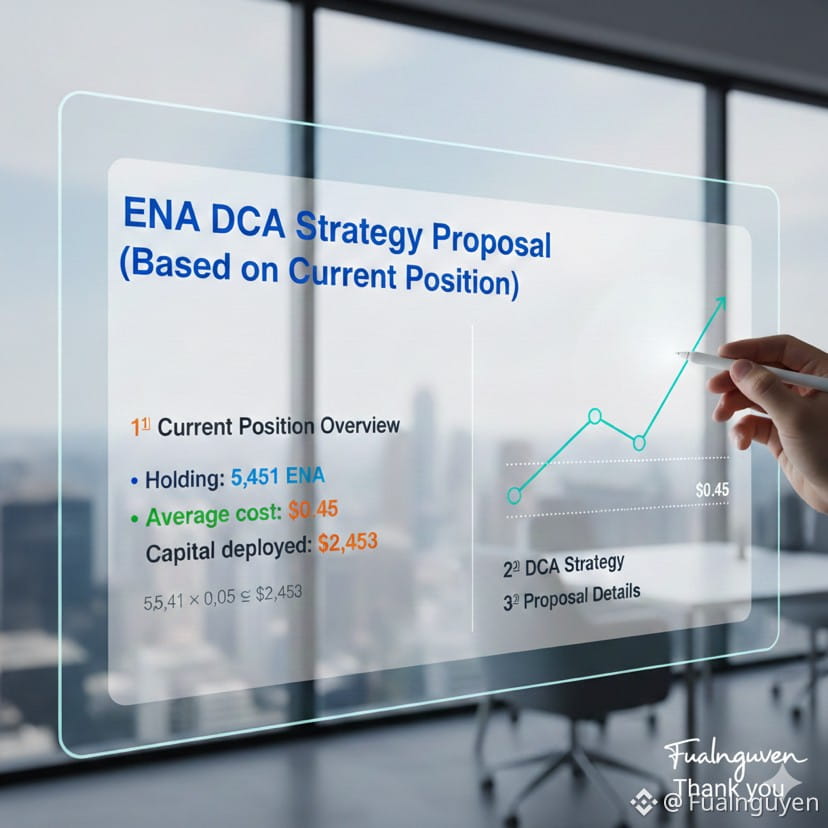

Portfolio context

Current position: 5,451 ENA

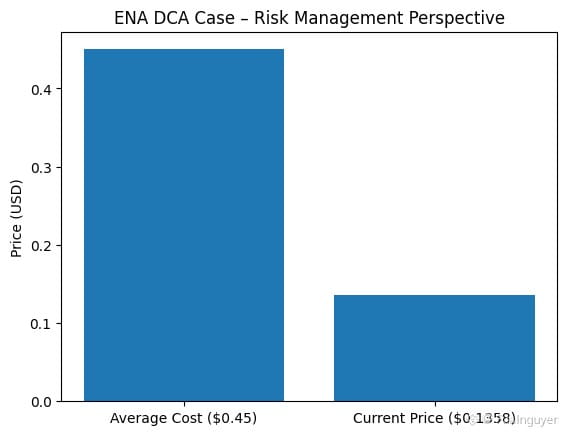

Average cost: $0.45

Monthly idle cashflow: approximately $200

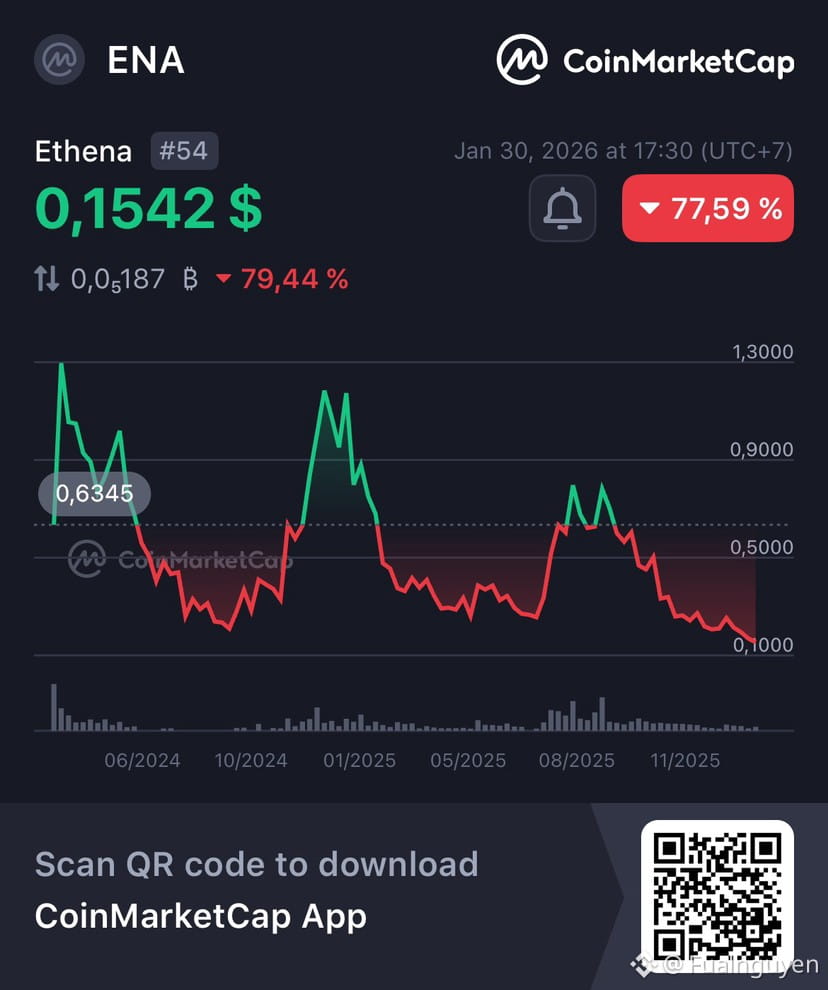

ENA price at the time of discussion: ~$0.1358

This portfolio has already experienced a significant drawdown. At this stage, the key question is no longer “where to buy cheaper”, but whether additional capital allocation improves or worsens overall risk.

1. At current price levels, DCA is no longer a technical decision

When price trades far below the original cost basis, defining “good price zones” becomes far less meaningful. DCA, in this context, is primarily a capital allocation decision, not a timing exercise.

A common mistake is continuing to split buy orders simply because price is lower, while supply dynamics and market structure remain unresolved.

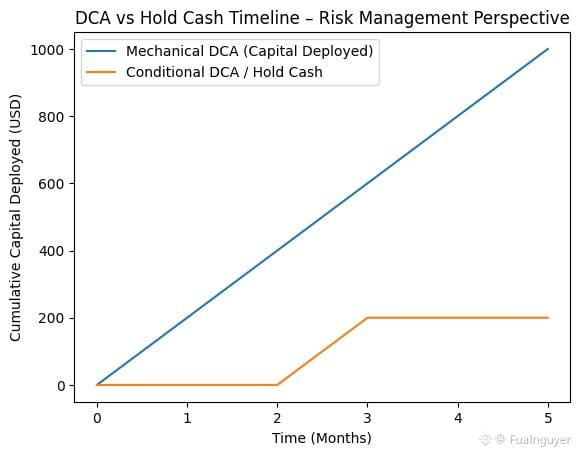

2. Handling the $200 monthly cashflow

Rather than treating the $200/month as mandatory deployment, a more conservative approach would be:

Not assuming the cashflow must be invested every month

Structuring capital into layers:

A very small portion to maintain optional exposure and market engagement

The remaining capital held as cash until there is a clear change in supply dynamics, liquidity, or narrative

At these price levels, not deploying capital is a valid risk-managed decision.

3. Replacing “price zones” with “deployment conditions”

Instead of fixed price levels—which can quickly become irrelevant in volatile conditions—this case is better approached through conditions, such as:

A visible reduction in vesting-related supply pressure

Stabilization of circulating supply

Funding rates and open interest signaling long-term basing rather than short-term bounces

Selective return of liquidity into altcoins

Only when conditions improve does DCA become meaningful from a risk perspective.

4. The role of DCA around the 0.13x price range

At current levels, DCA is no longer aimed at aggressively lowering the average cost. Its role is primarily to:

Maintain optionality in case ENA recovers

Avoid increasing exposure to a structurally weak asset

Preserve flexibility to rotate capital in the future

Here, DCA should be viewed as the cost of maintaining optionality, not as a strategy to increase allocation.

5. Final note: This case strictly discusses risk management and capital handling, not buy or sell recommendations. Whether ENA is worth holding long term remains an individual decision, based on personal research and risk tolerance.

After deep drawdowns, the right question is no longer “where to buy”, but whether to buy at all.

In this case, prioritizing capital preservation, holding cash, and waiting for conditions to change represents a more appropriate risk-managed approach.

#Fualnguyen #LongTermAnalysis #LongTermInvestment