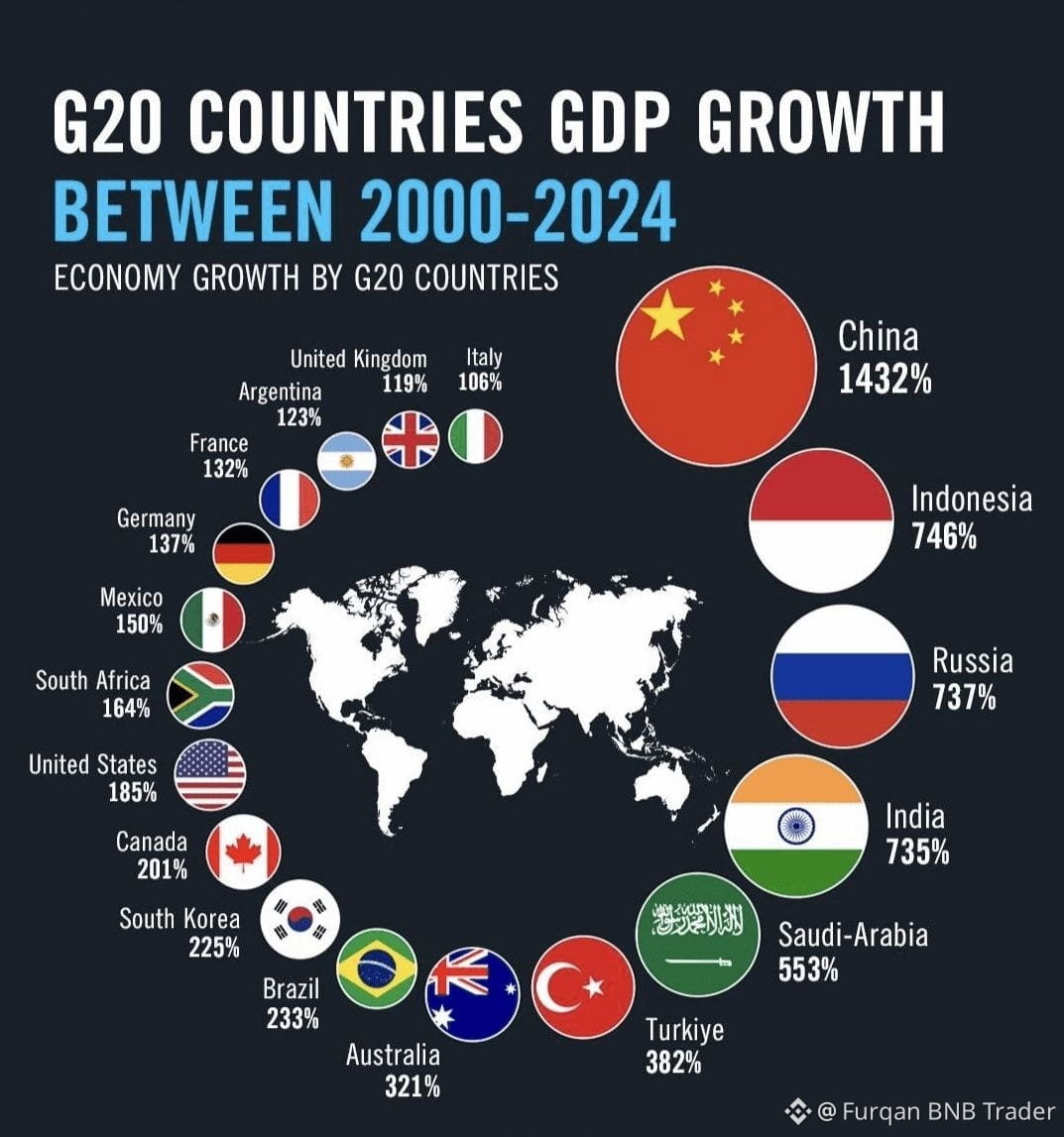

Over the past two decades, the global economic landscape has transformed dramatically. Emerging markets have outpaced developed economies, signaling a shift in economic influence and growth momentum.$BTC

China leads the G20 by a massive margin, posting an estimated +1432% GDP growth, reflecting its rapid industrialization, export dominance, and infrastructure expansion. Indonesia, Russia, and India follow closely, each recording over 700% growth, highlighting the rising strength of Asian and emerging economies.

Middle Eastern and developing nations like Saudi Arabia (+553%) and Türkiye (+382%) benefited from energy markets, population growth, and industrial reforms. Meanwhile, advanced economies such as the U.S. (+185%), Germany (+137%), France (+132%), and the U.K. (+119%) grew at slower, more stable rates—reflecting maturity rather than stagnation.$BNB

Latin American countries like Brazil (+233%), Mexico (+150%), and Argentina (+123%) show mixed performance, influenced by commodity cycles, inflation, and political shifts.

Notably, Japan is excluded due to long-term economic stagnation and deflationary pressure, underscoring the challenges of aging populations and slow domestic demand.$ETH

Key Takeaway:

Global economic power is gradually shifting toward emerging markets, while developed economies maintain steady but slower growth. The future of global finance may increasingly depend on innovation, demographics, and industrial transformation.#CZAMAonBinanceSquare