When gold breaks, crypto corrects - but the structure remains intact

When markets are shaken, the most important question is not which asset drops the most, but which asset refuses to collapse after the shock. In recent sessions, gold - the traditional symbol of safety - suffered a sharp, system-level sell-off.

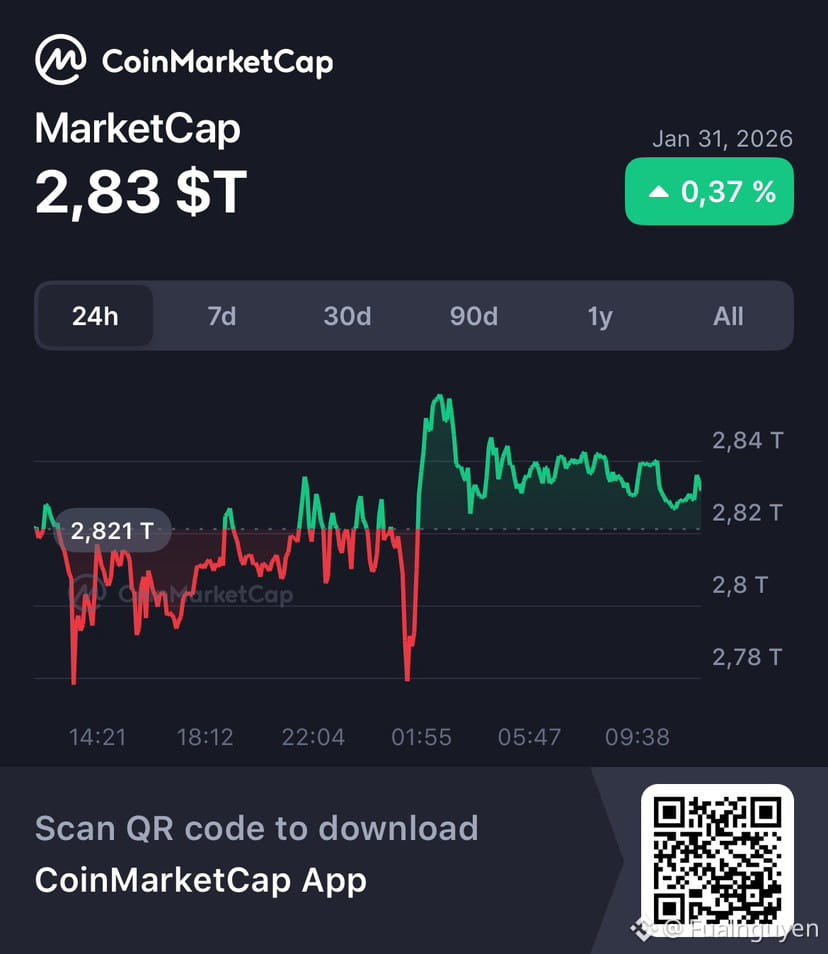

Meanwhile, the crypto market, represented by the Top 10 market capitalization, only corrected in a controlled manner and quickly stabilized its structure.

This is not a coincidence. It is a signal worth reading carefully.

A. Top 10 market cap: correcting, not breaking

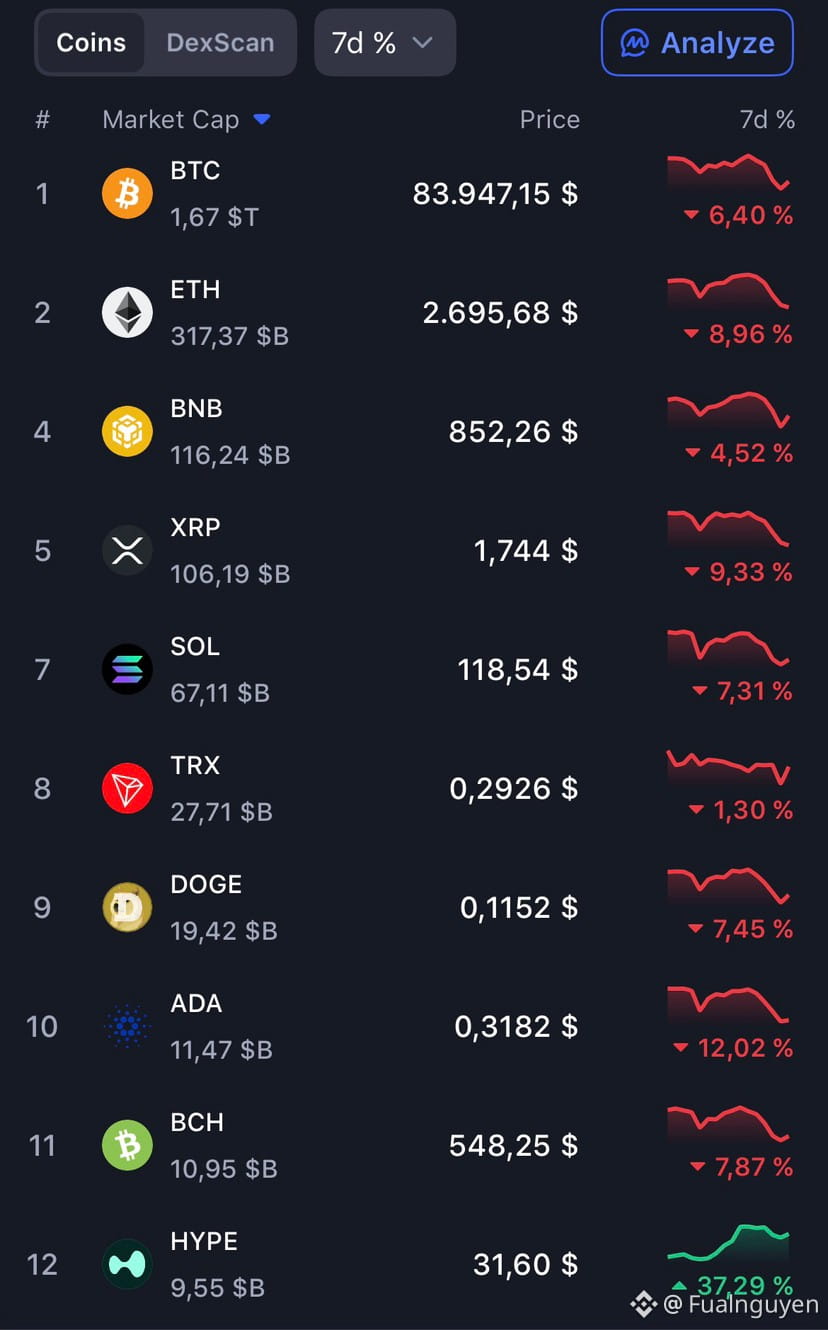

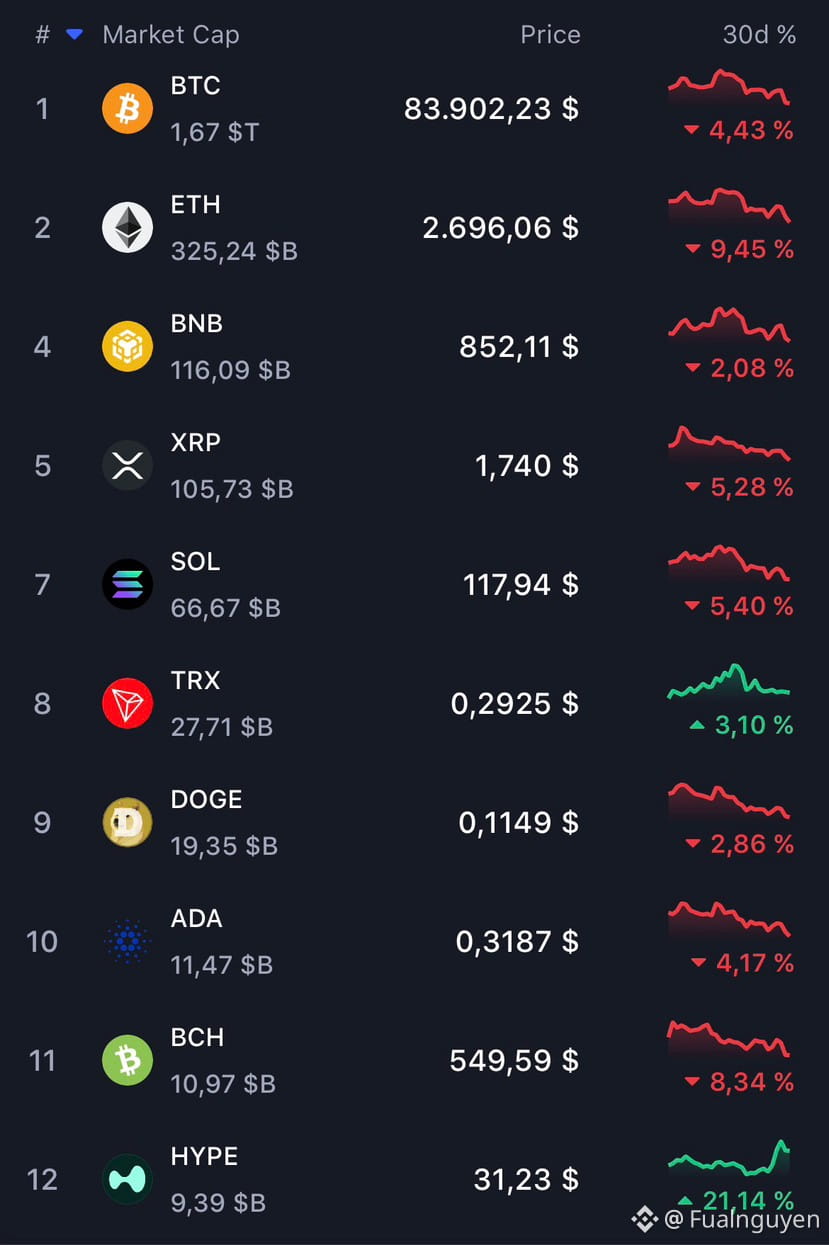

Looking at the 7-day and 30-day data for the Top 10:

BTC, ETH, BNB, SOL, and XRP all posted declines

But no cascading sell-off occurred

No evidence of broad capital flight out of the market

Some assets, such as TRX and HYPE, even remained green - a clear sign that capital is not leaving crypto, but rather being selectively reallocated.

Crypto is no longer reacting in a simplistic “risk-on / risk-off” manner. The market is digesting risk, not rejecting it.

B. The falling wedge in Top 10 market cap has been broken

On the higher timeframe, the Top 10 crypto market cap formed a long-term falling wedge - a structure typically associated with:

Prolonged corrections

Gradually weakening selling pressure

Contracting downside momentum

Most importantly: This falling wedge has now been broken to the upside.

Historically:

2019: wedge breakout → beginning of recovery

2023: wedge breakout → confirmation of a medium-term bottom

Today, a similar structural setup is emerging again. This is not a signal for an immediate rally, but a sign that the downcycle has largely completed its function.

C. When gold collapses, crypto does not

The 7–30 day data highlights a crucial contrast:

Crypto’s pullback remains largely technical

Gold’s decline was sharp, rapid, and disorderly

Gold’s move reflects:

Deleveraging

Forced selling

Stress originating from the traditional financial system

Crypto, by contrast, did not move in lockstep.

D. The inverse correlation between gold and Bitcoin is narrowing

Historically, gold and Bitcoin were often viewed as opposites. This time, however:

Gold fell sharply

Bitcoin did not rally as a substitute safe haven

But it also did not collapse alongside gold

This suggests that the inverse correlation between gold and Bitcoin is weakening.

Bitcoin is increasingly driven by:

Global liquidity cycles

Its own market structure

The growing maturity of the crypto ecosystem

Rather than acting as a derivative of gold or equities.

E. Reading the market through what doesn’t collapse

Putting all the pieces together:

Gold broke down

Crypto corrected but preserved its structure

Top 10 market cap held firm

The long-term falling wedge was broken

Capital remains inside the ecosystem

The market is sending a clear message.

“What doesn’t collapse after a major shock is precisely what deserves the closest attention”

Because that is often where:

Risk has already been priced in

Selling pressure has been absorbed

And smart money is quietly staying put

Crypto may not yet be accelerating upward, but it is no longer behaving as a direct victim of macro shocks. And many major cycles in the past have begun from exactly this kind of environment.

#Fualnguyen #LongTermAnalysis #LongTermInvestment