The year 2026 has brought stablecoins into sharper focus as foundational elements of modern finance. With market capitalization surpassing three hundred billion dollars and daily volumes frequently outpacing traditional payment giants, the narrative on platforms like Binance Square centers on infrastructure that can sustain this growth without friction. Regulatory advancements, including the GENIUS Act, have encouraged institutional participation, while new entrants and yield mechanisms expand utility beyond mere transfers. Discussions highlight the need for chains that treat stablecoins not as add-ons but as the primary driver of design, enabling seamless, high-volume settlement across borders and use cases.

Plasma addresses this demand directly as a Layer 1 blockchain constructed expressly for stablecoin settlement. It avoids the dilution that comes with supporting diverse applications, instead channeling resources toward optimizing the movement of digital dollars like USDT. The architecture employs the Reth client to ensure complete Ethereum Virtual Machine compatibility, meaning developers familiar with Ethereum tools can deploy contracts effortlessly. This pairs with PlasmaBFT consensus, which achieves sub-second finality and handles thousands of transactions per second reliably, making it suitable for scenarios requiring immediate confirmation.

Central to Plasma's appeal are features tailored to eliminate common obstacles in stablecoin usage. Gasless USDT transfers stand out prominently: the protocol sponsors fees for these operations through a built-in paymaster, allowing users to send and receive without holding native tokens or incurring costs. This removes a significant entry barrier, especially in emerging markets where access to volatile assets might be limited or undesirable. Stablecoin-first gas extends the logic further, permitting fees in approved stable assets when applicable, aligning the chain's economics closely with its core purpose.

Underpinning these capabilities is security rooted in Bitcoin-anchored mechanisms. By leveraging Bitcoin's decentralized and battle-tested properties, Plasma enhances neutrality and fortifies against censorship, distributing trust in a manner that appeals to institutions wary of concentrated control points. This foundation supports confidence in long-term settlement integrity for payments and financial applications.

Momentum builds through practical integrations and ecosystem expansions. Cross-chain solutions facilitate large transfers with competitive pricing, while yield-bearing options and neobank-like products demonstrate real-world applicability. These elements position Plasma within the broader shift toward programmable, borderless money that operates efficiently at scale.

Beginners exploring blockchain for financial purposes find Plasma particularly accessible due to its focus on utility over complexity. To get started, acquire a compatible wallet that supports the network, fund it with USDT from a bridge or exchange, and initiate a transfer to another address. The gasless mechanism activates automatically for eligible USDT sends, delivering confirmation in under a second without additional deductions. This straightforward process illustrates how the chain reduces hurdles that often discourage new users from engaging with on-chain transfers.

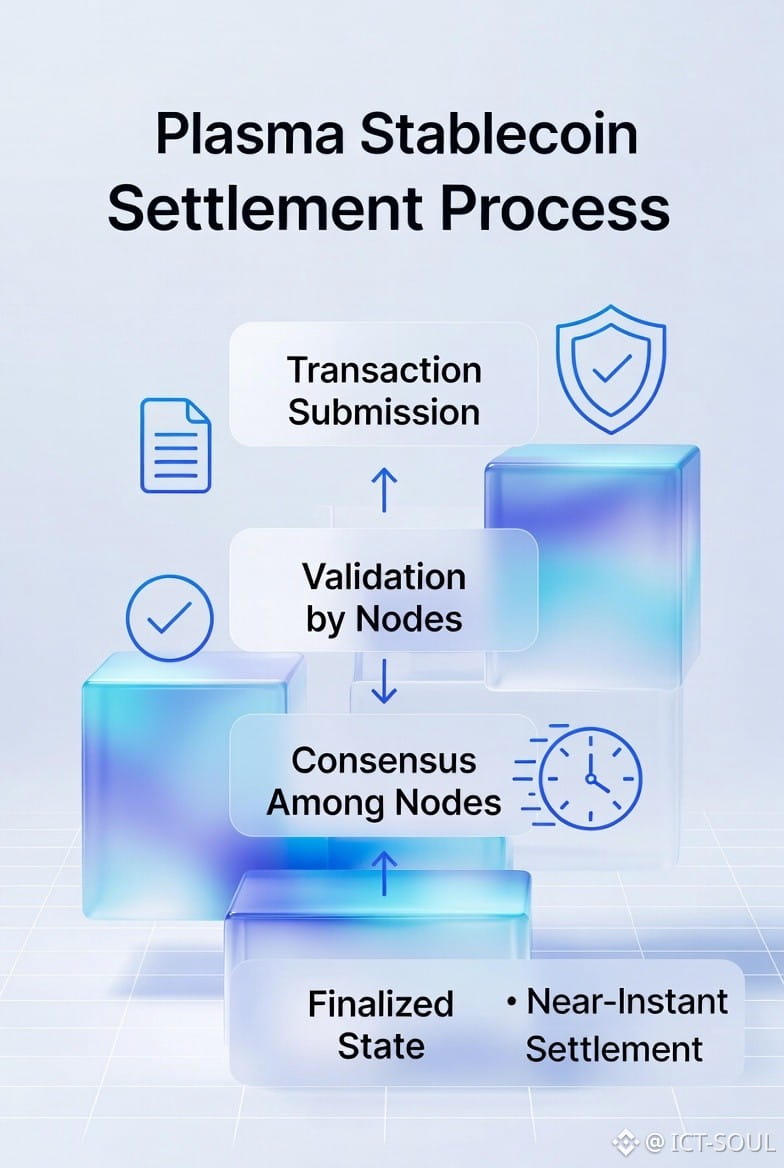

The following diagram captures the essence of sub-second finality on Plasma.

It outlines the progression from transaction submission through rapid consensus among nodes to finalized state, emphasizing the speed that enables near-instant settlement crucial for payments.

Another diagram illustrates the gasless USDT transfer process.

This visual details how locking assets on one layer leads to seamless movement on the child chain with zero gas requirements, followed by unlocking and confirmation, highlighting the cost efficiency that sets Plasma apart.

$XPL serves as the native token, supporting staking for security and validator incentives, while @Plasma advances development and partnerships that broaden adoption.

In the context of current Binance Square conversations, where stablecoins dominate as settlement infrastructure and infrastructure specialization gains traction, Plasma exemplifies targeted innovation. It prioritizes the attributes most needed for global payments: speed, negligible costs for core operations, and robust safeguards. As volumes rise and traditional finance increasingly intersects with crypto rails, such purpose-driven chains offer a glimpse into how digital money might function more inclusively and efficiently.

Plasma contributes meaningfully to this trajectory by providing a specialized environment where stablecoins thrive as programmable, accessible assets. Its design choices reflect a clear understanding of emerging demands, positioning it to capture meaningful share in the evolving landscape of financial technology.