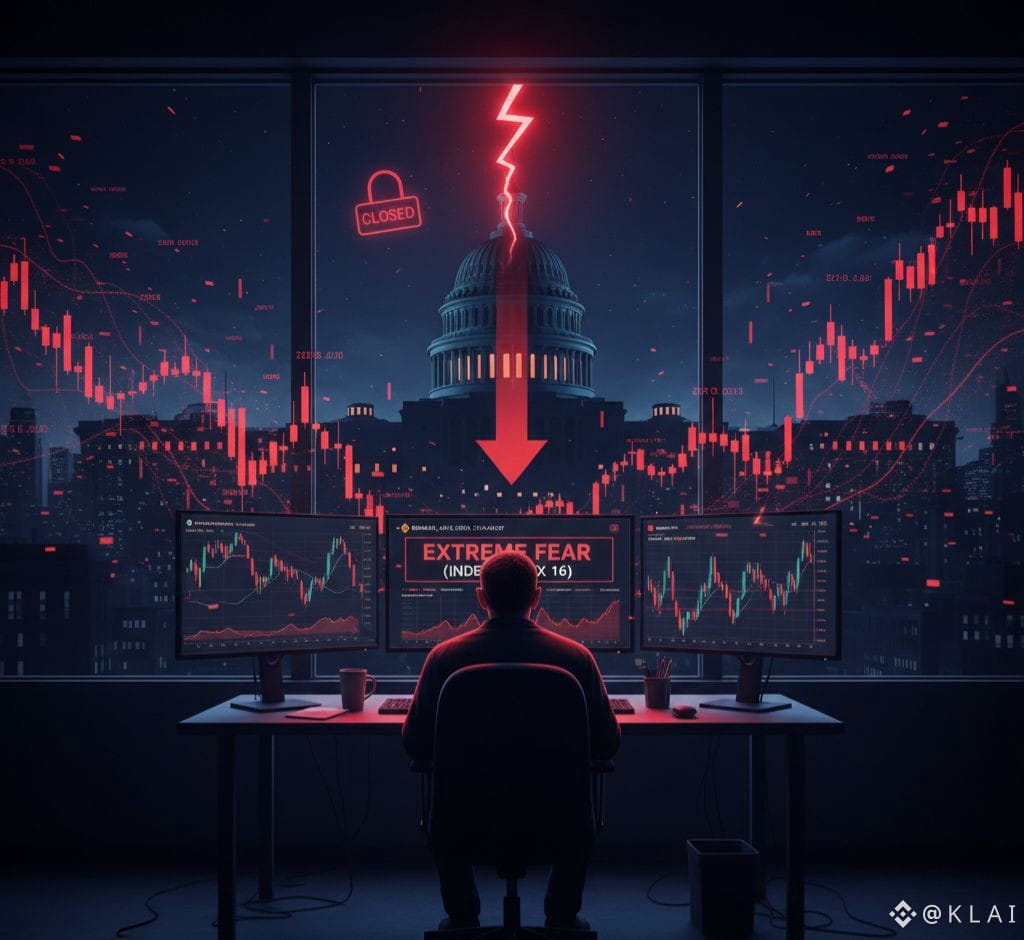

Today, January 31, 2026, the crypto market is experiencing significant downward pressure, with Bitcoin $BTC dropping below $65,000 and the overall market seeing double-digit percentage losses across many altcoins. The primary catalyst for this sudden downturn? Mounting fears of a looming US government shutdown.

🏛️ The US Shutdown Impact

The gridlock in Washington D.C. over budget negotiations has sent shockwaves through traditional markets, and crypto is not immune.

Risk-Off Sentiment: A government shutdown creates massive economic uncertainty, leading investors to flee riskier assets like cryptocurrencies and move into safer havens (e.g., USD cash or even gold).

Liquidity Crunch: Concerns about potential delays in federal payments, employee furloughs, and broader economic instability can lead to a liquidity crunch, forcing some institutional players to sell crypto assets to cover other liabilities.

Regulatory Stalling: A shutdown also means a halt to non-essential government functions, including regulatory bodies like the SEC. This can delay critical decisions (e.g., Spot ETF approvals), further eroding investor confidence.

💡 What Next?

While the situation is chaotic, historical data suggests that crypto markets often rebound once a shutdown is resolved. However, the short-term outlook remains volatile. Traders are advised to exercise extreme caution and closely monitor developments from Washington.