Back in November 2021, the total crypto market cap hit its all-time high around $3 trillion (peak euphoria with Bitcoin near $69K and altseason in full swing).

Fast-forward to early February 2026: The global crypto market cap sits at roughly $2.7–2.8 trillion (sources like CoinGecko ~$2.75T, CoinMarketCap ~$2.66–2.7T, with some variance due to volatility). Bitcoin dominates at 57–59% ($1.57–1.68T cap), but the broader market—including most altcoins—remains flat or down from that 2021 top. Many alts are still well below their 2021 highs, stuck in a prolonged correction phase.

Meanwhile, traditional assets have moved forward meaningfully:

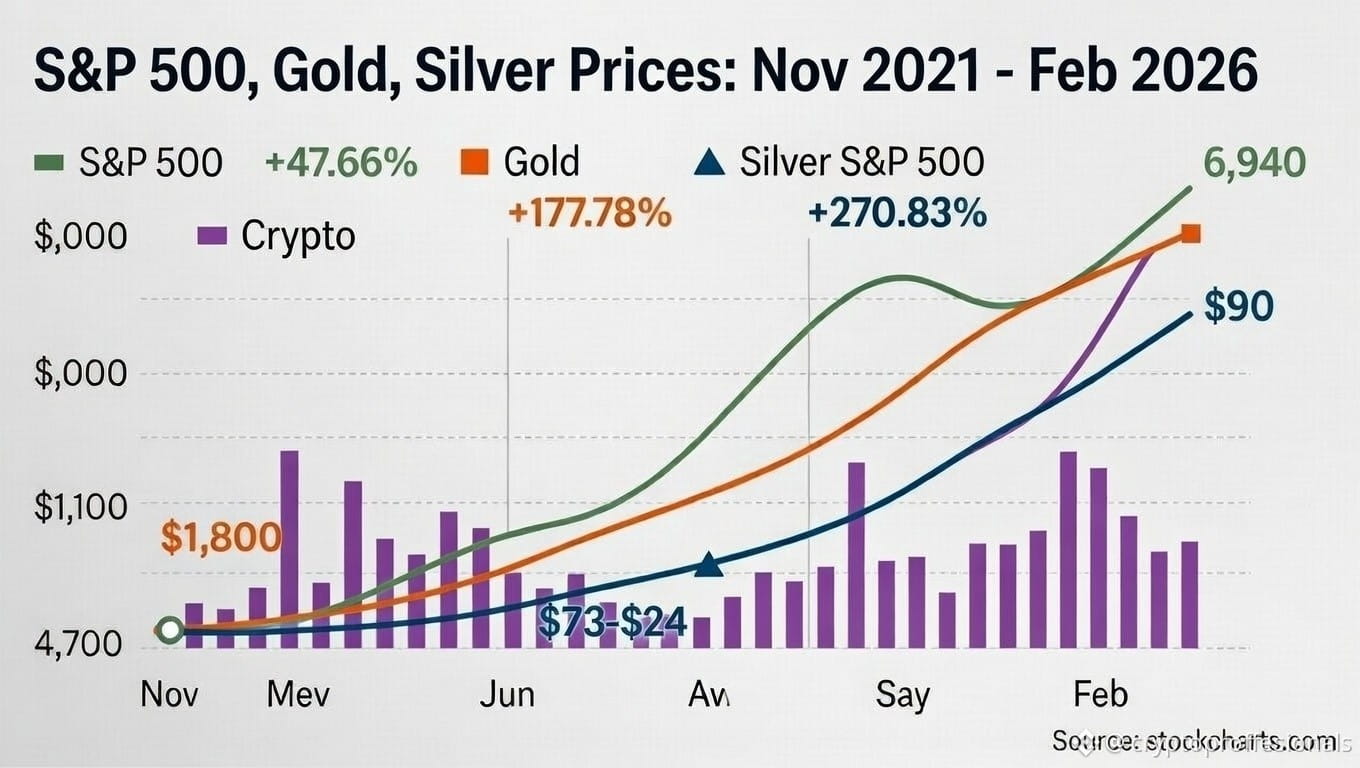

S&P 500: Closed around 4,567 in November 2021. Today? Hovering near 6,900–7,000 (recent levels ~6,939–6,969), up roughly 50–55% from that point. Steady corporate earnings, tech growth, and economic resilience have driven this.

Gold: Traded around $1,800–1,850/oz in late 2021. Now? Spot prices are in the $4,800–5,500/oz range (recent highs touched even higher before pullbacks), representing a massive ~160–200%+ increase. Central bank buying, inflation hedging, and geopolitical uncertainty have fueled the bull run.

Silver: Around $22–25/oz back then. Current levels? $85–100+/oz (with peaks over $120 in recent months), up ~300%+ in the same timeframe. Industrial demand (solar, EVs, etc.) plus safe-haven flows have supercharged it.

The takeaway? Crypto's "digital gold" narrative hasn't fully played out yet in this cycle. Bitcoin has held relatively strong (its market cap now exceeds 2021 levels thanks to higher dominance), but the overall space feels like it's still digesting the post-2021 hangover—macro headwinds, regulation, lack of fresh narratives, and capital rotating to "safer" hedges like metals.

Stocks have compounded steadily with real-world growth. Metals have exploded as true stores of value amid uncertainty.

Crypto remains high-risk/high-reward. This could be accumulation territory if the cycle turns (halving effects, potential macro easing ahead). But right now, the numbers don't lie: while the world has moved on in equities and commodities, crypto is largely treading water near 2021 territory.

What do you think—dip-buying opportunity or time to diversify? Patience wins in cycles, but so does acknowledging reality. 📉 vs 📈