After three consecutive crashes yesterday, the market is now starting to show a growing cluster of signals pointing to a potential recovery in tonight’s U.S. session.

🔹 Longling — an entity well known for its bottom-timing ability — has officially stepped back in.

🔹 Longling — an entity well known for its bottom-timing ability — has officially stepped back in.

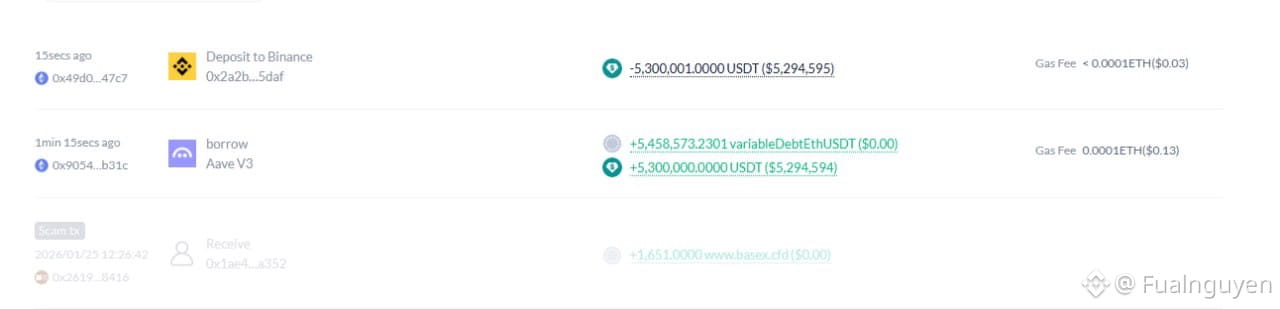

Just minutes ago, a wallet linked to Longling borrowed 5.3 million USDT from Aave and immediately transferred it to Binance to buy the dip in $ETH. Historically, whenever Longling becomes this active, $ETH has often seen a short-term rebound that can extend into the medium term.

The key question now is: can Longling maintain its track record of successful timing this time as well?

🔹 On another front, whale capital is quietly returning to altcoins. A large whale has been consistently DCA-ing $COW over the past four days, accumulating 1.76 million COW (~$289,000).

The average entry price sits at 0.171, and the current spot position is only about 4% underwater, suggesting this is clearly a long-term accumulation strategy rather than a short-term trade.

The average entry price sits at 0.171, and the current spot position is only about 4% underwater, suggesting this is clearly a long-term accumulation strategy rather than a short-term trade.

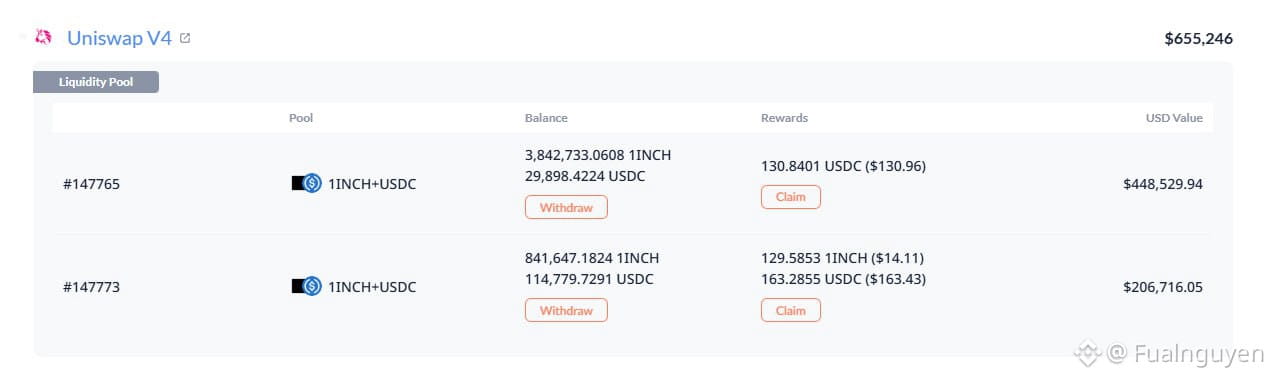

Whales Are Actively Accumulating $1INCH. Over the past three hours, a whale wallet has been aggressively accumulating $1INCH after being dormant for more than one year. This address has acquired a total of 5.59 million $1INCH, worth approximately $615,000, at an average price of $0.11 per token. Notably, a portion of these holdings has been deposited into Uniswap v4 liquidity pools to farm, signaling a longer-term positioning strategy rather than short-term speculation.

Whales Are Actively Accumulating $1INCH. Over the past three hours, a whale wallet has been aggressively accumulating $1INCH after being dormant for more than one year. This address has acquired a total of 5.59 million $1INCH, worth approximately $615,000, at an average price of $0.11 per token. Notably, a portion of these holdings has been deposited into Uniswap v4 liquidity pools to farm, signaling a longer-term positioning strategy rather than short-term speculation.

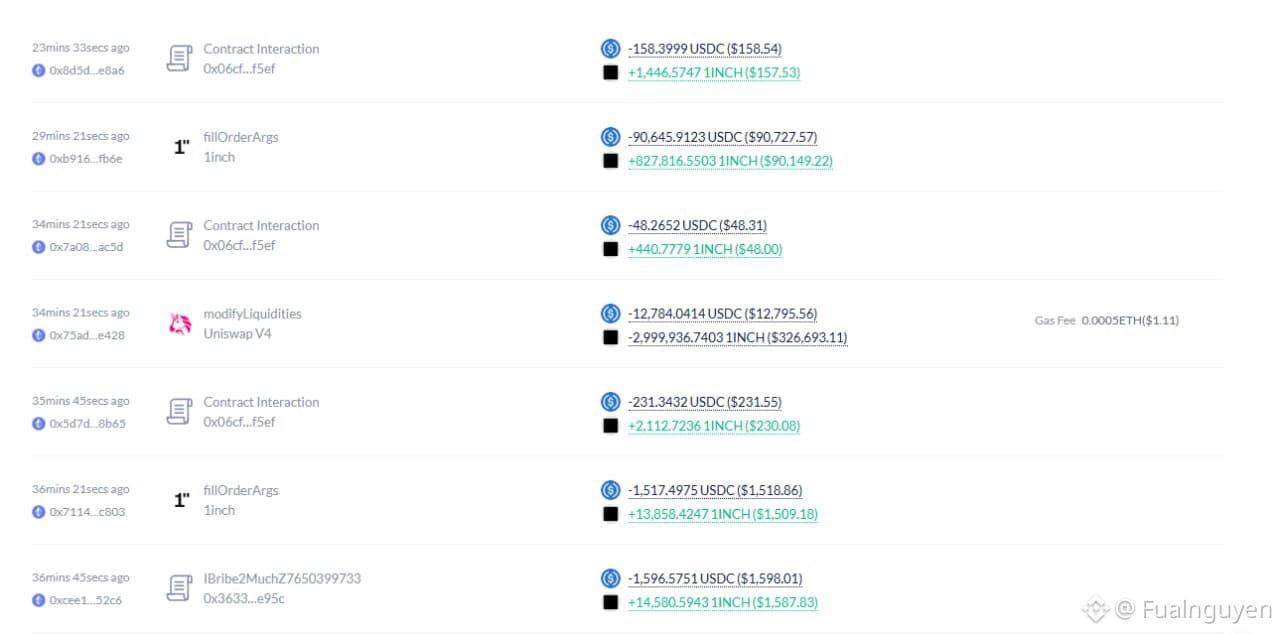

7Siblings Also Ramping Up $1INCH Accumulation. Another notable wallet linked to 7Siblings has been actively swapping $LINK and $USDC into $1INCH over the past few hours. So far, this address has accumulated 2.8 million $1INCH, with a total value of around $308,000. What stands out is that the $LINK used for these swaps was borrowed from Aave, suggesting a leveraged conviction trade. This move implies that 7Siblings may be betting on $1INCH outperforming $LINK in the near term. Similar to the previous whale, the acquired $1INCH was immediately deposited into Uniswap pools for farming.

Putting all the pieces together:

- The market has already endured heavy sell-offs and multiple crashes

- Smart money is beginning to borrow capital to buy the dip

- Whales are returning to accumulate at prolonged low-price zones.

All signs point to a familiar setup: selling pressure is gradually weakening while strategic buying interest is emerging, setting the stage for a notable rebound during the U.S. session tonight - at least from both a technical and market sentiment perspective.

Reference: NansenAI, GM Cashback, Phemex, BeinCrypto

#Fualnguyen #LongTermAnalysis #LongTermInvestment