Short Intro

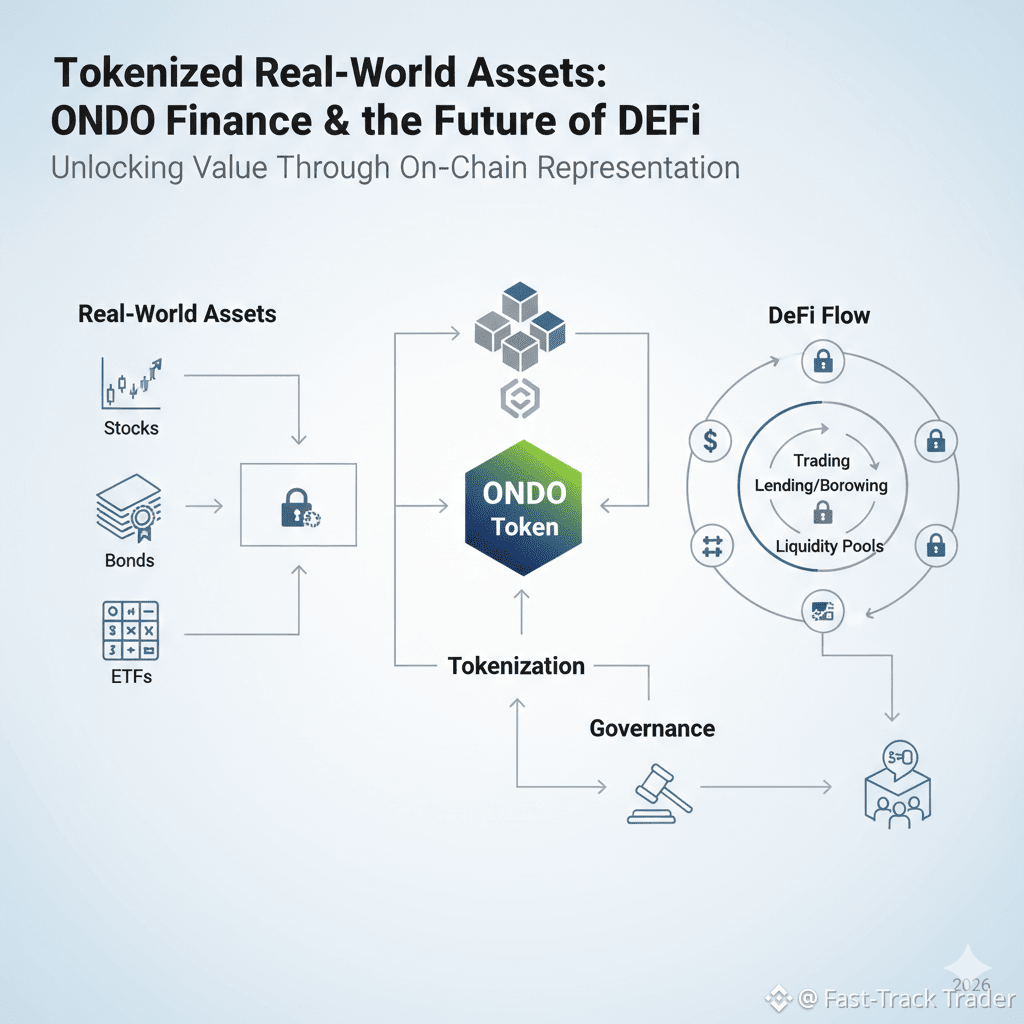

Ondo (ONDO) is a cryptocurrency and governance token for Ondo Finance — a project focused on bringing real-world assets (RWAs) like U.S. Treasuries, stocks, ETFs and other financial instruments onto blockchain networks. It aims to make traditional finance more accessible through decentralized finance (DeFi).

📌 What Ondo Does

Ondo Finance tokenizes real-world financial products such as government bonds, money market funds, and equities — turning them into on-chain tokens that can be traded or used in DeFi. The ONDO token itself serves as the governance token, letting holders vote on protocol changes and help shape the platform’s future.

Recent developments show Ondo’s ecosystem expanding across multiple blockchains (Ethereum, BNB Chain, Solana), bringing 100+ tokenized U.S. stocks and ETFs on-chain to platforms where global users can access them.

📊 Market & Price Snapshot

Right now, ONDO is trading as an ERC-20 token — meaning it runs on the Ethereum network and leverages Ethereum’s smart contract security. It has a total supply of 10 billion tokens, with about 4.86 billion in circulation. Market cap is around $1.4 billion with active trading volume.

Despite strong fundamentals in tokenized assets, ONDO’s price has struggled after broader unlocks increased circulating supply, creating sell pressure in the market.

🧠 Why It Matters

Ondo stands out because it bridges traditional finance with blockchain technology — something many DeFi projects aim for but few achieve at scale. Here’s why that’s significant:

• Tokenized assets allow access to financial products usually limited to big institutions.

• ONDO governance lets the community vote on key platform decisions.

• Bringing stocks and ETFs on-chain opens doors for 24/7 transparent trading.

• Expansion to multiple blockchains increases accessibility and DeFi liquidity.

⭐ Key Takeaways

• What it is: ONDO is the token for Ondo Finance, a platform tokenizing traditional assets into blockchain-friendly formats.

• Use cases: Governance, participation in tokenized asset markets, voting on protocol upgrades.

• Ecosystem growth: 100+ tokenized stocks and ETFs now available on-chain across multiple networks.

• Market context: Price action has faced pressure due to token unlocks, but the underlying RWA sector continues to grow.

• Risks: Like all crypto tokens, ONDO is volatile and tied to broader market sentiment.

#OndoFinance #Tokenization #RealWorldAssets #DeFi #ONDO $ONDO