$ZK has been the talk of the crypto town, not just for its recent price action but for its ambitious vision and strategic roadmap for 2026. While the broader market navigates choppy waters, ZK has managed to capture significant attention, hinting at its potential to redefine the Layer-2 landscape.

$ZK has been the talk of the crypto town, not just for its recent price action but for its ambitious vision and strategic roadmap for 2026. While the broader market navigates choppy waters, ZK has managed to capture significant attention, hinting at its potential to redefine the Layer-2 landscape.

1. The Strategic Pivot: 2026 Roadmap & Institutional Push

ZKsync's aggressive 2026 roadmap is a major catalyst. The team is strategically focusing on:

Institutional Adoption: Moving beyond retail, ZKsync is actively developing solutions to onboard financial institutions, leveraging its superior scalability and security. This includes customisable zkEVMs for enterprise-grade applications.

"Prividium" Technology: A new proprietary technology, "Prividium," is at the core of ZKsync's push for enhanced privacy and regulatory compliance, making it attractive for large-scale corporate use cases.

Atlas Upgrade: The upcoming "Atlas Upgrade" is poised to significantly enhance network throughput and reduce transaction costs, further cementing ZKsync's position as a leading Layer-2 solution.

Sunsetting ZKsync Lite: The decision to gradually sunset the legacy ZKsync Lite in 2026 marks a crucial transition towards a more advanced, high-performance, and unified "Elastic Network." This shift aims to consolidate resources and focus on a single, robust platform capable of handling future demands.

These strategic moves are designed to future-proof ZKsync, positioning it as a foundational infrastructure for the next wave of Web3 innovation.

2. Technical Outlook: Navigating Key Levels

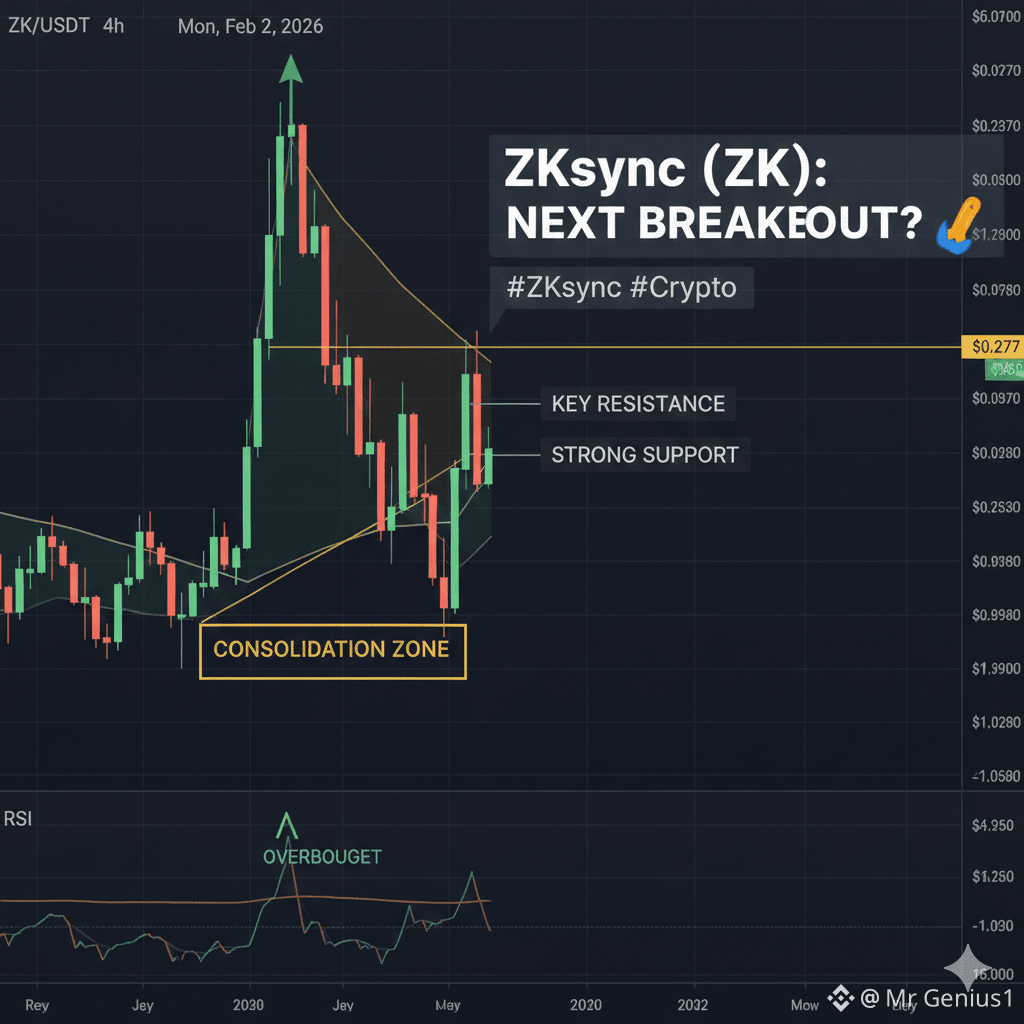

Looking at the 4-hour chart (as generated), ZK has shown remarkable resilience and breakout potential:

Consolidation Zone Breakout: ZK recently broke out of a significant consolidation zone, indicating that buyers have stepped in aggressively after a period of price discovery. This breakout is usually a strong bullish signal.

Key Resistance at $0.0277: The immediate challenge for ZK is to firmly break and hold above the $0.0277 resistance level. A sustained daily close above this point would confirm bullish momentum and open the doors for further upside.

Strong Support: There's robust strong support established below the current price action, suggesting that any pullbacks might find buyers quickly, preventing a deeper correction.

RSI (Relative Strength Index): While the chart indicates an overbought condition previously, the RSI is now resetting. A healthy RSI level allows for sustainable price growth without excessive short-term volatility. Traders should watch for the RSI to remain above the 50-mark, signaling continued buying strength.

Next Targets: If ZK successfully clears the $0.0277 resistance, the next significant target could be around the $0.035 mark, potentially even higher depending on market sentiment and network developments.

3. Market Sentiment & What's Next?

Social sentiment around ZKsync has turned "Very Bullish," with growing interest from both retail and institutional investors. This positive sentiment, coupled with strategic upgrades, provides a strong tailwind.

However, traders should remain cautious of broader market volatility (like the ongoing ETH weakness). A healthy correction after such a strong run is possible. Look for ZK to consolidate above key support levels before attempting new highs.

In conclusion, ZKsync is not just riding the Layer-2 wave; it aims to lead it. Its ambitious roadmap, coupled with promising technicals, makes it a coin to watch closely in 2026

#Zksync #ZK #CryptoNew #BinanceSquare #altcoins #blockchain