While much of the blockchain industry has been built around speed, speculation, and open experimentation, Dusk Network has followed a very different philosophy. It is not trying to replace existing financial systems overnight, nor is it chasing short-lived narratives. Instead, Dusk is attempting something far more difficult and far more consequential: designing blockchain infrastructure that regulated financial markets can actually use.

This is a story of patience, precision, and purpose. Since its founding in 2018, Dusk has focused on one question that most projects avoided: how do you put real financial assets on-chain while respecting privacy laws, regulatory oversight, and institutional requirements?

A Blockchain Built for the Real World, Not the Ideal One

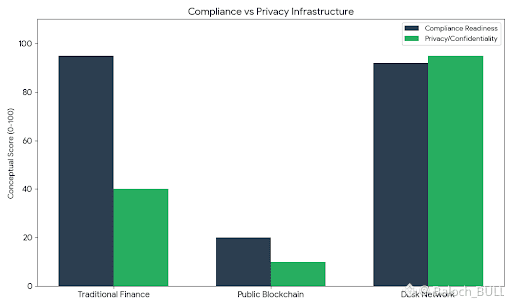

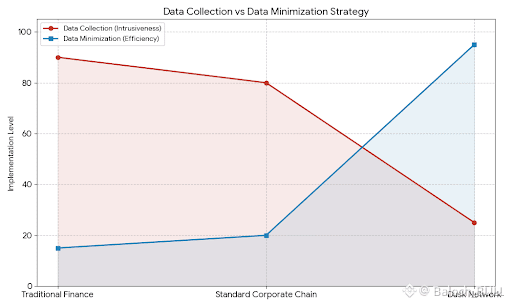

Most public blockchains assume full transparency is a feature. In real financial markets, it is often a liability. Banks, exchanges, asset issuers, and regulators operate in environments where confidentiality is essential, yet accountability is non-negotiable.

Dusk was designed around this reality. Its Layer-1 architecture enables transactions and smart contracts that remain private by default, while still allowing authorized disclosure for compliance, audits, and legal review. This is not privacy as secrecy, but privacy as controlled visibility.

The result is a system that mirrors how financial markets already work, while replacing slow, fragmented back-office processes with programmable, on-chain logic.

Six Years of Development Before a Single Mainnet Block

Dusk’s mainnet launch in January 2025 was not a starting point, but a milestone reached after years of groundwork. During that time, the team focused on cryptography, consensus design, data availability, and regulatory alignment rather than rapid public deployment.

The network upgrades throughout 2025 further reinforced this foundation. Improvements to performance, transaction efficiency, and data handling were not aimed at maximizing raw throughput for retail users, but at ensuring reliability for institutional-scale operations.

This approach explains why Dusk often flies under the radar. It is being built more like financial infrastructure than consumer software.

The Strategic Importance of EVM Compatibility

One of the most critical decisions in Dusk’s roadmap is the development of DuskEVM, an Ethereum-compatible execution environment. Rather than forcing developers and institutions to learn entirely new tooling, Dusk chose to meet them where they already are.

With DuskEVM, Solidity-based applications can operate within a privacy-preserving and regulation-aware environment. This opens the door to compliant DeFi, token issuance platforms, and financial dApps that would not be viable on fully transparent chains.

In practical terms, DuskEVM turns Dusk into a bridge between Ethereum’s innovation ecosystem and the compliance standards required by real financial markets.

Partnerships That Reflect Intent, Not Marketing

Dusk’s partnerships are notable not for their quantity, but for their relevance. Integrations with data and interoperability providers support secure pricing, settlement, and cross-chain activity for tokenized assets.

More importantly, collaborations with regulated exchanges and licensed DLT firms move Dusk from theory to execution. These partnerships are signals that Dusk is being evaluated not just as a blockchain, but as financial market infrastructure.

This distinction matters. Many projects claim institutional interest. Few are designed to survive regulatory scrutiny once institutions actually arrive.

Tokenized Securities and the Future of Capital Markets

One of Dusk’s most ambitious goals is enabling the issuance and trading of regulated securities directly on-chain. This includes equities, bonds, and other financial instruments that traditionally rely on complex intermediaries and slow settlement cycles.

By combining privacy-preserving smart contracts with regulatory auditability, Dusk aims to reduce friction while maintaining legal certainty. If successful, this model could fundamentally change how capital markets operate, shifting processes that currently take days into near-instant settlement without compromising compliance.

Early indications suggest that significant volumes of real-world assets could eventually flow through this infrastructure, marking a shift from experimental tokenization to production-grade markets.

Market Perception Versus Structural Value

From a market perspective, DUSK has displayed volatility typical of infrastructure projects that sit between crypto and traditional finance. Price movements tend to follow technical milestones, regulatory developments, and ecosystem progress rather than meme-driven cycles.

This reflects the underlying reality: Dusk’s value proposition is structural, not speculative. Its long-term relevance depends on adoption by regulated entities, not short-term trading enthusiasm.

Why Dusk Is Difficult to Compare

Dusk does not fit neatly into existing categories. It is not a pure privacy chain, nor a generic smart contract platform. It is not a retail payment network, nor a permissioned enterprise ledger.

Instead, it occupies a narrow but powerful intersection: public blockchain infrastructure designed for regulated financial activity. This makes comparisons with other projects misleading. Dusk is solving a problem most blockchains are not designed to handle.