If you believe “everything is fine,”

you are not watching the charts.

And if you are watching the charts and still ignoring them—

then you haven’t studied history.

I’m not making a prediction today.

I’m issuing a warning.

Because markets always move before the headlines appear.

🧠 When History Repeats — But Investors Refuse to Learn

Let’s look at three key moments side by side:

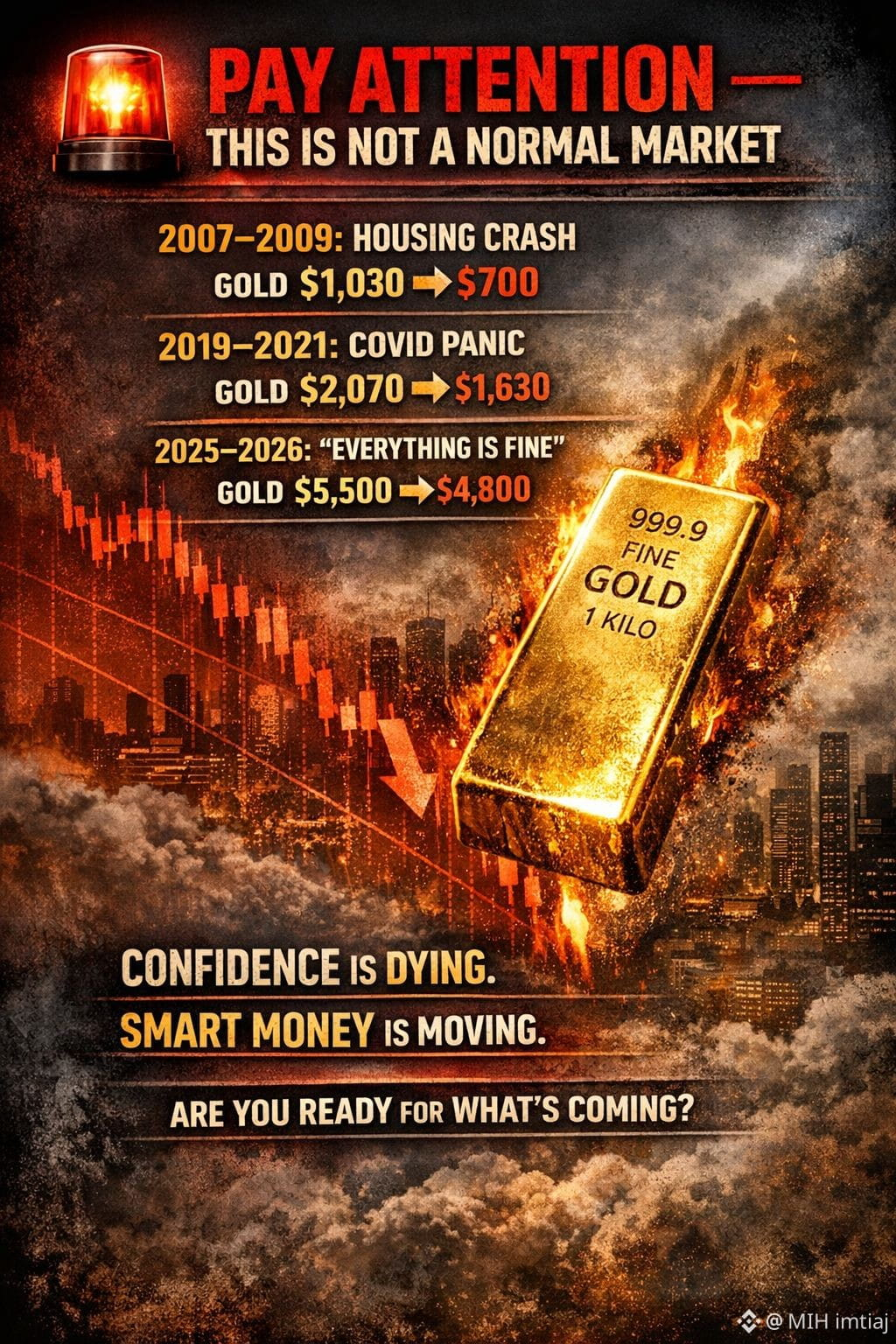

🔻 2007–2009 | The Housing Crash

When the world kept saying “subprime is contained”

👉 Gold collapsed

$1,030 → $700

Almost no one believed something was wrong.

We all know what happened next.

🔻 2019–2021 | The COVID Panic

When the narrative was “just a temporary shock”

👉 Gold dumped again

$2,070 → $1,630

What followed?

Unlimited money printing. Inflation. Systemic stress.

🔻 2025–2026 | The “Everything Is Fine” Era

Today the story sounds familiar:

“The economy is resilient”

“Soft landing”

“Nothing to worry about”

And right on cue—

👉 Gold has dropped

$5,500 → $4,800

Yet people are still saying:

“Nothing is happening.”

That’s not optimism.

That’s delusion.

⚠️ Gold Does NOT Move Like This in a Healthy System

Let’s be very clear:

Gold does not behave like this when markets are stable.

Gold moves like this when:

Confidence starts to die

Trust begins to crack

The system quietly starts leaking

Gold is the ultimate confidence barometer.

And right now, that gauge is flashing danger.

📺 CNN, The Fed, and “Experts” Will Be Late — As Always

Here’s the uncomfortable truth:

By the time CNN admits there’s a problem,

you’re already too late.

The Federal Reserve never warns you in advance.

They step in after the damage is done.

Smart money moves silently, long before the headlines.

💣 “I Didn’t Predict This — I Warned You”

I’ve studied macro markets for over a decade.

Liquidity cycles. Risk behavior. Crowd psychology.

I’ve warned near multiple major market tops—

including the October Bitcoin all-time high.

I don’t sell comfort.

I don’t chase narratives.

Because markets don’t care how confident you feel.

🔑 The Only Question That Matters Now

Which side are you on?

Those saying “ignore it”

Or those quietly positioning early

History is very clear:

Early awareness = survival

Late reactions = becoming liquidity

🪙 Where Smart Capital Is Quietly Looking

When confidence fades, capital rotates into:

🟡 Gold ($XAU )

🟠 Bitcoin ($BTC )

⚙️ Hard assets

🧠 Asymmetric, non-consensus bets

This isn’t hype.

This is capital preservation.

🚨 Final Note — Read This Twice

This is not a crash call.

This is a warning shot.

You’re free to ignore it.

The market won’t care.

But remember one thing:

The biggest moves always begin when most people feel comfortable.

The rest is up to you.

#BTC☀ #XAU #BTC🔥🔥🔥🔥🔥 #cryptouniverseofficial #CryptoMarketMoves