I've watched enough failed blockchain partnerships to recognize the moment of truth. Project announces big institutional deal, price pumps on speculation, then crashes as nothing materializes. The real test comes when price hits levels so low that anyone who believed in the partnership has to make a binary decision—either this was always vaporware and you exit, or the market is catastrophically wrong and you buy aggressively.

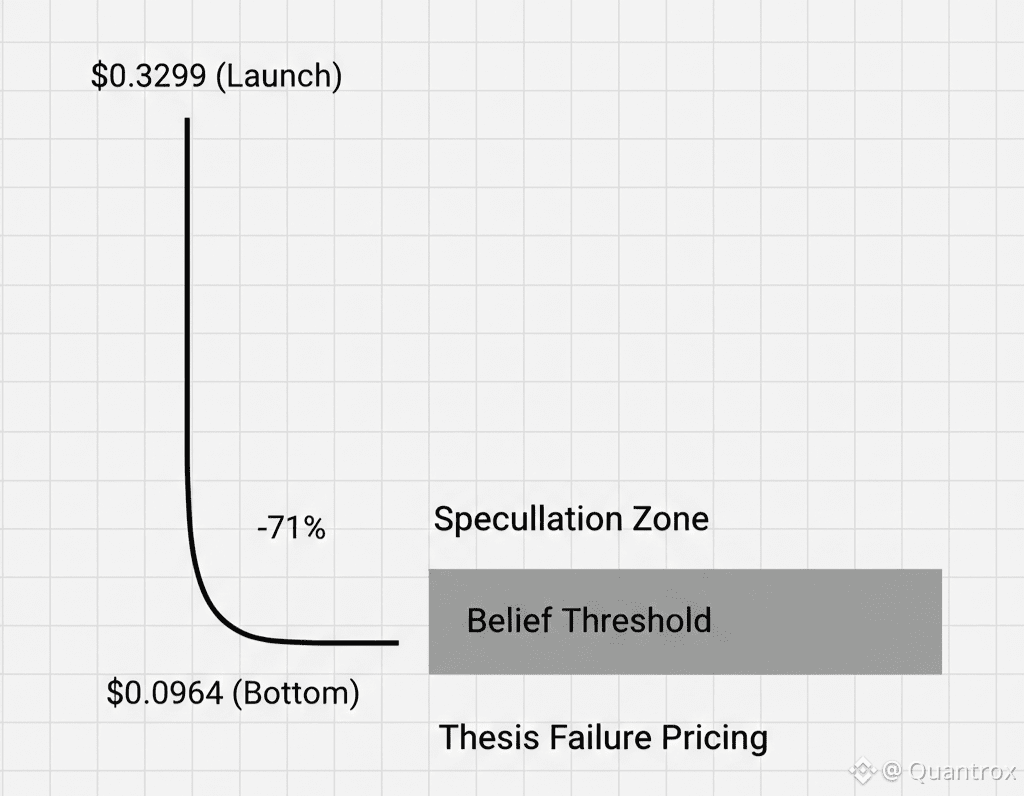

Dusk touched $0.0964 today before bouncing to $0.1060. That $0.0964 low represents a 71% crash from the $0.3299 mainnet launch. RSI recovered to 45.85 from yesterday's oversold readings, suggesting the bounce off $0.0964 brought some buyers back. Volume of 4.21 million USDT remains pathetic but stable. What makes this bottom at $0.0964 significant isn't the technical bounce—it's that Dusk is now testing whether anyone actually believes NPEX will tokenize securities on Dusk infrastructure or if that entire narrative was marketing.

At $0.0964, you're either a buyer because you think €300 million in tokenized securities is coming, or you've concluded DuskTrade was never real and even $0.10 is overvalued.

Dusk sits at $0.1060 after that $0.0964 bottom, with RSI at 45.85 showing momentum recovering from yesterday's 33 reading. The range from $0.1093 to $0.0964 represents 13% intraday volatility on minimal volume, typical of illiquid markets where small flows create exaggerated moves. Volume at 4.21 million USDT is consistent with recent days—barely anyone is participating in Dusk markets regardless of whether price is crashing or bouncing.

What the $0.0964 bottom forces is clarity about what you actually believe regarding Dusk's institutional adoption thesis. At launch prices around $0.30, you could buy Dusk while being uncertain about whether DuskTrade materializes. At $0.0964, down 71% during the year when securities settlement is supposed to launch, there's no room for uncertainty. Either you believe it's real or you don't.

The market at $0.0964 clearly voted that DuskTrade isn't real. If participants believed NPEX was actually preparing to migrate €300 million in assets under management onto Dusk infrastructure this year, there would be accumulation at these levels, not continued selling to new lows. Nobody lets a legitimate institutional adoption story trade at 71% discounts during the launch year.

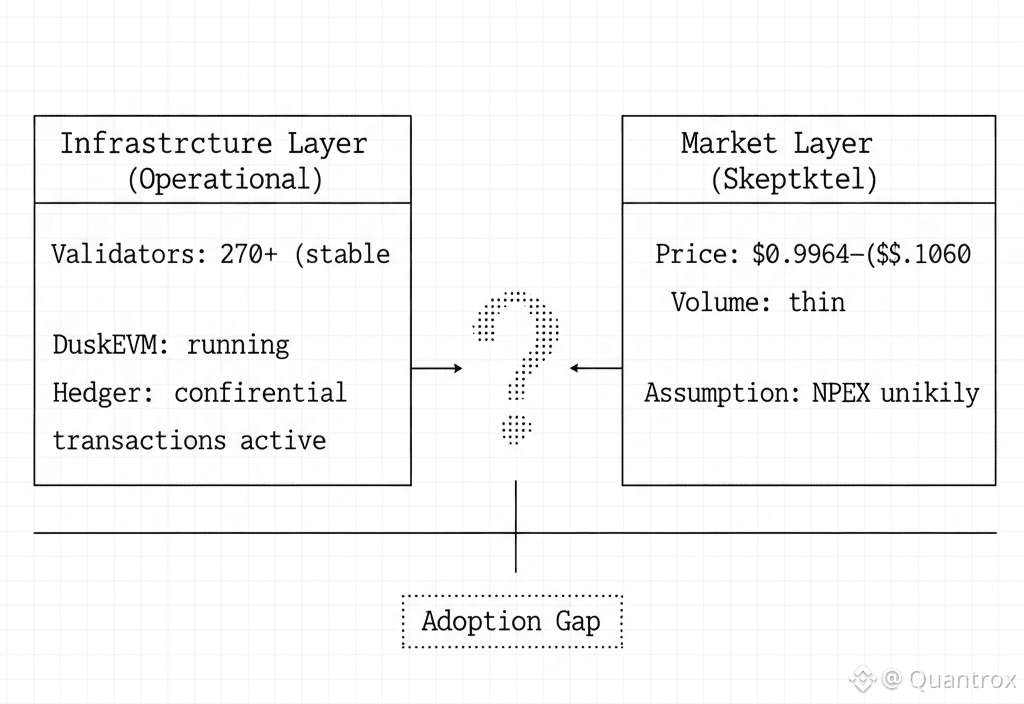

But here's what doesn't fit the complete vaporware narrative. Those 270+ validators are still running Dusk nodes. DuskEVM is still processing contract deployments. Hedger is still handling confidential transactions. All the infrastructure that was operational at $0.3299 is operational at $0.0964. If this was pure marketing with no real technology, why is infrastructure still functioning?

My read is the technology is real but the institutional adoption might not be. Dusk built actual privacy-preserving infrastructure for securities settlement. Whether institutions actually use it for real volume is the completely separate question that price at $0.0964 says "probably not."

What makes Dusk's situation brutal is that the technology working doesn't matter if nobody pays to use it. You can have the best regulatory-compliant privacy features in crypto, but if NPEX doesn't actually tokenize securities on Dusk, all that technology is worthless commercially even if it works perfectly technically.

The RSI recovery to 45.85 from yesterday's 33 reading shows some buying interest appeared at the $0.0964 bottom. Whether those buyers are value investors who think the market is wrong about DuskTrade, or just short-term traders playing an oversold bounce, won't be clear until we see if this bounce sustains or fails.

For Dusk to sustain any recovery from $0.0964, there needs to be concrete updates from NPEX about DuskTrade launch timeline. Not vague "we're making progress" statements—actual operational details like regulatory approvals completed, specific securities lined up for tokenization, launch dates confirmed. Without those updates, any bounce from $0.0964 is just dead cat that fails when reality sets in.

What I keep coming back to is the timing. We're in 2026, the year DuskTrade was announced to launch. We're already into late January with no concrete updates about imminent securities trading on Dusk infrastructure. Every day that passes without announcements makes the $0.0964 bottom look less like capitulation opportunity and more like correct pricing of failed thesis.

The 270+ Dusk validators staying committed through the crash to $0.0964 provides the only tangible evidence that maybe the institutional story is real. If operators with actual skin in the game believe enough to keep running nodes at these prices, maybe they know something about DuskTrade timeline that market doesn't believe.

Or maybe they're just trapped. Once you've operated at losses for months waiting for DuskTrade, shutting down at $0.0964 means admitting you were wrong the entire time. Psychologically easier to keep running and hope the thesis eventually proves out, even if economics say you should quit.

The volume of 4.21 million USDT shows minimal market participation regardless of whether Dusk is at $0.30 or $0.10. The same thin liquidity that created the crash to $0.0964 would create explosive rallies if any real buying demand appeared. If NPEX announced concrete DuskTrade details tomorrow, Dusk would probably gap up 50%+ immediately because there's no seller supply to absorb sudden demand.

But without that catalyst, Dusk sitting at $0.1060 after touching $0.0964 is just another oversold bounce in a downtrend that continues until the fundamental thesis either proves true or dies completely.

For anyone deciding whether to buy Dusk at these levels, the question is simple: do you believe NPEX tokenizes real securities on Dusk infrastructure in 2026, or was that always marketing? At $0.1060, down 68% from launch during the supposed adoption year, you're making a binary bet on that question.

The technology exists—DuskEVM works, Hedger provides privacy, validators maintain consensus. Whether institutions actually use that technology for real securities settlement worth €300 million is what determines if Dusk at $0.0964 was generational buying opportunity or value trap.

Time will tell, but the longer 2026 progresses without concrete DuskTrade announcements, the more the $0.0964 bottom looks like correct market pricing rather than capitulation. The validators staying committed are betting their operational costs that the market is wrong. Price bouncing to $0.1060 with RSI at 45.85 shows some participants agree with that bet, but volume at 4.21 million USDT shows most participants don't care either way.

Either NPEX proves the market wrong soon with actual securities settlement on Dusk, or the market proves validators wrong and Dusk continues grinding toward zero as the institutional adoption thesis dies. The $0.0964 bottom was the moment where anyone still holding had to decide which outcome they believe is coming.