I've been trying to understand how Walrus operators keep running infrastructure at $0.0944 when the economics look impossible and the answer keeps coming back to one technical decision made years ago. WAL sits just below $0.10 today with RSI at 29.19—still oversold after weeks of decline. Volume hit $1.11M as price tested $0.0867 overnight. Every operator should be bleeding money at these token prices. But they're not all quitting. The reason is Red Stuff encoding efficiency creating margin where traditional replication would mean total collapse.

That technical choice made before mainnet launched is literally what's keeping infrastructure alive today.

Most people think about erasure coding as abstract technical detail. Something engineers worry about while token holders focus on price. But at $0.09, the difference between 4.5x overhead and 25x overhead is the difference between survival and shutdown. That's not hyperbole. That's basic math on operator economics.

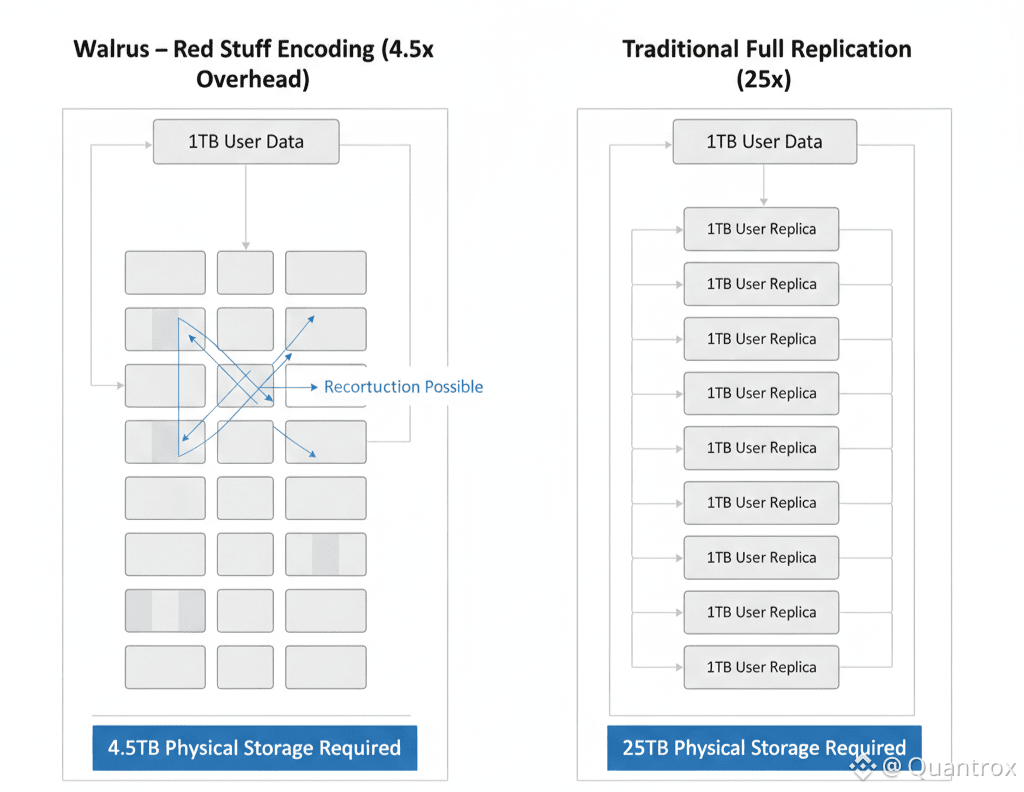

Here's what caught my attention when talking to an operator. They walked me through actual infrastructure costs. To store one terabyte of actual user data on Walrus requires 4.5 terabytes of physical storage capacity across nodes due to Red Stuff encoding. That encoding provides redundancy—you can lose multiple nodes and still reconstruct data. It's two-dimensional erasure coding that splits data both horizontally and vertically.

Traditional full replication to achieve similar durability requires 25 terabytes of physical storage for that same one terabyte of user data. You're literally copying the full file to 25 different locations. Simple. Reliable. Catastrophically expensive.

The operator told me their hardware costs scale directly with physical storage required. Enterprise SSDs for fast availability challenge responses. The difference between deploying 4.5TB and 25TB of SSD capacity for serving 1TB of user data is massive. Power consumption scales with drive count. Cooling requirements scale with heat generation. Rack space scales with physical volume. Everything costs 5.5x more with traditional replication versus Red Stuff encoding.

At $0.16, that efficiency was nice to have. At $0.09, it's the only reason operators haven't all quit.

The circulating supply of 1.58 billion WAL out of 5 billion max doesn't change this cost structure. But it does mean operators earning fees at $0.0944 are getting paid 41% less in fiat terms than they were at $0.16. Their costs didn't drop 41%. Hardware costs the same. Power bills are constant. Bandwidth pricing doesn't fluctuate with WAL.

Walrus processed over 12 terabytes during testnet when developers were validating that Red Stuff actually worked at scale. The encoding mathematics were sound. The question was whether implementation could handle real workloads efficiently. Five months of testing proved it could. Now mainnet serves 333TB+ of actual user data with about 1,500TB of physical storage deployed across operators.

If Walrus used traditional 25x replication instead, that same 333TB of user data would require 8,325TB of physical storage across the network. The hardware investment alone would be 5.5x higher. Most current operators couldn't afford to participate. The ones who could would need dramatically higher storage fees to justify costs. Applications would pay more. Adoption would suffer. The entire economic model breaks at that overhead level.

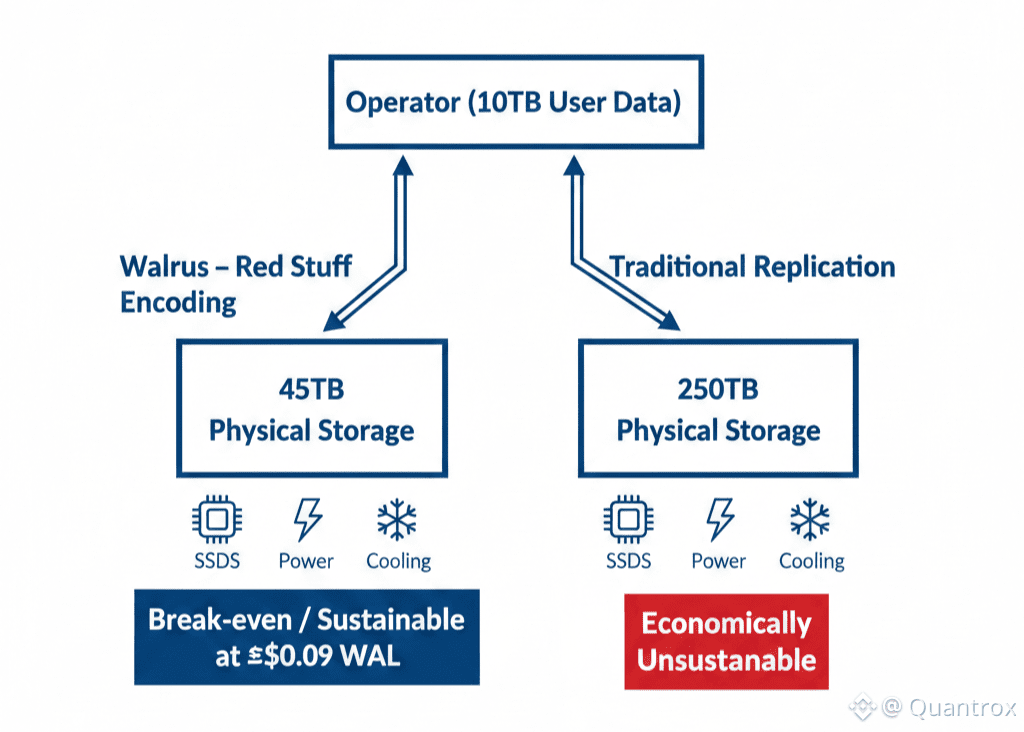

Here's a concrete example of what this means for operator margins. An operator serving 10TB of actual user data deploys 45TB of physical capacity with Red Stuff encoding. At current WAL prices around $0.09, they're earning storage fees that roughly cover their infrastructure costs—break-even or small margin. Not great, but sustainable.

If they were using 25x replication, that same 10TB of user data would require 250TB of physical capacity. Five and a half times more hardware cost, power consumption, cooling, maintenance. Their storage fee revenue didn't increase 5.5x—it stayed the same because users are paying for 10TB regardless of backend overhead. The operator would be massively underwater financially. They'd have quit months ago.

That's why Red Stuff efficiency matters more at $0.09 than it did at $0.16. Higher token prices create margin buffer that hides inefficiency. Lower token prices expose every cost. The protocols with wasteful overhead can't survive compression. Walrus can because the overhead is fundamentally more efficient.

My gut says most Walrus users don't know Red Stuff exists or understand what it does. They just want storage that works. But that invisible technical decision—choosing two-dimensional erasure coding over simple replication—is what enables the storage to keep working when token economics get brutal. Infrastructure quality shows up in survival, not marketing.

The RSI at 29.19 indicates continued oversold conditions. Markets are still pessimistic. But operators making decisions about whether to continue running nodes aren't checking RSI. They're calculating monthly costs versus monthly revenue. And Red Stuff efficiency is giving them just enough margin to stay operational where competitors using traditional replication would already be gone.

Volume of $1.11M during the past 24 hours shows sustained trading activity at these depressed prices. Real capital moving, not just thin market noise. But storage activity on Walrus doesn't correlate with trading volume. Applications keep uploading data. Operators keep serving requests. The infrastructure operates independent of speculation because the technical foundation is solid enough to survive token crashes that would kill less efficient protocols.

Walrus: 5.5x efficiency advantage isn't marketing—it's the mathematical difference between infrastructure surviving or collapsing at $0.09.

This is where technical decisions made early matter more than anyone expected. Mysten Labs chose Red Stuff encoding during Walrus design phase. Could have gone with simpler replication. Easier to implement, easier to explain, easier to reason about. But fundamentally wasteful in ways that would make current economics impossible.

The bet they made was that efficiency would matter more than simplicity for long-term sustainability. Today at $0.0944, that bet is proving correct. Operators stay because margins work. Margins work because overhead is 4.5x instead of 25x. That efficiency came from technical choices made before token price existed.

Time will tell whether Red Stuff efficiency is enough to build sustainable infrastructure long-term or just delays inevitable collapse if token price falls further. But the difference between protocols that survive compression and protocols that don't often comes down to technical efficiency choices made years before crisis hits. Walrus made the efficient choice. That's why infrastructure is still running when economics say it shouldn't be.