I've been around long enough to know how projects die in crypto. They don't usually blow up spectacularly with exit scams or hacks that make headlines. Most just slowly fade away, trading sideways on volume that keeps shrinking while the team posts updates nobody bothers reading anymore and validators keep running infrastructure that processes basically nothing. What kills me is how long the process takes. Months, sometimes years of this slow bleed before everyone finally admits what they already knew deep down.

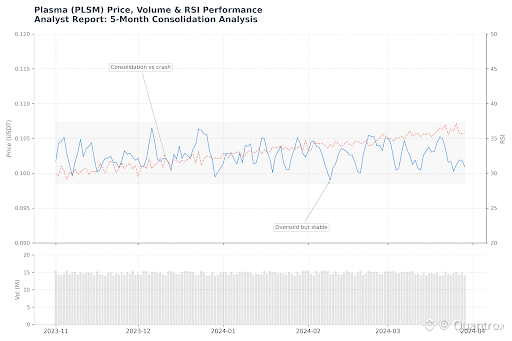

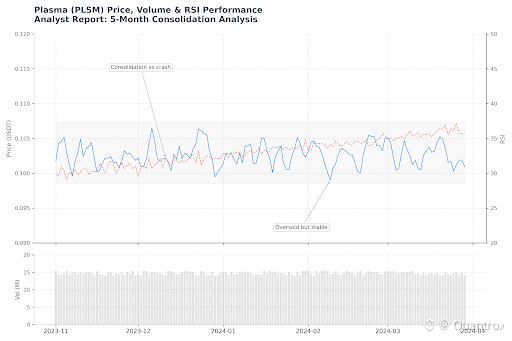

Plasma is sitting at $0.1049 today, barely moved from yesterday's $0.1040. RSI crawled up to 36.16 from 29.89, still oversold but grinding higher slowly. Volume bumped slightly to 15.50M USDT from 14.78M yesterday. The range today from $0.0985 to $0.1073 is tighter than we've seen recently, which tells you Plasma is consolidating instead of violently swinging around.

That consolidation is honestly worse than just crashing hard. At least violent crashes give you resolution. People capitulate, weak hands bail out, and whatever survives either recovers properly or dies fast. This slow sideways drift means nobody's convinced enough to buy Plasma hard but nobody's panicking to exit either. Just complete apathy, which kills momentum for any project faster than anything else.

XPL sitting at $0.1049 puts it still down about 86% from that September launch around $0.73. Five solid months of bleeding with absolutely nothing changing fundamentally about why markets stopped believing in Plasma. The infrastructure still functions fine. Technology does exactly what they said it would. But none of that matters even slightly if the core assumption about demand turns out to be completely wrong.

The assumption was simple. Zero-fee USDT transfers would drive massive adoption of Plasma because cost is what stops people from using crypto for payments. Cut fees to literally zero, make transactions instant, remove every friction point, and users would pour onto Plasma from expensive traditional rails and even from cheaper alternatives like Tron.

Five months later, that assumption is looking pretty shaky. Cost isn't the main problem for most people thinking about Plasma. Complexity is the problem. Regulatory uncertainty is the problem. Merchants not accepting it is the problem. Worrying about volatility is the problem. All stuff that has zero connection to whether moving stablecoins on Plasma costs 2 cents or nothing.

For international remittances specifically, cost matters a ton actually. Saving $30-40 every time you send money home is genuinely life-changing for workers doing monthly transfers. But grabbing that market needs way more than Plasma just offering cheap infrastructure. You need deals with local exchanges in recipient countries so people can actually turn USDT into local currency without hassle. You need brand trust in communities that got burned by scams constantly. You need customer support in like ten different languages. You need regulatory approvals everywhere Plasma wants to operate.

That's the brutal part everyone avoids discussing. Building Plasma the blockchain was honestly the easy part. Building actual go-to-market strategy and distribution to capture remittance flows or get merchants accepting Plasma payments or any real use case is infinitely harder. Crypto teams are usually amazing at technology and absolutely terrible at distribution, which explains why payment projects keep failing no matter how good the tech is.

Has Plasma cracked distribution? Can't tell from outside because they're not publishing anything that answers that. No daily transaction counts for Plasma payments. No numbers on merchant adoption. No data on remittance corridor volume. Just silence, which in my experience means the numbers are embarrassing.

Volume at 15.50M USDT is basically unchanged from recent days. Not growing, not collapsing, just this steady low-conviction trading of XPL. RSI at 36.16 shows we're climbing out of extreme oversold but we're nowhere near neutral. Chart looks like consolidation before either dropping to new lows or actually recovering, and nothing about Plasma fundamentals gives you any clue which way it breaks.

What tips the scales toward recovery for Plasma? Obviously showing real payment adoption that justifies all this infrastructure spending. But "real payment adoption" is too vague. What actual metrics would make skeptics believe Plasma works?

Tens of thousands of daily transactions on Plasma for actual payments would help. Not DeFi stuff, real payments for goods and services. Merchants accepting Plasma growing every month with some recognizable brands. Remittance data showing real volume through Plasma corridors with growth suggesting network effects starting. Plasma Card going public with user numbers proving product-market fit exists.

Those are specific milestones that would shift how people talk about Plasma. Without them, you're asking everyone to believe in Plasma based on maybe instead of actual results. That worked the first couple months after launch when everyone was optimistic and willing to wait. We're way past that now. This is show-me-results time.

The Plasma zero-fee model has this tokenomics problem that keeps getting more obvious. By killing the requirement to hold XPL for using the network, Plasma removed the natural demand that creates price floors. When utility tokens crash, buyers usually show up eventually because people actually need the token to use stuff. That buying exists regardless of speculation.

Plasma doesn't get that because you can use everything Plasma offers without ever touching XPL. Amazing for users, terrible for building sustainable demand for the token. Only people buying XPL are speculators hoping price goes up later or validators staking for yield. Neither creates the steady organic demand that would stabilize XPL when things get rough.

Maybe staking changes things when it finally launches on Plasma. If enough XPL locks up in staking contracts, circulating supply drops and maybe price stabilizes just from less float. But staking only works if people think Plasma validator yields beat the opportunity cost. At current XPL prices with growth looking questionable, why lock capital in Plasma staking when you could just hold stablecoins earning safe yield?

Competition hasn't eased up for Plasma at all. Tron keeps crushing USDT volume with infrastructure that works and costs basically nothing. Ethereum has the deepest liquidity even with expensive gas. Solana keeps pulling developers with speed and actual ecosystem activity. New chains like Sui launch with fresh narratives and capital backing them.

Plasma is wedged in this weird middle space. Not dead, but definitely not thriving either. Infrastructure runs smoothly but processes hardly any real payment volume. Team still working on Plasma but not dropping announcements that move sentiment. XPL consolidating at awful price levels without capitulating to zero or recovering meaningfully.

That middle space is exactly where failed projects spend their last year or two. Just existing with no real purpose, burning remaining capital, keeping infrastructure running that nobody uses while everyone slowly accepts product-market fit never happened. Not dramatic at all. Just depressing and wasteful.

I honestly don't know if that's where Plasma ends up or if they're building something that just takes way longer than markets want to wait for. Next three to six months probably decide Plasma's fate. If actual payment adoption shows up with real metrics, that crash to $0.0985 becomes the bottom everyone wishes they bought. If it's just more silence and sideways action, this consolidation at $0.1049 is just a pause before Plasma drops again.

Right now RSI at 36.16 says oversold but recovering, XPL at $0.1049 says nobody knows which direction next, volume at 15.50M says markets aren't convinced either way about Plasma. That uncertainty defines everything. Markets gave up on Plasma as a growth play but haven't totally written it off as dead yet. Everyone's just waiting and watching, hoping someone gives them an actual reason to care about Plasma again.