When I started seriously looking at blockchain and finance, I kept wondering: Why are real-world assets kept off-chain? Stocks, bonds, and other regulated securities represent markets worth trillions, but most blockchains seemed more focused on speculation than on real value. This question led me to DuskTrade.

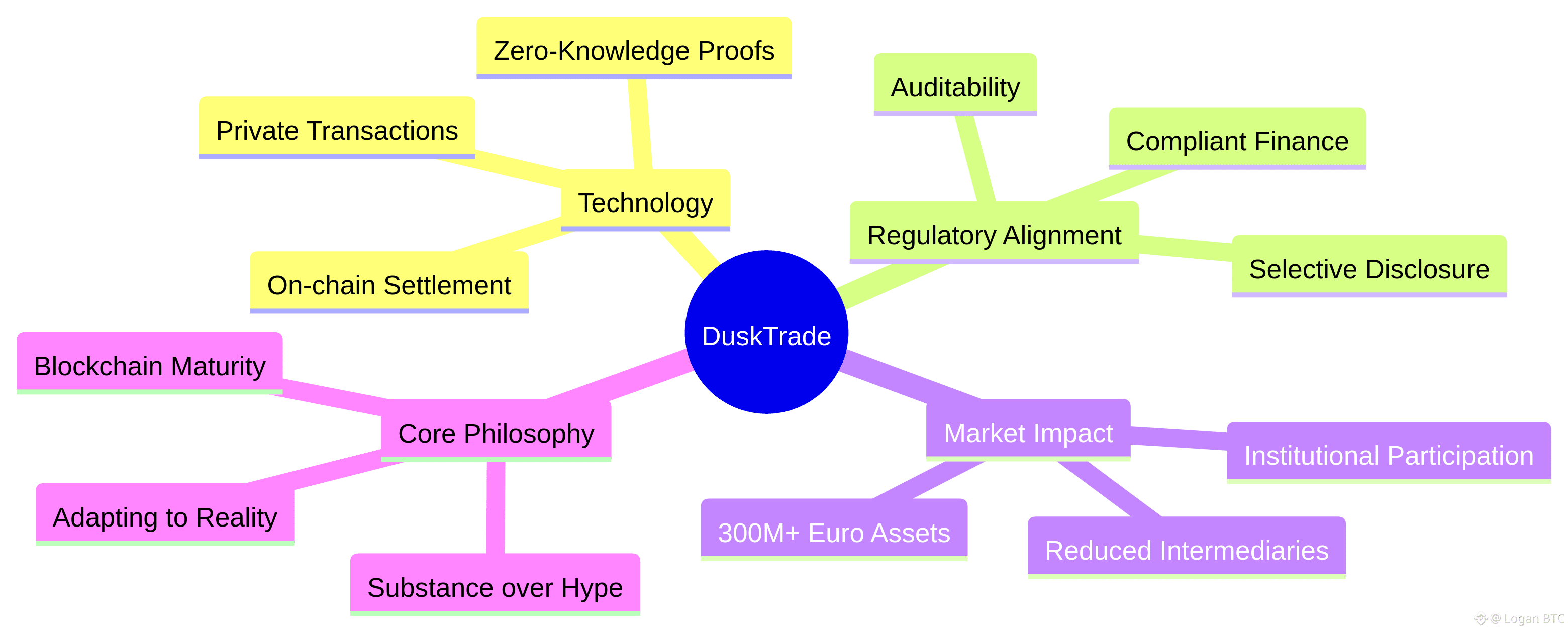

DuskTrade isn't trying to change finance. It's doing something harder and more important: bringing actual, regulated assets onto the blockchain while following all the rules. Currently, this system represents over €300 million in regulated securities. This number is important as it shows trust, not just excitement.

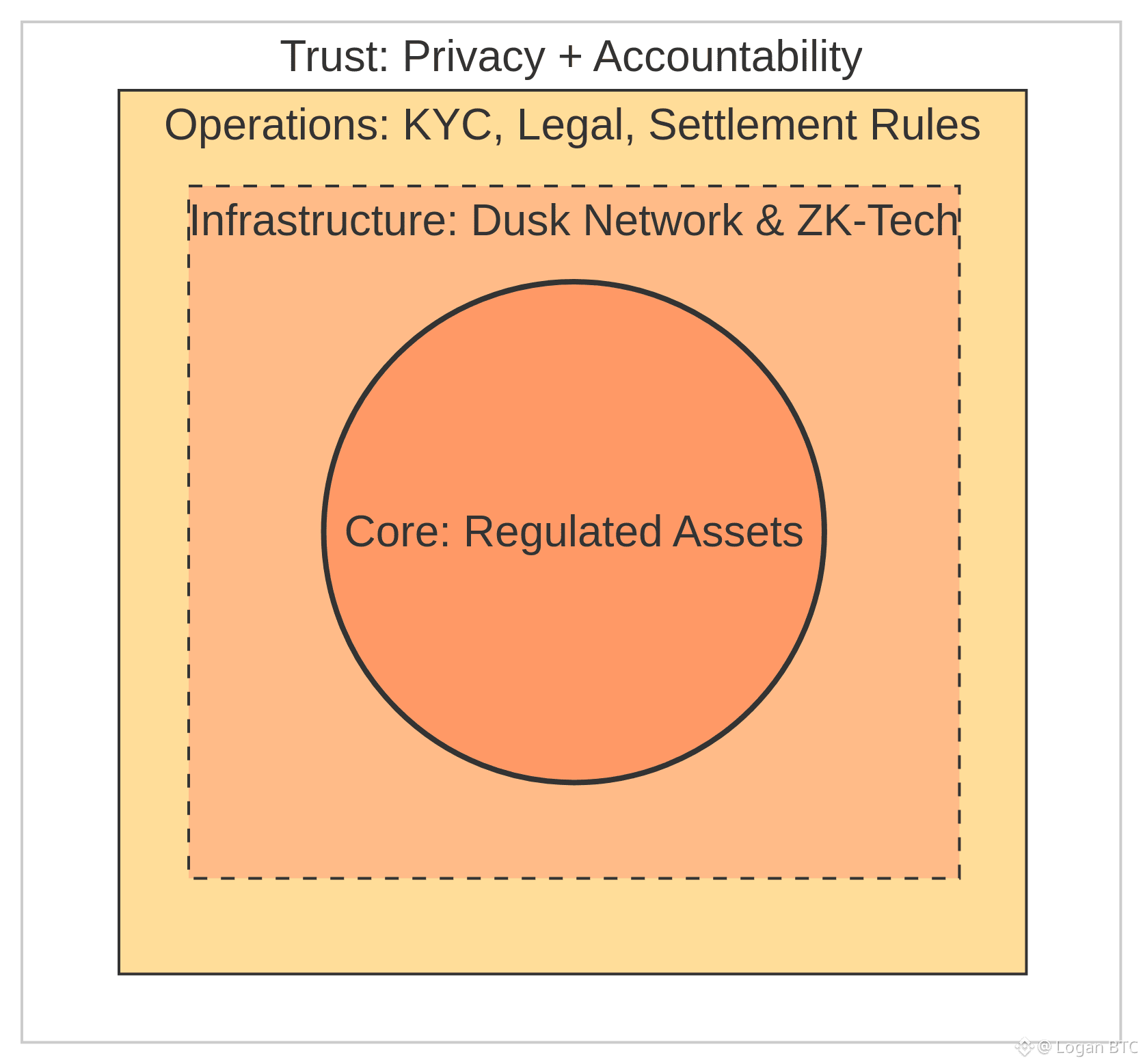

I was impressed by the design. DuskTrade uses Dusk Network, built for compliant finance. It's not DeFi ignoring regulation; it's infrastructure designed for markets already governed by laws, audits, and accountability.

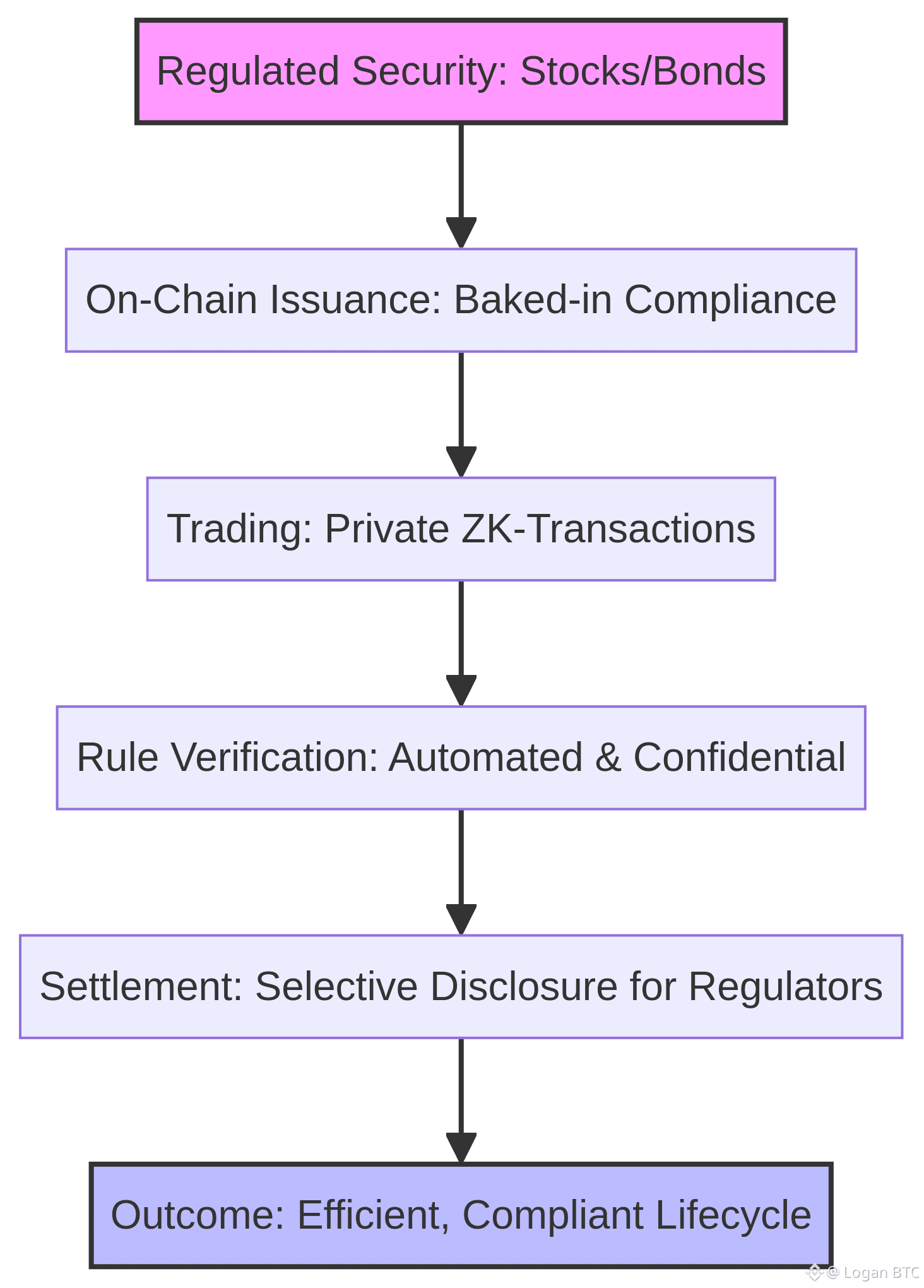

The cool part is how privacy and compliance work together. Traditional blockchains show everything: wallets, transactions, and parties involved. That might be okay for open testing, but it doesn't work for securities. DuskTrade uses zero-knowledge tech to keep transactions private but verifiable. The system can prove rules were followed without showing sensitive data publicly.

This is why €300M+ in regulated assets is possible. Issuers can tokenize real securities knowing their strategies, investor data, and transactions won't be exposed. At the same time, regulators can still access information. When needed, selective disclosure lets them see only what they need to nothing more.

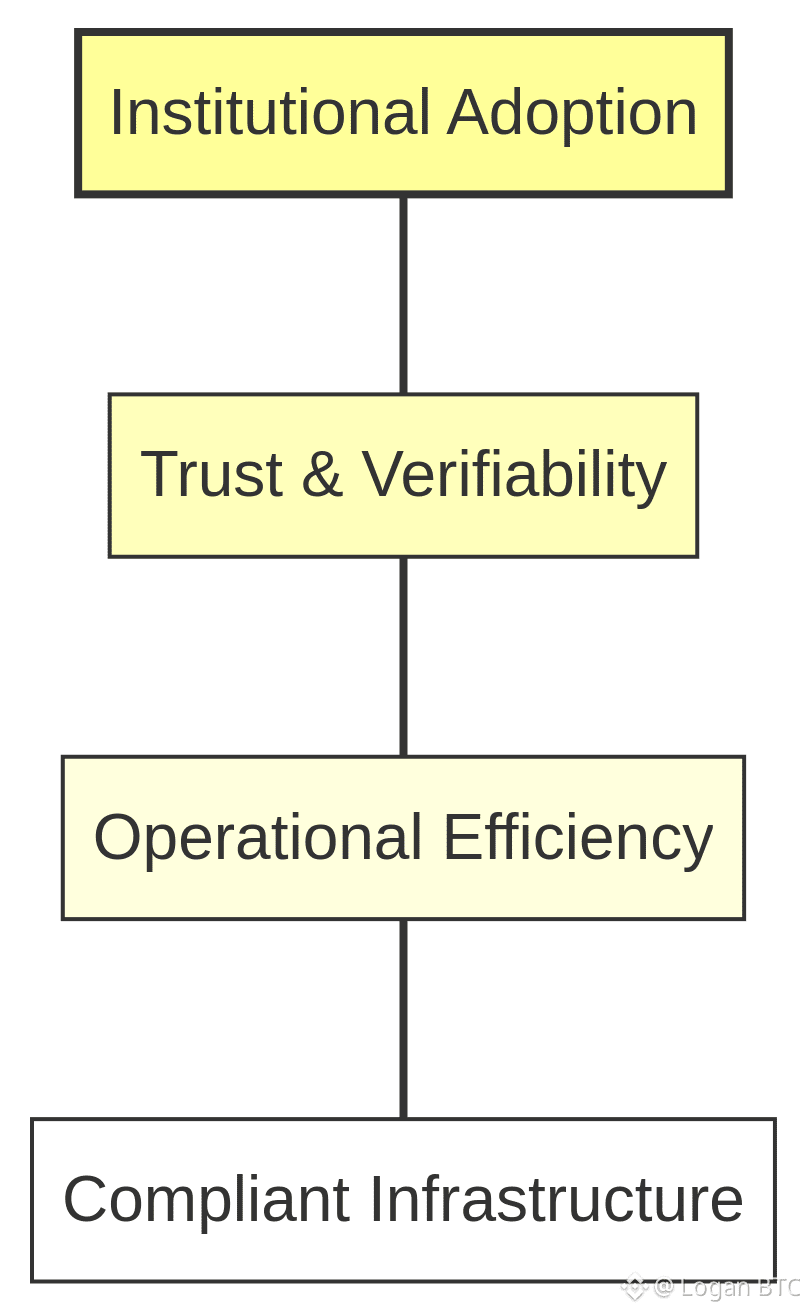

My thinking changed when I realized how different this approach is from typical on-chain finance. With DuskTrade, compliance is built-in. KYC, legal frameworks, and settlement rules are part of the system from the start. That's why institutions can participate without worrying about breaking the law just by using the blockchain.

Another reason this works is settlement efficiency. Traditional securities trading involves many intermediaries, slow settlement, and high costs. DuskTrade makes it simpler by handling issuance, trading, and settlement on-chain, securely and privately. You get faster results without compromising regulatory integrity.

Personally, this feels like blockchain maturing. Instead of asking finance to adapt to crypto, DuskTrade adapts crypto to financial reality. It respects market functions while quietly making things better.

The €300M+ figure isn't just a milestone—it's proof that institutions will move on-chain when the infrastructure makes sense, that privacy doesn't equal secrecy, and that blockchain doesn't have to choose between innovation and regulation.

To me, DuskTrade is what the industry has talked about for years but rarely achieves. It's not showy, and it doesn't depend on hype. It just works, and that's why it's important.

As more real-world assets move on-chain, systems like DuskTrade will become the norm.