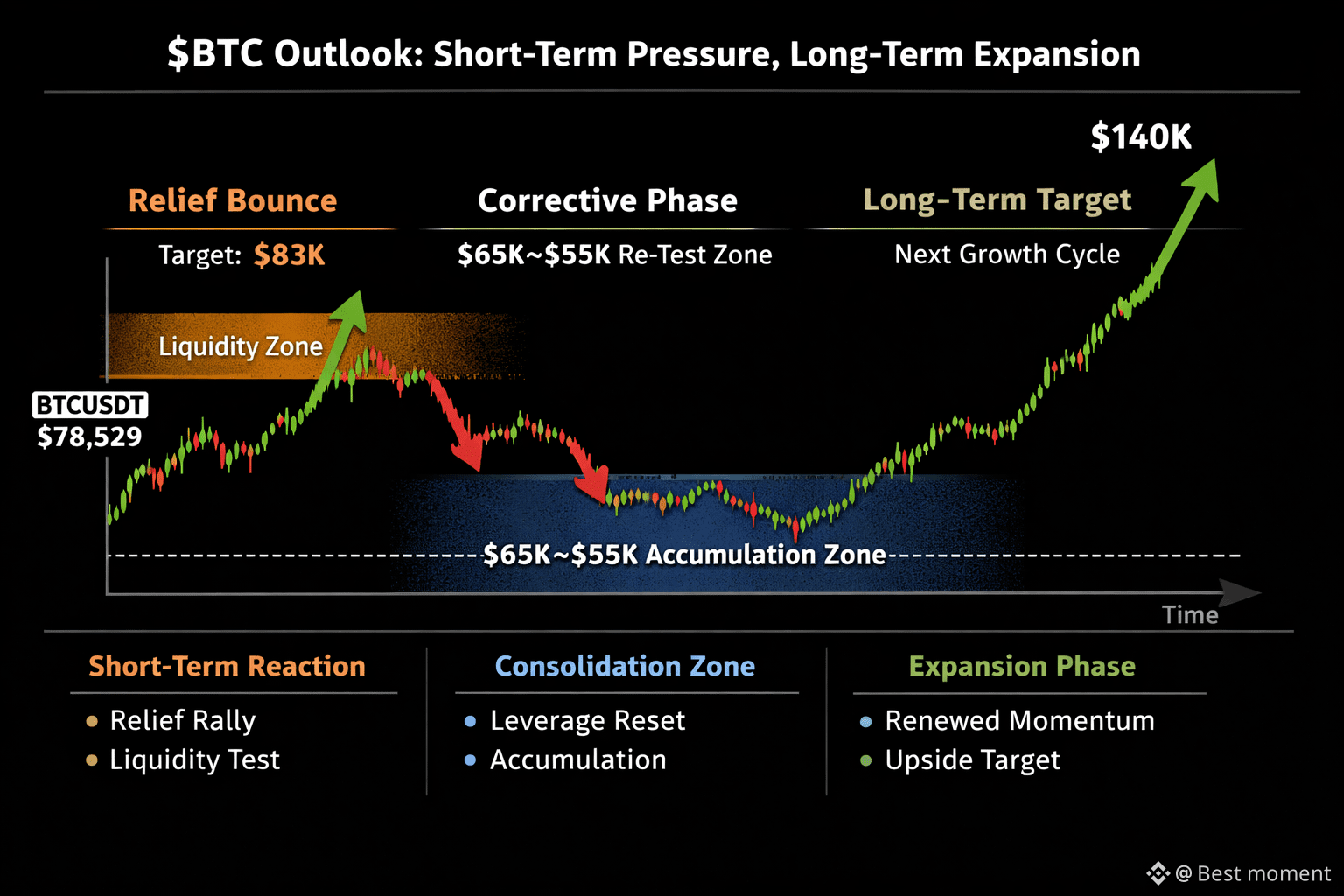

$BTC Outlook: Short-Term Pressure, Long-Term Expansion

Bitcoin is approaching a decisive inflection point.

Volatility here is not danger — it’s information.

Near-term:

Price action suggests a technical relief bounce toward $83K, driven by liquidity resting above current levels.

This should be viewed as a reactionary move, not confirmation of a new uptrend.

Next phase (key):

After the bounce, BTC is likely to enter a controlled corrective rotation into the $65K–$55K zone.

This area historically acts as: • Leverage reset

• Emotional capitulation

• Strategic accumulation by stronger hands

These conditions are necessary before any sustainable expansion.

What really matters:

Watch the post-correction consolidation — likely ~2 weeks.

This is where volatility compresses, narratives go quiet, and market control shifts back to patient capital.

Expansion thesis:

Once accumulation completes, Bitcoin can transition into its next growth leg with healthier structure and renewed momentum.

If this cycle continues to rhyme with prior market behavior, $140K BTC becomes a realistic upside objective — not speculation.

Short-term drawdowns test patience, not conviction.

Stay disciplined. Manage risk. Let structure — not emotion — lead.

📌 Bookmark this. Revisit it in August.

Clarity always comes after volatility.

#BTC #BitcoinOutlook #MarketStructure #CryptoStrategy