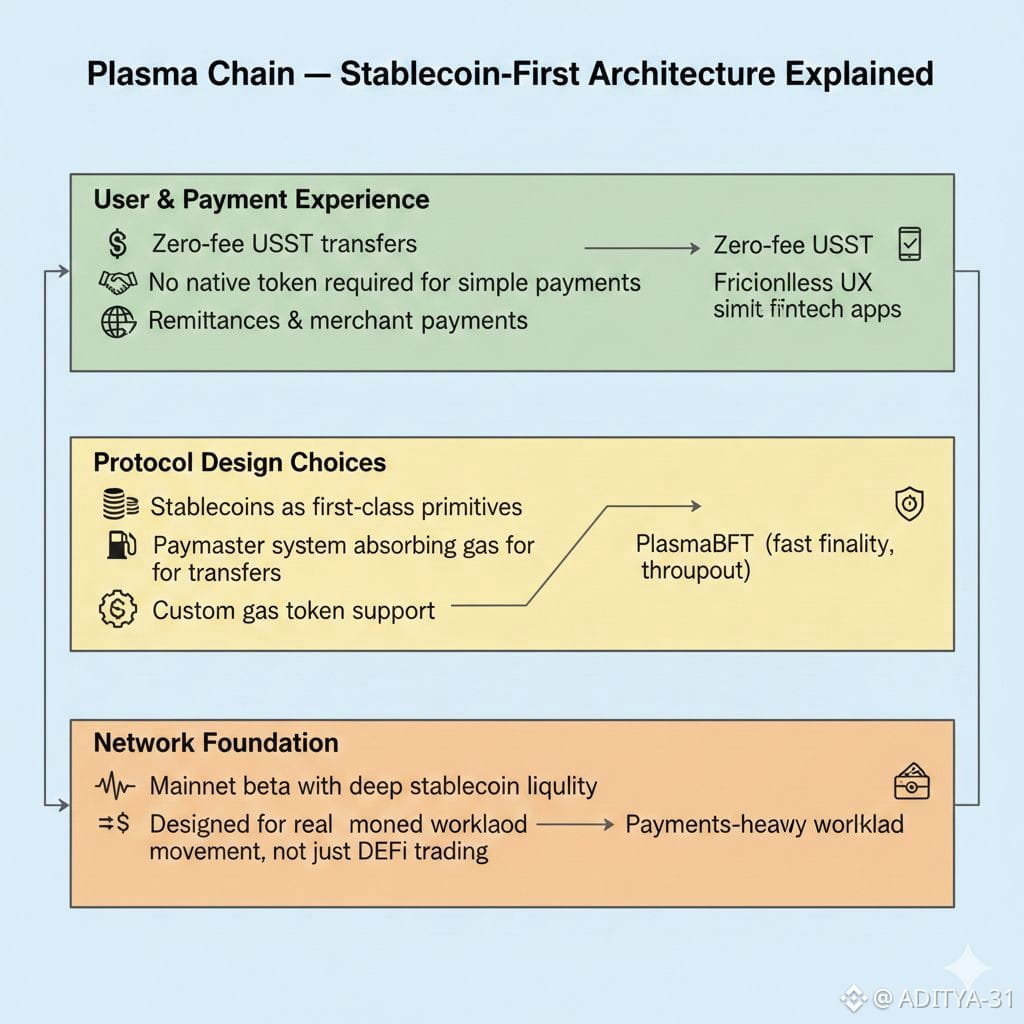

Plasma ko samajhne ka sabse simple tareeqa ye hai: ye ek aisa Layer-1 blockchain hai jo stablecoins ko speculation ke tool ke bajaye actual money rails ki tarah treat karta hai. Zyada chains pe stablecoins sirf ek token hote hain jo smart contracts ke upar run karte hain. Plasma me logic ulta hai — yahan stablecoins core design ka hissa hain, side feature nahi.

Is approach ka matlab ye hai ki network ka focus pehle din se ye raha hai ki digital dollars ko fast, cheap aur friction-free kaise move kiya jaaye — bina user ko unnecessary crypto mechanics me phasaaye.

Stablecoin-First Design Ka Practical Impact

Plasma ka ek sabse noticeable design choice zero-fee USDT transfers hai. Network paymaster system use karta hai jahan simple stablecoin transfers ke liye gas fee absorb ho jaati hai. Iska real-world impact kaafi seedha hai: user ko sirf stablecoin rakhni hoti hai, alag se native token lene ki majboori nahi.

Ye chhoti si cheez lag sakti hai, lekin mainstream adoption ke liye ye ek bada barrier hata deti hai. Remittances, merchant payments, ya simple value transfer jaise use cases me user experience suddenly traditional fintech ke kaafi close aa jata hai.

Mainnet Launch Aur Liquidity Signals

Plasma ka mainnet beta September 25, 2025 ko live hua, aur launch ke saath hi network par $2 billion se zyada stablecoin liquidity deploy hui. Ye number sirf marketing ke liye impressive nahi tha — isne ye bhi dikhaya ki ecosystem pehle din se hi real capital ke saath bootstrapped hua.

Itna liquidity ek vacuum me nahi aata. Iske peeche early community participation, structured deposit programs aur DeFi ecosystem ke saath coordination ka role raha. Is wajah se Plasma launch ke baad “empty chain” jaisa feel nahi deta, balki ek functioning financial layer jaisa lagta hai.

Architecture Jo Payments Ko Priority Deti Hai

Plasma ka tech stack deliberately payments-heavy workloads ke liye optimize kiya gaya hai. PlasmaBFT consensus fast finality aur high throughput ke liye design kiya gaya, jisse stablecoin transfers smooth rehte hain even under load.

Saath hi chain EVM-compatible hai, isliye developers ko naya stack seekhne ki zarurat nahi padti. Solidity contracts, familiar wallets aur existing tooling easily Plasma par kaam kar sakti hai. Ye combination — payments focus + dev familiarity — ecosystem growth ke liye important hai.

Ek aur interesting element custom gas token support hai. Matlab fees sirf native token me hi dene ki compulsion nahi hoti. Ye flexibility stablecoin-based applications ke liye kaafi relevant hai.

$XPL Ka Actual Role Kya Hai

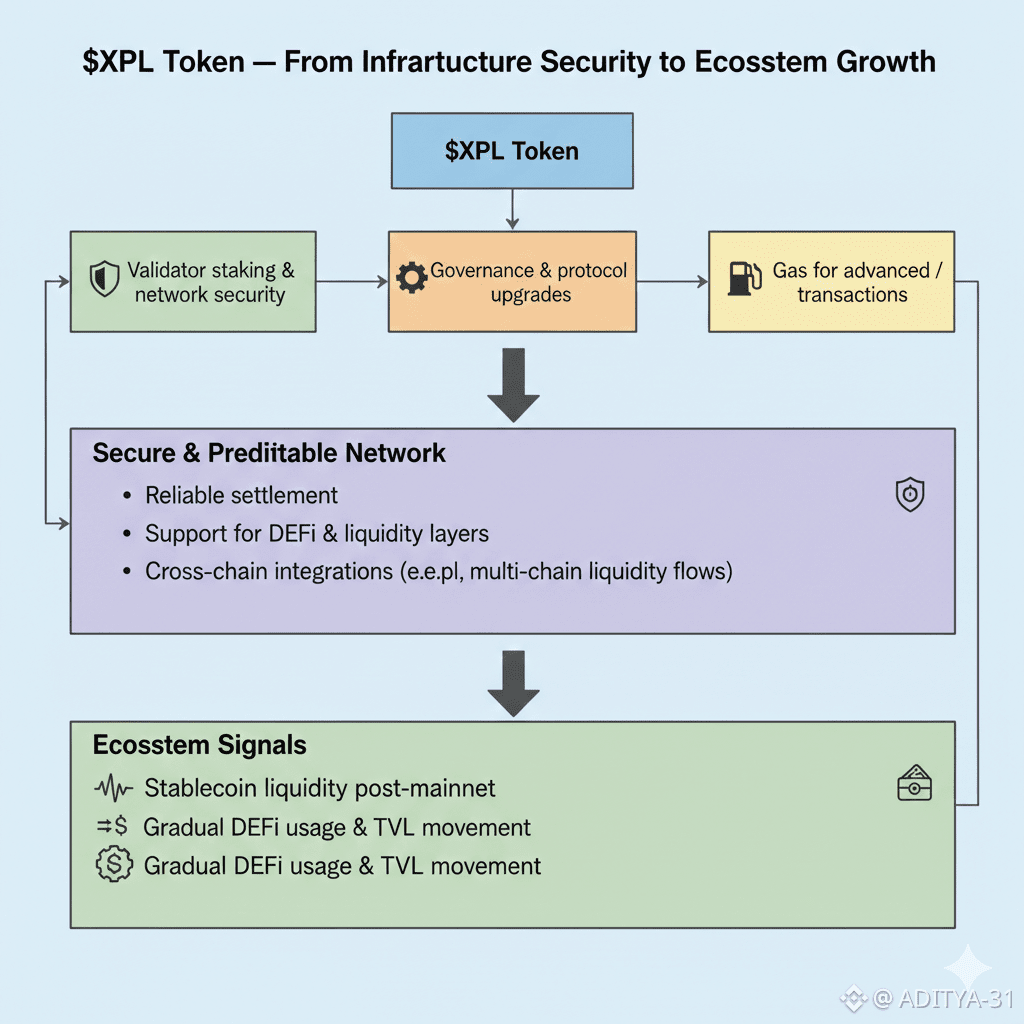

$XPL ko sirf ek tradeable token ke roop me dekhna thoda incomplete picture deta hai. Ye token network ke core mechanics me deeply integrated hai.

Validators $XPL stake karke network secure karte hain. Complex contract interactions aur advanced transactions me gas ke liye bhi $XPL ka use hota hai. Governance ke through protocol upgrades aur parameters par bhi token holders ka influence rehta hai.

Is model ka fayda ye hai ki network activity aur token utility naturally linked rehte hain. Agar ecosystem grow karta hai, to token ka role sirf price chart tak limited nahi rehta.

Cross-Chain Direction Aur Ecosystem Signals

Plasma sirf apne chain tak confined rehna nahi chahta. Recent integrations — jaise NEAR Intents ke saath — Plasma ko multi-chain liquidity environment me connect karti hain. Isse stablecoins aur assets ka movement zyada seamless ho jata hai, bina user ko har chain ke technical differences samajhne ki zarurat pade.

Ye type ke integrations usually short-term hype ke liye nahi hote. Ye long-term settlement aur liquidity efficiency ke liye kiye jaate hain, jo Plasma ke overall narrative ke saath align karta hai.

Market Noise Se Aage Ka Perspective

Jaise har naya Layer-1, Plasma aur Xpl bhi volatility se guzarte hain. Ye crypto ka normal cycle hai. Lekin Plasma ke case me discussion zyada tar “kitna fast pump” se zyada “kya ye actual money movement solve karta hai” par centered rehti hai.

Stablecoins already crypto ke sabse zyada used assets hain. Agar future me on-chain finance aur payments grow karte hain, to purpose-built rails ki demand bhi naturally badhegi.

Aage Kya Matter Karega

Plasma ka long-term success flashy announcements se zyada execution par depend karega — confidential payment tools, deeper DeFi integrations, aur planned Bitcoin bridging jaise upgrades agar smoothly land hote hain, to chain ka role aur clear ho jaayega.

Is stage par Plasma ek experiment se zyada lagta hai — ek infrastructure bet jo stablecoins ko speculation se nikaal kar daily finance ke closer le jaane ki koshish kar raha hai.

Bottom line:

Plasma ek aisa Layer-1 hai jo stablecoins ko blockchain ke center me rakhta hai, na ki edge pe. Zero-fee transfers, strong liquidity launch, aur infrastructure-first mindset isse ek utility-driven project banate hain. Xpl sirf trade nahi hota, balki network ko chalata hai. Agar stablecoins digital money ka future hain, to Plasma unke liye dedicated rails build kar raha hai.