Die Aktie von Strategy (MSTR) bleibt stark im Aufwind und schließt die Handelssitzung am Mittwoch mit einem historischen Marktwert von 128,4 Milliarden US-Dollar ab, getrieben von der starken Aufwärtsbewegung von Bitcoin auf fast 120.000 US-Dollar.

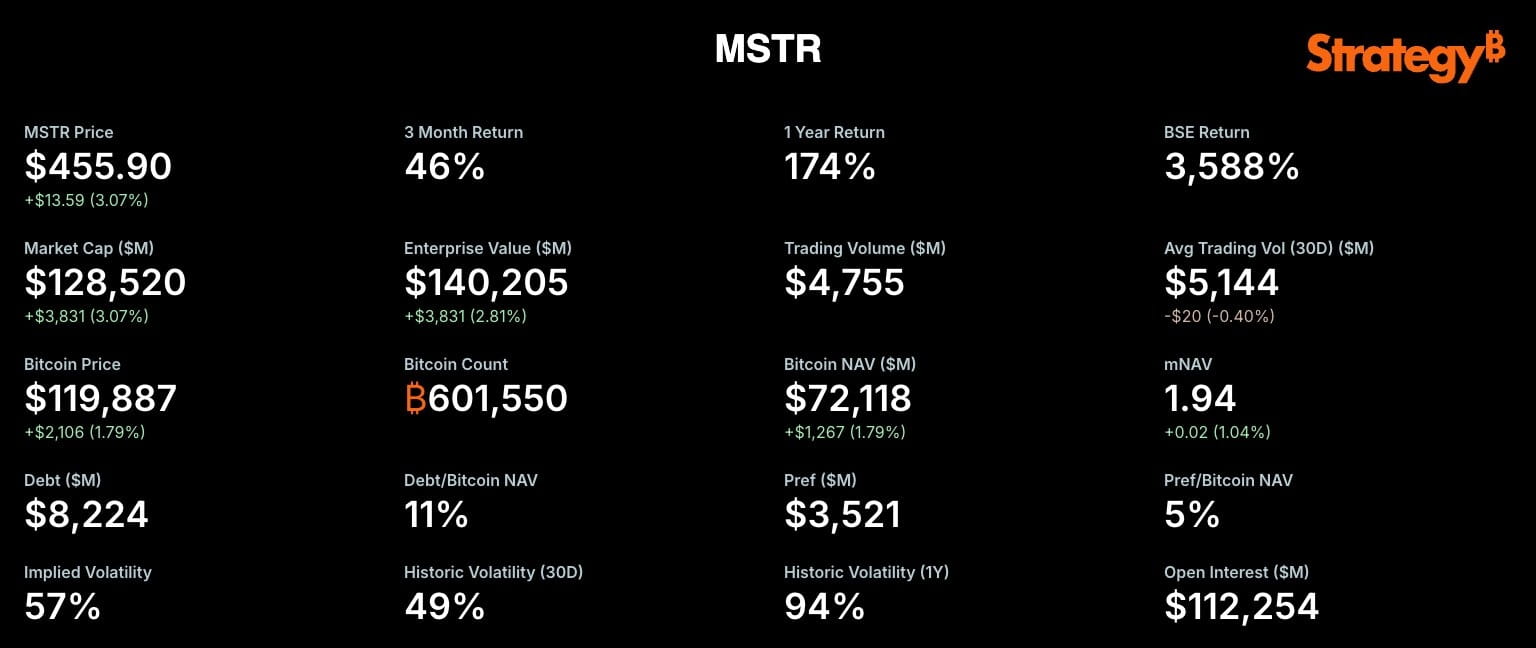

Konkret stieg die MSTR-Aktie um 3,07 % auf 455,90 US-Dollar, was eine Gesamtsteigerung von 46 % in den letzten drei Monaten und 174 % innerhalb eines Jahres bedeutet. Seit der Umsetzung der Strategie zur groß angelegten Akkumulation von Bitcoin hat sich die Gesamtrendite von MSTR um 3.588 % erhöht, laut den neuesten Daten.

The world's largest Bitcoin holder company

As of July 14, Strategy holds 601,550 BTC, valued at over 72.1 billion USD, equivalent to 2.86% of the global Bitcoin supply. The average price the company paid per Bitcoin is 71,270 USD, meaning it still maintains significant profits given that Bitcoin was trading around 119,887 USD at the time the data was released.

The company's current debt stands at 8.22 billion USD, equivalent to 11% of the nominal value of the Bitcoin it holds, indicating well-controlled financial leverage. Additionally, Strategy has an extra 3.52 billion USD in preferred equity, accounting for approximately 5% of Bitcoin's NAV.

The driving force behind it: Bitcoin and institutional investors

The increase in MSTR is closely linked to the rise in the cryptocurrency market, particularly Bitcoin, with 24-hour trading volume reaching 47.8 billion USD and market capitalization holding steady at 2.4 trillion USD — the highest in the world of cryptocurrencies.

Notably, Vanguard Group — one of the largest fund management organizations in the world — has been revealed as the largest shareholder of Strategy, despite previously referring to Bitcoin as an 'unmatured asset.' This shift reflects the growing trend of traditional financial institutions increasingly accepting Bitcoin as a strategic store of value.

High volatility, but strong confidence

Despite the current implied volatility of 57% and a 1-year historical volatility of 94%, investors still view MSTR as the leading 'proxy' for Bitcoin in the US stock market. Trading indicators also show positive sentiment: open interest (OI) reached 112.25 billion USD, indicating substantial capital inflows into derivatives contracts related to this stock.

With a fully committed corporate 'Bitcoinization' strategy, Michael Saylor has transformed Strategy into one of the most attractive assets on Wall Street. As Bitcoin continues to grow and attract global attention, MSTR stock is in a prime position to benefit from the new cryptocurrency upcycle.