@Dusk has always taken a different path. Instead of chasing attention, it’s been quietly building for a reality most blockchains avoid: real finance cannot operate on rails where every balance, transaction, counterparty, and strategy is exposed forever. For institutions and regulated markets, that level of transparency isn’t a feature it’s a deal breaker.

At its core, Dusk is designed around confidential settlement, not secrecy for its own sake, but structured confidentiality that still allows oversight, reporting, and enforcement when required. This matters because regulated finance doesn’t ask for anonymity it asks for privacy with rules, proofs, and accountability. That balance defines Dusk’s entire identity.

What sets the network apart is that privacy isn’t bolted on as an afterthought. It’s embedded into how assets, transactions, and ownership are modeled from the start. Most chains force a tradeoff: either you get programmability without privacy, or privacy without proper lifecycle control. Dusk is trying to hold both—supporting confidential activity while still enabling ownership tracking, snapshots, transfer restrictions, and corporate actions that real financial instruments demand.

This is why components like Phoenix and Zedger are so central to the architecture. Phoenix focuses on making private transactions viable even when execution costs can’t be known upfront, while Zedger addresses the stricter world of securities—where whitelisting, transfer rules, and historical ownership reconstruction are non-negotiable. The goal is to avoid turning the blockchain into a public spreadsheet of everyone’s financial life while still preserving full financial logic.

The Confidential Security Contract (XSC) standard makes that ambition concrete. It points toward tokenized assets that behave like actual financial instruments, not just transferable tokens. Things like compliant issuance, settlement, redemption, dividends, governance, and controlled transfers become native capabilities, not awkward workarounds. This is infrastructure meant for markets, not experiments.

Another signal of seriousness is how Dusk treats compliance and market structure as part of the product itself. The project consistently talks about licensed frameworks and regulated marketplaces because adoption in finance isn’t just about shipping code it’s about fitting into the real legal and operational environment assets live in. That quiet alignment work is often ignored until it becomes the reason a protocol survives multiple cycles.

Technically, Dusk is moving toward a more modular setup. That choice reflects reality: developers want EVM familiarity, while institutions want privacy and selective disclosure. By separating concerns core settlement and consensus, an expanding EVM execution layer, and dedicated privacy engines the network aims to support both. Newer components like Hedger extend confidentiality into the EVM world using cryptographic proofs, enabling private activity that can still be verified when necessary.

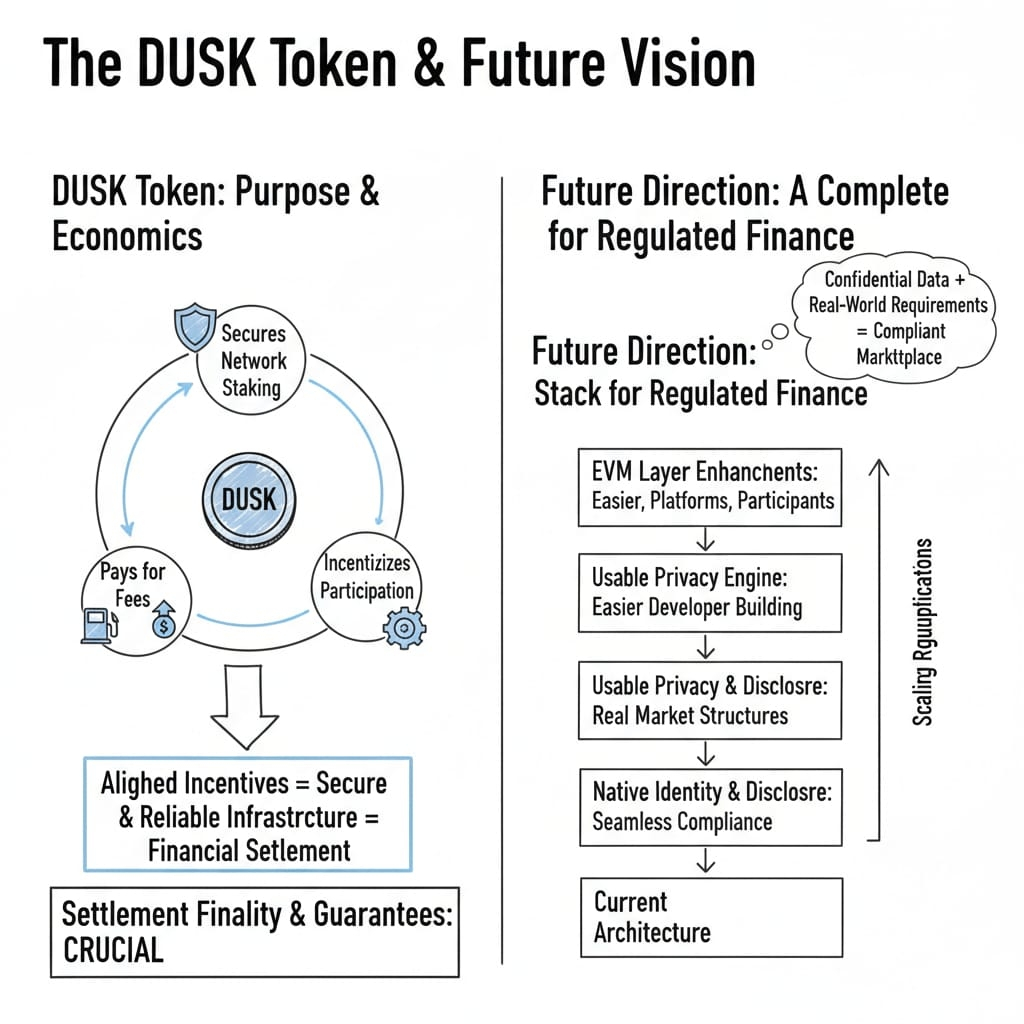

The DUSK token itself plays a clear role. It secures the network through staking, pays fees, and aligns incentives around reliability and finality. That matters because in financial settlement, instability isn’t an inconvenience, it’s unacceptable. The emphasis on direct settlement guarantees and strong economic alignment reflects that mindset.

Looking ahead, the direction is straightforward if you focus on intent rather than price action. The next phase is about turning this architecture into a full marketplace grade stack: smoother EVM development, more usable privacy tooling, native identity and selective disclosure for compliance flows, and an environment where regulated applications can actually operate at scale.

In short, Dusk isn’t trying to win attention. It’s trying to solve the hard problem most networks sidestep: putting finance on-chain without forcing institutions to expose their businesses, clients, and positions to the public internet. That may sound niche, but once tokenization moves beyond pilots, confidentiality with enforceable rules and provable auditability won’t be optional it will be required. And that’s the world Dusk is clearly building for.