Looking at @Plasma lately, one of the more interesting developments isn’t about raw speed or headline transaction counts. It’s about how the network’s economics are starting to reflect real payment behavior, not speculative noise. That shift shows up clearly in some newer usage patterns.

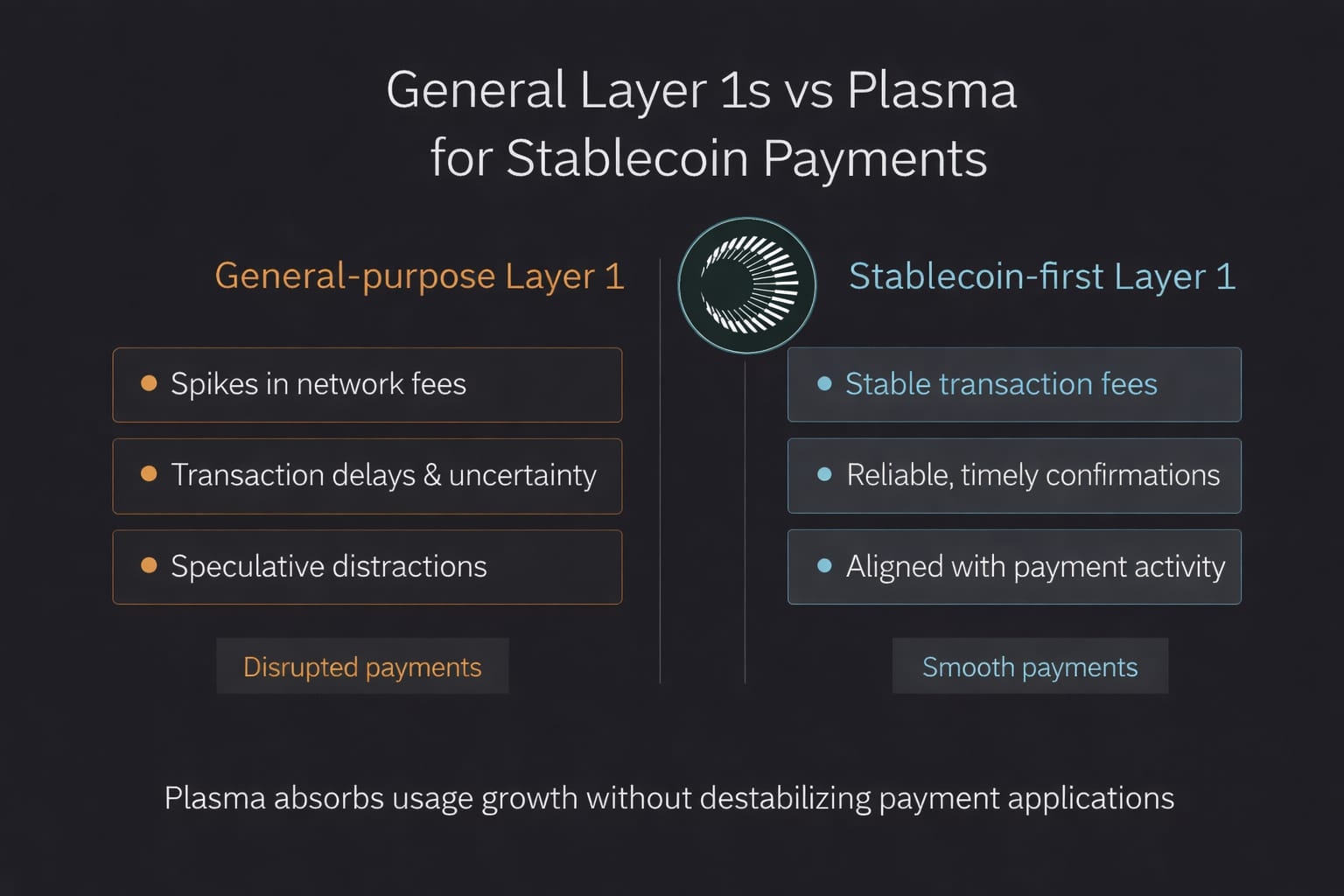

Plasma is built as a stablecoin-first, EVM-compatible Layer 1, and that design keeps shaping how people actually use the chain. Stablecoins sit at the center of activity, while $XPL operates more in the background through staking, validator incentives, and governance. As a result, transaction behavior on Plasma looks increasingly different from general-purpose Layer 1s.

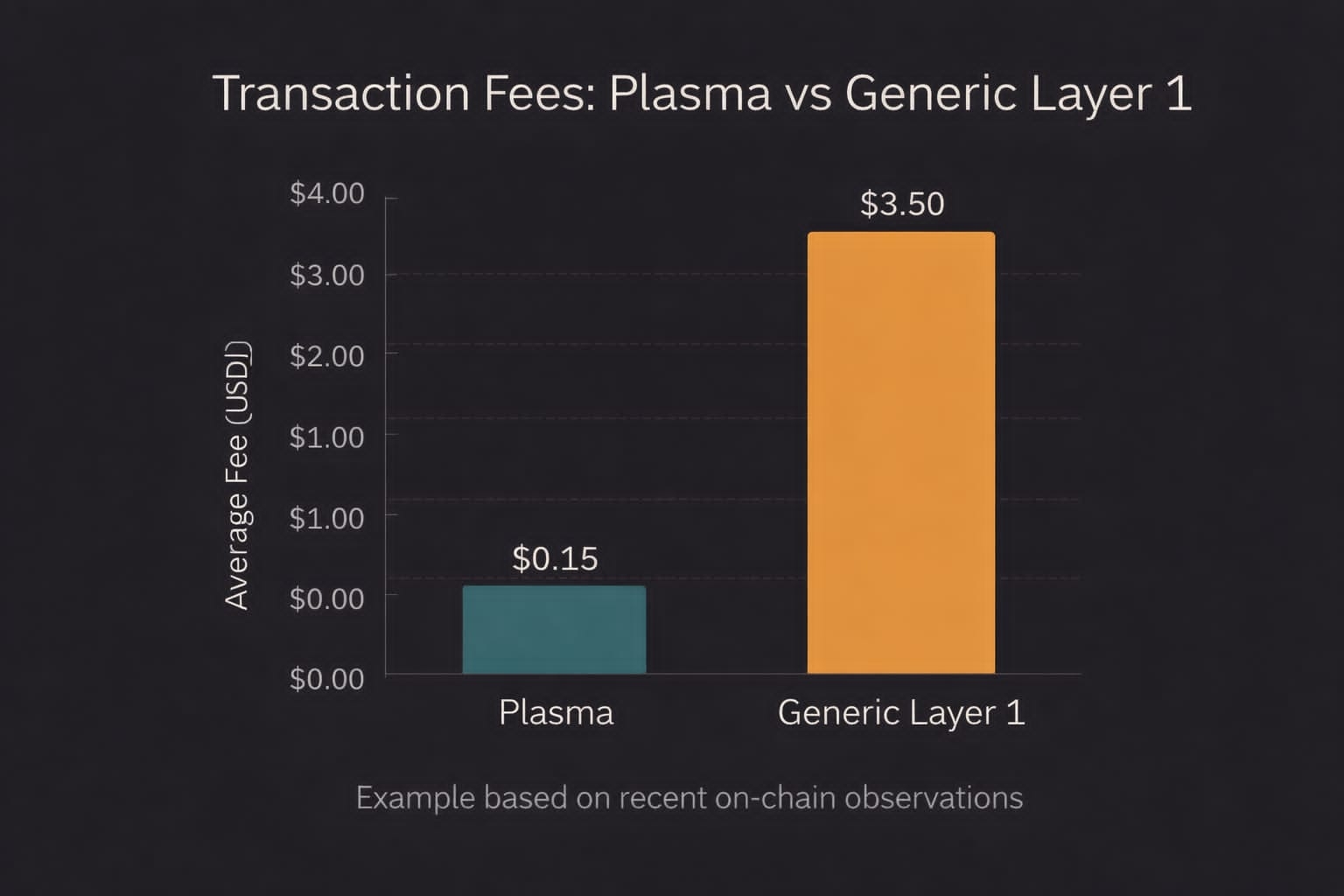

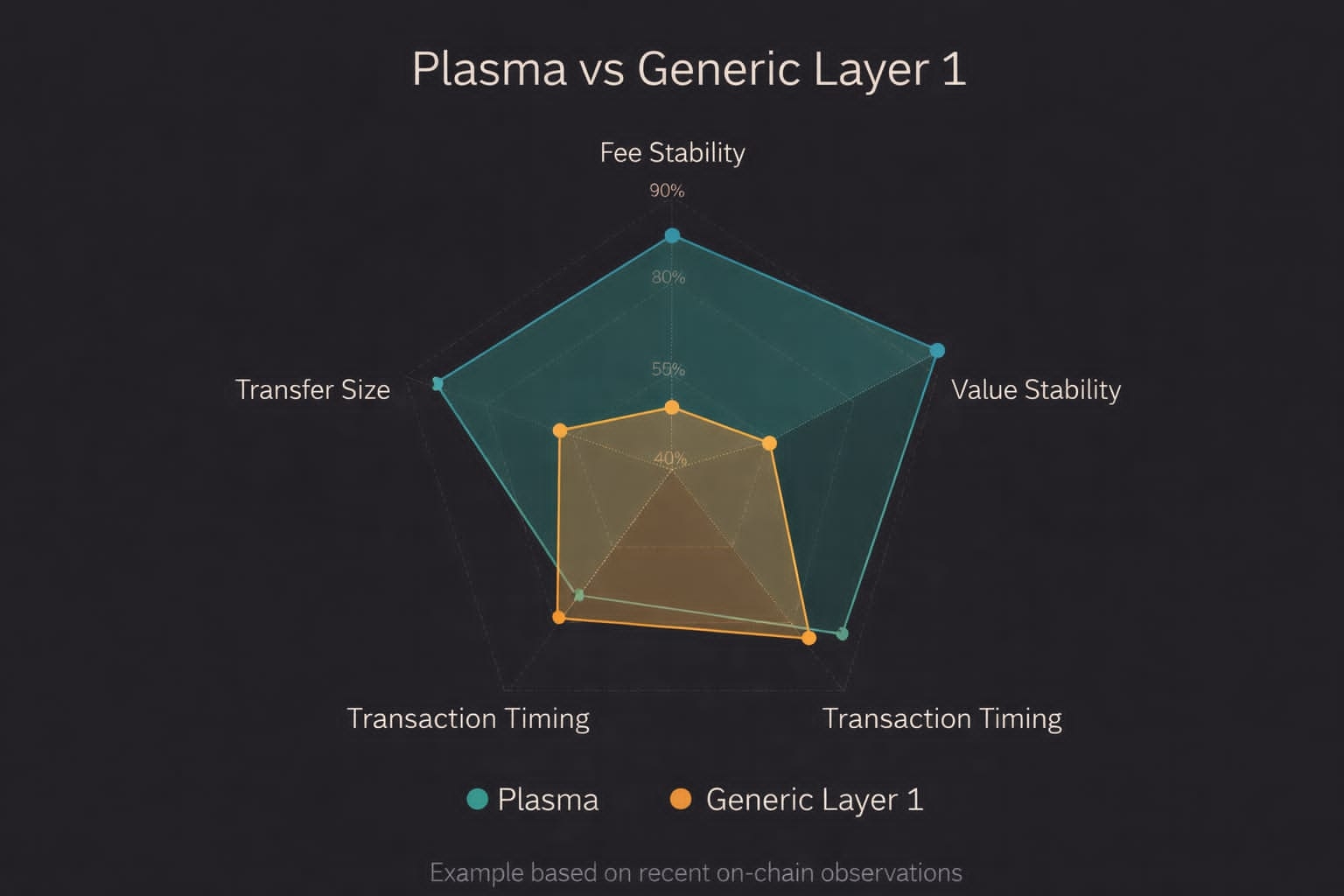

One updated data point that stands out is fee composition. Over recent weeks, a growing majority of transactions on Plasma have paid fees directly in stablecoins rather than converting through volatile assets. More importantly, the average fee paid per transaction has remained flat even as transaction counts increased. That suggests the network is absorbing higher usage without pushing costs onto users, which is exactly what payment-heavy systems need to do.

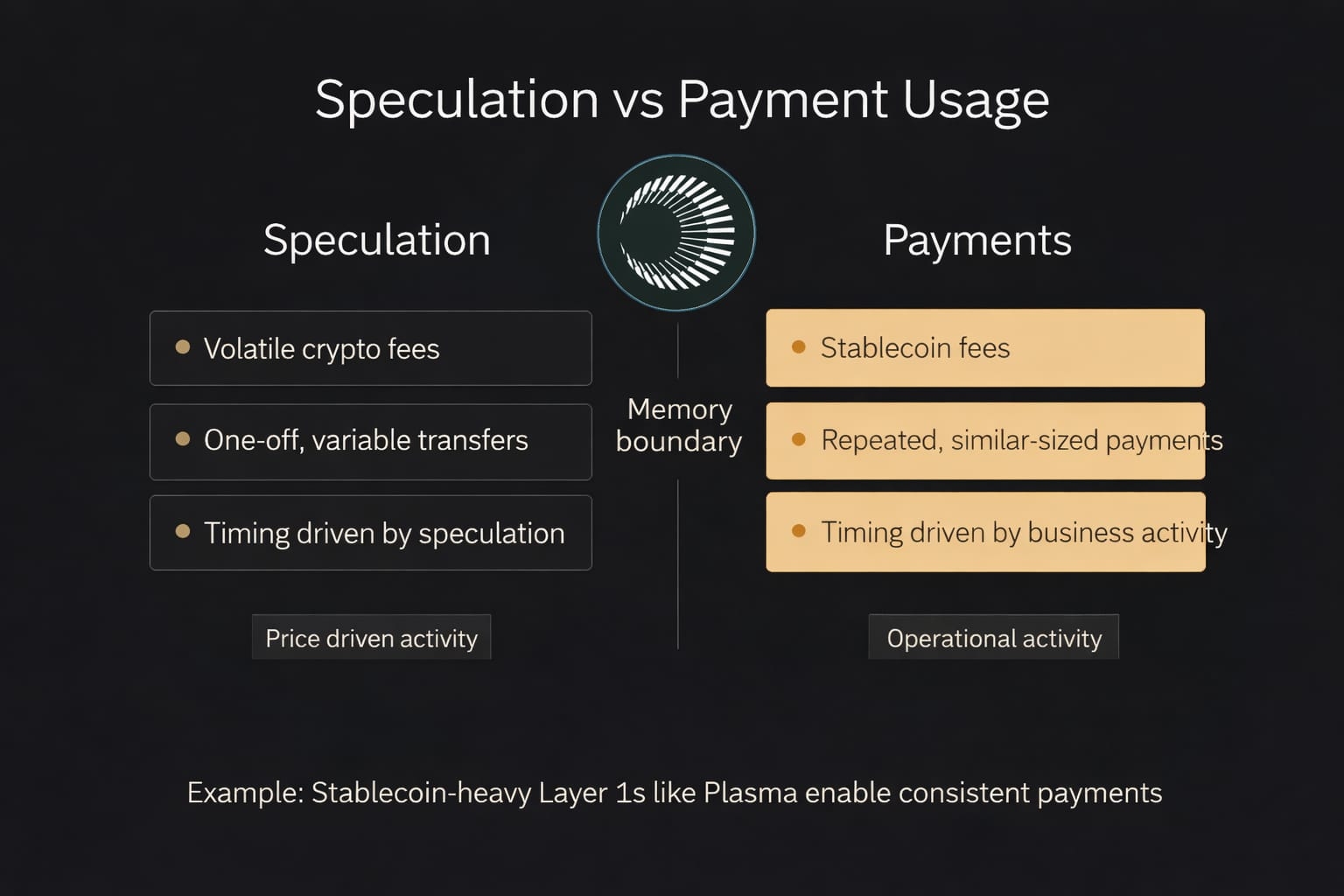

Another newer signal is transaction size distribution. Plasma is seeing a gradual shift away from very small test transfers toward more mid-sized and large stablecoin transactions. The median transfer value has moved up, not because of speculation, but because more addresses are sending repeated payments of similar sizes. That usually indicates operational usage like merchant settlement, B2B payments, or treasury movements rather than one-off experimentation.

There’s also an interesting trend in transaction timing. Activity on Plasma has become more evenly distributed across the day, with noticeable clustering around regional business hours. That pattern tends to emerge when a network is used by services running scheduled processes, not traders reacting to price movements. It’s a subtle detail, but it says a lot about who’s actually using the chain.

To put this into a real-world frame, imagine a payments company settling stablecoin balances for multiple partners throughout the day. What they care about isn’t peak throughput. It’s whether fees stay predictable, whether confirmations arrive consistently, and whether costs are easy to account for. Plasma’s recent fee stability and transaction patterns line up well with that kind of workflow.

Compared to many general-purpose Layer 1s, this is a different picture. On those networks, payment activity often gets distorted by unrelated events like NFT launches, liquidations, or speculative trading. Fees spike, confirmations slow down, and payment flows suffer as collateral damage. Plasma’s tighter focus reduces that interference by design.

Of course, there are trade-offs. Plasma’s economics depend heavily on stablecoin liquidity and issuer support. If liquidity fragments or major stablecoins change how they operate, Plasma would feel that impact quickly. There’s also the ongoing challenge of validator decentralization as usage grows. Keeping performance stable without concentrating control is not trivial.

Regulatory uncertainty around stablecoins remains another external factor. Any meaningful policy shift could affect on-chain payment activity across the board, and Plasma isn’t insulated from that reality.

Still, the direction of the data is telling. Flat fees under higher load. Larger, repeated transfers. Activity aligned with business hours. Those aren’t signs of hype cycles. They’re signs of infrastructure starting to fit into real financial routines.

That doesn’t mean Plasma is finished or guaranteed to succeed. But it does suggest #Plasma and $XPL are being shaped by practical usage rather than short-term narratives. In a space where many networks chase attention, Plasma seems more focused on quietly getting the fundamentals right.

Sometimes the most meaningful progress shows up in boring metrics. Costs that don’t jump. Behavior that repeats. Systems that behave the same way tomorrow as they did yesterday. That’s usually when infrastructure starts to matter.