When I first looked at plasma, What stood out to me wasn’t the typical selling points. There were no bold claims about being the lowest-cost chain, no noisy fixation on fee battles. The appeal was more subtle. Plasma wasn’t positioning itself to compete on price at all.

Plasma doesn’t feel like it’s trying to win a price war. There’s no obsession with being the cheapest or the fastest. Instead, it’s aiming for something subtler. It wants transaction fees to stop entering the conversation at all, the same way we stopped talking about buffering once internet speed became reliable.

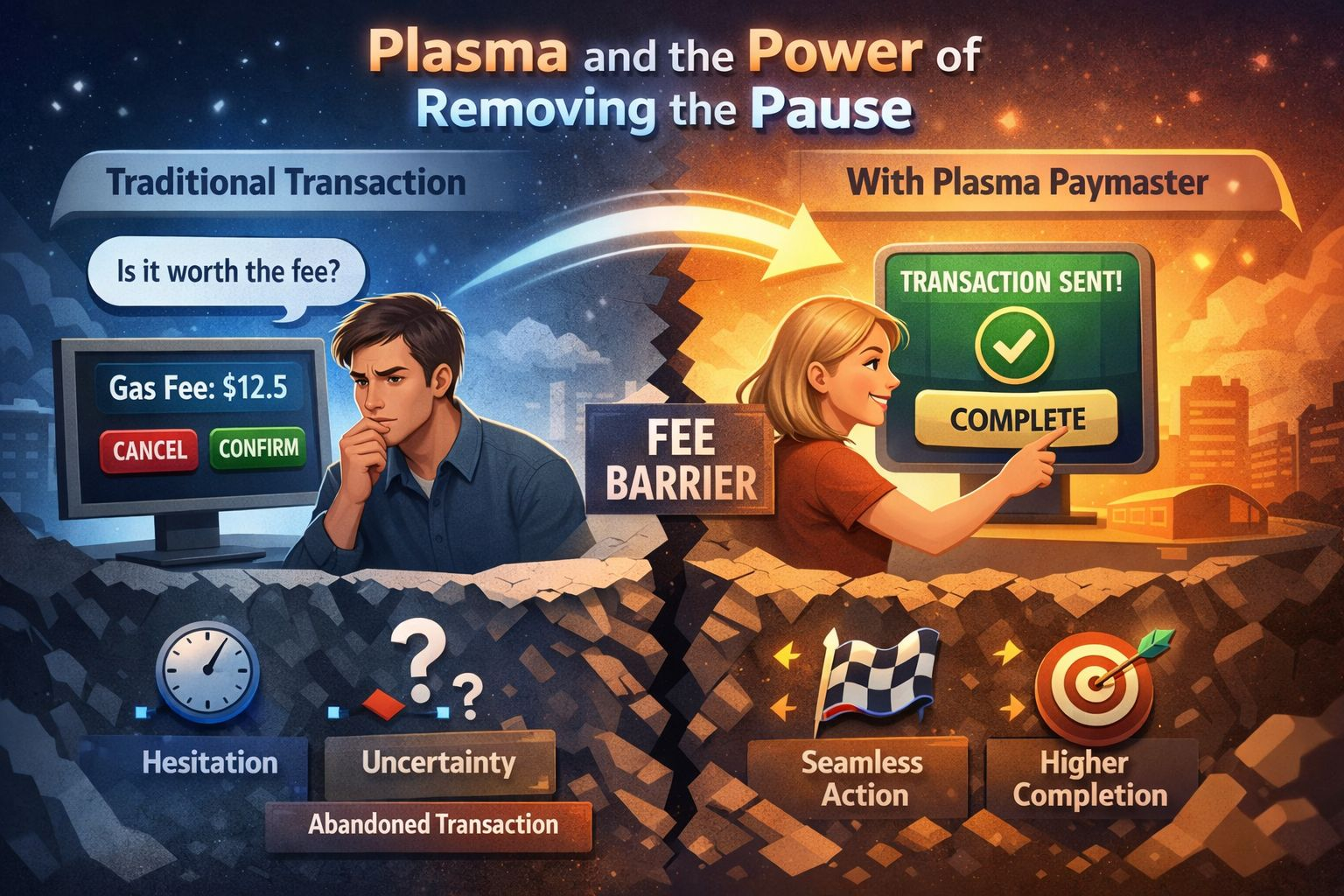

Most blockchains still make fees part of the experience. Even when they’re low, users see them, calculate them, and react to them. That visibility shapes behavior more than people admit. Traders pause. Builders insert warnings. Users delay actions, asking whether now is the right time. Plasma challenges that entire pattern by asking what happens if fees are never presented as a choice.

Across the ecosystem, “cheap” has become the standard promise. Ethereum fluctuates. Solana stays low but struggles under load. Layer twos reduce cost while adding layers of decision making. The industry keeps lowering numbers, yet the friction remains because users are still asked to notice it.

Plasma takes a more structural route. Stablecoin transfers are treated as normal infrastructure, not discounted events. When something feels native rather than subsidized, behavior stabilizes. People stop waiting. They just act.

From the user side, the experience is simple. Transfers happen without gas prompts or mental math. Behind the scenes, paymasters and sponsored execution cover blockspace. Costs don’t vanish, they move. Developers and protocols decide when it makes sense to absorb them, often during onboarding or repeat usage. That shift realigns incentives away from hesitation and toward outcomes.

This model isn’t new outside crypto. Traditional payment networks scaled because fees were invisible at the moment of use. Plasma appears to be borrowing that lesson rather than chasing short-term narratives.

There’s risk in that choice. If applications fail to create real value, the model strains. Subsidies can’t replace economics. Plasma’s design assumes steady, utility-driven activity, not speculative spikes.

As stablecoins already move trillions annually, Plasma positions itself alongside that current. Add in its Bitcoin bridge, built for credibility rather than hype, and the message becomes clear. This isn’t a chain trying to impress you. It’s one trying to disappear into the background.

If Plasma succeeds, fees won’t matter because they’re zero. They’ll stop mattering because no one needs to think about them at all.$XPL @Plasma #Plasma