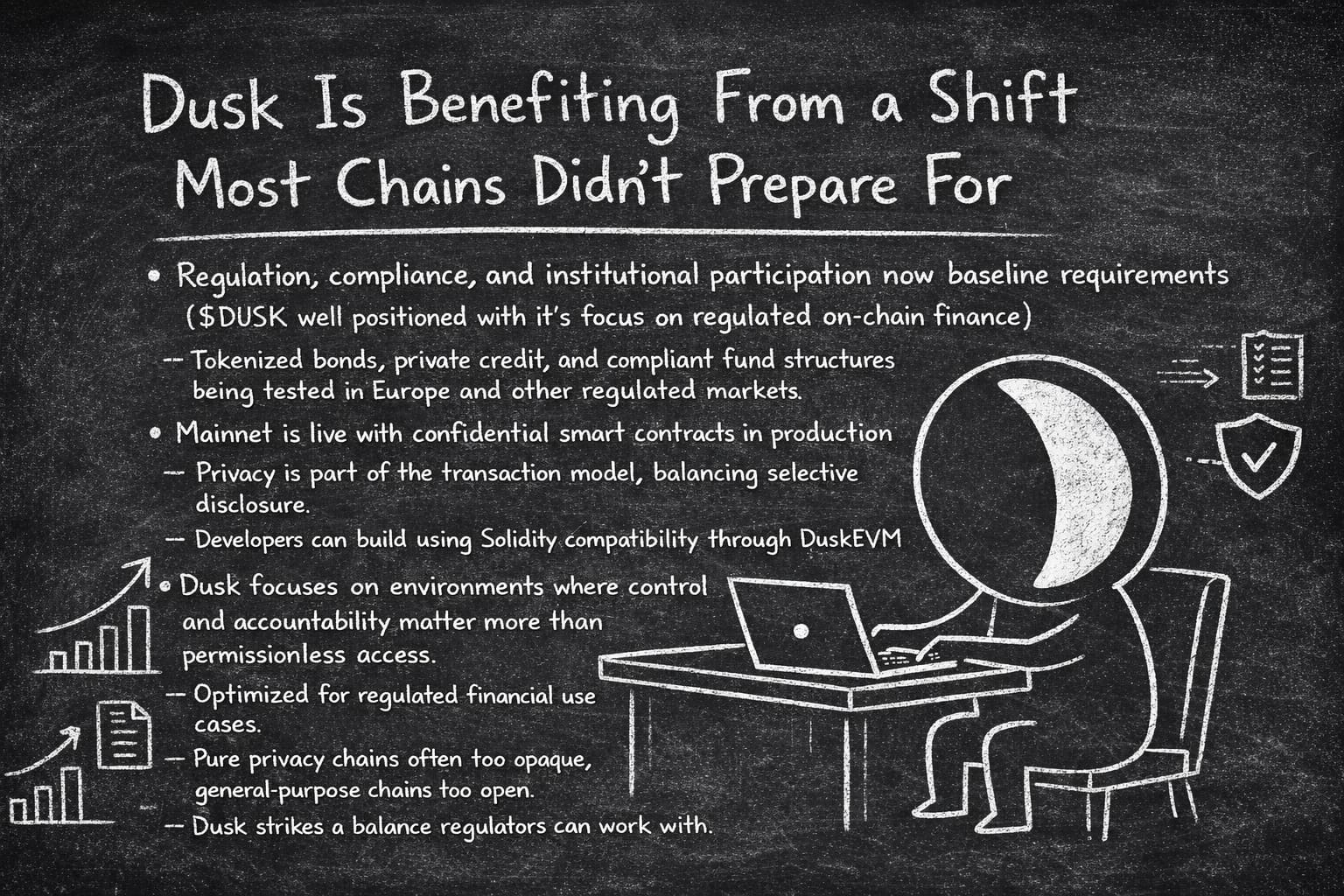

What’s quietly working in Dusk’s favor right now is that the crypto market is maturing in a direction many Layer 1s never planned for. Regulation, compliance, and institutional participation are no longer side conversations. They’re becoming baseline requirements. That’s where Dusk starts to look less speculative and more intentional.

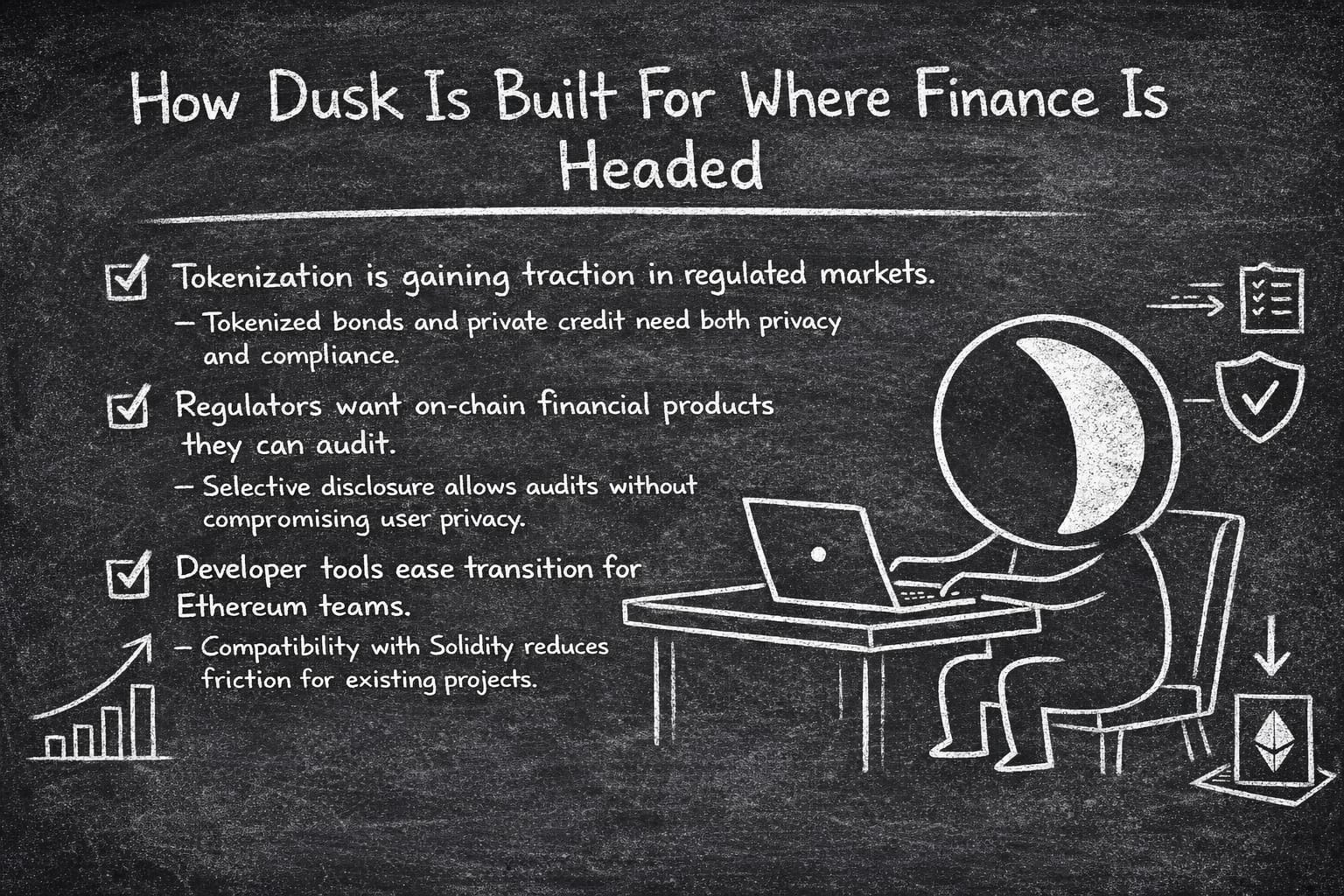

@Dusk has always focused on regulated on-chain finance, but only recently has that focus started to align with real demand. Tokenized bonds, private credit, and compliant fund structures are being tested across Europe and other regulated markets. Those products need privacy, controlled access, and auditability at the same time. Most public chains can’t offer that without heavy off-chain work.

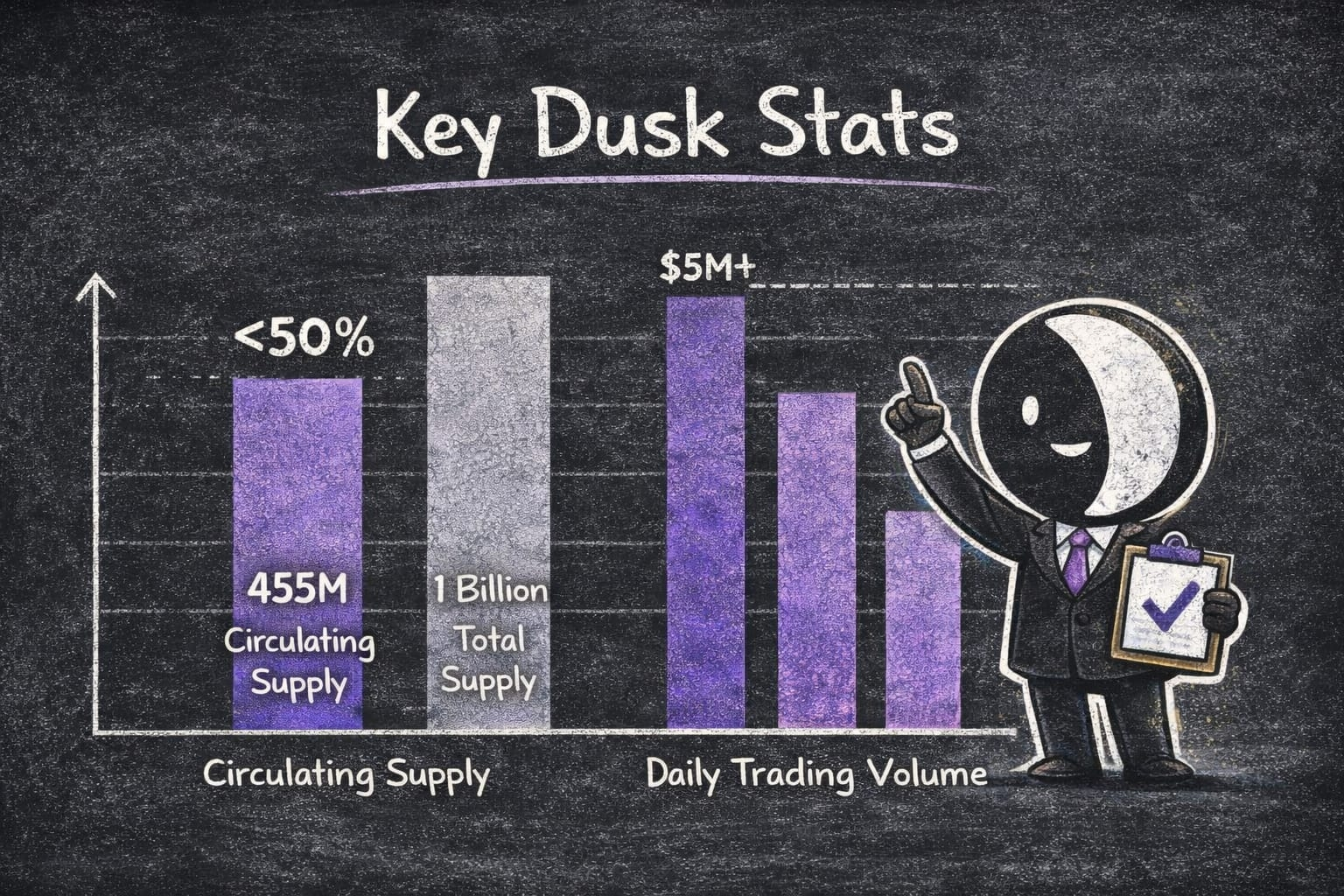

From a data standpoint, $DUSK remains in the small-cap range, with circulating supply still below half of the total 1 billion cap. That matters because network incentives and emissions are still tied closely to participation rather than being fully diluted. Trading volume has stayed relatively consistent over recent months, often reaching multi-million daily levels even when broader market activity slowed. That suggests the asset hasn’t fallen off the radar.

What stands out more than market data is how complete the stack looks.

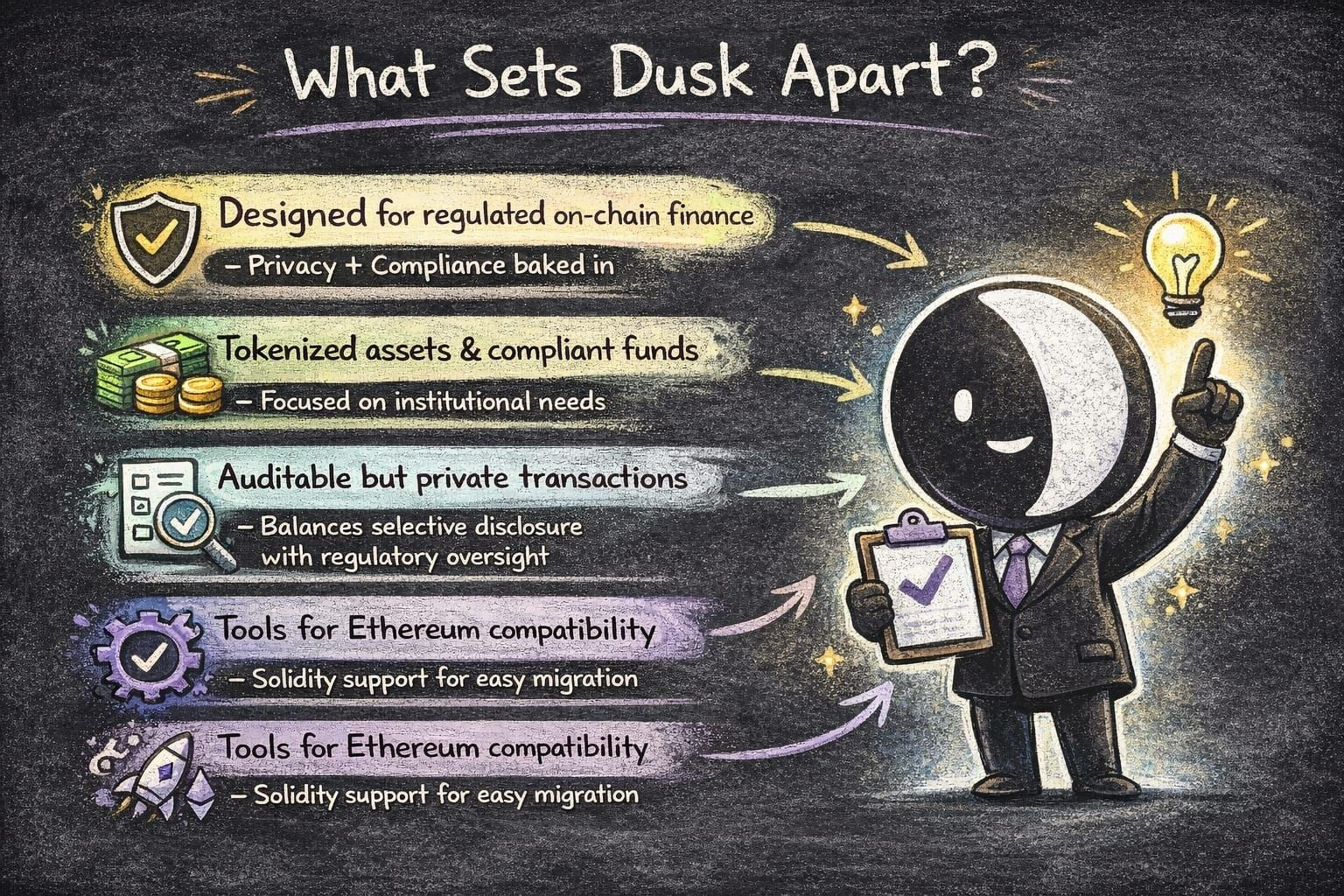

Dusk’s mainnet is live, and confidential smart contracts are running in production. Privacy is not an optional feature. It’s part of the transaction model. At the same time, Dusk avoids the trap of total opacity. Its selective disclosure framework allows regulators and auditors to verify activity when required. That balance is hard to get right, but it’s exactly what regulated finance needs.

Developer tooling has also reached a point where experimentation makes sense. With Solidity compatibility through DuskEVM, teams coming from Ethereum don’t have to abandon familiar tooling. That lowers the cost of testing real products, not just demos. It also explains why Dusk’s progress shows up through pilots instead of loud launches. A concrete use case makes this clearer.

Imagine a regulated platform issuing tokenized private debt to professional investors. Investor eligibility must be enforced. Holdings should stay private. Transfers must follow strict rules. Regulators need access if there’s an investigation. On most chains, this requires off-chain systems stitched together with legal workarounds. On Dusk, these constraints are assumed from the start. The protocol is built around them.

This is also why Dusk doesn’t compete directly with general-purpose Layer 1s like Ethereum or Solana. Those networks optimize for openness and composability. Dusk optimizes for environments where control and accountability matter more than permissionless access. Compared to pure privacy chains, Dusk takes a more realistic approach that regulators can actually work with. There are still real risks.

Regulatory frameworks vary by rule, and selective disclosure models need ongoing taking. Institutional adoption takes time, and some flyer won’t move beyond testing. Token volatility can also turn perception if markets focus too heavily on short-term price action. Still, the broader trend matters.

On-chain finance is moving toward compliance, not away from it. As tokenization shifts from experimentation to infrastructure, chains designed for regulated use cases become more relevant over time.

That’s how I’m viewing #dusk right now. Not as a fast-moving trade, but as infrastructure positioned for where finance is realistically headed.