I’ve been taking another look at @Plasma , and one of the more telling recent data shifts isn’t happening purely on the network itself. It’s showing up in how funds are moving into and out of Plasma, and what that says about how the chain is being used.

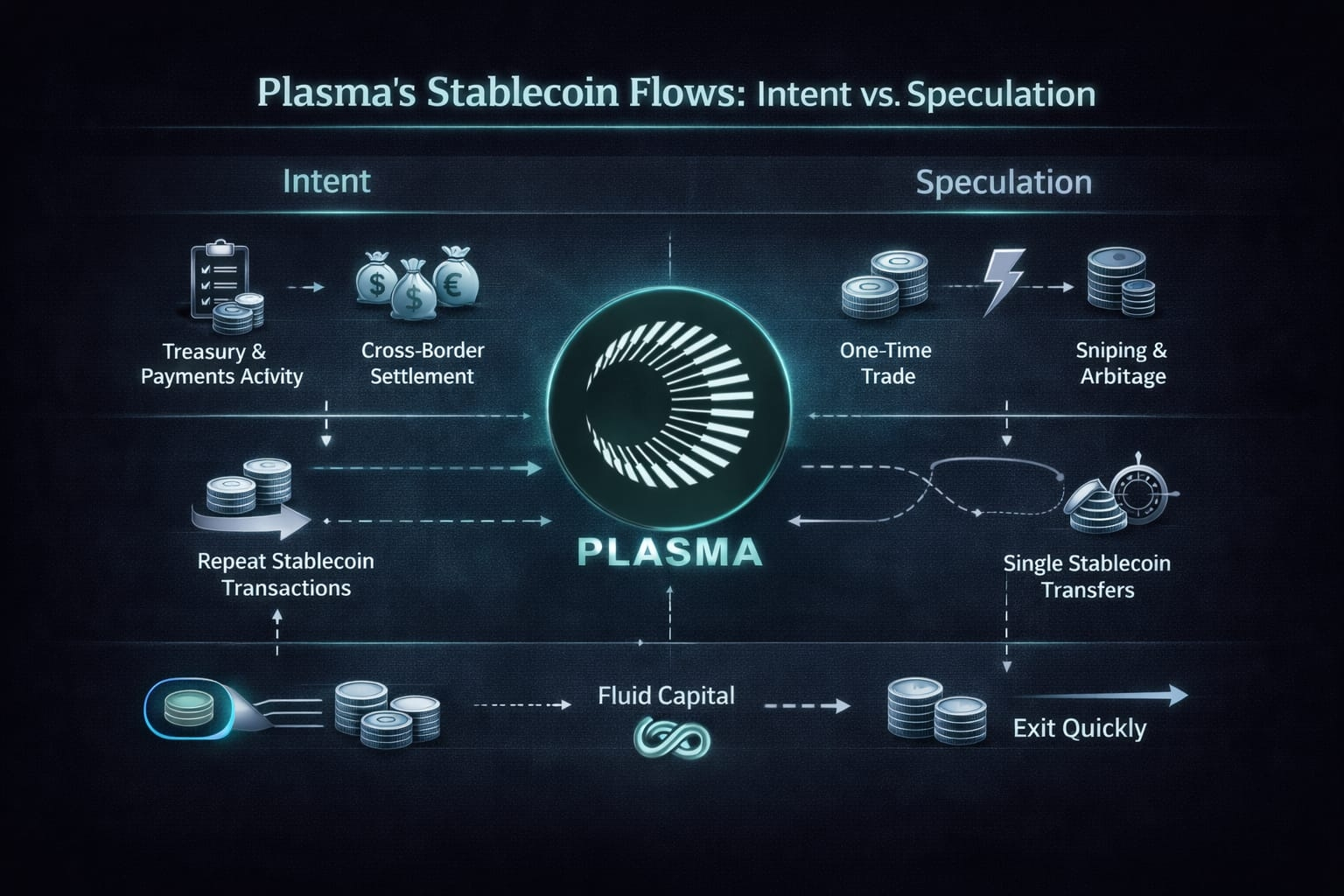

Plasma is built as a stablecoin-first, EVM-compatible Layer 1, so it makes sense that cross-chain behavior would matter more here than raw app counts. Stablecoin infrastructure lives or dies by how easily capital can move where it’s needed. Lately, Plasma’s flow patterns are starting to look a lot less speculative and a lot more deliberate.

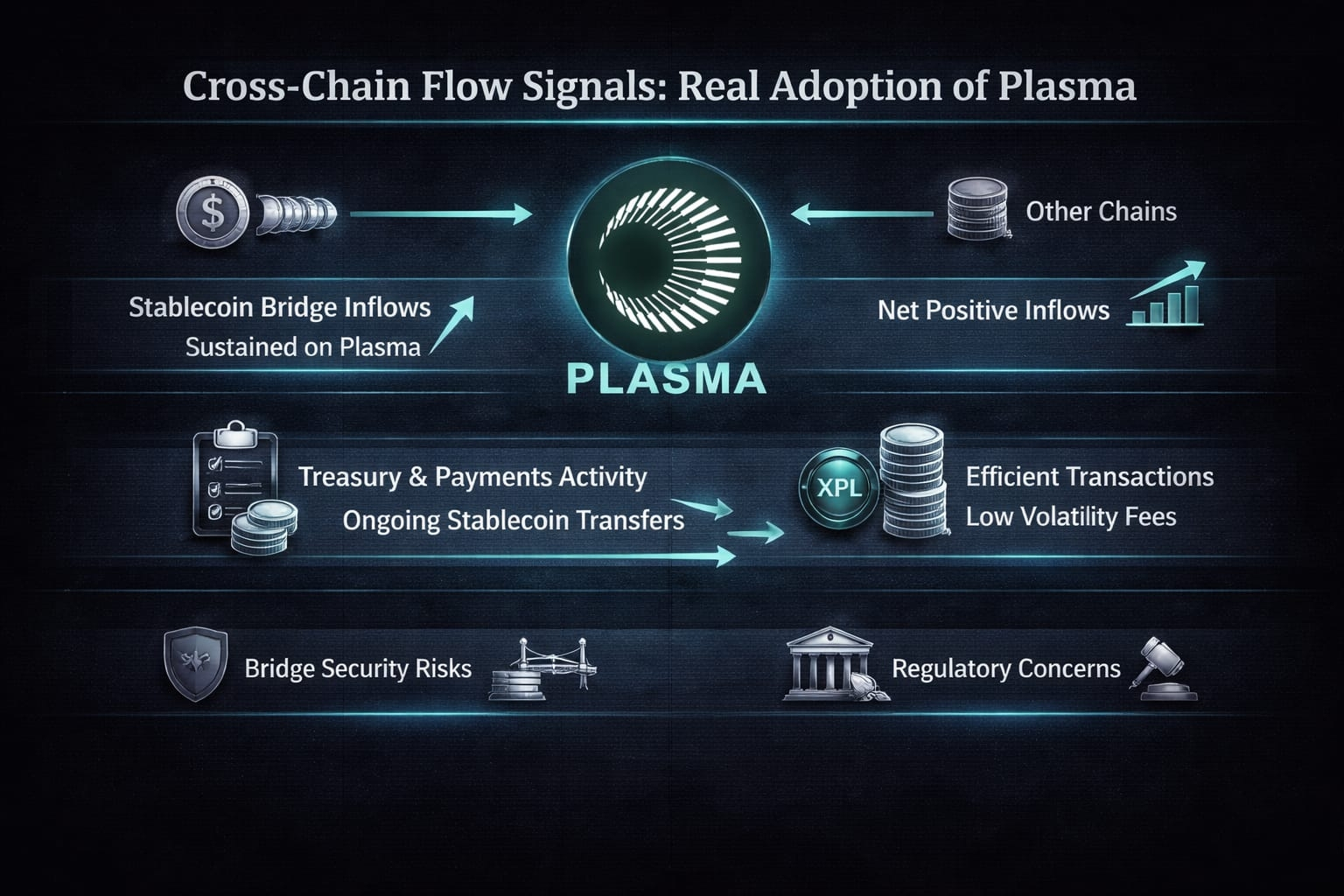

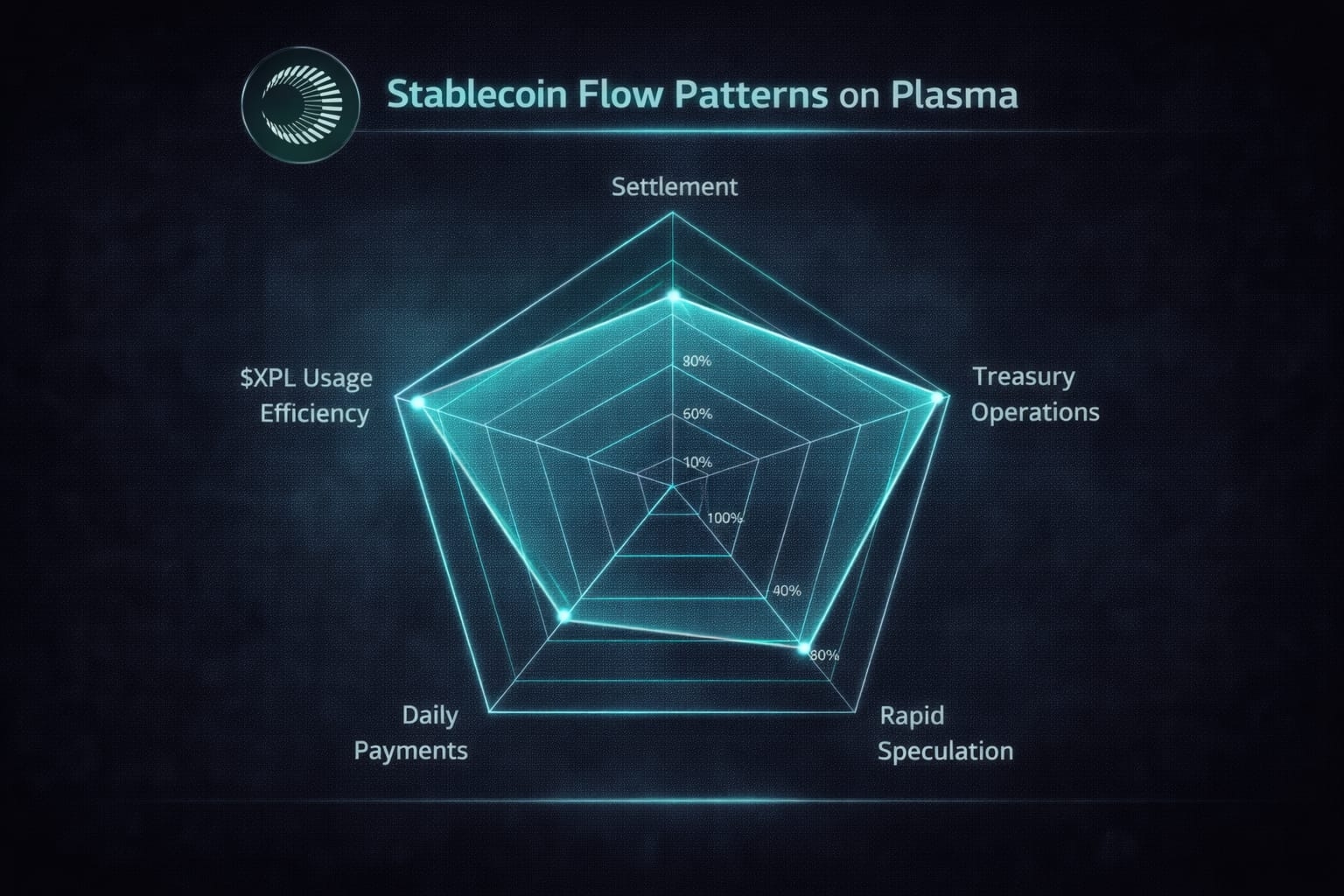

One of the latest data points that stood out is a change in bridge behavior. Recent snapshots show a higher share of stablecoin inflows staying on Plasma for longer periods instead of cycling back out quickly. In simple terms, funds are parking and being reused rather than bouncing in for a test transaction and leaving. That’s usually a sign that capital is supporting ongoing activity like settlement, payouts, or treasury operations.

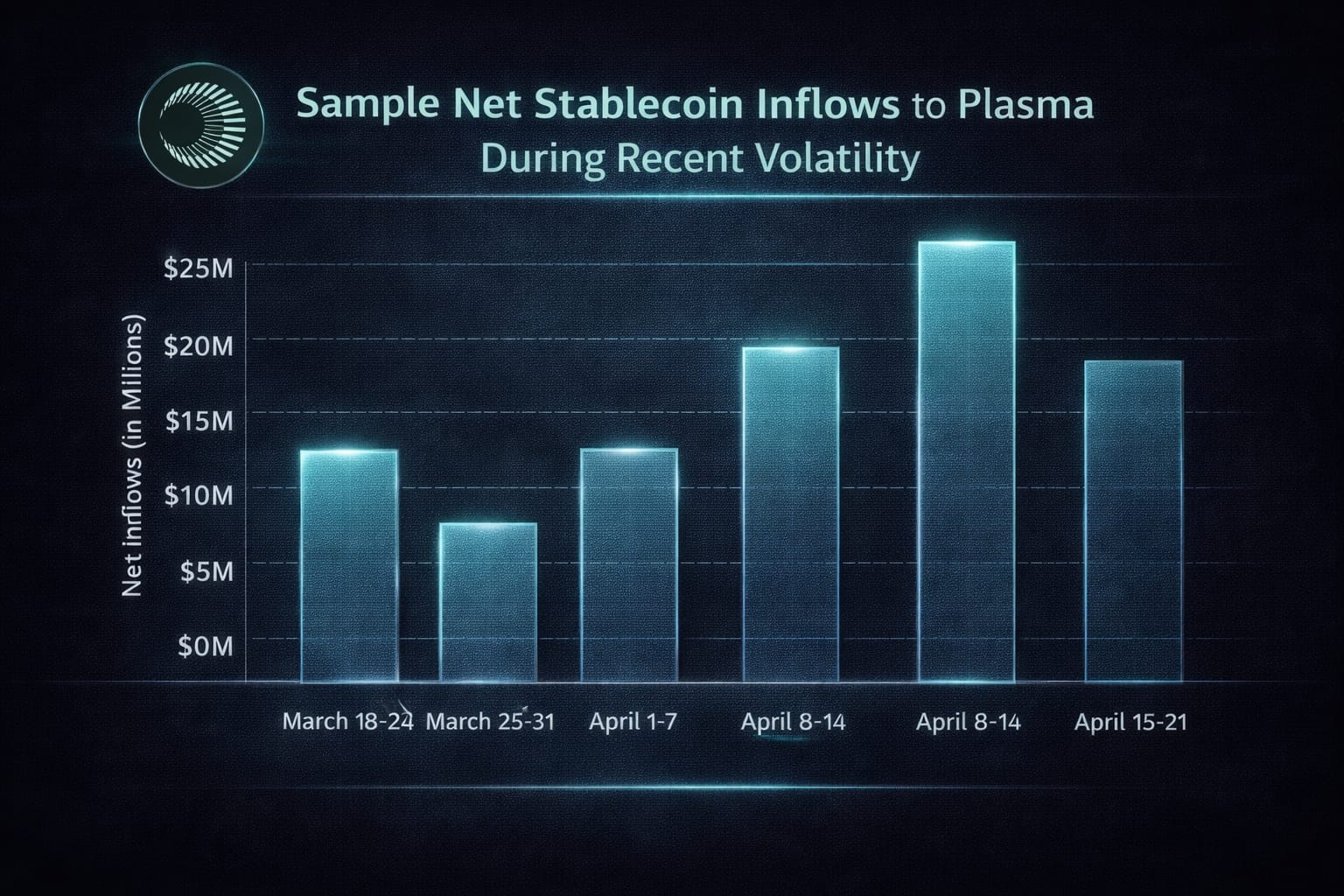

Another newer signal is net flow balance. During several recent weeks, Plasma recorded net-positive stablecoin inflows even when broader market volatility picked up. On many chains, uncertainty triggers rapid outflows as users retreat to larger ecosystems. Plasma holding net inflows during those windows suggests users weren’t just experimenting. They were keeping funds where they needed them operationally.

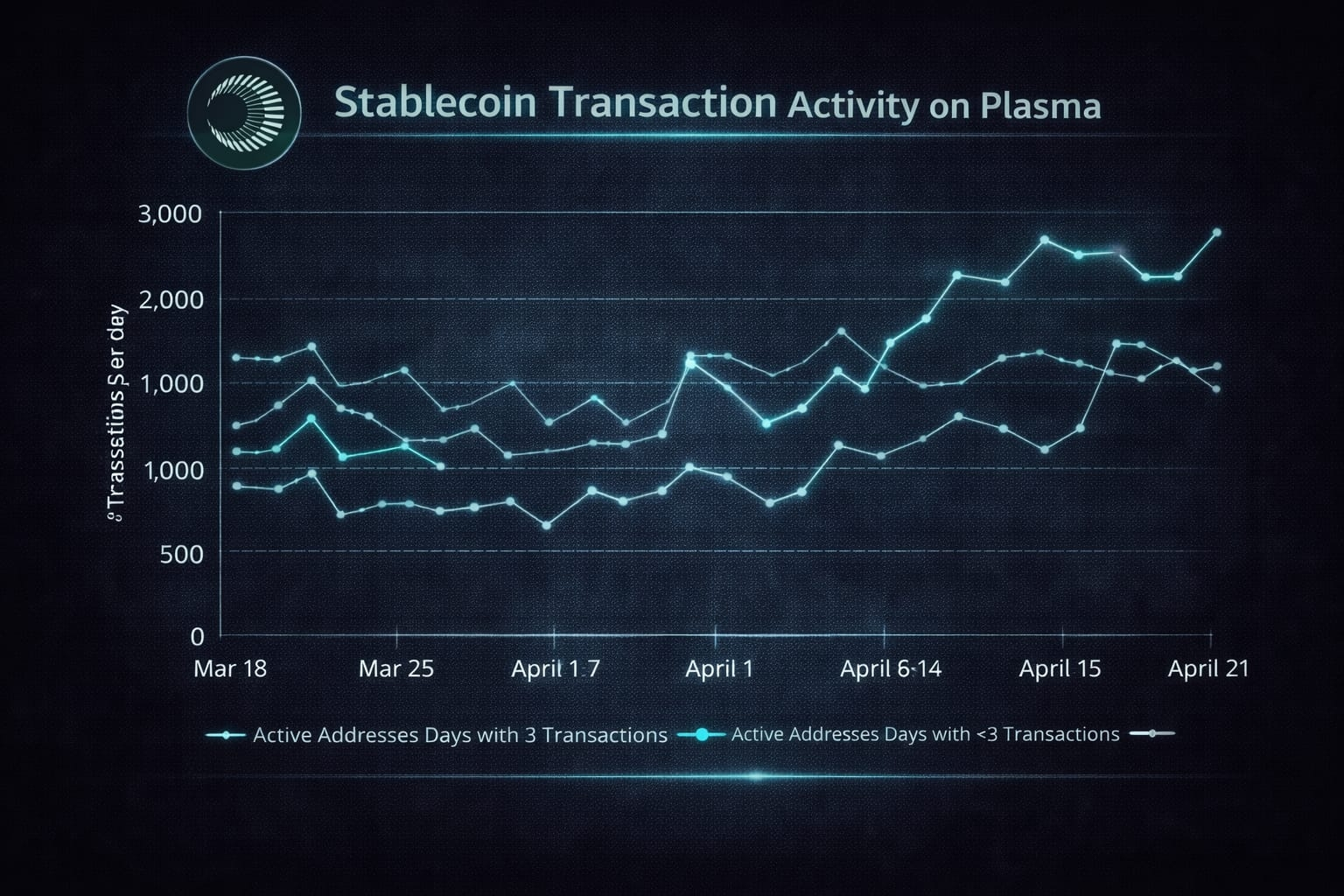

This lines up with what we’re seeing in transaction patterns. Instead of one large transfer followed by inactivity, more addresses are executing clusters of stablecoin transactions over multiple days. That behavior usually points to services running repeat workflows rather than individuals testing the network once.

The role of $XPL fits neatly into this picture. Because users aren’t required to constantly interact with a volatile gas token, capital efficiency improves. Stablecoins come in, get used, and stay productive without forcing extra conversions. For businesses tracking balances and reconciliation, that simplicity matters more than people often admit.

A practical example helps make this concrete. Imagine a cross-border payments provider routing stablecoin liquidity through Plasma to handle regional settlements. They bridge funds in, distribute payments throughout the week, and only rebalance when needed. The recent flow data suggests Plasma is increasingly being used in exactly that way, not as a pass-through, but as a working layer.

When you compare this to general-purpose Layer 1s, the contrast is noticeable. On many networks, cross-chain flows are noisy and reactive. Capital floods in during hype cycles and exits just as quickly. Payments struggle to compete with speculative demand for block space. Plasma’s stablecoin-first design dampens some of that volatility by aligning the network around predictable value transfer.

That doesn’t mean there are no risks. Plasma’s reliance on bridges and stablecoin liquidity introduces exposure to external infrastructure and counterparties. Any issues with bridge security or stablecoin recovery mechanics would have real impact. There’s also the ongoing challenge of scaling validator participation while maintaining consistent performance.

Regulatory pressure around stablecoins remains another variable. If issuer policies or compliance requirements change, cross-chain liquidity behavior could shift quickly. Plasma’s advantage depends on stablecoins continuing to function as reliable digital cash.

Still, what stands out in the latest data isn’t growth for growth’s sake. It’s stickiness. Capital staying put. Repeated use. Flows that reflect operational needs instead of speculation.

That kind of behavior usually shows up before narratives catch on. It doesn’t guarantee long-term success, but it’s hard to ignore when evaluating infrastructure meant to move real money.

For that reason, #Plasma and xpl remain interesting to watch. Not because of big announcements, but because the underlying data suggests Plasma is quietly becoming a place where stablecoins don’t just pass through, they get used.

Sometimes the clearest signal isn’t how much money shows up on a given day. It’s how long it sticks around once it does.