If you’ve been in crypto long enough, you’ve seen this pattern:

Every cycle brings dozens of Layer-1 chains claiming to be faster, cheaper, and more scalable.

But @Plasma is different in one key way:

It doesn’t try to be everything. It tries to dominate one thing — stablecoin payments.

And that focus is exactly why XPL is worth paying attention to.

1. What Plasma ($XPL ) Actually Is

Plasma is a high-performance Layer-1 blockchain designed specifically for stablecoins and global payments rather than general-purpose DeFi or NFTs.

Its mission is simple:

Make sending digital dollars as easy as sending a message.

Key design principles:

• Near-instant transfers

• Extremely low or zero fees for stablecoins

• High throughput optimized for payments

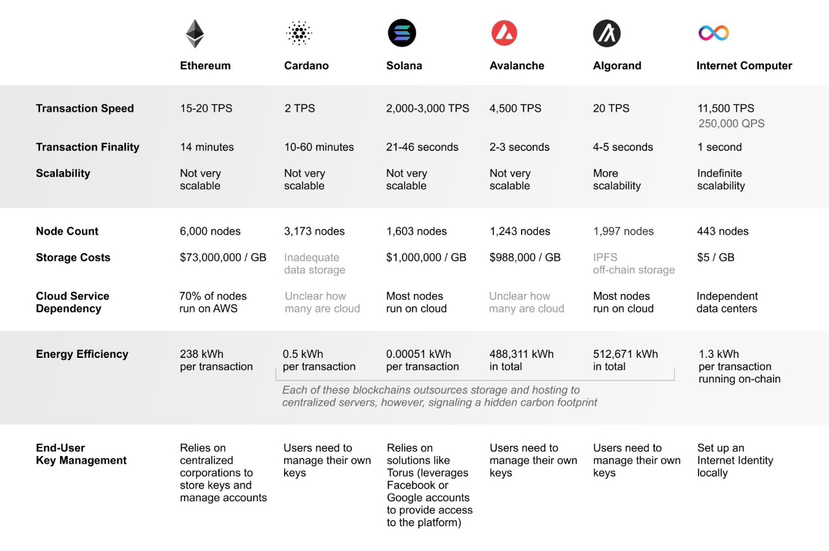

This is a very different positioning compared to Ethereum, Solana, or Avalanche, which try to be full-stack ecosystems.

Plasma is trying to be the settlement rail for stablecoins globally.

That’s a huge narrative.

2. The Real Problem Plasma Is Trying to Solve

Let’s be honest:

Stablecoins are already the most used crypto product in the world.

But sending USDT or USDC still has issues:

• Gas fees

• Network congestion

• Need to hold native tokens

• UX friction for new users

Plasma’s approach:

• Zero-fee stablecoin transfers in some implementations

• No need to hold gas tokens in certain payment flows

• Optimized infrastructure for payments rather than speculation

That’s not just an improvement.

That’s targeting mass adoption directly.

3. How the Technology Works (Simplified but Real)

Plasma uses a high-performance consensus model designed for fast settlement and scalability, with sub-second finality and high throughput suitable for payments.

Other technical aspects:

• EVM compatibility

• Smart contracts

• Staking and validator incentives

• Payment-optimized architecture

Meaning:

Developers don’t need to learn a new stack.

They can deploy similar tools as Ethereum.

That lowers friction for builders — which matters more than people think.

4. Token Utility – What XPL Actually Does

XPL is not just a speculative token.

It has core functions in the network:

• Gas fees

• Validator rewards

• Staking

• Network security

• Governance participation

Total supply example:

• Around 10 billion tokens max supply reported in several sources.

Circulating supply and market cap fluctuate, but the token sits in the mid-cap range in early 2026.

5. Funding, Backing, and Market Signals

One of the most interesting parts about Plasma:The project has raised tens of millions in funding and attracted notable investors and advisors in the crypto and fintech space.

That doesn’t guarantee success.

But it does mean:

Serious capital believes in the stablecoin infrastructure thesis.

And capital usually chases real adoption narratives.

6. Why the Narrative Matters (This Is the Real Alpha)

Crypto cycles rotate narratives:

2017: ICO

2020: DeFi

2021: NFT

2024–2026: RWA + Stablecoins

Stablecoins are quietly becoming:

• Global settlement layer

• Dollar infrastructure outside the banking system

• Payment rails in emerging markets

If that trend continues…

Infrastructure chains built specifically for stablecoins could become extremely important.

Plasma is positioned exactly there.

7. Strengths of the Project

Let’s be objective.

What Plasma is doing right:

1. Clear positioning

Not another generic L1.

2. Massive market

Stablecoins already move hundreds of billions monthly.

3. UX-first design

Removing gas friction is a huge unlock.

4. Institutional narrative

Payments infrastructure attracts real partnerships faster than meme ecosystems.

8. Weaknesses and Risks (Real Talk)

No creator analysis is honest without risks.

Here are the real ones:

1. Competition

Ethereum L2, Tron, and Solana already dominate stablecoin transfers.

Breaking network effects is hard.

2. Adoption risk

Technology doesn’t matter if users don’t come.

3. Token value capture

If stablecoin transfers are nearly free, how much value accrues to XPL?

This is a real question investors should think about.

9. The Big Question: Is Plasma Early or Late?

Here’s the interesting part.

Stablecoin infrastructure is still early globally.

Most people in the world:

• Don’t use crypto wallets

• Don’t use stablecoins daily

• Haven’t experienced digital dollar payments

If that changes…

Projects like Plasma could become core infrastructure.

Not hype coins.

Infrastructure.

And infrastructure narratives last longer.

10. Creator Verdict

Here’s my honest take:

Plasma is not a hype-driven project.

It’s a thesis-driven project.

And thesis-driven projects are slower…

But when they hit, they hit big.

The real bet on XPL is not:

“Will this pump next week?”

The real bet is:

“Will stablecoins become the internet money layer of the world?”

If yes — Plasma has a seat at the table.