When I look at Dusk Network, I don’t see another Layer 1 trying to out shout Ethereum or chase the latest DeFi trend. I see something far less glamorous and, oddly, far more ambitious. It feels like someone asked a simple, uncomfortable question that most crypto builders avoid: what would a blockchain look like if it had to survive contact with real world law, auditors, and institutions, not just traders?

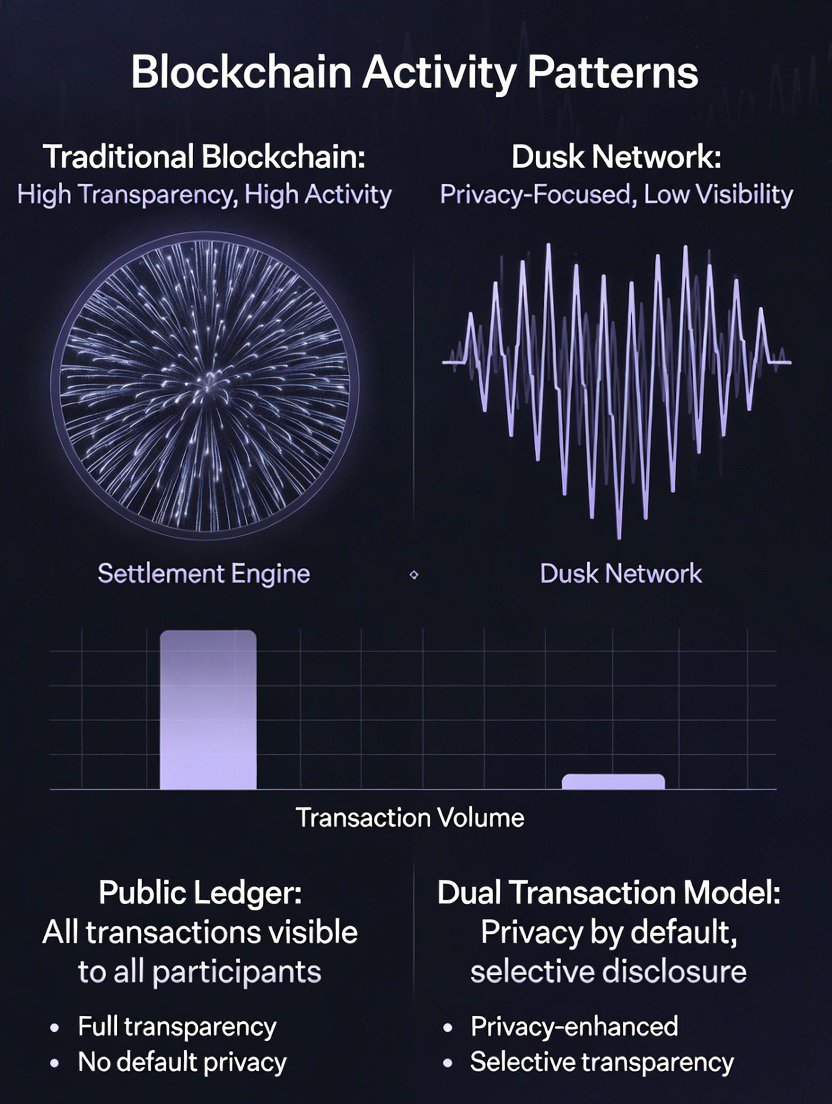

Most chains grew up in a culture of radical transparency. Every wallet exposed, every transaction immortalized, every move traceable. That works fine in a casino. It’s terrible in a boardroom.

In traditional finance, privacy isn’t suspicious. It’s normal. Your salary, your portfolio, your company’s cap table, your clients’ identities. None of that lives on a public billboard. Yet crypto keeps pretending that total visibility equals trust.

Dusk flips that logic. It treats privacy not as a feature you toggle on, but as the default human condition. You don’t show everything. You prove what’s necessary.

That subtle difference changes everything.

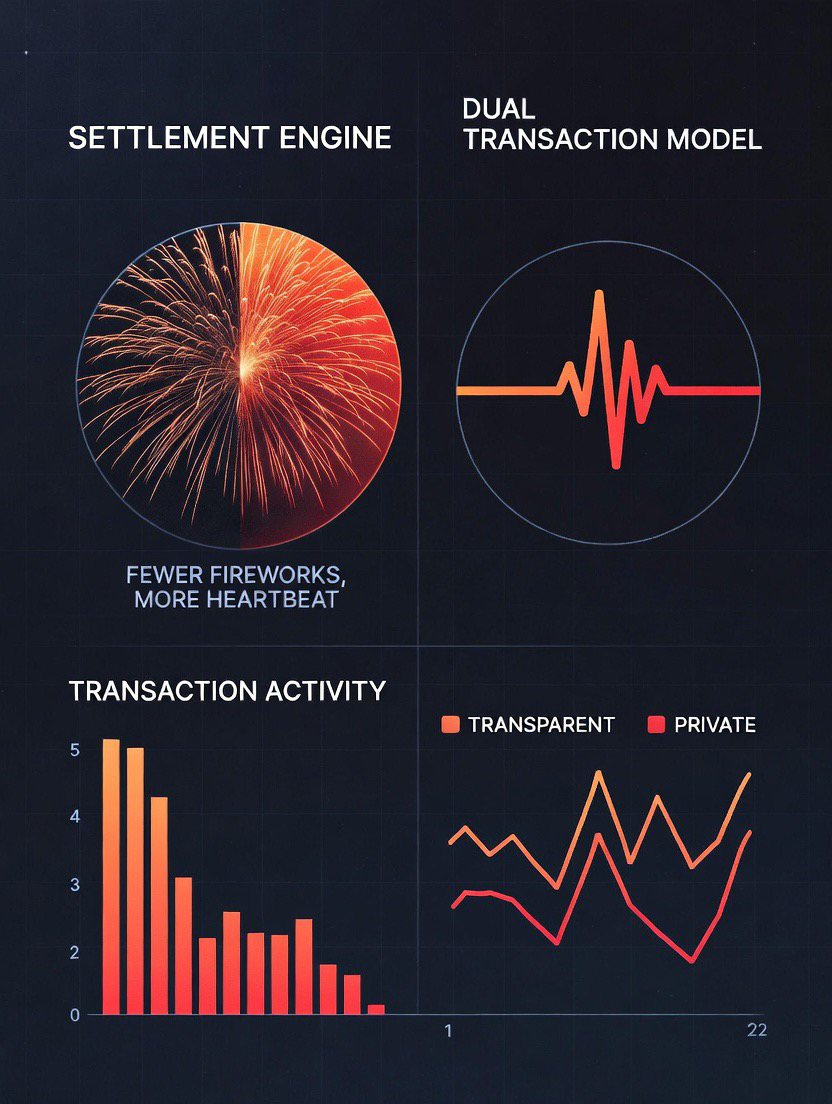

With its dual transaction model, value can move publicly when it should, or privately with zero knowledge proofs when it must. To me, it feels less like hiding and more like controlled disclosure, like handing an auditor a sealed envelope instead of live streaming your entire life. The system says: here is the proof you asked for, nothing more. It’s a very adult way to design infrastructure.

And then there’s the part that most people overlook: user experience.

Anyone who has tried to explain gas fees to a non crypto friend knows how absurd we sound. “Yes, you can trade, but first you need this other token to pay fluctuating network tolls.” That’s not finance. That’s friction.

Dusk’s economic design, where applications can shoulder costs or structure their own fee logic, feels refreshingly practical. It lets apps behave like actual products instead of forcing every user to become a mini treasury manager. It’s the kind of detail that doesn’t excite speculators but matters enormously to institutions who just want things to work.

Even the tokenomics read differently. Long emissions, steady staking, predictable cadence. It doesn’t scream for attention. It reads like something designed to exist for decades. Almost boring. And in infrastructure, boring is often the highest compliment.

When I check the chain’s activity patterns, it doesn’t look like a memecoin highway. It looks like a settlement engine slowly ticking in the background, like plumbing. Fewer fireworks, more heartbeat. That tells me the team isn’t optimizing for hype cycles. They’re optimizing for reliability.

The more I think about it, the more Dusk reminds me of a courthouse or a bank vault rather than a trading floor. Quiet rooms. Controlled access. Verifiable records. Doors that open only for the right people. Not because secrecy is cool, but because trust sometimes requires restraint.

In a space obsessed with noise, that restraint feels almost radical.

If most blockchains are trying to be the loudest marketplace on the internet, Dusk feels like it’s trying to be the place where serious agreements actually get signed. And if regulated finance truly moves on chain one day, it probably won’t happen in the spotlight. It will happen somewhere quiet, structured, and deliberate.

Somewhere that looks a lot like this.