Dusk Network feels like one of those projects that was designed with a clear purpose from day one, because it doesn’t try to be everything for everyone, and it doesn’t rely on loud narratives to explain why it exists. It sits in a very specific lane, where privacy is not a marketing keyword but a core requirement, especially for financial activity that cannot operate in a fully transparent environment without breaking how real markets function. When people talk about putting finance on-chain, they usually focus on speed, composability, and access, but they skip the uncomfortable truth that most serious financial workflows need confidentiality, controlled disclosure, and predictable settlement, because no institution wants to expose positions, counterparties, strategies, and internal flows to the entire internet just to use a blockchain.

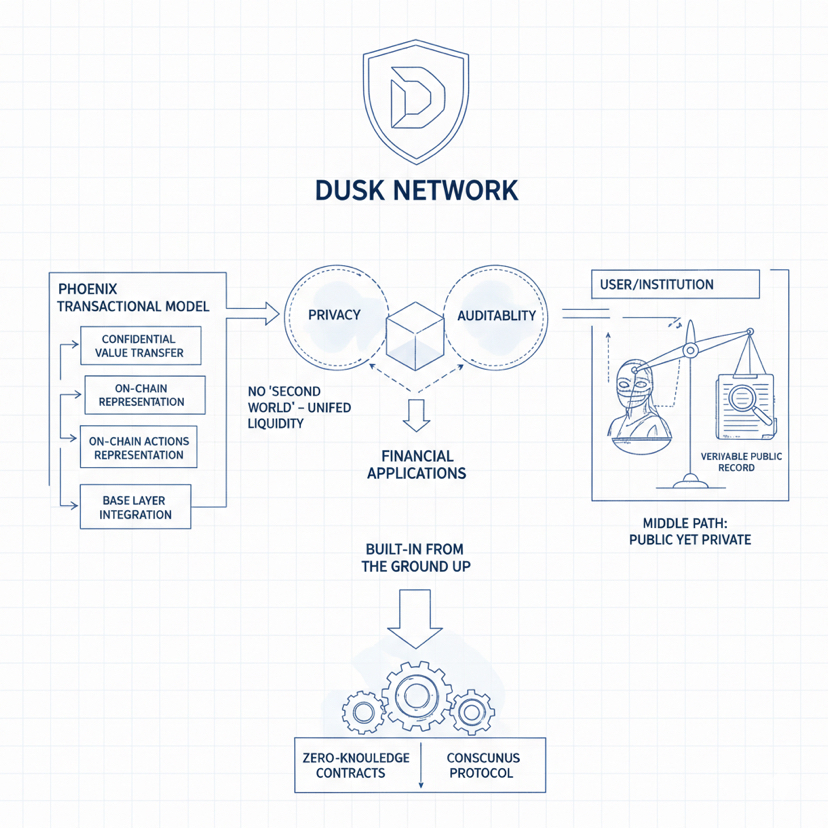

That’s the heart of why Dusk matters, because it approaches privacy in a way that tries to stay compatible with real financial realities instead of fighting them. The project is built around the idea that financial applications need privacy and auditability at the same time, not as separate modes, not as optional features you toggle on and off, but as properties the system is built to support from the ground up. A lot of networks either go fully transparent and call it a feature, or they go private and lose the openness that makes public networks valuable, while Dusk is aiming for a middle path that still feels public, still feels verifiable, but doesn’t force every user and every institution to reveal their entire financial footprint just to participate.

Under the surface, the project’s approach becomes clearer when you look at the building blocks it keeps coming back to. Phoenix is presented as a transactional model built to support confidentiality in how value moves and how actions are represented on-chain, and it’s important because it points to privacy being part of the base layer rather than something glued on later. When privacy is added as an afterthought, it often creates a second world inside the same ecosystem, where some funds are “normal” and some are “private,” liquidity gets split, integrations get messy, and user experience becomes confusing, but Dusk’s framing suggests it wants privacy to feel natural, consistent, and compatible with the way the chain is supposed to operate.

Then there’s Zedger, which is where Dusk starts to feel more tailored for regulated or security-like assets rather than casual token transfers. The simple way to understand this is that financial assets have rules, restrictions, lifecycle events, and requirements that don’t always fit cleanly into the most common models used by general-purpose chains. Dusk talks about Zedger as a hybrid model built specifically with these realities in mind, which signals that the team is thinking about what happens after the token is created, because real finance isn’t just issuance, it’s ongoing compliance, settlement, reporting, and the ability to prove correctness without exposing everything publicly.

That connects directly to XSC, the Confidential Security Contract standard, which is basically Dusk making a strong statement about what kind of assets it wants to support and how it wants them to behave. Standards matter more than most people realize because they become the template that builders reuse, and in regulated environments, reusable templates reduce friction and reduce risk. If the ecosystem ever reaches a point where confidential, security-like assets are being issued and managed in a consistent way across multiple applications, then a standard like XSC becomes a long-term anchor that can attract serious development and serious integrations, because teams don’t want to reinvent compliance logic and lifecycle rules every time they build a new financial product.

The project’s bigger direction starts to feel clearer when you connect these ideas together, because Dusk isn’t just trying to hide transfers, it’s trying to support confidential asset behavior while still making room for controlled verification, which is exactly what regulated markets need. It’s the difference between secrecy and privacy, because secrecy is hiding everything from everyone, while privacy in finance usually means the right people can verify what they need to verify, without forcing everyone else to see data they were never meant to see. That is a difficult problem to solve properly, and it’s also why this category tends to move slower than trend-driven ecosystems, because it depends on deep engineering, stable tooling, and careful design choices that can hold up under scrutiny.

The token side of the story also fits into this bigger picture, because $DUSK represents the network’s core economic layer and the asset people track across markets, and on Ethereum it exists as an ERC-20 contract that reflects supply details, holder distribution, and transfer activity at that representation level. The token itself becomes more meaningful when you view it as a proxy for whether Dusk succeeds in becoming necessary infrastructure rather than a temporary narrative, because projects like this don’t win by being the loudest, they win by becoming the default choice for a specific high-value use case that is difficult to replicate, and if that happens, the token’s relevance becomes tied to ecosystem gravity, builder activity, and the credibility of the network’s long-term role.

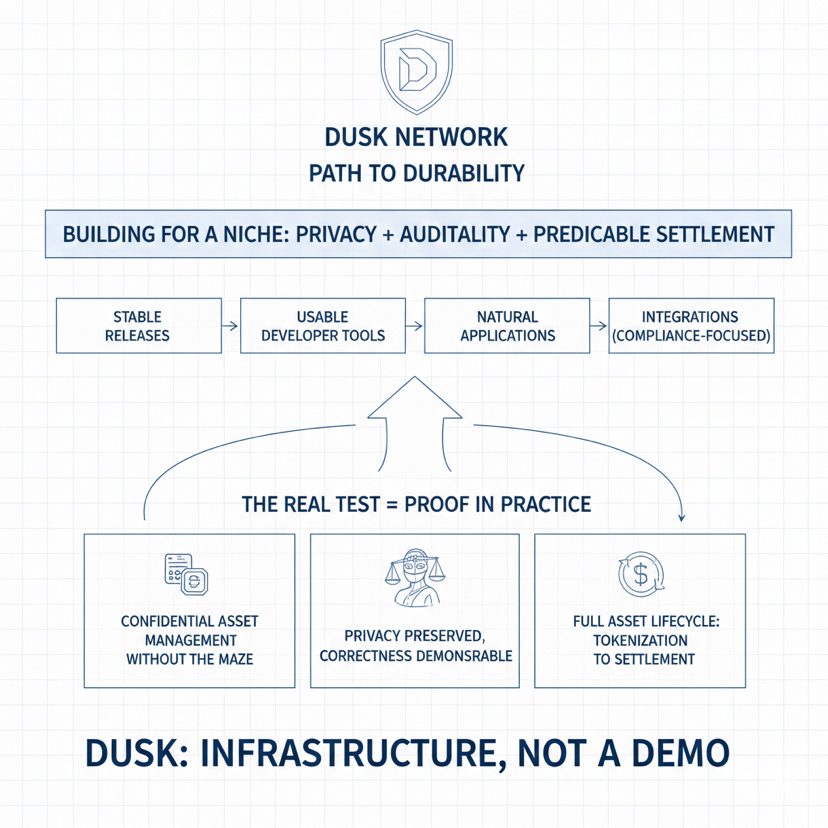

What stands out most is that Dusk is not trying to win the entire Layer-1 race, and that is actually a strength if the goal is durability. It’s building for a niche where privacy is required, auditability cannot be ignored, and settlement needs to behave predictably, because that’s what financial infrastructure is expected to do. The real test is not whether the concept sounds good, because it does, but whether it becomes practical at scale through stable releases, usable developer tools, applications that feel natural to interact with, and integrations that prove the model works in environments where compliance expectations are real and unforgiving.

When you ask what’s next, the answer is less about one feature and more about proof, because the next phase for Dusk should look like a growing set of real workflows that make its design choices feel justified. Proof looks like applications that can issue and manage confidential assets without turning the experience into a confusing maze. Proof looks like systems where privacy is preserved, but correctness can still be demonstrated when it matters. Proof looks like an ecosystem that doesn’t just talk about tokenization but shows the full lifecycle of assets behaving properly over time, with the chain acting like infrastructure instead of a demo environment.

My takeaway is simple, because Dusk is building in a direction that many projects avoid, not because it’s unimportant, but because it’s hard and it takes time to mature. If it delivers on its core promise, it can become a chain that institutions and serious financial builders don’t choose for hype, but choose because it solves a real problem that most public networks still struggle with. That kind of positioning is not fast, but it can be powerful, and it’s the kind of foundation that can stay relevant across multiple market cycles if the execution stays consistent and the ecosystem keeps growing in a way that matches the project’s original purpose.