I've been tracking the 3D structure closely, and the flush into 59.8K wasn't just a normal pullback.

I've been watching the 3D structure closely and the flush to 59.8K was no ordinary pullback.

That candle had:

• Clear Displacement

• A visible volume spike

• Liquidation-type acceleration

• Immediate Reaction Buying

That is typical of forced selling. But here's the important part: capitulation doesn't necessarily mean reversal.

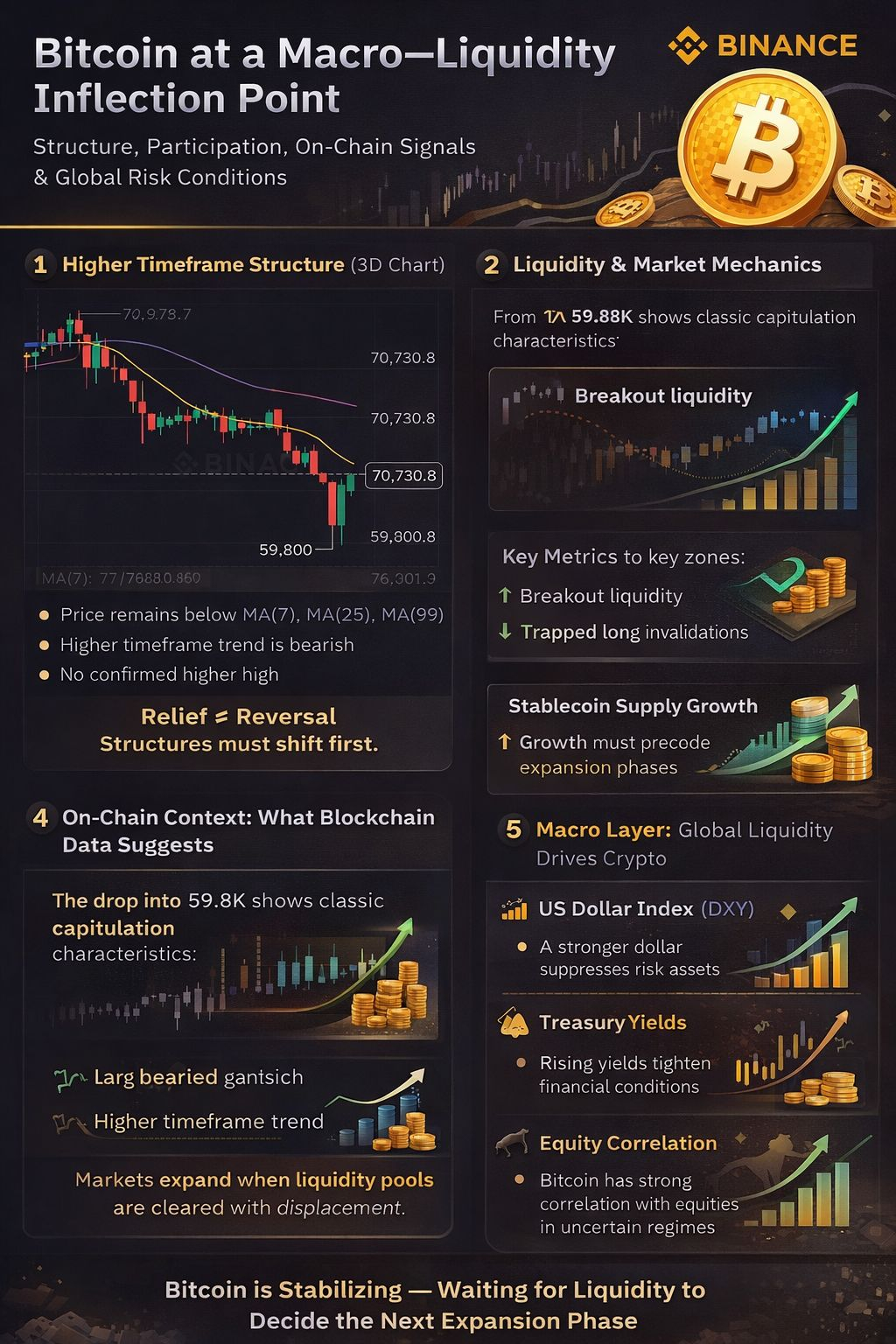

1️⃣ Structure First: Trend Is Still Technically Bearish:

On the 3D timeframe:

• Price is still below MA(7)

• Still below MA(25)

• Still far below MA(99)

The Moving Averages are bearishly aligned.

Unless the price breaks and holds higher than the 77-78K region, which is the MA7 area, the price action remains a relief bounce within the corrective pattern.

A real reversal requires a shift in structure, not just oversold momentum.

2️⃣ What 59.8K Actually Did:

That amount probably cleared:

• Late-long-stop losses

• Overleveraged positions

• Panic sellers

When markets wipe both liquidity and leverage, they often stabilize.

Participation is thus the important question at this point.

If buyers step in with conviction, we will see rising price + rising open interest.

The bounce will fade if this is just short covering.

3️⃣ Macro Context: It is Here Things Get Interesting:

Bitcoin has high sensitivity to conditions of global liquidity.

Currently:

US Dollar Index (DXY):

Risk assets are usually a struggle when the dollar has been strengthening.

That means if DXY weakens, BTC has more room to extend.

Treasury Yields:

Rising yields tighten liquidity.

declining yields boost risk appetite.

We're not in an aggressively loose macro environment at present – that lowers the probability of a breakout without catalysts.

Equity Markets:

Bitcoin correlation rises in situations of uncertainty.

If the equities markets decline further, it could negatively impact the potential gains in the upside If equities stabilize, that also contributes to the prospect of expansion. Since macro alignment is particularly important in this case more than usual.

4️⃣ On-chain signals: stabilization, no aggressive accumulation:

From a broader behavioral viewpoint:

• No major signs of long-term holder panics

• No extreme distribution signals

• Exchange flows look more unbiased than aggressive

This supports stabilization – not yet confirmation of accumulation.

Strong bull reversals normally indicate clear on-chain conviction.

We’re not fully there.

5️⃣ Market Phase: Compression After Expansion:

The markets follow cycles.

The fall from 116K to 59.8K is an expansion downwards. What's happening now appears to be early stage contraction/stabilization.

The compression phases may reverse direction.

The next impulsive action is expected to be:

• Structural reclaim

• Participation expansion

• Macro support.

Without those, breakouts will fail.

Scenario Thinking (Not Prediction):

Bullish probability increases if:

78K is reclaimed with strength

Volume expands

Dollar weakens

Yields stabilize

Bearish probability increases if:

Rejection Below MA7

Under 65K: Break

Dollar strengthens further

Equity weakness continues

Right now, we’re in decision territory.

Risk Perspective:

In environments with high volatility post-liquids:

Size reduction

Avoid Chasing Mid-Range Moves

Wait for confirmation

The market has already punished emotional positioning once.

No reason to repeat that mistake.

Final Thought :

59.8K was a liquidity event.

Liquidity events, however, don’t determine the shift of trends; structure and macroeconomic alignment do.

Bitcoin is stabilizing.

The next real move will not start quietly. It will begin with participation.