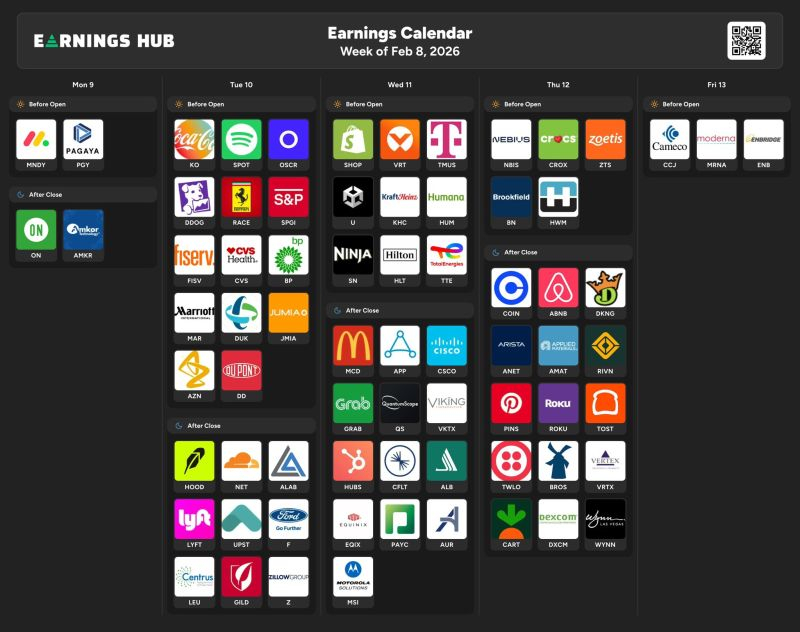

The period from February 9th to 13th cannot be read merely as a financial reporting schedule; it represents a direct confrontation between "trader expectations" and the "reality of cash flows." Behind every figure released this week, a profound battle unfolds between legacy economic models and emergent ones asserting their undeniable presence.

Here are the three critical trajectories that will define the global liquidity landscape:

1. Testing Consumer Resilience (Coca-Cola - Tuesday):

Coca-Cola's results serve as the ultimate litmus test for "pricing power." The fundamental question isn't "how much did they sell?", but "at what price were they able to sell?" If profit margins decline, it signals that inflation is indeed eroding consumer purchasing power. Conversely, sustained growth might indicate entrenched "corporate inflation," potentially forcing central banks to maintain higher interest rates longer than markets anticipate.

2. The Vulnerability of Growth & Services (Spotify, Airbnb, Lyft):

This sector acts as the "lungs" of the digital economy. This week's announcements will reveal the true depth of the wound inflicted by high interest rates on available disposable income. Any significant slowdown in growth here would suggest that markets have been overly optimistic about the recovery of the retail and services sectors, potentially hinting at a harder economic landing than projected.

3. The Regulatory & Financial Front ($COIN & $HOOD):

The spotlight on Coinbase and Robinhood isn't just about their quarterly earnings; it's about their role as a "pressure gauge" for crypto's resilience against Washington's regulatory onslaught. Robust growth in assets under management and liquidity stability would serve as practical proof that the "interconnectedness" between crypto and the traditional system is becoming organic and irreversible, transcending mere administrative decrees.

Professional Outlook:

The discerning investor doesn't chase "expectations"; they observe "liquidity behavior." This week's results will reveal whether we've entered a phase of "structural correction," or if the traditional financial system still retains enough maneuverability for a prolonged stand.

The Philosophical Conundrum:

Should the FinTech sector's results outperform traditional retail, would that officially mark the shift of global liquidity's gravitational center towards the new economy?

#EarningsSeason #MacroAnalysis  #coin #FinancialMarket #FLOW

#coin #FinancialMarket #FLOW