Plasma caught my attention not as another chain, but as a mirror of something I’d been noticing for a while. Stablecoins were doing the heavy lifting in crypto, but they still lived in houses built for someone else’s priorities.

For a long time, stablecoins have carried most of crypto’s real economic weight while being treated like temporary tenants. They move payroll, remittances, treasury balances, and arbitrage flows, yet most chains still build their economics around a volatile native token and expect dollars to adapt. Plasma flips that order. It starts from the assumption that stablecoins are the main event, and that single change reshapes everything built on top.

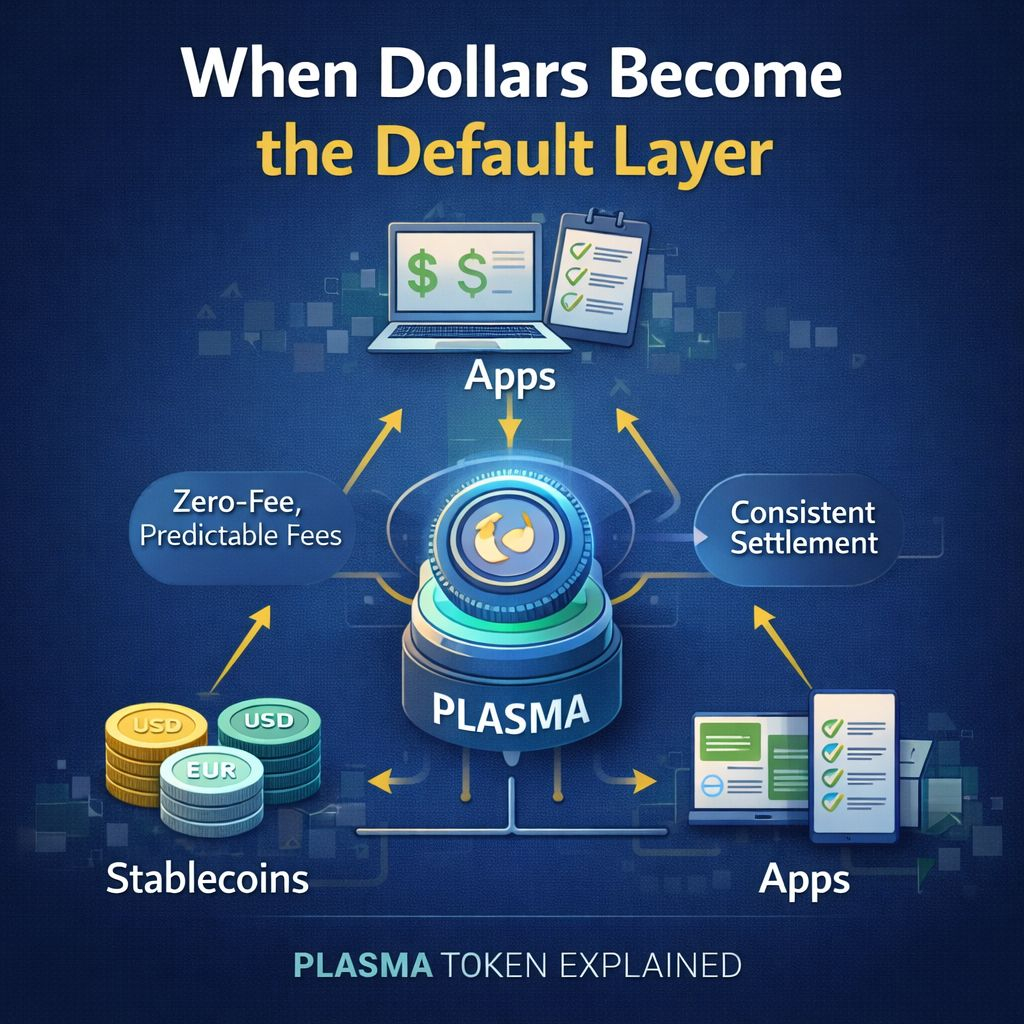

The headline features sound straightforward: zero-fee stablecoin transfers, native support for dollar-pegged assets, and familiar EVM execution. But the more important shift is behavioral. Plasma is designed for users who aren’t speculating when they move money. They care about amounts arriving intact. They want timing to be dull. They don’t want to think about gas tokens that swing in value between sending and settlement. Removing that friction is not generosity; it’s a bet that dependable flow matters more than collecting small rents from every transaction.

Once users don’t need a separate asset just to move dollars, stablecoins stop feeling secondary. They become the unit apps price in. Teams model costs without adding volatility buffers. As friction drops, velocity rises, and higher velocity is what turns a network into infrastructure instead of a trading venue.

Plasma’s architecture reflects this. It’s built for stablecoins, not merely compatible with them. Contract logic, settlement assumptions, and fee abstraction all assume assets that are meant to stay at one dollar. That simplifies building and accounting, even if it narrows the ideological scope.

There are tradeoffs. Stablecoin issuers are concentrated, and designing around them increases trust dependencies. Abstracted fees mean someone absorbs cost, and the model only works if serious volume shows up and sticks. Plasma is accepting those constraints rather than pretending they don’t exist.

This fits a broader split happening in crypto. One lane optimizes for leverage and narratives. The other optimizes for settlement and reliability. Plasma is choosing the second. It doesn’t ask users to believe its token should replace money. It accepts that dollars already won and builds rails around that reality. If that approach spreads, the chains that matter most may end up being the ones that made existing money feel native on-chain.$XPL @Plasma #Plasma