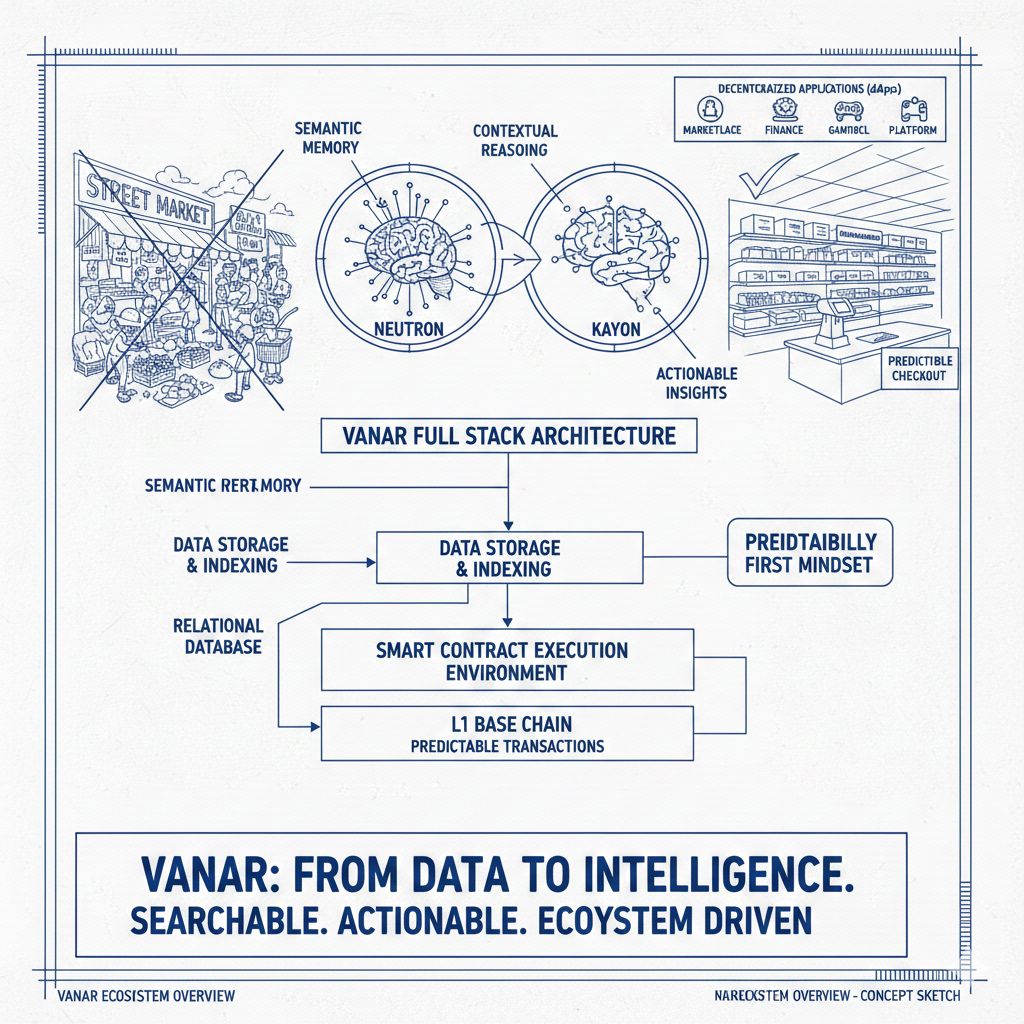

When I try to explain Vanar to someone who isn’t deep in crypto, I don’t start with “it’s an L1.” I start with a feeling: most chains still behave like a busy street market where the price tag changes depending on the crowd. Vanar is clearly trying to feel more like a supermarket same aisles every day, predictable checkout, and a system that doesn’t punish you for showing up at the wrong time.

That “predictability first” mindset shows up in the way Vanar talks about itself: not just a base chain, but a full stack where data isn’t treated like dead storage. On Vanar’s own architecture pages, the emphasis is that the chain should understand what it stores Neutron as “semantic memory” and Kayon as “contextual AI reasoning,” with the bigger idea being: don’t just record transactions, make the information behind them searchable and actionable inside the ecosystem.

The part I find most practical is that they’re trying to reduce the amount of “glue” needed to build real products. In a lot of Web3 builds, your smart contract is only half the story—then you need indexers, oracles, middleware, and off-chain services to interpret what happened and decide what happens next. Vanar’s framing is basically: “bring more of that interpretation closer to the chain,” so a receipt, a document, or a proof can become something your app can reason about instead of just something you store and pray you can retrieve later.

Now, the “latest updates” that actually matter to users aren’t usually flashy protocol slogans—they’re the boring things that remove friction. A concrete recent one from Vanar’s own weekly recap is DeBank: they said the Vanar proposal passed and integration is underway, with the explicit point being expanded wallet compatibility and visibility. That’s the kind of upgrade that quietly changes onboarding, because people feel lost in Web3 when their assets and activity don’t show up where they already track everything.

Another recent signal that stands out (and honestly fits Vanar’s “real-world rails” angle) is the Worldpay appearance around Abu Dhabi Finance Week. A GlobeNewswire release from late December 2025 describes Vanar and Worldpay sharing a stage and talking about what adoption really requires: execution, compliance workflows, and operational controls—not tokenization in isolation. Whether you’re bullish or skeptical, that’s a different room than the usual “L1 ecosystem hype” room.

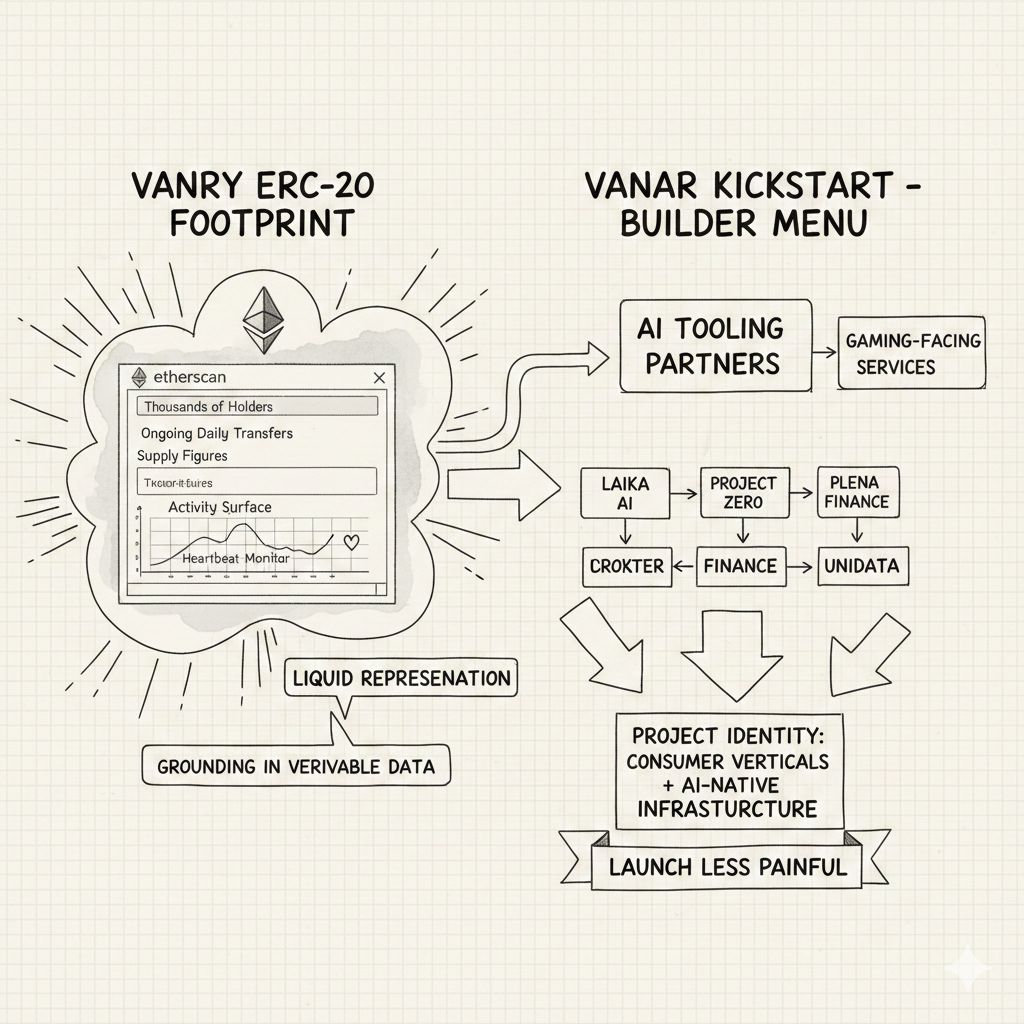

On the token side, I like grounding the conversation in what’s verifiable right now instead of vibes. On the Ethereum contract you linked, the VANRY ERC-20 footprint shows thousands of holders and ongoing daily transfers; Etherscan also presents supply figures and the contract’s activity surface in a way anyone can sanity-check. It’s not the whole story of Vanar (because the network has its own native context), but it’s still a useful “heartbeat monitor” for the asset’s liquid representation.

And if you look at how Vanar is trying to pull builders in, the Kickstart page is basically a menu of “here are the missing pieces you’ll need to ship.” What caught my eye is how explicitly it leans into AI tooling partners (Laika AI, Project Zero, Plena Finance, UniData) alongside gaming-facing services (Warp Chain). That mix matches the project’s identity: consumer verticals plus an AI-native infrastructure story, packaged in a way that makes launching less painful.

Takeaway:Vanar isn’t trying to win by being the loudest chain. It’s trying to win by being the chain that feels least surprising fees and UX that can support consumer apps, an AI-flavored stack that’s really about turning data into usable “memory,” and distribution moves (like DeBank integration and payments-world credibility via Worldpay conversations) that reduce the gap between “cool tech” and “people actually using it.