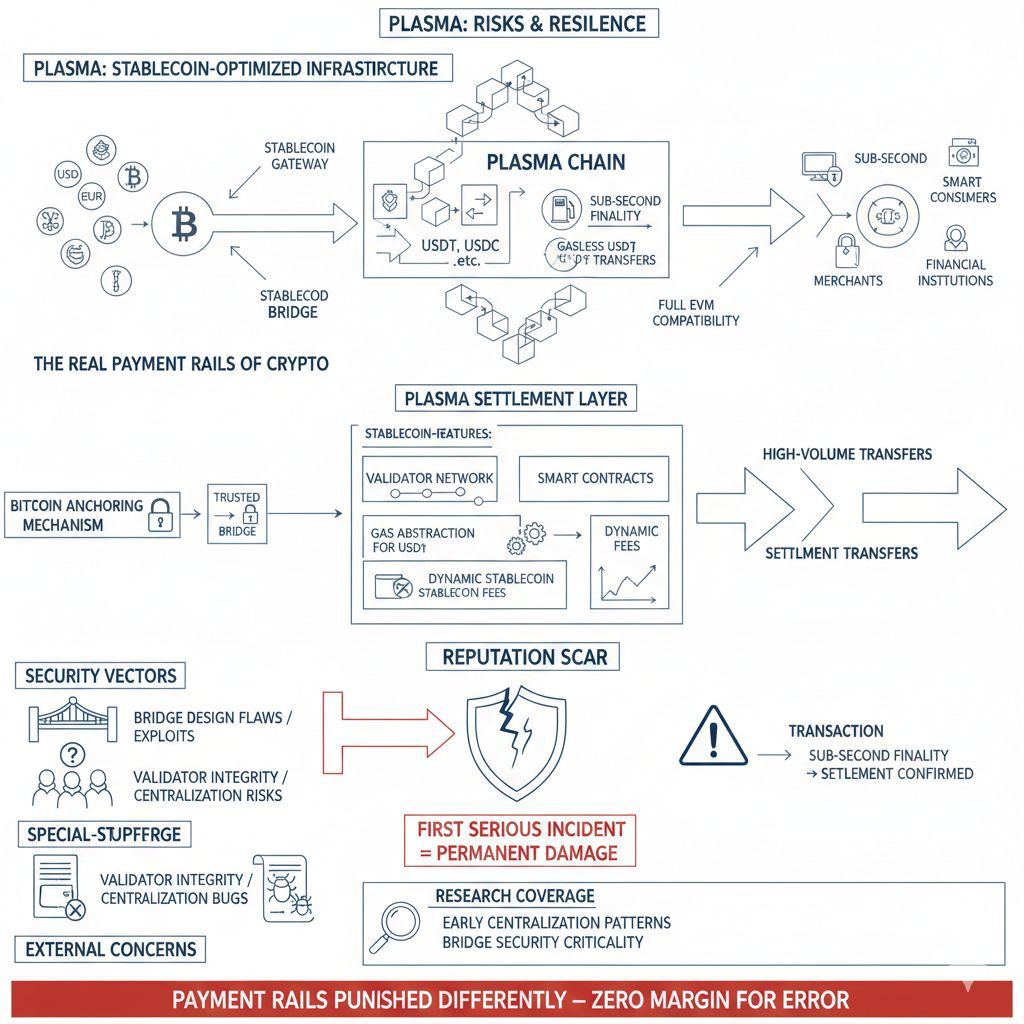

Plasma is trying to solve a very specific problem that most blockchains only talk around: stablecoins have become the real payment rails of crypto, yet the places where they move at scale tend to be cheap for a reason, not because they were built for it. Plasma’s bet is that a chain designed around stablecoin settlement can feel less like “a general-purpose L1 with a payments narrative” and more like infrastructure that naturally fits high-volume transfers, especially if it keeps full EVM compatibility while offering sub-second finality and stablecoin-native mechanics like gasless USD₮ transfers and stablecoin-first gas.

The bear case starts with the uncomfortable truth that payments networks get punished differently than app platforms, because once users treat a chain as a money rail, the margin for errors collapses and the first serious incident becomes a permanent reputation scar. The most lethal category is security, not in the abstract “smart contracts might have bugs” sense, but in the specific places where value and trust concentrate, because Plasma is explicitly building around stablecoin movement and Bitcoin anchoring ideas, which naturally pushes attention toward bridging, validator integrity, and the special-purpose contracts that make the stablecoin UX work. External research coverage has already highlighted that bridge design and early centralization patterns are the kinds of risks that determine whether a settlement chain becomes durable or becomes a cautionary tale.

The quickest way Plasma dies is through a bridge event, because bridges are where the industry’s biggest historical failures have happened, and the market treats bridge losses as proof that the entire system is unsafe rather than as an isolated module that can be fixed later. Plasma’s strategy of “Bitcoin-anchored security” makes the BTC pathway part of the narrative, which is useful if it works, but punishing if it fails, because a successful exploit would not be interpreted as a normal DeFi hack but as a fundamental break in the chain’s settlement promise. Survival here is not about having the most elegant whitepaper, it is about operational discipline that looks almost boring: tight caps at launch, staged rollouts, conservative withdrawal limits, rapid pause mechanisms, rigorous audits, continuous monitoring, and a design that decentralizes verification over time rather than trusting a small group permanently. The point is not to claim the bridge is invulnerable, it is to ensure that even if adversaries probe it aggressively, the maximum blast radius stays small enough that the network does not lose legitimacy.

Right behind bridging is the risk that the validator set behaves like a private committee for too long, because high-performance chains often begin with a curated validator set, which can be practical early on, but it creates an obvious attack and perception surface: if a small group can coordinate, then censorship becomes possible, liveness becomes fragile, and governance starts to look like a foundation meeting rather than a credibly neutral network. The danger is not only technical capture, it is also narrative capture, because payments partners and liquidity follow the chains that feel durable and impartial, and they avoid systems that appear dependent on a few operators. The way Plasma survives this is by making decentralization measurable and time-bound, not aspirational, which means expanding validator participation, enforcing meaningful penalties for downtime and misbehavior, documenting criteria for validator inclusion, and publishing progress in a way that makes it difficult for critics to argue that “permissioned” is the real long-term model. DL Research explicitly treats validator concentration and the decentralization trajectory as a core risk axis for Plasma’s approach, and that is exactly why the roadmap has to be legible to outsiders rather than only to insiders.

Then there is the risk Plasma creates on purpose, which is the gasless USD₮ experience, because “free” is the fastest growth lever and the fastest abuse magnet at the same time. If basic stablecoin transfers are free, attackers will test whether they can spam the network, bloat state, overload the relayer/paymaster infrastructure, or simply drain the sponsorship pool until the promise collapses and the chain has to pull back the feature. Plasma’s own design choices show that it understands this risk, because the sponsorship is scoped tightly to USD₮ transfer and transferFrom rather than arbitrary execution, it relies on eligibility controls that can incorporate identity signals such as zkEmail, and it applies rate limits, all of which are basically saying that the system is engineered to prevent “free for everyone, forever” from becoming “free for bots, immediately.” The chain survives if it keeps that discipline and treats sponsorship as a controlled acquisition layer, with levers that can tighten automatically under attack without breaking normal retail usage, because the moment sponsorship becomes uncontrolled charity, it becomes unsustainable and therefore unreliable.

Stablecoin-first gas adds a subtler but equally important failure mode, because letting users pay fees in stablecoins or BTC improves UX, yet it introduces pricing and settlement complexity that must work under adversarial conditions. If the paymaster relies on oracle pricing and token whitelists, then any oracle manipulation, liquidity shock, or misconfiguration can create a gap where users underpay gas, the paymaster bleeds value, and the chain either quietly subsidizes an exploit or abruptly disables the feature, both of which damage trust. Plasma’s documentation describes the custom gas token flow that depends on oracle pricing and approval logic, which means survival depends on conservative whitelisting, robust oracle design with sanity bounds, circuit breakers that can disable a token instantly, and a safe fallback mode that keeps the chain usable even if “pay gas in stablecoins” needs to be paused. This is less glamorous than marketing, but it is how a payments-first chain stays alive when market conditions turn chaotic.

Regulatory risk is not theoretical for Plasma because the project is explicitly built around assets that have issuer controls, and stablecoin issuers can and do freeze addresses under legal and sanctions pressure. When that happens on a chain that is not stablecoin-first, it is painful; when it happens on a chain that is stablecoin-first, it can look existential, because users may equate the chain’s settlement reliability with the issuer’s policy decisions. Public reporting has repeatedly shown that issuer-level freezes disrupt services and force sudden operational changes, and stablecoin terms typically reserve these powers, which means the bear case has to assume it will happen again in the future. The way Plasma survives is by never allowing itself to become dependent on a single issuer or a single asset flow, which pushes it toward multi-stablecoin settlement, institutional-grade compliance tooling for partners who need it, and a network posture where issuer freezes are treated as an external constraint to route around rather than a chain-wide collapse event. DL Research frames multi-stablecoin design as a key mitigation compared with ecosystems that become structurally reliant on one dominant stablecoin, and Plasma’s long-term resilience will be judged by how real that diversification becomes in practice.

There is also a more political version of this risk that matters just as much: once a chain markets itself as a payments rail, it attracts regulated institutions, and regulated institutions bring compliance requirements that can easily slide into de facto censorship if they become embedded into protocol rules instead of staying at the application and services layer. Plasma has leaned into being compliance-ready through partnerships like Elliptic, which is a smart move for adoption, but it creates a tightrope, because if users conclude that the base layer will increasingly behave like a permissioned settlement network, then the chain loses the neutrality narrative that helps it compete globally. Survival here looks like a careful separation of concerns where compliance tooling is strong and widely available for businesses that must use it, while the core protocol stays transparent about what it enforces and what it does not, and where privacy and selective disclosure ideas are pursued in a way that satisfies legitimate oversight without turning the chain into an always-on surveillance pipeline. Plasma’s own stablecoin-native contract direction hints at this kind of approach, and the market will watch whether it remains a design principle as the chain scales.

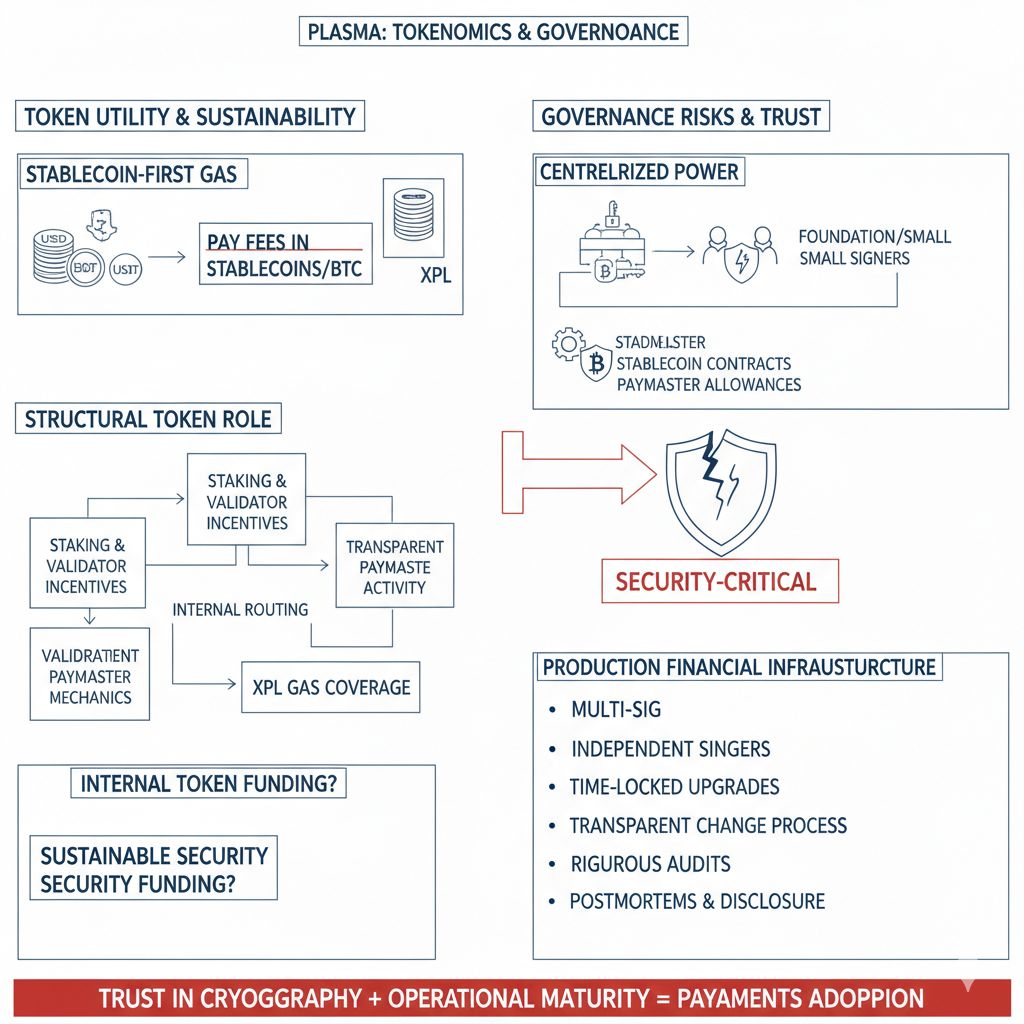

The token and economic bear case is quieter but deadly, because the “free transfers” hook is only a moat if it is sustainable, and it becomes a liability if it turns into a permanent subsidy that never converts into paid activity. If the majority of users do only zero-fee transfers and the chain does not capture meaningful revenue elsewhere, then validators either get underpaid, security weakens, or the network is forced to reduce sponsorship abruptly, which breaks the promise that made users come in the first place. This is why external descriptions of Plasma emphasize that free USD₮ applies to narrow transfer activity while other transactions still carry fees that support validators and security, because that distinction is the economic bridge between onboarding and long-term viability. Plasma survives by ensuring the free tier is tightly scoped, heavily rate-limited, and measured as a funnel, while higher-value execution, institutional settlement, and other advanced usage remain paid and expand over time, so that “free” is a growth feature and not the entire business model.

Another token-related pressure point is that stablecoin-first gas can weaken the usual demand story for the native token, because if users can pay fees in stablecoins or BTC, the chain cannot rely on “everyone needs the token for gas” as the primary driver of demand. The right way to survive is to make the token’s role structural rather than cosmetic, so that staking and validator incentives are funded by real economic activity, paymaster mechanics are transparent, and governance cannot become a shortcut for printing value or hiding subsidies. Plasma’s system still routes gas coverage internally through XPL even when users pay with other assets, but long-term credibility depends on whether that design yields sustainable security funding rather than short-term optics.

Governance risk is the final category that can turn ordinary problems into existential ones, because stablecoin-native contracts, paymaster allowances, token whitelists, and upgrade paths tend to be controlled early on by a foundation or a small set of signers, and that concentrates power in precisely the components that can affect user funds and network reliability. Plasma’s documentation references foundation-managed allowances and protocol-maintained contracts, which means the bear case must assume that key management, upgrade procedures, and parameter changes are security-critical, not administrative. Plasma survives if governance behaves like production financial infrastructure: multi-sig signers that are genuinely independent, time-locked upgrades, transparent change processes, rigorous audits, and a culture of postmortems and disclosure when issues arise, because payments adoption depends on trust not only in cryptography but in operational maturity.

When all of these risks are put together, Plasma’s survival story becomes simple in a way that is almost unromantic: it must avoid the single catastrophic event that permanently destroys confidence, while proving over time that “stablecoin-first” is not merely a UX wrapper but a defensible architecture that stays reliable under attack, under regulatory pressure, and under the messy realities of global payments. If Plasma keeps bridge risk constrained, keeps the gasless transfer system tightly scoped and abuse-resistant, decentralizes validators fast enough to avoid a permissioned label, builds compliance readiness without converting neutrality into censorship, and makes the free-transfer hook economically sustainable as an acquisition layer rather than a permanent subsidy, then the bear case weakens dramatically, because the chain stops being judged as an experiment and starts being judged as infrastructure.