U.S. spot Bitcoin exchange-traded funds extended their recovery this week, posting fresh inflows that nearly erased last week’s losses, even as Bitcoin prices remained under pressure.

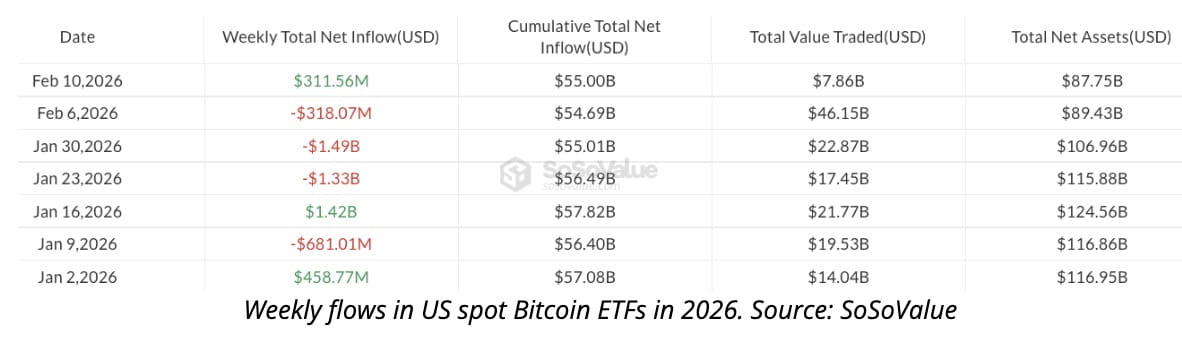

Spot Bitcoin ETFs recorded $166.6 million in net inflows on Tuesday, lifting total inflows for the week to $311.6 million, according to data from SoSoValue.

The rebound comes after $318 million in net outflows last week, the third consecutive weekly decline, which pushed cumulative losses over the prior three weeks to more than $3 billion.

Inflows return despite Bitcoin price weakness

ETF momentum has improved despite Bitcoin falling 13% over the past seven days and briefly slipping below $68,000, according to CoinGecko.

Analysts earlier this week pointed to signs of a potential inflection across crypto exchange-traded products, citing a slowdown in selling pressure and more stable fund flows.

Goldman trims Bitcoin ETFs, adds XRP and Solana exposure

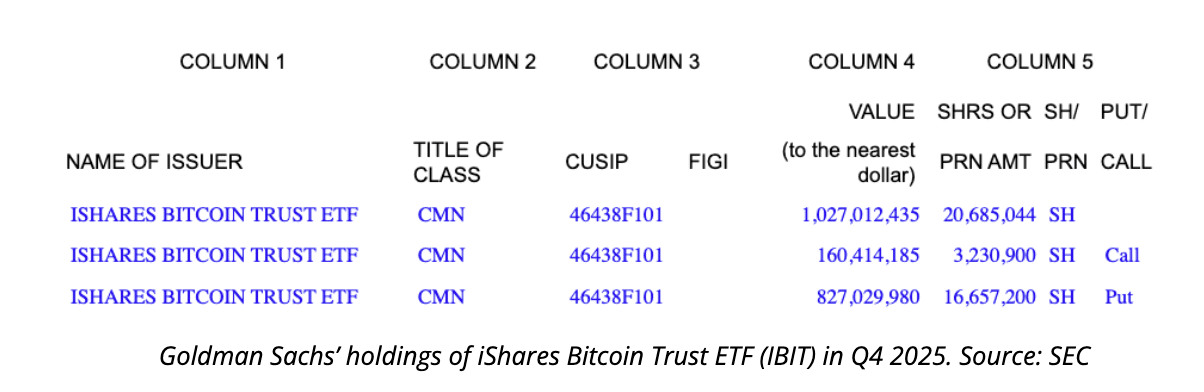

Institutional positioning continues to evolve. Goldman Sachs disclosed in a Form 13F filing with the U.S. Securities and Exchange Commission that it reduced its Bitcoin ETF exposure in the fourth quarter of 2025.

The bank cut its holdings in BlackRock’s iShares Bitcoin Trust (IBIT) by 39%, reducing shares outstanding from about 34 million in Q3 to 20.7 million in Q4, valued at roughly $1 billion. Goldman also trimmed positions in other Bitcoin-linked products, including Fidelity’s Wise Origin Bitcoin Fund (FBTC), Bitcoin Depot, and Ether ETFs.

At the same time, Goldman disclosed first-time positions in XRP and Solana ETFs, acquiring 6.95 million XRP ETF shares worth $152 million and 8.24 million Solana ETF shares valued at $104 million.

SoSoValue data shows spot altcoin ETFs also attracted modest inflows on Tuesday, with Ether funds adding about $14 million, while XRP and Solana ETFs gained $3.3 million and $8.4 million, respectively.

Most ETF investors continue to hold

Despite recent volatility, long-term ETF holders have largely remained in place. Eric Balchunas, senior ETF analyst at Bloomberg, said last week that only around 6% of total Bitcoin ETF assets have exited during the downturn.

Balchunas added that while IBIT’s assets have fallen to about $60 billion from a peak near $100 billion, the fund could remain at that level for years and still retain its distinction as the fastest ETF on record to reach $60 billion in assets.