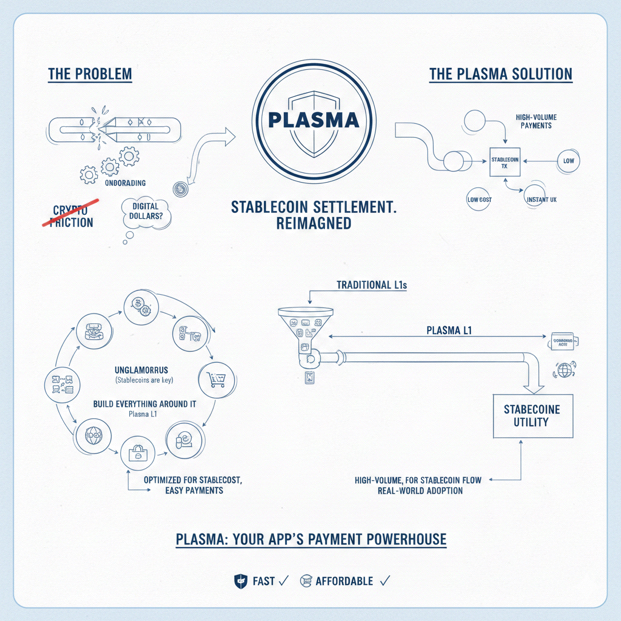

Plasma feels like one of those projects that starts from a very unglamorous observation and then builds everything around it: stablecoins are already the closest thing crypto has to a real, everyday product, and most of the friction people blame on “crypto” is actually friction from how blockchains handle fees, confirmations, and onboarding rather than anything inherent to sending digital dollars. Plasma positions itself as a Layer-1 that treats stablecoin settlement as the main event rather than a side effect, so the chain’s identity is less “come build anything here” and more “if your app needs to move stablecoins all day, every day, cheaply and reliably, this is what we’re optimizing for,” which is why you see the messaging repeatedly circle back to high-volume payments, low cost, and the kind of user experience that doesn’t require a tutorial to get a transfer out the door.

The center of gravity is the stablecoin-first user experience, and the most direct example is the idea of gasless USDT transfers, because most people who have actually tried to use stablecoins for practical payments know the moment that kills the vibe: you receive USDT, you want to send USDT, and then you discover you can’t because you don’t have the chain’s native gas token, which is the equivalent of being handed cash and being told you must first buy a special coin before you’re allowed to spend it. Plasma’s approach is to remove that “you must own gas to move money” bottleneck for the most common payment action by using a protocol-managed sponsorship mechanism, so eligible transfers can be executed without the sender holding the native token, while still keeping the underlying economics honest by making sponsorship a controlled resource rather than a magical infinite free lunch, which is where the real engineering work hides because it forces the network to think in terms of abuse prevention, rate limiting, and sustainability instead of hand-waving away spam and pretending the cost of free transactions never shows up somewhere else.

Alongside gasless transfers sits the broader idea of stablecoin-first gas, which is a subtle but important shift in mental model, because it acknowledges that most users in a stablecoin payments environment want their “unit of account” and their “fee token” to be the same thing or at least closely related, so they are not forced into the constant overhead of acquiring, storing, and managing a separate volatile asset purely to keep the lights on. Plasma leans into that by supporting fee payment in approved tokens rather than making the network feel like a gated community that only opens the door if you already own the right badge, and when you combine that with familiar EVM compatibility you get a practical builder story where teams can deploy Solidity contracts and integrate typical Ethereum tooling, while still benefiting from a payments-oriented gas model that is designed to reduce the number of steps between “user wants to pay” and “payment is completed,” which is ultimately the only thing that matters when you are trying to move from crypto-native users to mainstream usage in places where stablecoins are already a daily tool rather than a speculation vehicle.

Performance and finality matter here in a way that is different from the usual L1 marketing, because for payments you don’t just want theoretical throughput, you want the psychological feeling of immediacy that comes from sub-second to near-instant confirmation, and Plasma’s design language reflects that by emphasizing fast finality and a BFT-style consensus approach built for settlement rather than for slow, probabilistic confirmation. This isn’t only about bragging rights, it’s about making stablecoin transfers behave like a modern payment rail where the sender does not sit there wondering whether the payment will land, the recipient does not have to interpret ambiguous “pending” states, and merchants or payout systems can operate with clean assumptions about transaction completion, because nothing kills adoption faster than payments that feel unreliable even when they are technically “secure.”

One of the more ambitious elements in Plasma’s direction is the effort to make stablecoin settlement not only fast and cheap but also suitable for the kinds of real-world financial flows that demand discretion, which is why confidential payments show up as part of the stablecoin-native feature set. The way Plasma frames it is less about edgy anonymity and more about practical privacy that businesses and institutions recognize as normal, because in the real world a payroll transfer, a supplier payment, or a treasury movement often should not broadcast sensitive details to anyone watching the chain, and if a stablecoin settlement network wants to be taken seriously beyond retail transfers it has to offer privacy primitives that don’t destroy composability or make compliance impossible, so the long-term differentiator here could be less “we have privacy” and more “we have privacy that is opt-in, usable, and compatible with the reality of finance,” which is a hard needle to thread and is therefore one of the more meaningful things to watch as the project evolves.

The neutrality and censorship-resistance narrative is another part of the Plasma identity that shows up in how it talks about security, particularly through the idea of being Bitcoin-anchored, because in stablecoin settlement the political and counterparty risk angle is not theoretical: payment rails are exactly where pressure appears first, and a network that wants to serve global flows has to persuade sophisticated users that it is not easily captured or arbitrarily constrained. Whether someone fully buys the “Bitcoin-anchored” framing or simply views it as a design aspiration, the intention is clear and consistent with the project’s payments thesis, because stablecoin users care about access, uptime, and neutrality more than they care about novelty, and the moment a settlement network starts to look like it can be turned off, singled out, or selectively filtered, the users who need it most begin to route around it.

When you zoom in on the token, XPL sits in the role that most infrastructure tokens occupy even when the product is stablecoin-centric: it exists to secure consensus, align incentives, and reward validators, while the day-to-day economic activity the chain wants to attract is denominated in stablecoins. The healthiest way to think about this is that Plasma is trying to separate “what users want to hold and move” from “what the network needs to function,” so stablecoins can be the primary medium for settlement and fees can be abstracted or paid in stablecoin where appropriate, while the chain still maintains a native asset that underpins validator incentives and network security. That separation can be powerful for adoption because it allows user experience to be anchored in dollars while the network’s incentive structure remains coherent, but it also means anyone looking at XPL has to pay attention to token distribution, unlock schedules, and incentive design in the same way they would for any infrastructure network, because even a great product can have rough market phases if emissions and unlock dynamics are poorly understood or poorly timed relative to demand growth.

What makes Plasma “exist” in a way that matters is not a promise, it’s the observable reality that the network is running, blocks are being produced, transactions are flowing, contracts are being deployed, and developers are verifying code on the explorer, because those are the signs that the chain is not just a whitepaper and a narrative. The more interesting interpretation, though, is not the raw count of activity but the composition of it, because a payment-first chain should eventually show patterns that resemble payment behavior rather than purely speculative behavior, meaning stablecoin transfers that look like real settlement flows, integrations that make it easier to move stablecoins in and out through exchanges and bridges, and application activity that reduces friction for merchants, payout systems, and everyday users who simply want their digital dollars to move with minimal ceremony.

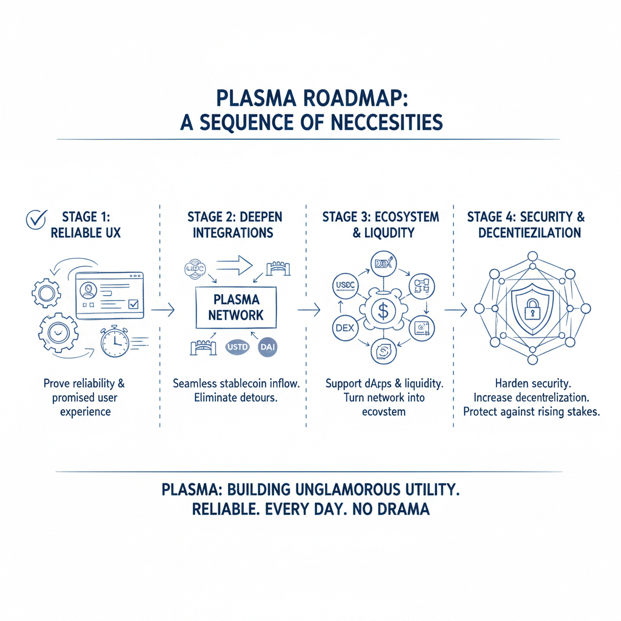

If you want a grounded way to judge what’s next without getting pulled into hype cycles, the roadmap direction can be understood as a sequence of necessities rather than optional features: first the chain must prove it can run reliably with the promised user experience, then it must deepen integrations that bring stablecoins into the network without awkward detours, then it must support the liquidity and application layer that turns a fast settlement network into a real ecosystem, and finally it must harden security and decentralization as the stakes rise, because a stablecoin settlement rail that becomes meaningfully used also becomes meaningfully targeted. In that sense, Plasma’s “next” is less about surprising announcements and more about steadily converting a strong product thesis into an expanding web of integrations, usage patterns, and operational resilience, because payments infrastructure wins the same way roads and electricity grids win: by working every day, for everyone, without drama.

My personal takeaway, keeping it strictly about the project and not about market noise, is that Plasma is aiming at the most defensible slice of crypto utility and is designing around the real reasons stablecoins still feel inconvenient in practice, which makes the thesis easy to understand and, if executed well, hard to dismiss. The project’s strongest advantage is that it treats user experience as a protocol-level concern rather than as a wallet UX trick, because removing the need to hold gas for basic stablecoin transfers is the kind of small-sounding change that can unlock huge usage in places where people already live on stablecoins, while the project’s biggest challenge is that any network offering sponsored transactions and settlement-scale throughput has to be extremely disciplined about economics, security, and abuse prevention, since the easiest way to destroy a good payments experience is to let it become a spam magnet or a fragile bridge-dependent system. If Plasma continues to translate its stablecoin-native design into real integrations and sustained payment-like behavior on-chain, it starts to look less like another L1 competing for attention and more like an infrastructure layer that quietly becomes part of how stablecoin payments work in the background, which is exactly the kind of “boring success” that tends to outlast narratives.