When I first read Plasma’s pitch, my brain didn’t file it under “new Layer 1.” It filed it under “that annoying last-mile problem stablecoins keep tripping over.”

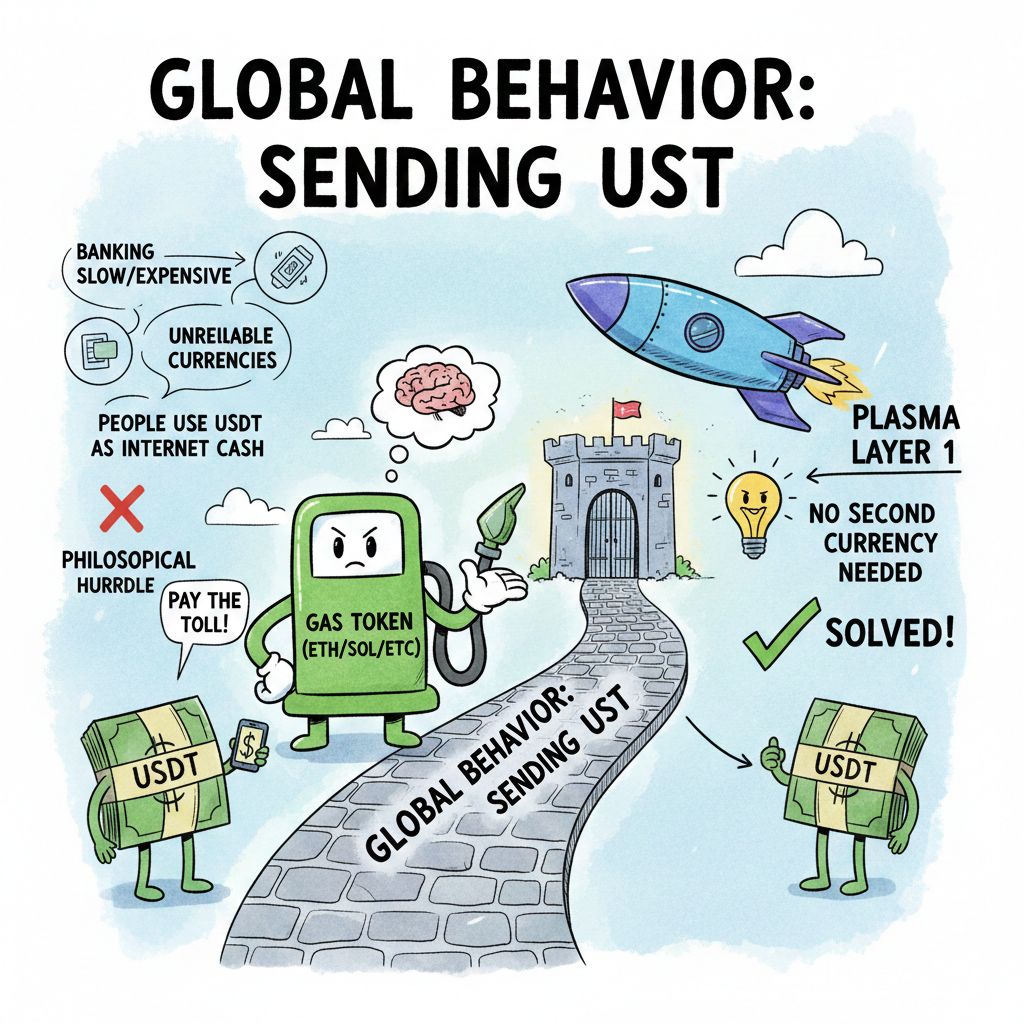

Because stablecoins are already a global behavior. People use USDT like internet cash in places where banking is slow, expensive, or quietly unreliable. The weird part is that the tech layer underneath still often forces you into a second currency just to move the first one. You’re holding dollars, trying to send dollars, and the system goes: “Great now buy some gas token to pay the toll.” That’s not a philosophical hurdle. It’s a usability tax.

Plasma feels like it’s trying to remove that tax at the protocol level instead of asking wallets and apps to duct-tape around it. The chain’s docs are pretty explicit about this stablecoin-first posture: full EVM compatibility via Reth so builders can show up with normal Ethereum tooling, a fast-finality consensus (PlasmaBFT) so “paid” feels immediate, and then the stablecoin-centric mechanics that are basically saying: let the stablecoin be the star of the transaction, not the passenger.

The “gasless USDT transfers” part is easy to misread as marketing, but it’s more like a product lever. Plasma describes a dedicated paymaster that sponsors fees for simple USDT transfers (transfer / transferFrom) under eligibility controls and rate limits, with the sponsorship budget coming from an allowance managed by the Plasma Foundation. In plain terms: it’s trying to make “send USDT” feel like tapping “send,” not like starting a mini onboarding quest.

And then there’s the less flashy but arguably more important piece: stablecoin-first gas. Plasma’s docs describe a protocol-maintained ERC-20 paymaster approach where approved tokens (including stablecoins) can cover gas. That’s the difference between “we sometimes subsidize you” and “your everyday experience doesn’t require a second asset.” It’s the “same-pocket” principle: if the user lives in dollars, the fee model should live there too.

Speed and finality matter here, but not as a bragging-rights chart. Payments are emotional: you want the moment of certainty. PlasmaBFT is presented as a pipelined take on Fast HotStuff designed for quick deterministic finality, and the chain explorer is already showing a roughly one-second block cadence. That isn’t “cool tech.” That’s the baseline sensation you need if you want retail payments to feel normal instead of “crypto-ish.”

The other choice that stands out is the Bitcoin anchoring narrative. Plasma frames Bitcoin-anchored security as a path to more neutrality and censorship resistance. I read that as: if you’re going to build a settlement rail that might be used in politically messy environments (which is exactly where stablecoins often become most valuable), you want your ultimate reference point to be something hard to capture. It’s like building a fast local court system but making sure the constitution lives somewhere nobody can casually rewrite.

Token utility is where a lot of chains lose the plot, but Plasma’s story is at least internally consistent: XPL is positioned as the security asset for staking/validation, with an EIP-1559-style burn component described to help offset emissions as activity grows. The docs state a 10B initial supply at mainnet beta and outline a lock that keeps US public sale purchasers locked until July 28, 2026. I don’t treat those as “token hype details”—they’re signals about whether Plasma is building for “payments infrastructure timelines” rather than just “market cycle timelines.”

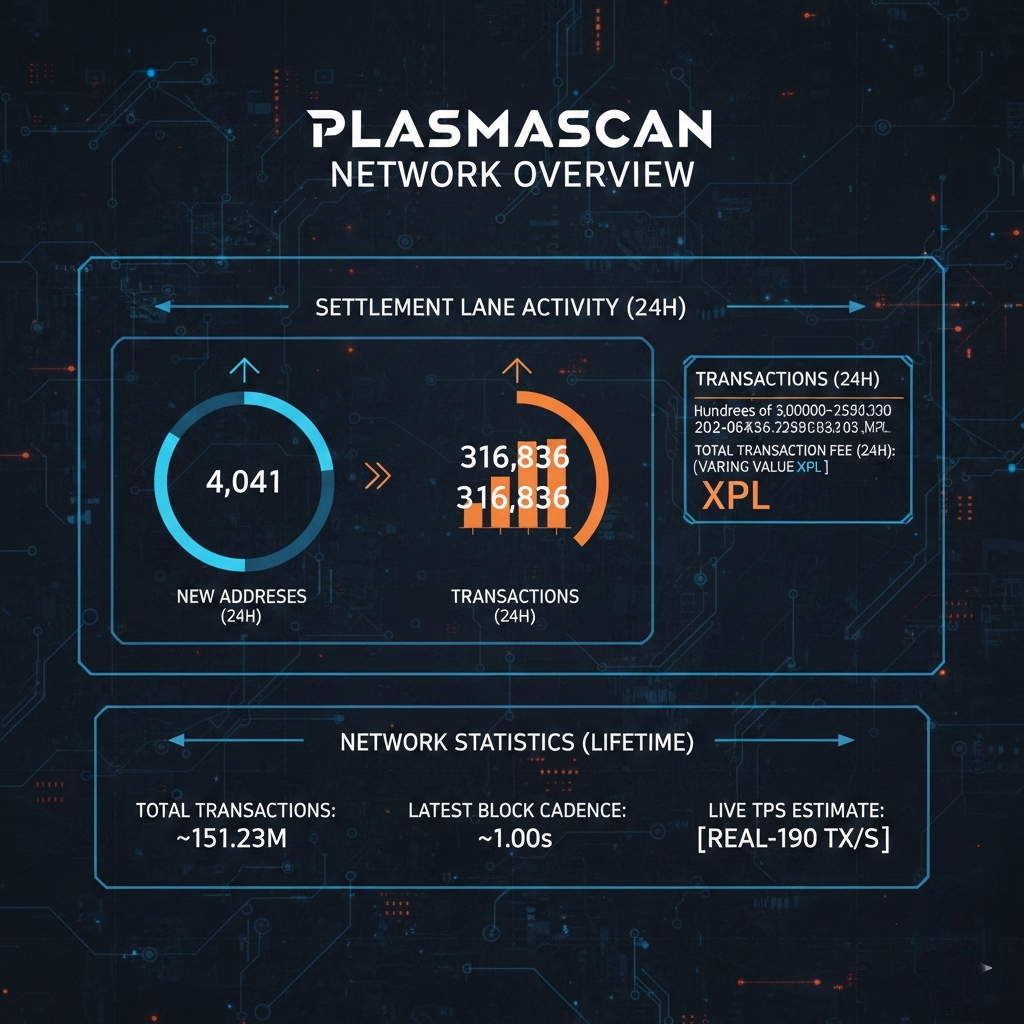

Right now, the most honest way to check whether Plasma is becoming a real settlement lane is to look at what the chain is actually doing. Plasmascan’s charts page shows New Addresses (24h): 4,041 and Transactions (24h): 316,836 in its rolling window.

On the transactions page, Plasmascan also reports a rolling Transactions (24H) figure in the hundreds of thousands and shows Total Transaction Fee (24H) denominated in XPL (this value moves as the window rolls).

Zooming out, the network overview still shows ~151.23M total transactions, around ~1.00s latest block cadence, and a live TPS estimate.

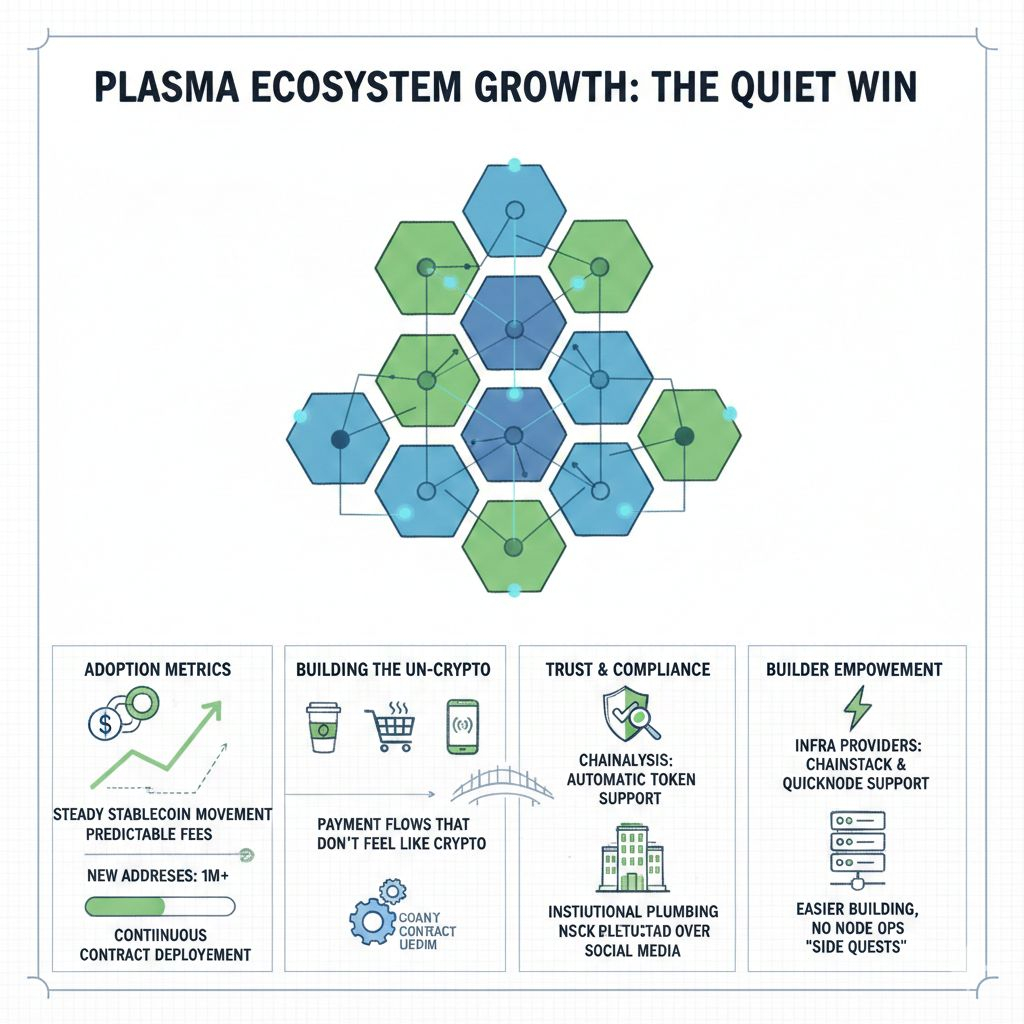

I’m intentionally leaning on those explorer numbers because they’re the cleanest “is this alive?” proof that doesn’t require trusting anyone’s narrative. If Plasma is going to win its niche, the winning will look boring: a steady drumbeat of stablecoin movement, predictable fees, lots of new addresses, and continuous contract deployment from teams building payment flows that don’t feel like crypto.

The quiet ecosystem signals match that direction too. Chainalysis announcing automatic token support is the kind of compliance plumbing institutions care about (often more than they care about Twitter partnerships), and infra providers like Chainstack and QuickNode listing support makes it easier for builders to ship without turning node ops into a side quest.

If Plasma succeeds, it probably won’t be because it “beats” other L1s at being everything. It’ll be because it makes stablecoins behave the way people already assume they should behave: you hold dollars, you send dollars, it finalizes fast, and nothing in the middle forces you to become a crypto power user.